Here's Why XMH Holdings (SGX:BQF) Has Caught The Eye Of Investors

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like XMH Holdings (SGX:BQF). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide XMH Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for XMH Holdings

XMH Holdings' Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that XMH Holdings' EPS went from S$0.027 to S$0.085 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

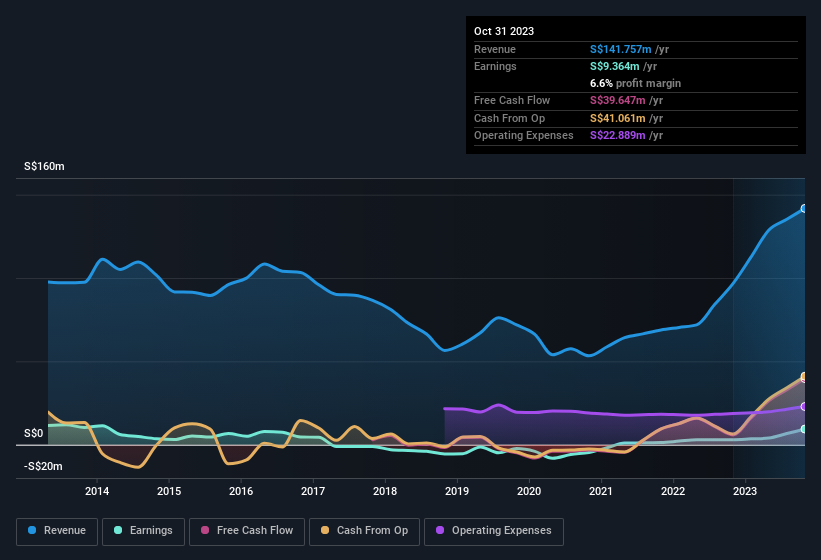

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. XMH Holdings shareholders can take confidence from the fact that EBIT margins are up from 6.2% to 12%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

XMH Holdings isn't a huge company, given its market capitalisation of S$45m. That makes it extra important to check on its balance sheet strength.

Are XMH Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The real kicker here is that XMH Holdings insiders spent a staggering S$7.9m on acquiring shares in just one year, without single share being sold in the meantime. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Chairman & MD Tin Yeow Tan who made the biggest single purchase, worth S$1.8m, paying S$0.35 per share.

And the insider buying isn't the only sign of alignment between shareholders and the board, since XMH Holdings insiders own more than a third of the company. In fact, they own 84% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. To give you an idea, the value of insiders' holdings in the business are valued at S$38m at the current share price. That's nothing to sneeze at!

Does XMH Holdings Deserve A Spot On Your Watchlist?

XMH Holdings' earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe XMH Holdings deserves timely attention. What about risks? Every company has them, and we've spotted 3 warning signs for XMH Holdings (of which 1 is concerning!) you should know about.

Keen growth investors love to see insider buying. Thankfully, XMH Holdings isn't the only one. You can see a a curated list of Singaporean companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance