Nanjing Chixia Development Co.,Ltd. (SHSE:600533) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

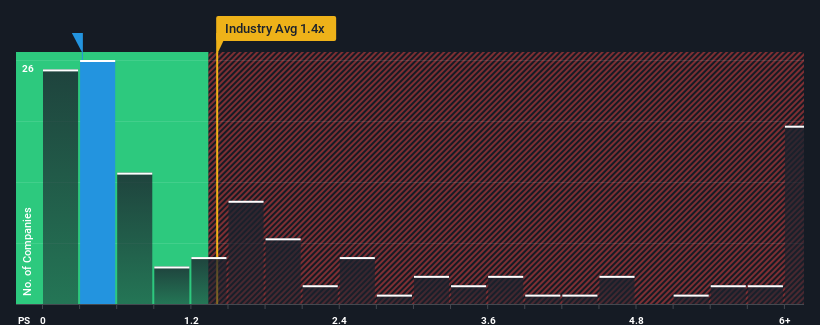

After such a large drop in price, Nanjing Chixia DevelopmentLtd may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.3x, since almost half of all companies in the Real Estate industry in China have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Nanjing Chixia DevelopmentLtd Has Been Performing

Nanjing Chixia DevelopmentLtd certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Nanjing Chixia DevelopmentLtd will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Nanjing Chixia DevelopmentLtd?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nanjing Chixia DevelopmentLtd's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 84%. The strong recent performance means it was also able to grow revenue by 121% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 9.7% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Nanjing Chixia DevelopmentLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Nanjing Chixia DevelopmentLtd's recently weak share price has pulled its P/S back below other Real Estate companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see Nanjing Chixia DevelopmentLtd currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Nanjing Chixia DevelopmentLtd.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.