Returns On Capital Signal Difficult Times Ahead For China Film (SHSE:600977)

Returns On Capital Signal Difficult Times Ahead For China Film (SHSE:600977)

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. So after glancing at the trends within China Film (SHSE:600977), we weren't too hopeful.

当我们研究一家公司时,有时很难找到警告信号,但是有一些财务指标可以帮助及早发现问题。衰落的企业通常有两个潜在的趋势,第一,衰退 返回 论资本使用率(ROCE)和下降情况 基础 所用资本的比例。这表明该公司的投资利润减少了,总资产也在减少。因此,在看了一眼中国电影(SHSE: 600977)的趋势之后,我们并不抱太大希望。

Understanding Return On Capital Employed (ROCE)

了解资本使用回报率 (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for China Film:

为了澄清一下你是否不确定,ROCE是评估公司从投资于其业务的资本中获得多少税前收入(按百分比计算)的指标。分析师使用这个公式来计算中国电影的利润:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

已动用资本回报率 = 息税前收益 (EBIT) ¥(总资产-流动负债)

0.0099 = CN¥135m ÷ (CN¥20b - CN¥6.6b) (Based on the trailing twelve months to September 2023).

0.0099 = 1.35亿元人民币 ÷(20亿元人民币-6.6亿元人民币) (基于截至2023年9月的过去十二个月)。

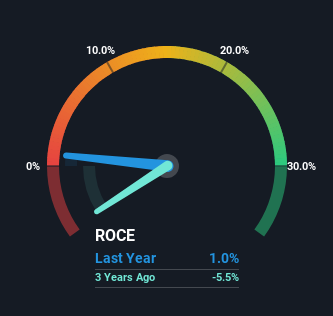

Therefore, China Film has an ROCE of 1.0%. In absolute terms, that's a low return and it also under-performs the Entertainment industry average of 4.4%.

因此,中国电影的投资回报率为1.0%。从绝对值来看,这是一个低回报,其表现也低于娱乐业4.4%的平均水平。

Above you can see how the current ROCE for China Film compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for China Film .

上面你可以看到中国电影当前的投资回报率与其先前的资本回报率相比如何,但从过去可以看出来的只有那么多。如果您有兴趣,可以在我们的免费中国电影分析师报告中查看分析师的预测。

The Trend Of ROCE

ROCE 的趋势

We are a bit worried about the trend of returns on capital at China Film. About five years ago, returns on capital were 9.4%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect China Film to turn into a multi-bagger.

我们对中影资本回报率的趋势有些担忧。大约五年前,资本回报率为9.4%,但现在已大大低于我们在上面看到的水平。最重要的是,值得注意的是,企业内部使用的资本量一直保持相对稳定。这种组合可能表明一家成熟的企业仍有资金部署的领域,但由于新的竞争或利润率降低,获得的回报并不那么高。如果这些趋势继续下去,我们预计中国电影不会变成一个多面手。

What We Can Learn From China Film's ROCE

我们可以从中国电影的ROCE中学到什么

In summary, it's unfortunate that China Film is generating lower returns from the same amount of capital. Long term shareholders who've owned the stock over the last five years have experienced a 23% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

总而言之,不幸的是,中国电影从相同数量的资本中获得的回报较低。在过去五年中持有该股的长期股东的投资贬值了23%,因此看来市场可能也不喜欢这些趋势。由于这些领域的潜在趋势并不理想,我们会考虑将目光投向其他地方。

If you want to continue researching China Film, you might be interested to know about the 1 warning sign that our analysis has discovered.

如果你想继续研究中国电影,你可能有兴趣了解我们的分析发现的1个警告信号。

While China Film isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

尽管中国电影的回报率并不高,但请查看这份免费清单,列出了资产负债表稳健的股本回报率高的公司。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?对内容感到担忧?直接联系我们。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St的这篇文章本质上是笼统的。我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。它不构成买入或卖出任何股票的建议,也没有考虑到您的目标或财务状况。我们的目标是为您提供由基本数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感型公司公告或定性材料。简而言之,华尔街没有持有任何上述股票的头寸。

译文内容由第三方软件翻译。