EyePoint Pharmaceuticals Inc (EYPT) Reports Growth Amidst Strategic Shifts in Q4 and Full-Year 2023

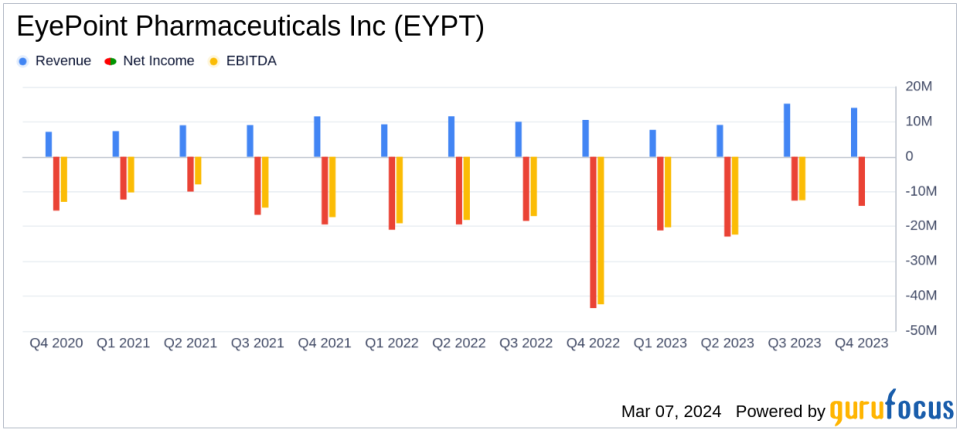

Total Net Revenue: Increased to $14.0 million in Q4 2023 from $10.5 million in Q4 2022.

Net Product Revenue: Decreased to $0.7 million in Q4 2023 due to strategic exit from commercial business.

Royalties and Collaborations Revenue: Rose significantly to $13.3 million in Q4 2023.

Operating Expenses: Decreased to $30.4 million in Q4 2023 from $54.3 million in Q4 2022.

Net Loss: Improved to $14.1 million in Q4 2023 from $43.5 million in Q4 2022.

Cash Position: Strong with $331.1 million as of December 31, 2023.

EyePoint Pharmaceuticals Inc (NASDAQ:EYPT), a company dedicated to developing ophthalmic products for eye diseases, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company, which has operational footprints in the U.S., China, and the UK, and generates most of its revenue from the U.S., has reported a year of strategic shifts and clinical advancements.

Financial Performance and Clinical Progress

For the fourth quarter of 2023, EyePoint Pharmaceuticals reported total net revenue of $14.0 million, up from $10.5 million in the same period last year. This increase was despite a decrease in net product revenue to $0.7 million, down from $9.9 million in the fourth quarter of 2022, following the company's strategic exit from its commercial business in the first half of 2023. The company's net revenue from royalties and collaborations for the quarter totaled $13.3 million, a significant increase from $0.7 million in the corresponding period in 2022, primarily due to partial recognition of deferred revenue from the license of the YUTIQ franchise.

Operating expenses for the quarter ended December 31, 2023, were $30.4 million, a decrease from $54.3 million in the prior year period, mainly due to the strategic exit from the commercial business and a one-time intangible asset impairment charge in the fourth quarter of 2022. The net non-operating income totaled $2.3 million, and the net loss improved to $14.1 million, or ($0.33) per share, compared to a net loss of $43.5 million, or ($1.16) per share, for the prior year period.

Annual Results and Corporate Developments

For the full year ended December 31, 2023, total net revenue was $46.0 million compared to $41.4 million for the previous year. The decrease in net product revenue, which totaled $14.2 million for the year, was offset by a substantial increase in net revenue from royalties and collaborations, which totaled $31.8 million. Operating expenses for the year were $121.1 million, down from $141.0 million in the prior year. The net loss for the year was $70.8 million, or ($1.82) per share, an improvement from a net loss of $102.3 million, or ($2.74) per share, for the previous year.

EyePoint Pharmaceuticals' cash position remains strong, with $331.1 million in cash, cash equivalents, and investments as of December 31, 2023, compared to $144.6 million as of December 31, 2022. The company expects that its cash reserves will fund operations through topline data for the planned Phase 3 clinical trials of EYP-1901 for wet AMD in 2026.

Outlook and Future Plans

EyePoint Pharmaceuticals has had a transformative year with positive data from its Phase 2 DAVIO 2 trial of EYP-1901 in wet AMD and the advancement of ongoing Phase 2 trials in NPDR and DME. The company has also strengthened its balance sheet with a $230 million oversubscribed financing in December and the sale of rights to YUTIQ for $82.5 million plus future royalties last May. With the appointment of Ramiro Ribeiro, M.D., Ph.D. as Chief Medical Officer and the anticipation of topline data for the Phase 2 PAVIA clinical trial of EYP-1901 in NPDR in the second quarter of 2024, the company is poised for further growth.

EyePoint Pharmaceuticals' commitment to advancing EYP-1901 through clinical development across significant indications, coupled with a robust financial position, positions the company for potential success in the biotechnology industry. Investors and stakeholders will be watching closely as the company progresses towards its Phase 3 clinical trials and continues to leverage its proprietary Durasert and Verisome technology platforms.

For more detailed information on EyePoint Pharmaceuticals' financial results and corporate developments, interested parties are encouraged to join the conference call or access the webcast replay available on the company's website.

Explore the complete 8-K earnings release (here) from EyePoint Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance