Exploring BRC Asia Plus Two More Elite Dividend Stocks

In a session marked by cautious optimism, Singapore's market inched higher despite a lackluster response to Wall Street's upbeat performance, reflecting the complex interplay of global and local economic signals. Amid these conditions, identifying dividend stocks that offer stability and potential growth becomes even more critical for investors seeking to navigate the uncertainties of today's markets.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Singapore Exchange (SGX:S68) | 3.63% | ★★★★★☆ |

Civmec (SGX:P9D) | 6.10% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.52% | ★★★★★☆ |

New Toyo International Holdings (SGX:N08) | 8.70% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 8.56% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 8.36% | ★★★★★☆ |

Asia Enterprises Holding (SGX:A55) | 7.30% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

Ban Leong Technologies (SGX:B26) | 6.81% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Click here to see the full list of 0 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

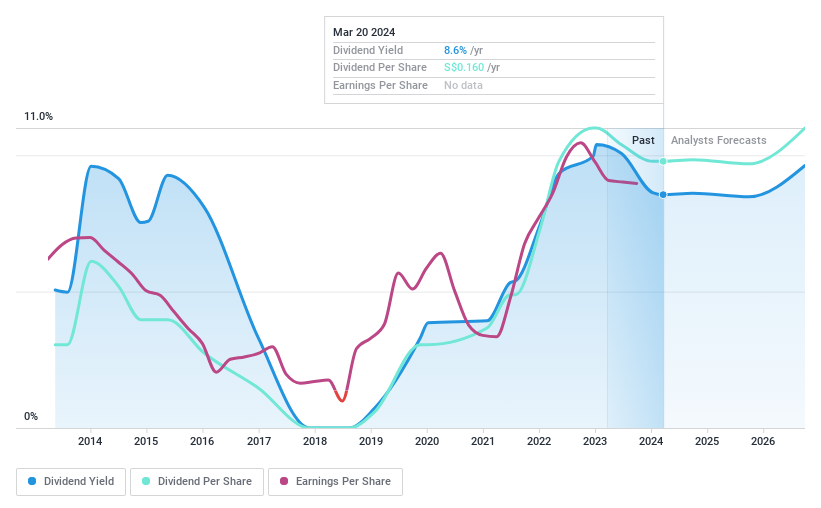

BRC Asia (SGX:BEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: BRC Asia Limited operates in the prefabrication of steel reinforcement for concrete across Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India and other international markets with a market capitalization of approximately SGD 513.03 million.

Operations: BRC Asia Limited generates its revenue primarily through two segments: trading, which brought in SGD 413.27 million, and fabrication and manufacturing, contributing SGD 1.21 billion.

Dividend Yield: 8.6%

BRC Asia, trading at a significant discount to its estimated fair value, offers an attractive dividend yield in the top quartile for Singapore's market. Despite a history of dividend growth over the past decade, payments have shown volatility and unreliability. The company maintains a low payout ratio (38%) and cash payout ratio (28.1%), suggesting dividends are well-covered by earnings and cash flow. However, it carries a high level of debt which may concern investors seeking stability. Recent announcements include maintaining director fees at S$500,000 and approving both final and special dividends of 5.5 Singapore cents per share for FY2023, with payment due on 17 May 2024 following shareholder approval at the Annual General Meeting held on January 31, 2024.

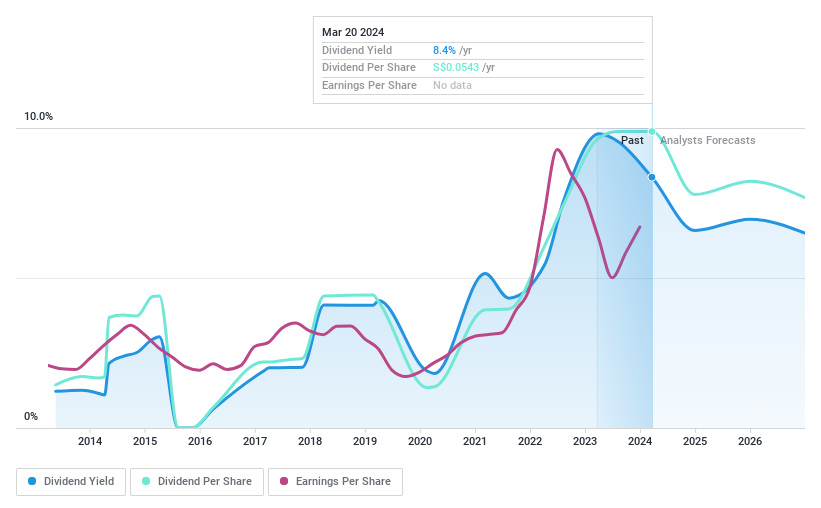

Bumitama Agri (SGX:P8Z)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bumitama Agri Ltd. is an investment holding company focused on the production and trade of crude palm oil (CPO), palm kernel (PK), and related products, primarily serving refineries in Indonesia, with a market capitalization of approximately SGD 1.13 billion.

Operations: Bumitama Agri Ltd.'s revenue primarily comes from its plantations and palm oil mills segment, generating IDR 15.44 billion.

Dividend Yield: 8.4%

Bumitama Agri's recent financials reveal a decrease in net income from IDR 2.83 billion in the previous year to IDR 2.45 billion, alongside a slight drop in sales. Despite these challenges, its dividend payments are considered sustainable due to a low payout ratio of 32.4% and a cash payout ratio of 68.2%. However, the company's dividends have been inconsistent over the past decade, with occasional significant drops. The resignation of an independent director might raise governance questions but the firm trades at good value relative to peers and is priced significantly below its fair value estimate, potentially offering attractive entry points for investors focused on dividends within Singapore's market context.

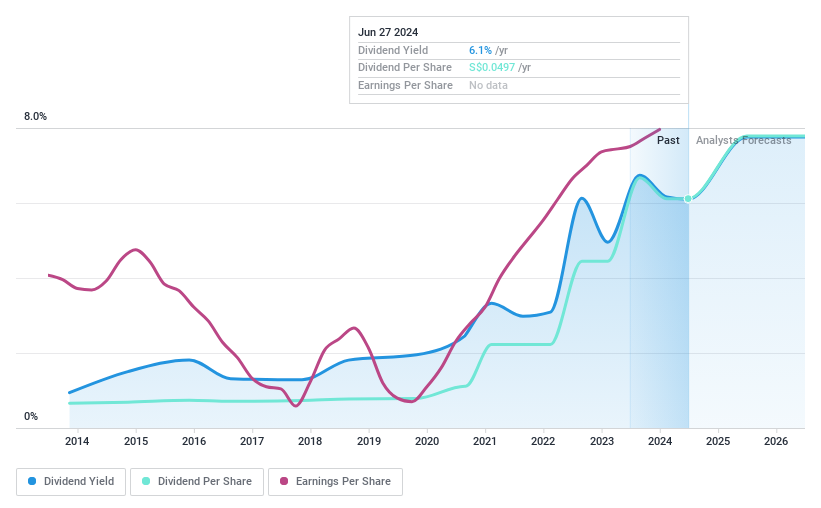

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company, offers construction and engineering services across the energy, resources, infrastructure, and marine and defense sectors primarily in Australia, with a market capitalization of approximately SGD 400.99 million.

Operations: Civmec Limited generates its revenue from three main segments: energy (A$46.02 million), resources (A$752.82 million), and a combined infrastructure, marine, and defense sector (A$105.52 million).

Dividend Yield: 6.1%

Civmec Limited has shown a positive trajectory in its financials, with an increase in interim dividend to AUD 0.025 from AUD 0.02 per share and a rise in net income to AUD 31.89 million from AUD 28.25 million year-over-year. The company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 45.4% and a cash payout ratio of 27%, indicating sustainability and reliability over the past decade despite its dividend yield being slightly lower than the top quartile of Singapore market payers at 6.1%.

Dive into the specifics of Civmec here with our thorough dividend report.

Our expertly prepared valuation report Civmec implies its share price may be lower than expected.

Taking Advantage

Embark on your investment journey to our 38 Top Dividend Stocks selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion .

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance