This article is edited from: China International Capital Corporation "overseas Asset allocation October report: troubled years", Sino-Thai Securities "domestic market closure overseas earthquake, what happened behind it?" "

Abstract: the Q3 financial report of US stocks is coming. According to the financial calendar of Futu Niuniu, starting from October 15, the Q3 financial reports of Wells Fargo & Co, Goldman Sachs Group, Netflix Inc and other major companies will debut one after another. Entering the earnings season, earnings will become the focus of the market, and the market expects Q3 earnings to fall into negative growth. Morgan Stanley said that the feeling of US stocks is "very similar" to that before last year's crash.

1. Q2 performance of US stocks: profits improved slightly, but investment growth stagnated.

Before forecasting the Q3 performance of US stocks, let's review the Q2 performance of US stocks.

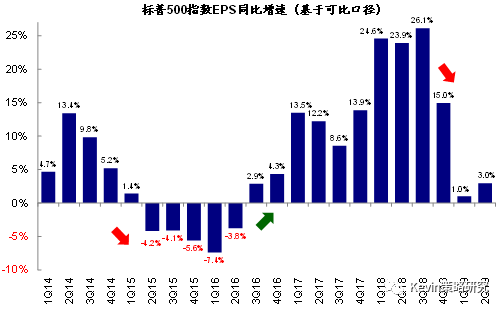

Us stock Q2 performance is different from previous market cautious and even pessimistic expectations, the actual disclosure of US stock Q2 performance is not as bad as expected, not only most of them are still better than expected (75%), and the actual growth rate has rebounded slightly under a comparable caliber, showing very strong resilience.

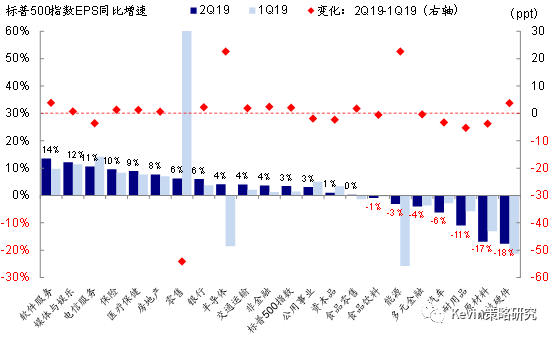

Specifically, the s & p's EPS (excluding non-recurrent gains and losses) rose 3 per cent in the second quarter from a year earlier, a slight improvement from 1 per cent in the first quarter.Meanwhile, EPS growth in the Nasdaq 100 index rebounded slightly to 4.9 per cent in the second quarter from 3.3 per cent in the first quarter.The reason for this is that the drag on overall growth of the cyclical sector decreased in the second quarter, while the growth rate of the technology sector (including software, hardware and semiconductors) improved greatly, and the contribution of the financial sector increased.

Corporate capital expenditure, which reflects corporate confidence in the future, weakened further in the second quarter.Year-on-year Capex growth for non-financial companies in the S & P 500 fell sharply to 0.2 per cent from 4.9 per cent in the first quarter, and even turned negative (- 0.9 per cent) year-on-year after excluding the energy sector. This is consistent with the recent trends reflected by some macro high-frequency indicators, such as manufacturing PMI new orders, non-defense new orders for aircraft capital goods, shipments, and undelivered orders, at the same time, except for the wholesale sector, inventory growth and inventory-to-sales ratio remained basically the same as in the first quarter.

2. Q3 Preview of US stocks: profits may fall into negative growth

Based on the market expectations summarized by FactsetThe EPS growth rate of the S & P 500 in the third quarter is expected to be-3.9% year-on-year.At present, the earnings market of US stocks is still expected to be in the downward channel. However, compared with the forecast of 2.13% year-on-year EPS growth in 2019, the growth forecast for 2020 is still as high as 10.4% (partly because sell-side analysts usually wait until after the third quarter to formally review their 2020 forecasts).

China International Capital Corporation believes that trade frictions and tariff levies have further escalated since August.Therefore, during the upcoming third-quarter earnings period, management's guidance for next year and changes in market expectations deserve close attention.It was the sharp reduction in 2019 earnings forecasts after October 2018 that further increased the downward pressure on the market at that time.

China International Capital Corporation believes that trade frictions and tariff levies have further escalated since August.Therefore, during the upcoming third-quarter earnings period, management's guidance for next year and changes in market expectations deserve close attention.It was the sharp reduction in 2019 earnings forecasts after October 2018 that further increased the downward pressure on the market at that time.

It is worth noting that during our National DayPMI and ADP non-farm payrolls data released in the United States in September were both lower than expected.It makes the market worry that the fundamentals of the US economy are going down, leading to a sharp adjustment in US stocks and even global stock markets. The s & p 500 fell 3% in the two days from October 1 to 2.

Euro zone manufacturing PMI hit a new lowIn particular, the PMI of German entrepreneurial manufacturing industry has reached an all-time low since it was announced.Trade relations between Europe and the United States have also become more strained and global uncertainty has increased.

Japan, the world's third-largest economy, also released its August sentiment index on October 7th, and the Japanese economy worsened.

3. Morgan Stanley: us stocks before Q3 are "very similar" to those before last year's crash.

Michael Wilson, chief equity strategist at Morgan Stanley, said the time was approaching the Q3 earnings season for US stocks, which are now "very similar" to the crash a year ago.

Over the past year, defensive stocks and bonds have been the market's first choice, not growth stocks, especially after risk adjustment. Although growth stocks were favored by investors in the first half of the year, things began to change in mid-July. Michael Wilson also saidFor US stocks, the Fed's suspension of rate hikes is good news, but if the Fed starts the rate-cutting cycle by cutting interest rates, it is bad news.

Looking back at history, the Fed's rate cut is not necessarily a good thing. Take the 2008 financial crisis as an example:

From 2004 to 2006, the US economic growth has been in a slowing channel, and the subprime mortgage crisis in 2007 accelerated the pace of economic decline. In response to the impact of the subprime crisis, the Fed began another sharp interest rate cut in September 2007, which lasted for 18 months, reducing the federal funds target rate from 5.25% to 0.25%.

At the beginning of the interest rate cut, US stocks rose briefly, but then the subprime crisis worsened and triggered the global financial crisis, which still did not curb the downward trend of US stocks. The Fed cut interest rates for the last time in December 2008, and three months later US stocks bottomed out and rebounded. During the period, the Dow fell 53.8%, the S & P fell 56.8%, and the Nasdaq fell 55.6%.

Edit / jasonzeng

Is the trend of stocks unpredictable? House prices have their ups and downs? Is the investment market unpredictable? Want to know more financial channels? Click below to learn about Futu Fund Bao, broaden your investment variety, income all year round, fund 0 commission trading, to help you seize market opportunities.

"" Click the link to learn about Fortune Fund Bao immediately ""