The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Henan Yuguang Gold&LeadLtd (SHSE:600531), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Henan Yuguang Gold&LeadLtd's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Henan Yuguang Gold&LeadLtd has grown EPS by 19% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

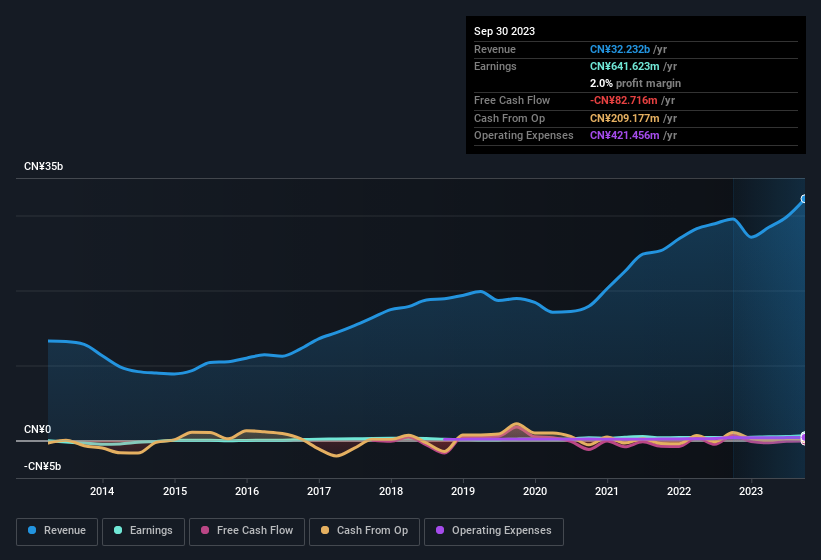

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Henan Yuguang Gold&LeadLtd shareholders is that EBIT margins have grown from 0.3% to 2.4% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Henan Yuguang Gold&LeadLtd's balance sheet strength, before getting too excited.

Are Henan Yuguang Gold&LeadLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥2.9b and CN¥12b, like Henan Yuguang Gold&LeadLtd, the median CEO pay is around CN¥939k.

Henan Yuguang Gold&LeadLtd's CEO took home a total compensation package worth CN¥535k in the year leading up to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Henan Yuguang Gold&LeadLtd To Your Watchlist?

You can't deny that Henan Yuguang Gold&LeadLtd has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. Based on these factors, this stock may well deserve a spot on your watchlist, or even a little further research. Even so, be aware that Henan Yuguang Gold&LeadLtd is showing 2 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.