Mid-Autumn Festival short holiday is over in the blink of an eye. Are you already on your way back? Wande will show you the financial events of the holiday.

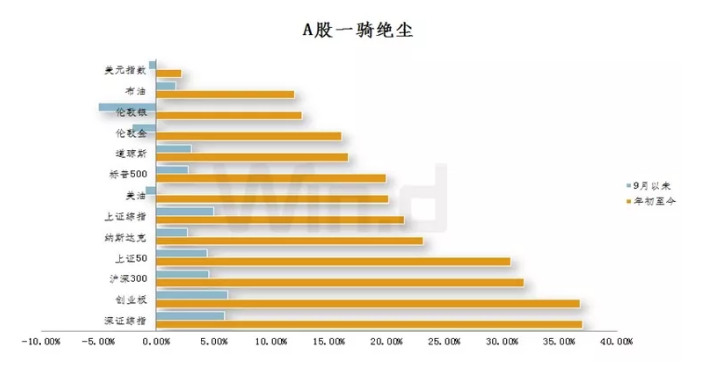

Reviewing the performance of major categories of assets in the global market at the beginning of this year and since the beginning of September, I have a clear view of the small mountains around me.Among them, the Shenzhen Composite Index has risen 36% since the beginning of the year, and the gem ranks first with 6.5% high earnings since September this year.

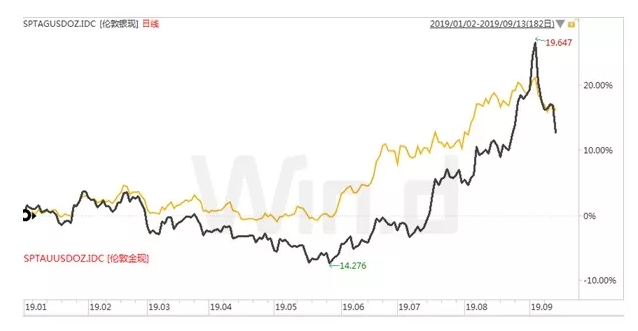

The assets that have fallen the most since September are precious metals, gold and silver, with the spot price of London silver down more than 6%.Since the beginning of this year, due to the instability of global trade and economic situation, gold and silver have emerged from a magnificent bull market, and gold has broken through the repression of US $1350 / oz for six years, and the market is generally judged to be able to stand at US $1600 this year.

Recently, under the influence of risk aversion, gold began to turn downward after hitting as high as $1557, as the decline in silver was more pronounced because of more speculative reasons.

Us Oil is down more than 3% this week and has had negative earnings since September. September 13 news, OPEC members and Russia and other non-OPEC oil producers reiterated their commitment to abide by the existing production reduction agreement, and did not announce larger production reduction measures as the market had expected. And before that,Tensions between the United States and Iran have eased, prompting speculation that global crude oil supplies will rise.

It is not clear whether there will be any impact on oil production after a fire broke out after a drone strike on two main oil facilities in Saudi Aramco on the night of Sept. 14.

Let's take a look at what other major events have happened in the world in the past few days during short holiday.

As risk aversion weakens, global risky assets soar, while safe-haven assets are sold.

Restart QE in Europe

The night before short holiday, Thursday, Beijing time (September 12)The European Central Bank cut interest rates and restarted QE, cutting deposit rates by 10 basis points to-0.5% for the first time since March 2016And will begin to implement the interest rate grading system. The ECB will buy 20 billion euros of bonds a month from November 1st, and will keep buying as long as necessary, and will not consider raising interest rates until the end of the new QE. The ECB will also change its model for a new round of quarterly target long-term refinancing operations (TLTRO III) to maintain favourable bank lending conditions.At the same time, cut the euro zone economic growth forecasts for this year and next, as well as inflation expectations for the next three years.Cut the growth forecast from 1.2 per cent to 1.1 per cent in 2019, 1.2 per cent from 1.4 per cent in 2020, 1.2 per cent from 1.3 per cent in 2019, 1 per cent from 1.4 per cent in 2020 and 1.5 per cent from 1.6 per cent in 2021.

Other side,As the October 31 Brexit deadline approaches, the risk of leaving the EU without an agreement is gradually decreasing.It has been reported that the European Union is prepared to allow Britain to postpone Brexit again in order to avoid Brexit without agreement. At the same time, German Chancellor Angela Merkel said there was still an opportunity for an orderly Brexit, but Germany was also ready to leave without an agreement.

On the one hand, there is a hard Brexit, on the other hand, there has been a decline in the economies of several major European economies, Germany and Italy. The pound and the euro have fallen against the dollar since the beginning of this year, but stimulated by the "big release" of the European Central Bank, it rebounded this week.

On the night of the Mid-Autumn Festival, the London Stock Exchange issued a statement on its website saying that the board of directors unanimously rejected HKEx's offer, saying there was no need to approach Hong Kong Exchanges and Clearing further. Subsequently, HKEx responded that it was disappointed and would continue to approach.

The high level of the dollar is topped

This week, the Dow is up 1.58%, the Nasdaq is up 0.91%, and the S & P 500 is up 0.96%.Meanwhile, the 10-year yield rose 11 basis points to 1.887%, and the 30-year yield rose 10.2 basis points to 2.360%.

The dollar index turned downwards after approaching the 100-round mark. In the early stage, it was affected by the collective decline of currencies such as the euro, the pound and the Swiss franc.At one point, the dollar index passively rose to a high of 99, but that appreciation was disturbed by the continued contraction in manufacturing.As US manufacturing and economy continued to shrink and non-farm payrolls data were lower than expected, Powell warned that US economic expansion could derail and the dollar index plummeted from its high level.

The onshore and offshore RMB rose sharply against the US dollar this week.Among them, the offshore RMB rose more than 1600 basis points against the dollar since September.

Looking forward to the future, A-shares are expected to usher in the "Golden Nine".

On Sept. 11, the position of 50ETF options reached an all-time high of 4.31 million. On September 12, the position was 4.22 million, which remained high.Among them, bullish 3.1 rose 50% in September, and bullish 3.0 contracts rose 44.11% in September.

Edit / Grace