High-rolling investors have positioned themselves bullish on Dow (NYSE:DOW), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DOW often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Dow. This is not a typical pattern.

The sentiment among these major traders is split, with 62% bullish and 37% bearish. Among all the options we identified, there was one put, amounting to $30,000, and 7 calls, totaling $685,027.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $60.0 for Dow during the past quarter.

Volume & Open Interest Trends

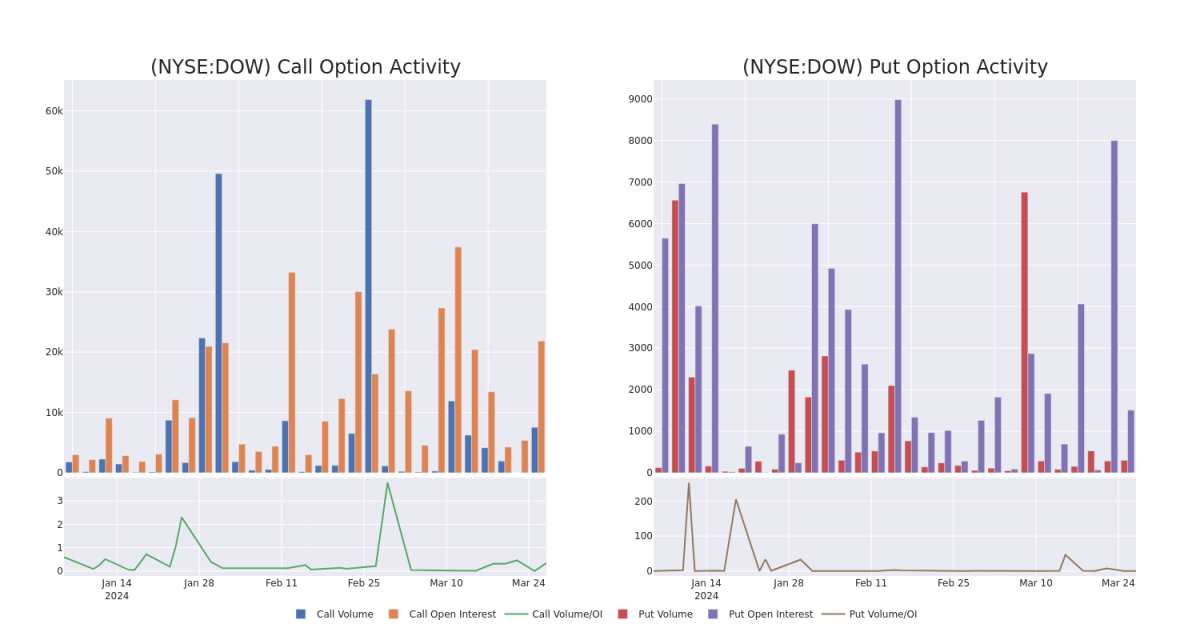

In today's trading context, the average open interest for options of Dow stands at 4669.2, with a total volume reaching 7,846.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dow, situated within the strike price corridor from $50.0 to $60.0, throughout the last 30 days.

Dow Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| DOW | CALL | SWEEP | BULLISH | 06/21/24 | $57.50 | $347.4K | 10.2K | 1.5K |

| DOW | CALL | SWEEP | BULLISH | 06/21/24 | $55.00 | $88.0K | 4.7K | 204 |

| DOW | CALL | SWEEP | BULLISH | 06/21/24 | $55.00 | $79.6K | 4.7K | 205 |

| DOW | CALL | SWEEP | BEARISH | 01/17/25 | $60.00 | $69.6K | 6.0K | 204 |

| DOW | CALL | SWEEP | BEARISH | 04/19/24 | $59.00 | $39.6K | 822 | 570 |

About Dow

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

In light of the recent options history for Dow, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Dow

- With a trading volume of 2,064,900, the price of DOW is up by 0.68%, reaching $57.46.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 29 days from now.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.