Original / Wang Yuling costs a lot of money

The semi-annual reports of 36 A-share listed securities firms have all been disclosed.Brokerage Chinese reporters sorted out six major indicators of revenue, net profit, brokerage, investment banking, self-management and asset management with consolidated caliber data to get a glimpse of the overall operation of the industry in the first half of this year.

Benefiting from the pick-up in the capital market, the overall performance of securities firms has strengthened. Large proprietary sector has become the main factor driving performance, investment banking business bright spots frequently, brokerage business generally pick up, and asset management in the overall decline in the context of the "dark horse".

In early trading today, the Prev stood again above 2900 points, while the gem index rose more than 1 per cent. Brokerage stocks rose across the board. As of the press release of the brokerage in China, Guosheng Financial Control rose more than 8%, while CITIC Construction Investment and Huaxi Securities rose more than 3%.

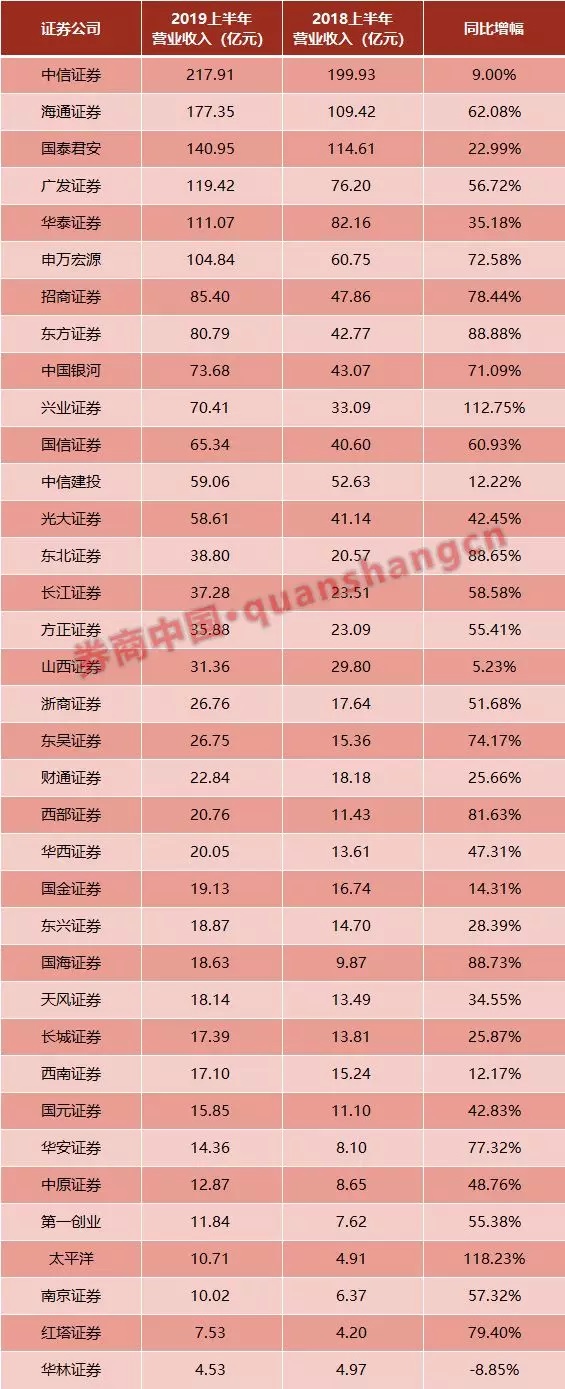

Revenue: 20 brokerages grew by more than 50% year-on-year

Since 2019, the clear positioning of the capital market hub has brought new development opportunities to the securities industry. On the whole, the overall performance of securities firms strengthened in the first half of this year. Of the 36 listed brokerages, revenue from Societe Generale and Pacific Securities grew by more than 100 per cent year-on-year. Including these two, a total of 20 listed brokerages have seen revenue growth of more than 50 per cent year-on-year. The operating income of Hualin Securities alone declined year-on-year.

The top 10 operating income in the first half of 2019 are CITIC, Haitong, Guotai Junan, GF Securities Co., LTD., Huatai, Shen Wanhongyuan, China Merchants, Oriental Securities, China Galaxy Securities and Societe Generale Securities.

It should be noted that in the past two years, the futures subsidiaries of many brokerages have developed commodity sales business, which has a low operating profit margin and contributes a lot to revenue, but does not increase net profit.Therefore, the ranking of operating income will also be affected by this factor.

For example, according to the semi-annual report of Oriental Securities, the company's other operating income was 3.383 billion yuan, an increase of 2.632 billion yuan over the same period last year, an increase of 350.48%, mainly due to an increase in commodity sales income from subsidiaries. Societe Generale Securities disclosed in its semi-annual report that the company's other business income was 2.021 billion yuan, an increase of 30357% over the same period last year, mainly due to a substantial increase in commodity sales revenue this year from the Xing Zheng Futures risk Management subsidiary.

Northeast Securities semi-annual report disclosed that other business income was 1.914 billion yuan, an increase of 135.19% over the previous year, mainly due to the increase in the scale of futures spot trading business carried out by Bohai Rongxing (Shanghai) Trading Co., Ltd., the grandson of the company. Of this total, the income from spot trading business is 1.908 billion yuan.

The relevant disclosure of Shanxi Securities is also very detailed: in the first half of 2019, the sales income of the warehouse receipt business was 1.775 billion yuan, and the procurement cost was 1.75 billion yuan. While the warehouse receipt business was carried out, the company hedged the value of the futures side, and the net income generated by the warehouse receipt hedging was 23.413 million yuan. The total profit of warehouse receipt business is 47.7069 million yuan. Commodity trading business is characterized by transparent prices, large volume of individual transactions, disproportionate changes in trading volume and gross profit margin, while the company adopts commodity trade model accounting, resulting in simultaneous increase in sales revenue and sales costs. The operating profit margin of Shanxi securities commodities trading and risk management business is 1.88%.

Brokerage Chinese reporters learned that "Big Brother" CITIC also generated a lot of commodity sales revenue in the second quarter. Although the semi-annual report is not directly disclosed, the "other business income" in the consolidated income statement is 4.043 billion, resulting in "other business costs" 3.9 billion. This part of the income and cost roughly reflects CITIC's commodity sales.

For example, in Haitong's other business income, 3.73 billion yuan is sales income. Of the other business income of Zheshang Securities, 1.055 billion yuan is from the sale of goods.

Net profit: Citic, Haitong and Guojun

Of course, net profit is the index that can best reflect the performance competitiveness of securities firms. The top 10 securities firms in the first half of 2019 are CITIC, Haitong, Guotai Junan, GF Securities Co., LTD., Huatai, China Merchants, Shen Wanhongyuan, Guoxin Securities, China Galaxy Securities and CSC FINANCIAL CO.,LTD. Among them, CITIC, Haitong and Guotai Junan made a net profit of more than 5 billion yuan.

From the point of view of the range of changes, Pacific Securities turned losses into profits. Soochow Securities was affected by market conditions in the first half of last year, affecting brokerage, proprietary and other related trading businesses, and net profit fell more than 90 per cent year-on-year. Soochow Securities's net profit soared 27-fold in the first half of this year, making it the listed securities firm with the largest year-on-year increase.

The net profit of Shanxi Securities, Guohai Securities, founder Securities and Hongta Securities increased by more than 200% compared with the same period last year, and the net profits of the first Venture Securities, Yangtze River Securities, Northeast Securities, Hua'an Securities and Guoxin Securities increased by more than 100% year-on-year. Haitong, among the top five brokerages, the increase in net profit was the most obvious, up 82.34% over the same period last year.

The net profit of Hualin Securities and Tianfeng Securities declined year-on-year. The net profit of Hualin Securities was 183 million yuan, down 1.38% from the same period last year, while the net profit of Tianfeng Securities was 168 million yuan, down 27.5% from the same period last year.

Brokers: 14 brokerages grew by more than 20% year-on-year

In the first half of 2019, the stock trading volume in the Shanghai and Shenzhen stock markets was 69.35 trillion yuan, an increase of 32.78% over the same period last year (data source: WIND). Affected by the recovery of the market, the brokerage business improved, and the industry achieved a net income of 44.4 billion yuan (including seat leases), an increase of 22.06% over the same period last year (data source: Securities Association).

The brokerage fee net income index adopted in this paper has a wider connotation, including agent trading securities business income, consignment financial products income, institutional split commission, futures brokerage and so on. Judging from the ranking of this index, CITIC, Guotai Junan, China Galaxy Securities, GF Securities Co., LTD., Guoxin Securities, Huatai, China Merchants, Shen Wanhongyuan, Haitong and founder Securities are in the top 10.

Although CITIC ranks first, he is one of only two listed securities firms with a decline in net income from brokerage fees. In the first half of 2019, CITIC achieved a net income of 3.799 billion yuan from the brokerage business, a decrease of 7.61 percent over the same period last year, mainly due to the downward market share. The stock-based trading volume of agent buying and selling reached 8.2 trillion yuan, with a market share of 5.55%, a decrease of 0.45% over the same period last year. In the first half of the year, the market warmed up, the activity of individual investors increased, the company's customer structure was dominated by institutional customers, and the transaction elasticity was weak. It is understood that CITIC's brokerage business decline is mainly due to the decline in overseas Citic Lyon income.

Another brokerage with declining brokerage revenue is Tianfeng Securities, with net income from brokerage fees of 314 million yuan in the first half of the year, down 4.93 per cent from a year earlier.

In the top 10, Guotai Junan, China Galaxy Securities, Huatai and founder Securities increased by more than 20 per cent year-on-year.Guotai Junan's net income from agency buying and selling business has remained the first in the industry in recent years, with a market share (including seat leasing) of 5.75% in the first half of the year. At the same time, Guotai Junan strengthened investment team building, promoted the production and operation of contracted products, strengthened asset allocation services, optimized the sales mechanism of financial products, and continued to improve wealth management capabilities. At the end of the reporting period, the number of investment advisers of the group was 2380, an increase of 11.37% over the end of last year, and the number of investment advisers signed by clients was 181000, an increase of 20.67% over the end of last year. The average monthly retained size of financial products sold on consignment was 155.5 billion yuan, an increase of 9.35 percent over the previous year.

China Galaxy Securities achieved 2.441 billion yuan in brokerage income in the first half of the year, an increase of 24% over the same period last year. Galaxy Securities is mainly retail customers, with 10.84 million securities brokerage customers, including 16500 institutional and product households. The company's consignment business of financial products continues to implement centralized and unified management, coordinated by the product center, and set up a vertical business echelon from headquarters to branches and business departments to promote the transformation of the company's wealth management. In the first half of the year, the net income of consignment sales of financial products was 260 million yuan, ranking third in the industry. The sales of financial products are 47.3 billion yuan, ranking third in the industry. By the end of June, the company's financial products totaled 117.4 billion yuan, an increase of 16% over the same period last year.

Huatai has built an integrated wealth management system online and offline, and built an investment management team and investment management platform based on the platform system. at present, the transformation of wealth management has achieved some results, and the stock-based trading volume has remained in the first place. the company's account fund balance rose to the first place in the market for the first time.

Founder Securities, on the other hand, accelerates the construction of high net worth customer service system, provides professional wealth management services with unique founder characteristics for high net worth customers, and gradually forms a wealth management development model driven by "inclusive + high clean" with founder characteristics.

In the first half of this year, Haitong further optimized the layout of the network, and the application for the establishment of 2 new branches and 15 securities business departments was formally approved, which attracted the attention of the industry. Haitong said that by increasing the tilt of policies and resources in Guangdong-Hong Kong-Macau Greater Bay Area, the economic zone on the west bank of the Taiwan Strait, the Beijing-Tianjin-Hebei economic circle, the Chengdu-Chongqing economic zone and the Yangtze River Delta economic zone, we will strengthen network coverage in key areas and enhance network service level and radiation capacity. In the first half of the year, Haitong comprehensively implemented the customer manager system, strengthened the scientific and technological empowerment of business management, effectively used the Internet platform, reshaped the customer service system, and enhanced the vitality of branch offices.

Investment bank: the top three of CITIC, Haitong and CITIC

In the first half of the year, the total amount of funds raised in the domestic equity financing market (including IPO, rights issue, rights issue, preferred shares and convertible bonds) was 554.4 billion yuan, down 16% from the same period last year; the total amount of mergers and acquisitions announced by the whole market for the first time was 1.16 trillion yuan, down 65.40% from the same period last year; the total amount of bonds issued by various institutions was 21.74 trillion, up 5% from the same period last year, of which subordinated debt of commercial banks increased by nearly 400% to 459.3 billion yuan The private placement of bonds on the exchange increased by 148% to 576.673 billion yuan, making it the largest exchange by volume.

In the first half of 2019, CITIC achieved a net income of 1.804 billion yuan in investment banking, an increase of 3.09 percent over the same period last year, which was less than the industry average.

Haitong, who ranked second, completed 574 phases of the main underwriting bond project in the first half of the year, with a total underwriting amount of 184.3 billion yuan, and his semi-annual income reached a new high. Despite the decline in the total amount of funds raised in the domestic equity financing market, Haitong International remains strong in the equity financing market. Haitong International completed 24 IPO projects and 27 equity financing projects in the first half of the year, ranking first among all investment banks in Hong Kong. The completed "LUCKN COFFEE DRC" US stock IPO project is the largest IPO of an Asian company on Nasdaq so far this year.

In the first half of 2019, Citic Construction achieved a net income of 1.621 billion yuan in investment banking fees, an increase of 14.11% over the same period last year, mainly due to the substantial increase in the scale of bond underwriting. In the first half of the year, the main underwriting scale of CITIC Construction Investment in China decreased significantly compared with the same period last year, but the underwriting size of six IPO; bonds completed in the Hong Kong market was 469.862 billion yuan, an increase of 113.05% over the same period last year. 10 financial advisory projects on mergers and acquisitions were completed, with a transaction value of 34.063 billion yuan, an increase of 2 projects over the same period last year, and a transaction value of 60.46% over the same period last year.

Everbright Securities also had an eye-catching performance in investment banking in the first half of the year, with net income from investment banking fees rising 120.66 per cent year-on-year, ranking among the top five. At the company's performance presentation held a few days ago, the company's management explained that the reason for the turnaround of the investment bank was to reform the incentive and assessment mechanism of the investment banking business, while seizing the opportunity of the corporate bond market.

Self-management: a large area of recovery, Guoxin Securities increased 14 times year-on-year

The large proprietary plate should be the biggest "contributor" to the performance of securities firms in the first half of this year. With the recovery of the capital market, many securities firms seize the opportunity of the equity market and greatly improve their own operation; there are also securities firms that distribute bonds to increase the scale of fixed income investment and drive the growth of investment income.

On the whole, with the exception of Guohai Securities, Dongxing Securities and Hualin Securities, the self-operating income of the other 33 listed securities firms (investment income + fair value change profit and loss-associated enterprise investment income) has improved significantly. Among them, many large brokerages have a remarkable increase in their own income.

The top five securities firms with self-income are CITIC, Haitong, Guotai Junan, GF Securities Co., LTD. and Huatai.

Note: it should be reminded that according to the different classification of bonds held by different brokerages, interest is included in interest income and investment income in part of the holding period.

CITIC was dragged down by floating losses on derivatives, but his overall performance was still good. CITIC realized 7.174 billion yuan in investment business income in the first half of 2019, an increase of 55.76 percent over the same period last year. Of this total, the company realized net investment income of 8.271 billion yuan, an increase of 6.518 billion yuan, or 371.92%, over the same period last year; but the loss on fair value changes was 796 million yuan, an increase of 4.035 billion yuan over the same period last year, mainly due to the loss of 3.648 billion yuan on the fair value of derivative financial instruments.

Haitong's investment business income was 5.847 billion, a sharp increase of 257.24% over the same period last year. The Chinese reporter of the securities firm learned that in addition to the increase in income from equity investment, Haitong seized the opportunity to increase the scale of fixed income investment and made a great contribution to investment income.

Guotai Junan's self-management as a whole is conservative and maintains a consistent and steady style. According to the reporter's understanding, Guotai Junan's self-income growth is mainly due to the fact that fixed income investment business accurately grasps the trend and achieves better growth. The semi-annual report said that during the reporting period, the company actively optimized long-term asset allocation, fixed income and equity derivatives have achieved better investment returns.

GF Securities Co., LTD. 's equity investment performance was weak last year. In the first half of this year, driven by the equity market and the improvement of the company's investment ability, proprietary investment income increased by 652.71% compared with the same period last year. Among them, the income of self-owned capital equity investment is 52%, and the contribution of equity in 4 billion of self-operated income is relatively high.

The reporter learned that Huatai's strategy is that whether it is the rights and interests category or the FICC category, the future investment business must be disoriented. Especially the equity category, from the perspective of long period, because the return on capital of equity assets caused by A-share bulls, short bears and bears is very low, it is difficult to achieve sustained excess returns in the direction, and disorientation is the company's unswerving train of thought; only through scientific and technological empowerment, through big data mining, through the establishment of quantitative investment model, can we have a foothold in investment.

Societe Generale Securities's proprietary business in the first half of the year is also a bright spot. The investment income in the first half of the year was 2.41 billion yuan, an increase of 153% over the same period last year, ranking eighth in the industry. Investment business is the traditional strength of Societe Generale Securities, benefiting from the sharp rebound in the market in the first quarter, showing the elasticity of proprietary income. In addition, the contribution of fixed income investment is also great. According to the reporter's understanding, Societe Generale Securities accounts for more than 60% of the fixed income investment income, and the scale accounts for more than 80%, all of which are the investment scale of their own funds. The fixed leverage is about twice as much.

Guoxin Securities achieved a net income of 677 million yuan in fair value changes in the first half of the year (a loss of 135 million yuan in the same period last year), and investment income + fair total 2.335 billion yuan, an increase of 14 times over the same period last year. Among them, bonds are the main asset allocation category, accounting for 71% of the investment.

In addition, China Merchants, China Galaxy Securities, Oriental Securities and Hongta Securities have all turned losses into profits.

Asset management: the overall decline, Caitong, Haitong against the trend into a "dark horse"

In the first half of 2019, affected by the new regulations on asset management and other policies, the asset management business of securities firms continued the trend of decline in scale and structural adjustment. As of the end of June, the assets under management of the asset management business of securities companies were 11.15 trillion yuan, down 13.63% from the end of 2018. In the first half of 2019, the net income of the asset management business of securities companies was 12.733 billion yuan, down 8.32 percent from 13.888 billion yuan in the same period last year, according to the China Securities Association.

CITIC's net income from the asset management business is still far ahead, but it is down 8.41 per cent from a year earlier. The main reason is that the business structure of CITIC asset management is mainly institutional business, and the bank is its largest customer, which leads to a decline in scale due to the continuous contraction of banks and the outsourcing cooperation of securities firms.

Huatai Capital Management has developed the advantage of fixed income in recent years, taking the lead in scale, and the income growth in the first half of this year is also excellent, an increase of 25.12% over the same period last year. Huatai semiannual report said that asset management companies around the needs of customer standardization and customization, to create new advantages of product innovation and active management.

Haitong capital management began to actively reduce the size of the channel in 2017, lay out the active management capacity in advance, and consolidate the strength of investment and research. At present, Haitong's ability to manage active investment and active management has been greatly improved, and the two core competencies have released performance this year. The net income of Haitong's asset management business was 1.144 billion yuan, an increase of 31.74% over the same period last year, ranking fourth in the industry.

It is worth mentioning that the net income of Caitong capital management fees was 400 million yuan, an increase of 60.93% over the same period last year, ranking ninth in the industry. Caitong Capital Management has always been famous for its solid income investment and research advantages, and the performance of equity funds has exploded this year. Ma Xiaoli, chairman and general manager of Caitong Capital Management, previously told brokerage Chinese reporters that Caitong Capital Management has been focusing on the layout of equity investment in recent years. In addition, under the clear strategic deployment, a set of "market-oriented assessment mechanism + partner culture" has been established, forming a flat management framework of "quasi-partner system", which has rapidly improved the efficiency of internal communication and decision-making. further stimulate the vitality of the platform.

Edit / Sylvie