① As one of the three founding partners and former chairman of New Open Source, Wang Jianqiang, who left the company for two years, is trying to return to the company's management. ② The executive team's plan to increase shareholding ratio through fixed increases was thwarted.

Financial Services Association, March 9 (Reporter Liang Xiangcai) As one of the three founding partners and former chairman of New Open Source (300109.SZ), Wang Jianqiang, who left the company for two years, is trying to return to the company's management. Currently, the executive team plans to increase the shareholding ratio through fixed increases.

On the evening of the 8th, the new open source announcement, a proposal to raise 623 million yuan of additional capital from the company's chairman Zhang Junzheng and Yang Hongbo, vice chairman, to supplement working capital was rejected at the company's shareholders' meeting on the same day. A company executive told reporters, “In the future, actual controllers (parties) will still increase their shareholding ratio in the general direction. It is still open to discussion about how to increase their holdings.”

The Financial Services Association reporter learned from the shareholders' meeting that some investors expressed dissatisfaction with the issuance price of 12.46 yuan/share in the proposed increase plan and stated at the conference why they chose fixed growth when the overall stock market performed poorly in the recent period (as the pricing reference date). “This is not friendly to small and medium-sized investors.”

The Financial Services Association reporter learned from the shareholders' meeting that some investors expressed dissatisfaction with the issuance price of 12.46 yuan/share in the proposed increase plan and stated at the conference why they chose fixed growth when the overall stock market performed poorly in the recent period (as the pricing reference date). “This is not friendly to small and medium-sized investors.”

Read the previous announcement. The pricing reference date for this new open source increase is the announcement date of the board resolution, which is February 21. The issuance price of 12.46 yuan/share is 80% of the average trading price of the company's stock in the 20 trading days before the pricing benchmark date. Currently, the latest closing price of New Open Source is 19.00 yuan/share.

At the meeting, some company executives responded that the issuance process was in line with laws and regulations, that the target of the fixed increase was prepared for long-term shareholding, that they could understand the above shareholders' views, and that they were “willing to meet and discuss again” the specific (issuance) price.

The reporter observed that investors' dissatisfaction at the meeting was not an exception, and since Xincun introduced a fixed increase plan on February 21, the controversy related to this in the company's stock bar has not stopped. Among them, there were voices calling for minority shareholders to vote against it.

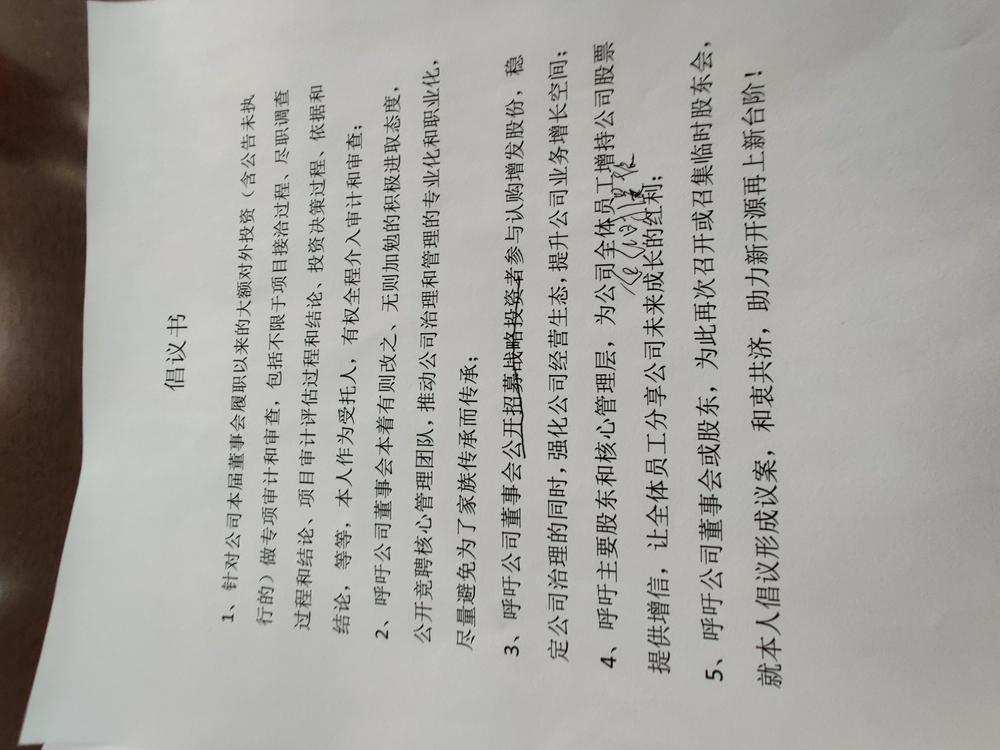

At the shareholders' meeting, the Financial Services Association reporter noticed that Wang Jianqiang's trustee, the company's former chairman and third-largest shareholder (holding 3.25% of shares as of press date), read out a proposal in public. The main contents include calling for the company to publicly compete for the core management team and publicly recruiting strategic investors to participate in subscribing for additional shares.

Photo by a reporter from the Financial Federation

Some executives of listed companies responded to the reporter. The majority of shareholders are welcome to put forward rational and constructive opinions on the company, and the company will also consider accepting and advancing as appropriate according to the actual situation.

Regarding the above proposal, several investors attending the conference told the Financial Federation reporter that it is expected that the company level will not accept the initiative, and Wang Jianqiang's own shareholding ratio is low. “He didn't lose heart in doing this, and wanted to get another chance to return to the company.” “Now that the three actual controllers are in harmony, I'm worried that he might disrupt the normal operation of the company.”

It should be pointed out that the decentralized shareholding structure is one of the important factors that are easily hampered by new open source matters. According to the announcement, as of September 30, 2023, the total shareholding ratio of the company's top ten shareholders was 28.14%; among them, the actual controllers of the company were three concerted actors, including Wang Donghu, Yang Haijiang, and Ren Dalong. Their direct shareholding ratios were 8.70%, 3.04%, and 1.90%, respectively.

The Financial Federation reporter will continue to follow up and report on subsequent developments (the Financial Services Association reporter previously reported: The former chairman of Xinjian Kaiyuan is “full of firepower”! The exchange quickly sent a letter “paying close attention” to whether the proposal to dismiss a number of current board members from their positions was rejected).

财联社记者从股东会现场获悉,有投资者就本次拟定增方案中12.46元/股的发行价格表示不满,并在大会上表示,为何趁着最近一段时间整个股市表现较差的时候(作为定价基准日)选择定增,“这样对中小投资者来看不友好。”

财联社记者从股东会现场获悉,有投资者就本次拟定增方案中12.46元/股的发行价格表示不满,并在大会上表示,为何趁着最近一段时间整个股市表现较差的时候(作为定价基准日)选择定增,“这样对中小投资者来看不友好。”