① Thanks to falling costs, the electrolytic aluminum company Jiaozuo Wanfang has doubled its non-net profit deducted last year. ② At the same time as the profits of the electrolytic aluminum industry expanded last year, electrolytic aluminum companies also increased their shipping efforts. ③ Industry insiders: “It is reasonable for the overall profit of electrolytic aluminum to increase and maintain high profits”.

Financial Services Association, March 29 (Reporter Liang Xiangcai) Thanks to falling costs, the electrolytic aluminum company Jiaozuo Wanfang (000612.SZ) doubled its deducted non-net profit last year.

This evening, Jiaozuo Wanfang announced its 2023 results. Financial reports show that the company achieved revenue of 6.187 billion yuan last year, a year-on-year decrease of 7.33%; net profit to mother was 593 million yuan, an increase of 95.67% year on year; deducted non-net profit was 591 million yuan, an increase of 137.1% year on year.

On a quarterly basis, Jiaozuo Wanfang performed well in the second half of last year. Net profit for Q3 and Q4 was 221 million yuan and 240 million yuan respectively, up 819.17% and 588.03%, respectively.

On a quarterly basis, Jiaozuo Wanfang performed well in the second half of last year. Net profit for Q3 and Q4 was 221 million yuan and 240 million yuan respectively, up 819.17% and 588.03%, respectively.

Regarding the reason for the increase in performance last year, the company stated in the announcement that the drop in sales prices of aluminum products in 2023 was less than the decrease in the purchase price of raw materials, and the gross profit of the product increased.

Specifically, the company's raw materials accounted for 46.92% of operating costs last year, down 10.24% from the previous year; electricity accounted for 41.24% of operating costs, down 20.59% year on year. The trend of aluminum prices was relatively stable last year, and the mainstream price range was between 18,000 yuan and 1,500 yuan/ton.

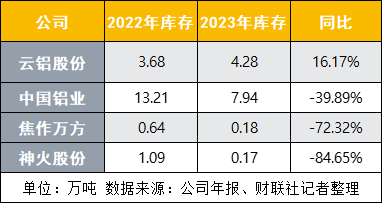

While profits in the electrolytic aluminum industry expanded last year, electrolytic aluminum companies also increased their shipping efforts. According to aluminum companies that have published their annual reports so far. In terms of inventory, in addition to Yunlu shares (000807.SZ), which increased 16.17% last year, China Aluminum (601600.SH), Jiaozuo Wanfang, and Shenhuo shares (000933.SZ) were all drastically removed from storage. Inventory in 2023 decreased by 39.89%, 72.32%, and 84.65%, respectively, compared to the previous year.

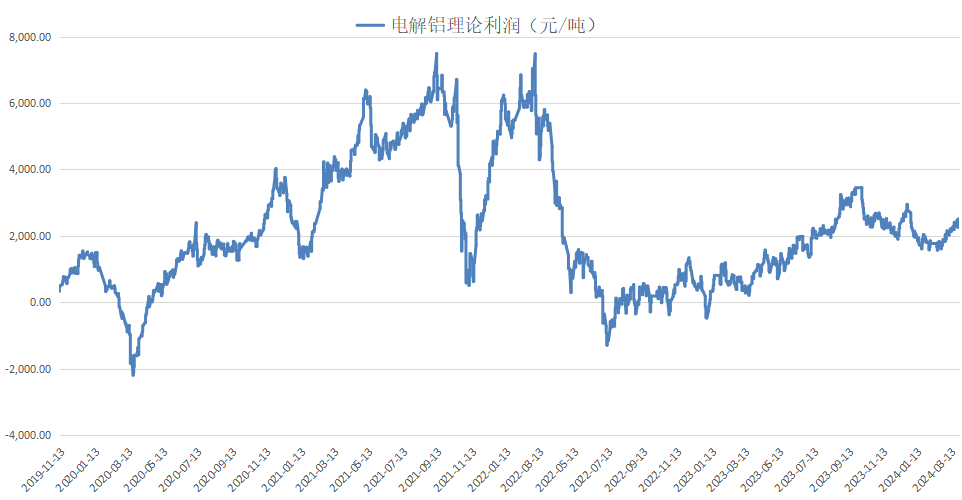

“It is reasonable for the overall profit of electrolytic aluminum to rise and maintain high profits,” Li Kui, a non-ferrous metals researcher at Huarong Rongda Futures, told reporters that due to policy capacity restrictions, the peak domestic electrolytic aluminum operating capacity is expected to reach 43.3 million tons in 2024, and the operating rate is expected to reach a high level of 94%, while the construction capacity of upstream alumina has been overbuilt for a long time, which has led to a shift in profits to the downstream electrolytic aluminum industry.

At the same time, an executive of a listed aluminum company once told reporters: “You can't look at this industry from the perspective that aluminum ingots earned a few hundred yuan per ton or lost money. Now the profit of more than 2,000 yuan per ton is not high. The previous era of marginal profit may not exist again. The main reason is that there is a ceiling with limited production capacity.”

According to SMM data, the average full cost of the domestic electrolytic aluminum industry in 2023 was about 16,485 yuan/ton, down 8.4% year on year. The average profit of the industry was about 2,214 yuan/ton, up 14.4% year on year. Recently, the domestic operating capacity of about 42 million tons of electrolytic aluminum has been profitable, and it is less likely that companies will actively cut production.

Electrolytic aluminum theoretical profit data source: Huarong Rongda Futures Calculation

分季度来看,焦作万方去年下半年业绩亮眼,Q3与Q4净利润分别为2.21亿元、2.4亿元,同比分别增加819.17%、588.03%。

分季度来看,焦作万方去年下半年业绩亮眼,Q3与Q4净利润分别为2.21亿元、2.4亿元,同比分别增加819.17%、588.03%。