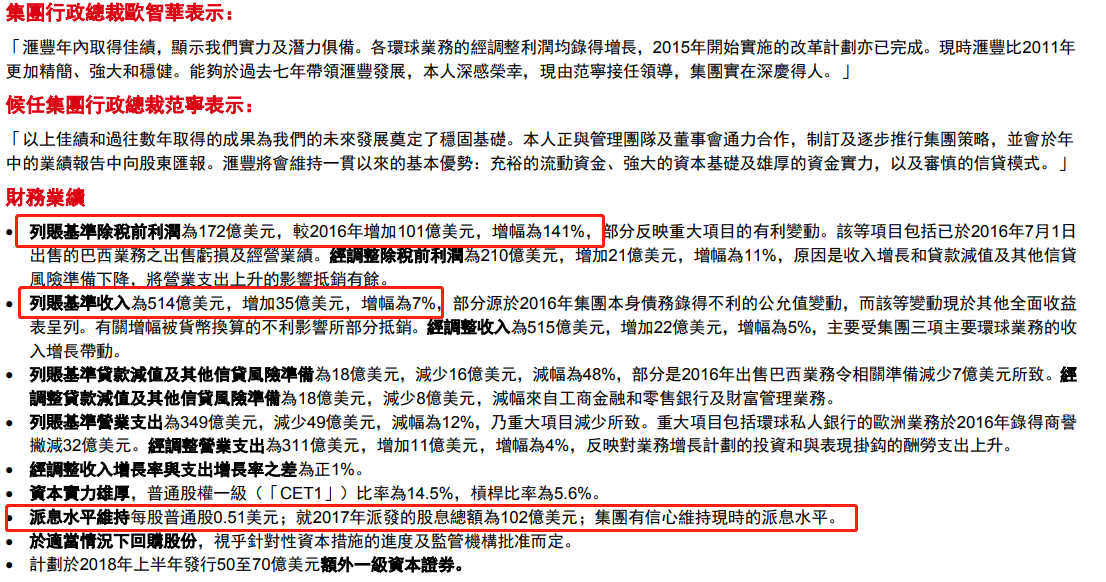

This afternoon, HSBC Holdings (00005) announced its 2017 full-year results. As of the end of 2017, the full-year accounting benchmark profit before tax was 17.167 billion US dollars, an increase of 141% over the previous year. The recorded base income was $51.4 billion, an increase of $3.5 billion, or 7 per cent.

Furthermore, HSBC Holdings maintained the level of interest payments from previous years, bringing the total dividend payout in 2017 to 10.2 billion US dollars.

During the period, adjusted profit before tax was 20.99 billion US dollars, an increase of 10.86% over the previous year, slightly lower than market expectations. The market originally anticipated that the median profit before tax for the whole year would rise 151% year on year to 17.883 billion US dollars. The sharp increase from year to year was mainly due to the loss of goodwill for European private banks in the late quarter of 2016, causing losses and lowering the base.

HSBC Holdings also stated that it will repurchase shares in appropriate circumstances, depending on the progress of targeted capital measures and regulatory approvals.

As of midday trading, HSBC Holdings closed up 0.78%, with a turnover of HK$2,651 million.

However, despite the rapid growth rate of performance, as soon as the market opened in the afternoon, HSBC Holdings fell in a straight line, falling close to 3% at one point.

As of press release, it was down 1.8%.