Shaanxi Construction Machinery Co.,Ltd (SHSE:600984) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

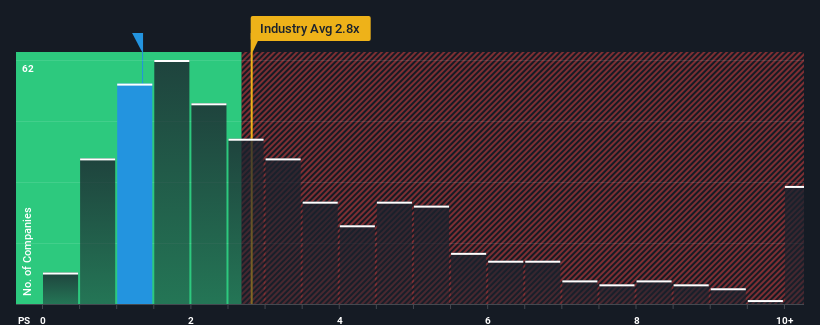

In spite of the firm bounce in price, Shaanxi Construction MachineryLtd may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.3x, since almost half of all companies in the Machinery industry in China have P/S ratios greater than 2.8x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Shaanxi Construction MachineryLtd Has Been Performing

While the industry has experienced revenue growth lately, Shaanxi Construction MachineryLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Shaanxi Construction MachineryLtd will help you uncover what's on the horizon.How Is Shaanxi Construction MachineryLtd's Revenue Growth Trending?

Shaanxi Construction MachineryLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Shaanxi Construction MachineryLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. This means it has also seen a slide in revenue over the longer-term as revenue is down 20% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 13% as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

With this in consideration, its clear as to why Shaanxi Construction MachineryLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Shaanxi Construction MachineryLtd's P/S?

Despite Shaanxi Construction MachineryLtd's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Shaanxi Construction MachineryLtd's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Shaanxi Construction MachineryLtd (of which 2 are concerning!) you should know about.

If you're unsure about the strength of Shaanxi Construction MachineryLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.