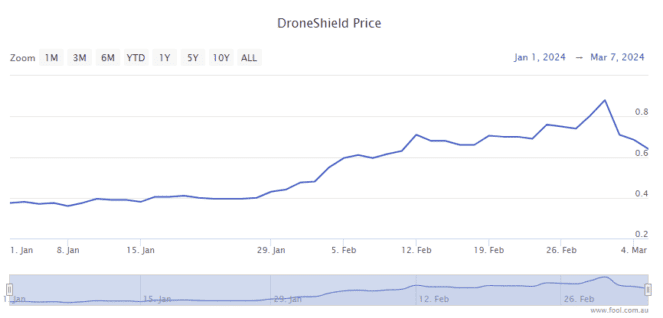

The DroneShield Ltd (ASX: DRO) share price is tanking today, down 15.11% to 59 cents per share.

In fact, the defence technology business has lost 36% of its market capitalisation in six trading days.

This represents a dramatic change after an impressive 56% upward sweep between 1 January and last Wednesday, when the ASX stock traded at a new all-time high.

What's gone wrong?

Let's take a look at the news affecting the Droneshield share price over the past six days.

What's driving the DroneShield share price down?

The DroneShield share price closed at a new record high of 93 cents last Wednesday, 28 February.

That was the day the company released its full-year results for FY23 and an investor presentation.

The company revealed an inaugural profit after tax of $9.3 million, up from a $900,000 loss in FY22.

ASX investors were impressed, and the Droneshield share price lifted 22.4% to its new peak.

Then on Thursday, the ASX small-cap stock plunged 25.8% to 69 cents per share. This was despite no news from the company.

That same day, the S&P/ASX Small Ordinaries Index (ASX: XSO) lifted 1.02%.

This indicates some investors may have celebrated the record high with some profit-taking.

On Friday, we learned that Droneshield would be added to the S&P/ASX All Ordinaries Index (ASX: XAO) in the S&P Dow Jones Indices quarterly rebalance.

This will take effect on 18 March.

Being added to an index like the ASX All Ords or ASX 200 is usually a good thing, as it prompts many passive index funds to automatically buy more stock to match the rebalanced weighting.

About twice the average volume of Droneshield shares were traded that day, but the price remained steady at 69 cents.

On Monday, the Droneshield share price dropped by 10.14% to 62 cents, then recovered completely on Tuesday back to 69 cents.

The next piece of news hit yesterday.

Directors sell millions of Droneshield shares

There was a series of notices published yesterday pertaining to Droneshield directors selling a stack of shares. We're talking millions of them.

They were sold between 29 February (the day after the record high) and 5 March.

The biggest sell-off came from managing director Oleg Vornik, who sold more than 10 million Droneshield shares for just over $7 million.

The company explained that 4,450,000 were loan-funded shares issued previously as part of the Incentive Option Plan.

Droneshield also said $1,597,500 of the proceeds represented the loan repayment, and therefore cash receipts for the company.

Vornik retains 15,000,000 unlisted and unvested performance options, vesting if certain performance milestones are met, each exercisable at $0.00 per option, expiring on 19 January 2029.

Droneshield said:

The sale of shares represents 41.07% of the total Director's holding on a fully diluted basis.

A substantive reason for the sale is to realise liquidity on some of his holdings, following a number of years of being involved with the Company.

Investors don't typically like seeing directors sell shares, but the Droneshield share price lifted 1.45% to 70 cents anyway.

But today, it's tanking by more than 15% on no news at all.

By comparison, the ASX Small Ords is up 2.8%.

Should you buy the dip?

This is one of those situations where nothing fundamentally bad has happened to make the stock dive by 36% over the past six days. And it's the sort of scenario that long-term investors love!

This is because it enables them to pick up more stock at a lower price. It's called buying the dip, and it's a great way of dollar-cost averaging to achieve a lower average price for your entire Droneshield holdings.

But before you buy, are you missing anything?

Not according to broker Bell Potter.

On Tuesday, the broker announced it was upgrading its rating on Droneshield to buy specifically due to the share price drop.

The broker reckons the Droneshield share price can get to 90 cents within the next 12 months.

Based on today's price, this represents a potential 52% upside for investors who buy the Droneshield dip today.