With EPS Growth And More, Huationg Global (Catalist:41B) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Huationg Global (Catalist:41B). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Huationg Global

Huationg Global's Improving Profits

Huationg Global has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Huationg Global's EPS skyrocketed from S$0.046 to S$0.068, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 49%.

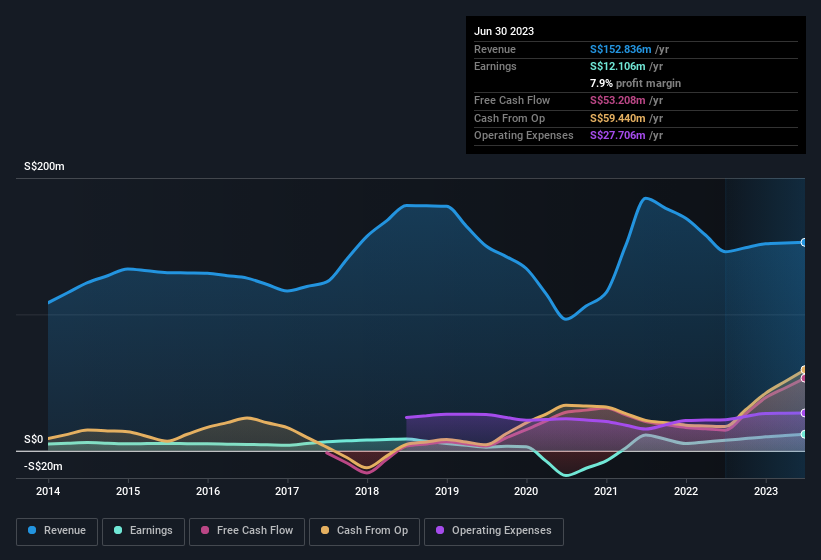

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Huationg Global shareholders is that EBIT margins have grown from 2.0% to 8.6% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Huationg Global is no giant, with a market capitalisation of S$26m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Huationg Global Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Huationg Global insiders walking the walk, by spending S$365k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was company insider Vimesh Mehta who made the biggest single purchase, worth S$77k, paying S$0.15 per share.

Does Huationg Global Deserve A Spot On Your Watchlist?

You can't deny that Huationg Global has grown its earnings per share at a very impressive rate. That's attractive. Growth in EPS isn't the only striking feature with company insiders adding to their holdings being another noteworthy vote of confidence for the company. So on this analysis, Huationg Global is probably worth spending some time on. Even so, be aware that Huationg Global is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, Huationg Global isn't the only one. You can see a a curated list of Singaporean companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance