Unfortunately for some shareholders, the Changzhou Tenglong AutoPartsCo.,Ltd. (SHSE:603158) share price has dived 30% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

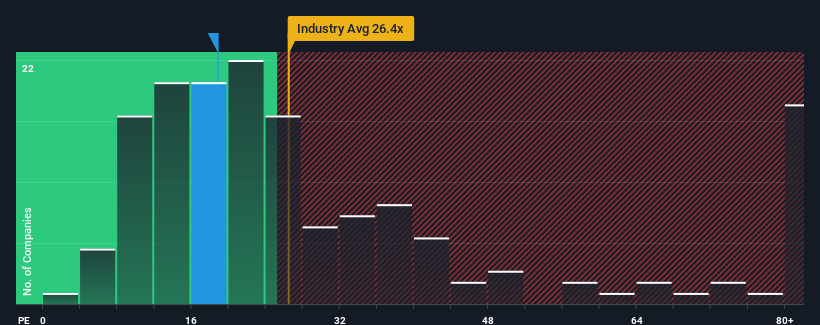

Following the heavy fall in price, Changzhou Tenglong AutoPartsCo.Ltd may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.8x, since almost half of all companies in China have P/E ratios greater than 27x and even P/E's higher than 48x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Changzhou Tenglong AutoPartsCo.Ltd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Changzhou Tenglong AutoPartsCo.Ltd would need to produce sluggish growth that's trailing the market.

In order to justify its P/E ratio, Changzhou Tenglong AutoPartsCo.Ltd would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 72% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 6.2% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 39% during the coming year according to the sole analyst following the company. That's shaping up to be similar to the 41% growth forecast for the broader market.

In light of this, it's peculiar that Changzhou Tenglong AutoPartsCo.Ltd's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Changzhou Tenglong AutoPartsCo.Ltd's P/E?

Changzhou Tenglong AutoPartsCo.Ltd's recently weak share price has pulled its P/E below most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Changzhou Tenglong AutoPartsCo.Ltd currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Changzhou Tenglong AutoPartsCo.Ltd (of which 1 is significant!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.