Those holding China Wafer Level CSP Co., Ltd. (SHSE:603005) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

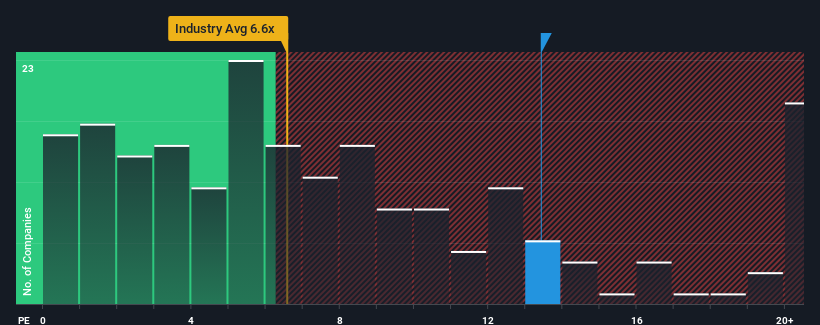

Following the firm bounce in price, China Wafer Level CSP's price-to-sales (or "P/S") ratio of 13.4x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in China, where around half of the companies have P/S ratios below 6.6x and even P/S below 3x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Has China Wafer Level CSP Performed Recently?

China Wafer Level CSP hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on China Wafer Level CSP will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as China Wafer Level CSP's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 24%. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.2% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 37% during the coming year according to the only analyst following the company. That's shaping up to be materially lower than the 20,706% growth forecast for the broader industry.

In light of this, it's alarming that China Wafer Level CSP's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Shares in China Wafer Level CSP have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for China Wafer Level CSP, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with China Wafer Level CSP.

If these risks are making you reconsider your opinion on China Wafer Level CSP, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.