① Donghua Energy expects net profit attributable to increase 2.5-3.7 times year-on-year in 2023. Compared with the three-quarter report, the annual report performance trend will reverse. ② The benefits of the company's PDH industry chain are limited by the price difference between propane and propylene. Last year, the boom in Q3 was low, but there was a slight improvement in Q4. ③ Currently, the total external guarantee balance of listed companies and holding subsidiaries is $22.516 billion, accounting for 217.76% of net assets.

Financial Services Association, January 29 (Reporter Wu Chao) Donghua Energy (002221.SZ), which is continuing to transform from a chemical industry to a hydrogen energy industry, released a performance forecast this evening, showing that net profit attributable to 2023 is expected to increase 2.5-3.7 times over the same period last year. Compared with the year-on-year decline in the three quarterly reports, the company's annual report performance trend will be reversed. This is related to the improvement in the efficiency of the company's main products.

According to the announcement, Donghua Energy expects to achieve net profit of 150 million yuan to 200 million yuan in 2023, an increase of 252.83%-370.44% over the previous year; net profit after deduction of 100 million yuan to 140 million yuan, an increase of 403.68% to 605.15% over the previous year.

According to the three-quarter report, the company's revenue was 20.349 billion yuan, down 7.54% year on year; attributable net profit was 117 million yuan, down 26.49% year on year; deducted non-net profit of 71.753 million yuan, down 42.17% year on year.

According to the three-quarter report, the company's revenue was 20.349 billion yuan, down 7.54% year on year; attributable net profit was 117 million yuan, down 26.49% year on year; deducted non-net profit of 71.753 million yuan, down 42.17% year on year.

According to calculations, Donghua Energy's Q4 net profit will be between 33 million yuan and 83 million yuan, which will also increase compared to the Q3 single quarter.

Donghua Energy said that the main reason for the change in performance was a significant increase in performance compared to the same period last year, thanks to effective control of raw material propane costs.

According to reports, Donghua Energy started with the LPG (liquefied petroleum gas) trading business and extended the PDH (propane dehydrogenation) industry chain downstream based on the advantages of light hydrocarbon resources. The company said in a related announcement that with the successive commissioning of the Zhangjiagang and Ningbo projects, the company quickly became the largest producer of PDH in China.

Industry insiders told the Financial Federation reporter that the PDH industry chain mainly uses propane to dehydrogenate propane to make propylene and other products. The cost of raw propane accounts for nearly 90% of the total cost, so the economy of this method is mainly determined by the price difference between propane and propylene. However, most of China's propane is imported from abroad, and the propane dehydrogenation projects currently under construction are basically projects that have signed agreements with foreign producers.

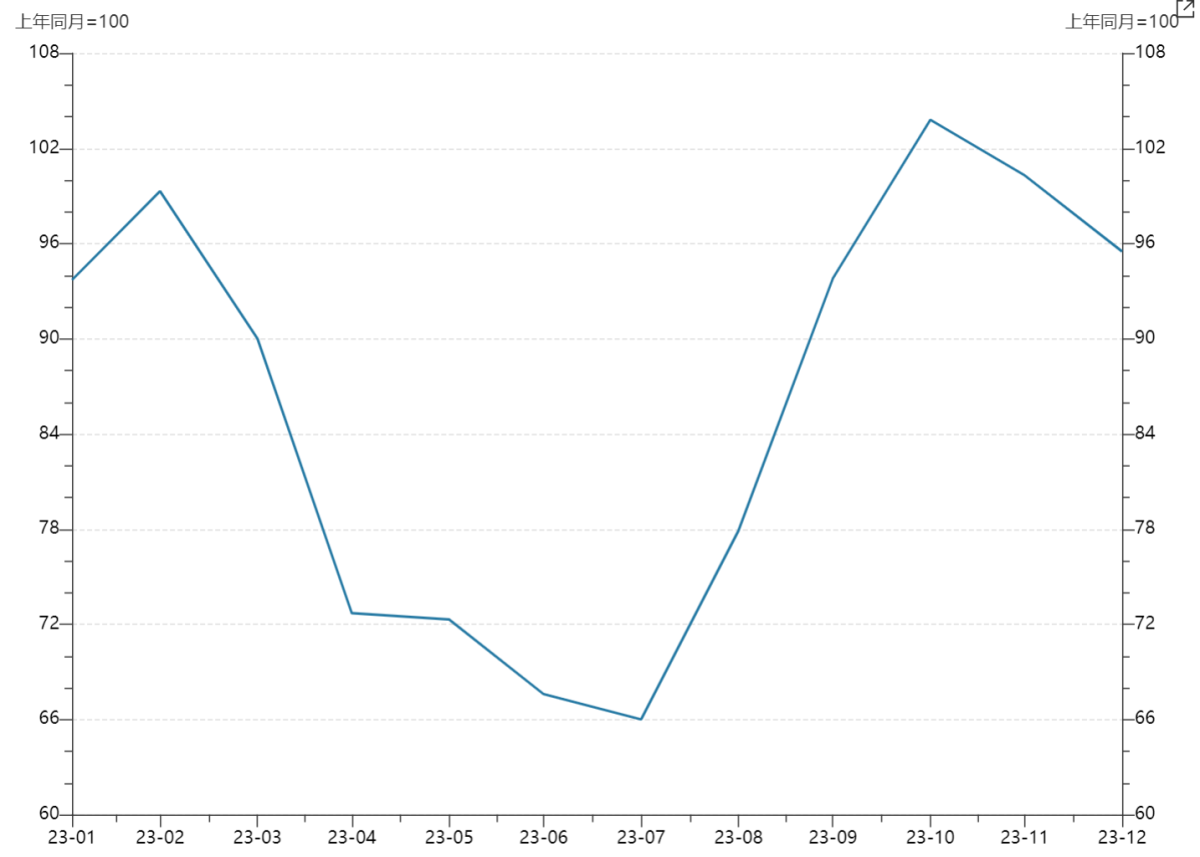

According to the China Propane Import Price Index according to Wind statistics, after the second half of last year, propane experienced a wave of upward rebound, while the price of propylene clearly did not keep up with the upward trend, limiting the prosperity of the PDH industry chain. However, towards the end of the year, there was a wave of decline in propane.

Propane import price index 2023 trend

However, the price of raw propane rose again at the beginning of this year. Saudi Aramco raised the January contract price (CP) for propane to 620 US dollars per ton, up from 610 US dollars per ton in December, while the price of butane was set at 630 US dollars per ton, up 10 US dollars. According to reports, Saudi Aramco's CP rise in January was mainly supported by expectations of a decline in international supply and reserves, as well as due to factors related to the Red Sea. Currently, import prices are relatively high.

A Financial Services Association reporter learned that Donghua Energy is developing green chemicals and hydrogen energy industries to mitigate the impact of fluctuations in propane-propylene price differences through increased hydrogen sales. According to agency statistics, the company is a leading domestic PDH producer, with a by-production scale of about 120,000 tons/year. It has now expanded the layout of ammonia synthesis plants, filling stations, hydrogen fueling stations, etc. downstream, and the degree of hydrogen energy utilization continues to deepen.

Furthermore, it is worth noting that in order to meet the need to expand production capacity, Donghua Energy obtains a large amount of capital through external guarantees. Today, the company announced that it will further guarantee the comprehensive credit line of 100 million yuan applied for by its subsidiary Donghua Energy (Zhangjiagang) New Materials Co., Ltd. from the relevant partner banks. After this guarantee, the total external guarantee balance of the listed company and holding subsidiary was $22.516 billion, accounting for 217.76% of the net assets of the listed company attributed to the parent company after the audit on December 31, 2022.

而三季报显示,公司营收203.49亿元,同比下降7.54%;归属净利润1.17亿元,同比下降26.49%;扣非净利润7175.03万元,同比下降42.17%。

而三季报显示,公司营收203.49亿元,同比下降7.54%;归属净利润1.17亿元,同比下降26.49%;扣非净利润7175.03万元,同比下降42.17%。