The A-Sonic Aerospace Limited (SGX:BTJ) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 30% in the last twelve months.

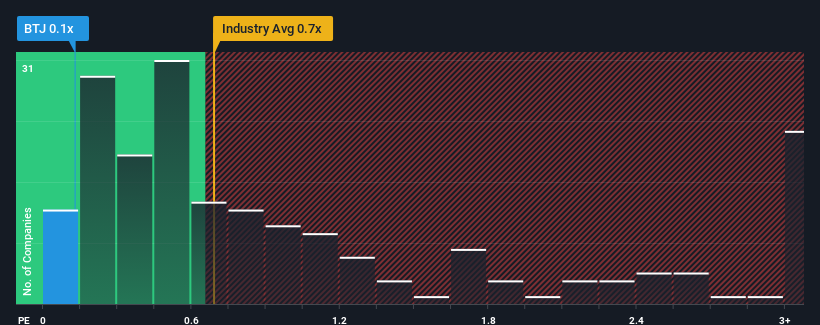

Although its price has surged higher, it's still not a stretch to say that A-Sonic Aerospace's price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Logistics industry in Singapore, where the median P/S ratio is around 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for A-Sonic Aerospace

What Does A-Sonic Aerospace's Recent Performance Look Like?

For instance, A-Sonic Aerospace's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on A-Sonic Aerospace will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For A-Sonic Aerospace?

There's an inherent assumption that a company should be matching the industry for P/S ratios like A-Sonic Aerospace's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 21% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the industry, which is expected to grow by 9.7% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that A-Sonic Aerospace's P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

What We Can Learn From A-Sonic Aerospace's P/S?

Its shares have lifted substantially and now A-Sonic Aerospace's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that A-Sonic Aerospace's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

Before you settle on your opinion, we've discovered 3 warning signs for A-Sonic Aerospace that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.