TransCode (RNAZ) Down 50% on Issue of New Common Stock

TransCode Therapeutics RNAZ announced that it is floating a secondary issue of around 5.94 million shares of its common stock to the public at an issue price of $1.22 per share, amounting to $7.5 million.

Per the terms of the public offer, the common stock will be accompanied by warrants. Through the issue of warrants, TransCode intends to issue around 11.89 million shares of common stock. The warrants will have an exercise price of $1.22 per share and will be exercisable immediately upon issuance and valid for 3.5 years from the issuance date.

RNAZ plans to use the net proceeds from this new issue and its existing cash balance to support the clinical development of its lead pipeline candidate TTX-MC138 in oncology indications. Management will also use the proceeds for its general corporate purpose, including working capital requirements.

Shares of TransCode plummeted 49.5% on Jan 18 after the announcement. The downtick was likely caused by the issuance of a large number of shares, diluting the company’s current shareholder base. Earlier this week, the company’s 1-for-40 reverse stock split decision came into effect, reducing its outstanding shares count to around 0.63 million. Considering the size of the secondary issue, the current shareholder base will be significantly diluted. The issue price per share also did not go well with investors, which was at a discount to the closing price on Jan 17, with the stock closing at $2.16.

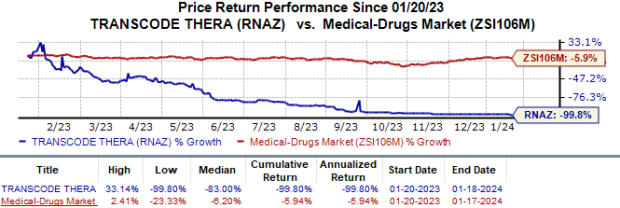

RNAZ’s shares have plummeted 99.8% year to date compared with the industry’s 5.9% fall.

Image Source: Zacks Investment Research

The secondary offering is expected to close by Jan 22, 2024.

TransCode Therapeutics has only one pipeline in clinical development, TTX-MC138, which is being evaluated in a First-in-Human phase 0 study for advanced solid tumors.

This secondary stock offering will strengthen RNAZ’s financial position. Earlier this month, management had said its preliminary cash balance, which stood at $2.8 million as of the end of December 2023, would dry out soon. This new cash inflow will enable management to fund its current business plans and extend the existing cash runway for the next eight months.

TransCode Therapeutics Inc. Price

TransCode Therapeutics Inc. price | TransCode Therapeutics Inc. Quote

Zacks Rank & Stocks to Consider

TransCode carries a Zacks Rank #3 (Hold) at present. Some better-ranked stocks in the overall healthcare sector include CytomX Therapeutics CTMX, Novo Nordisk NVO and Sarepta Therapeutics SRPT. While CytomX and Novo Nordisk sport a Zacks Rank #1 (Strong Buy), Sarepta carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CytomX Therapeutics for 2023 have swung from a loss of 10 cents per share to earnings of 2 cents. During the same period, estimates for 2024 have narrowed from a loss of 22 cents to a loss of 6 cents. Shares of CytomX have lost 33.3% in the past year.

CytomX Therapeutics’ earnings beat estimates in three of the last four quarters while missing the estimates on one occasion. On average, the company witnessed an average surprise of 45.44%. In the last reported quarter, CytomX Therapeutics’ earnings beat estimates by 123.53%.

In the past 60 days, estimates for Novo Nordisk’s 2023 earnings per share have increased from $2.62 to $2.67. During the same period, the earnings estimates for 2024 have risen from $3.15 to $3.29. Shares of NVO have surged 52.5% in the past year.

Novo Nordisk’s earnings beat estimates in two of the last four quarters while meeting the mark on one occasion and missing the estimates on another. On average, the company witnessed an average surprise of 0.58%. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 5.80%.

In the past 60 days, Sarepta’s loss estimates for 2023 have improved from a loss of $6.95 per share to $6.57. During the same period, earnings estimates for 2024 have risen from 96 cents to $2.14. Sarepta’s shares have lost 10.3% in the past year.

Sarepta’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 48.67%. In the last reported quarter, Sarepta’s earnings beat estimates by 72.29%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

TransCode Therapeutics Inc. (RNAZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance