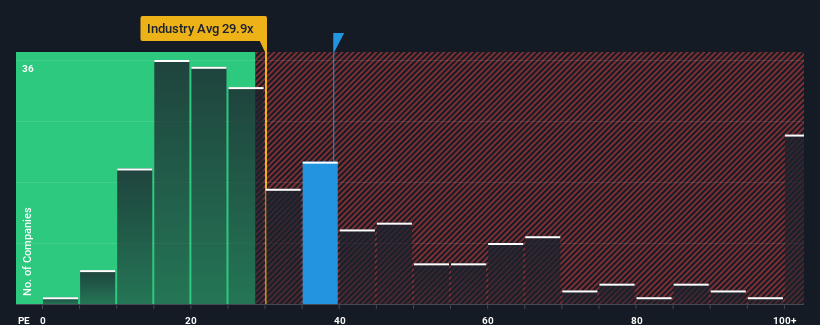

With a price-to-earnings (or "P/E") ratio of 39.1x Shaanxi Baoguang Vacuum Electric Device Co., Ltd. (SHSE:600379) may be sending bearish signals at the moment, given that almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Shaanxi Baoguang Vacuum Electric Device has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Shaanxi Baoguang Vacuum Electric Device

How Is Shaanxi Baoguang Vacuum Electric Device's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Shaanxi Baoguang Vacuum Electric Device's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 28%. The latest three year period has also seen an excellent 90% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 42% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Shaanxi Baoguang Vacuum Electric Device is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Shaanxi Baoguang Vacuum Electric Device revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shaanxi Baoguang Vacuum Electric Device with six simple checks.

You might be able to find a better investment than Shaanxi Baoguang Vacuum Electric Device. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.