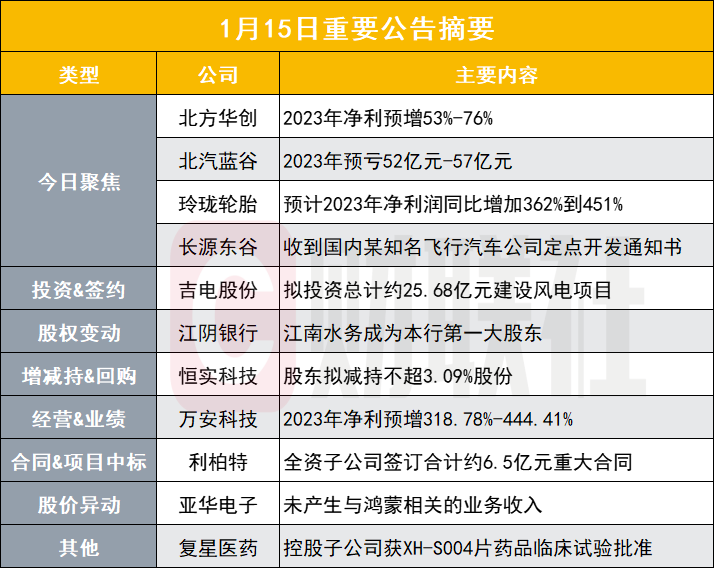

BAIC Blue Valley: Pre-loss of 5.2 billion yuan to 5.7 billion yuan in 2023

Today's focus

[Northern Huachuang: Net profit expected to increase 53%-76% in 2023]

[Northern Huachuang: Net profit expected to increase 53%-76% in 2023]

North China Huachuang announced that the net profit to be returned to mother is expected to be 3,610 billion yuan to 4.150 billion yuan in 2023, an increase of 53.44%-76.39% over the previous year. During the reporting period, the company always insisted on product innovation guided by customer needs. In 2023, the main business showed a good development trend, and market recognition continued to increase. Dozens of process equipment such as etching, film, cleaning and furnace tubes used in the high-end integrated circuit field achieved technological breakthroughs and mass production applications, and process coverage and market share were greatly increased; in 2023, the company signed more than 30 billion yuan of new orders, of which the integrated circuit sector accounted for more than 70%. Small financial note: Q3 net profit of 1,085 million yuan. Based on this calculation, the estimated net profit for Q4 is 726 million yuan to 1,266 million yuan, a change of -33% to 16% from the previous month.

[BAIC Blue Valley: Pre-loss of 5.2 billion yuan to 5.7 billion yuan in 2023]

BAIC Blue Valley announced that it expects a net loss of 5.2 billion yuan to 5.7 billion yuan in 2023, and a net loss of 5.46 billion yuan for the same period last year. The company's product sales are still in a period of rapid increase, and the scale effect has not yet been shown, resulting in a phased high product cost. As new products are launched in the later stages, the product structure is gradually enriched and channel construction is further improved, and the company's product sales volume and profitability are expected to continue to improve. Small financial note: Q3 net profit loss of 1,272 billion yuan. Based on this calculation, the estimated net profit loss for Q4 is 1,949 million yuan - 2,449 billion yuan.

[Linglong Tire: Net profit is expected to increase 362% to 451% year-on-year in 2023]

Linglong Tire announced that it expects net profit of 1,350 million yuan to 1,610 billion yuan in 2023, an increase of 362% to 451% over the previous year. In 2023, benefiting from the continued recovery of domestic economic activity and rising demand from overseas markets, compounded by falling raw material prices and shipping costs, product sales achieved significant growth. Cumulative sales increased 26.10% year-on-year over 23 years. Among them, passenger tires with high gross profit increased by 28.34% year on year. Small financial note: Q3 net profit of 399 million yuan. Based on this calculation, the estimated net profit for Q4 is 390 million yuan to 650 million yuan, a change of -2% to 62% from the previous month.

[Changyuan Donggu: Received a designated development notice from a well-known domestic flying car company]

Changyuan Donggu announced that the company recently received a designated development notice from a well-known domestic flying car company. The customer decided to select the company as a supplier to install the main stator case, outer rotor case, three-phase wiring cover, and controller for a certain model's flight electric drive case, requiring the company to connect with its technical and quality departments to confirm drawings and data and sign a contract. The supply time, price and quantity of specific models of products are subject to the supply agreement or sales order signed by both parties.

[Huali Co., Ltd.: Kangmao Electronics mainly sells Huawei government and enterprise products, IdeaHub conference tablets, etc. to the home furnishing industry]

Huali Co., Ltd. issued a stock trading risk warning notice. The company is concerned about media and stock bar rumors and believes that the company has the concept of “Huawei Hongmeng.” The company now explains the situation of Dongguan Kangmao Electronics Co., Ltd. (“Kangmao Electronics”), the holding subsidiary that investors are concerned about: the company invested 60% of Kangmao Electronics's shares in 2019. Up to now, Kangmao Electronics does not have the ability to develop related systems. Kangmao Electronics mainly sells Huawei government and enterprise products IdeaHub conference tablets; Huawei smart home products; Huawei Cloud, such as Cloud Conference, etc., with sales revenue of 1.2915 million yuan and net profit of 1,8427 million yuan in the first three quarters of 2023.

Investments & Contracts

[Jidian Co., Ltd. plans to invest a total of about 2,568 billion yuan to build wind power projects]

Jidian Co., Ltd. announced that it will invest in the construction of the Baiji Xinping 200 MW wind power project in Yongning, Guangxi, with a dynamic project investment of 1,244 billion yuan; to invest in the construction of the Guangxi Yongning Nalou 200 MW wind power project, with a dynamic project investment of 1,324 billion yuan. The company announced on the same day that it plans to introduce external equity capital by issuing asset-backed securities in the Shenzhen Stock Exchange market using photovoltaic power generation assets of Hetian Saiwei, Huocheng Huaguang, Chizhou Xinyang, and wind power assets of Chizhou Xiangyu as the target assets.

[Everweft Lithium: Subsidiary signs memorandum of understanding with Aksa]

Everweft Lithium Energy announced that its subsidiary Everweft Power signed a memorandum of understanding with Aksa. Everweft Power and Aksa plan to jointly establish a joint venture in Turkey. The purpose of establishing the joint venture is to manufacture, market and sell battery modules, outdoor cabinets, and containers, and implement energy storage system projects as the general contractor in Turkey (locally).

[Goertek Shares: The subsidiary Hong Kong Goertech plans to invest no more than US$280 million to establish a wholly-owned subsidiary in Vietnam]

Goertek Co., Ltd. announced that in order to meet the company's business development and long-term operation needs in Vietnam, the company's wholly-owned subsidiary Goertek (HongKong) Co., Ltd. , Limited (hereinafter referred to as “Hong Kong Goertek”) plans to establish a wholly-owned subsidiary in Vietnam with its own capital, with a total investment of no more than US$280 million (equivalent to approximately RMB 1990.35 million).

[Juli Rigging: Plans to invest 357 million yuan in an annual output of 50,000 tons of thick diameter high-end steel wire rope and supporting rigging projects]

Juli Rigging announced that its wholly-owned subsidiary invests in a project with an annual output of 50,000 tons of thick diameter high-end steel wire ropes and supporting rigging, with an estimated total investment of 357 million yuan.

[Wanwei Hi-Tech: Self-funded investment to build a new 20kt/A multi-functional PVB resin project]

Wanwei Hi-Tech announced that it plans to raise its own capital to invest in the construction of a 20kt/A multi-functional PVB resin project. After completion and delivery, the project is expected to have an average annual sales revenue of 521.36 million yuan and a total annual profit of 62.491 million yuan.

Changes in equity

[Jiangyin Bank: Jiangnan Water becomes the bank's largest shareholder]

Jiangyin Bank announced that on January 15, the Bank received the “Detailed Equity Change Report” issued by Jiangnan Water. Jiangnan Water held 142 million shares of the Bank through the Bank's convertible bonds and shares, accounting for 6.13% of the company's current total share capital, making it the Bank's largest shareholder.

Increase or decrease holdings & repurchase

[Hengshi Technology: Shareholders plan to reduce their holdings by no more than 3.09%]

Hengshi Technology announced that the controlling shareholder Qian Sujin holds 9.2702% of the company's shares and plans to reduce the company's shares by no more than 2.3175%; the controlling shareholder Zhang Xiaohong holds 4.0772% of the company's shares and plans to reduce the company's shares by no more than 0.6825%; shareholder Jiang Rimin plans to reduce the company's shares by no more than 0.0567%; and Zhou Wei plans to reduce the company's shares by no more than 0.0287%. In total, the above shareholders plan to reduce their holdings of the company by no more than 3.0854%.

[Wantong Development: GLP plans to reduce holdings by no more than 1%]

Wantong Development announced that shareholder GLP Capital Investment4 (HK) Limited plans to reduce its holdings by no more than 1%.

[Shenzhen Technology: Shareholders plan to reduce the company's shares by no more than 1%]

Shenzhen Technology announced that the shareholder Bo Xu (Hong Kong) Co., Ltd., which holds 5.61% of the company's shares, plans to reduce the company's shares by no more than 1% through centralized bidding.

[Kibing Group: Mr. Yu Yong and Ningbo Kibing plan to increase their holdings by a total of 120 million yuan to 240 million yuan]

Kibing Group announced that Mr. Yu Yong and Ningbo Kibing plan to increase their holdings by a total of 120 million yuan to 240 million yuan.

[Petty Shares: Controlling shareholders plan to increase their holdings by no less than 10 million yuan]

Petty Co., Ltd. announced that Chen Zhenbiao, the controlling shareholder and actual controller, plans to increase his holdings by no less than 10 million yuan.

[Hengtong Optoelectronics: Plans to repurchase shares with 100 million yuan to 200 million yuan]

Hengtong Optoelectronics announced that it plans to repurchase shares for 100 million yuan to 200 million yuan, with a repurchase price of no more than RMB 17.64 per share.

[Tianneng Co., Ltd.: Chairman proposes to repurchase shares for 50 million yuan to 100 million yuan]

Tianneng Co., Ltd. announced that the chairman proposed to repurchase shares for 50 million yuan to 100 million yuan, with a repurchase price of no more than RMB 42 per share.

Operation & Performance

[Wanan Technology: Net profit forecast to increase by 318.78% — 444.41% in 2023]

Wanan Technology announced that it expects net profit of 300 million yuan to 390 million yuan in 2023, a year-on-year increase of 318.78% to 444.41%. New energy vehicles continued their rapid growth trend during the reporting period; the estimated impact of non-recurring profit and loss on net profit was 220 million yuan to 230 million yuan.

[Tongqing Building: Net profit is expected to increase 191.45% year-on-year to 242.13% in 2023]

Tongqinglou announced that net profit is expected to be 270 million yuan to 320 million yuan in 2023, an increase of 191.45% to 242.13% over the previous year. Using Tongqinglou as a natural advantage of a food and beverage brand, the company extended the industrial chain and vigorously developed the food business. It built the competitive advantage of Tongqinglou Food based on long-established Chinese food brands, many large offline restaurants, and many chefs' R&D capabilities.

[Feilu Co., Ltd.: Net profit of 2023 is expected to be 17 million yuan - 25 million yuan to reverse the year-on-year loss]

Feilu Co., Ltd. announced that it expects a net profit of 17 million yuan to 25 million yuan in 2023, reversing losses from the previous year. The company's raw material purchase price was reduced in 2023, thereby reducing raw material costs; at the same time, the two major production plants have steadily mass-produced in 2023, thereby reducing unit labor and depreciation costs.

[Jinbin Development: Expected net profit of 500 million yuan to 550 million yuan in 2023, a year-on-year increase of 89.99%-108.98%]

According to the announcement of Jinbin Development, net profit is expected to be 500 million yuan to 550 million yuan in 2023, an increase of 89.99%-108.98% over the previous year. This is due to an increase in real estate project settlement revenue during the reporting period compared to the same period last year.

[Colon Pharmaceuticals: Net profit is expected to increase 37.82%-49.55% year-on-year in 2023]

Colon Pharmaceuticals announced that it expects net profit of 2.35 billion yuan to 2.55 billion yuan in 2023, an increase of 37.82%-49.55% over the previous year. During the reporting period, due to the recovery in market demand, sales volume and prices of major API intermediate products rose year on year, and profit increased year on year.

[Tebao Biotech: Net profit forecast to increase 85% to 102% year-on-year in 2023]

Tebao Biotech announced that it expects net profit of 530 million yuan to 580 million yuan in 2023, an increase of 84.66% to 102.08% over the previous year. During the reporting period, with the continuous deepening of clinical cure research on hepatitis B, the effects of pegubin as a first-line drug for chronic hepatitis B antiviral treatment were further recognized by experts and patients in improving the clinical cure rate of hepatitis B patients and reducing the risk of liver cancer, and the product continued to be released.

[Rambler: 2023 net profit forecast to increase by 60%-80% year-on-year]

Ramblers announced that it is expected to make a profit of 394 million yuan to 444 million yuan in 2023, an increase of 60% to 80% over the previous year. Mainly due to the company's continuous increase in R&D investment in new products and brand strength building, both revenue and gross margin increased in the current period.

[Andavia: Net profit expected to be 110 million yuan to 120 million yuan in 2023, reversing losses year on year]

Andavia announced that it expects net profit of 110 million yuan to 120 million yuan to return to mother in 2023, reversing losses from the previous year. The company's revenue in 2023 increased significantly compared to the same period last year, mainly due to the continuous release of key models supported by the company and the winning and delivery of major projects during the reporting period, which led to a sharp year-on-year increase in the airborne equipment business; at the same time, the civil aviation business also achieved year-on-year growth due to the recovery of flights.

[Gold Card Smart: Net profit pre-increased by 40% to 65% in 2023]

According to Gold Card Smart's announcement, net profit due to mother is expected to be 378 million yuan to 446 million yuan in 2023, an increase of 40% to 65% over the previous year. In 2023, favorable policies such as the renovation of old urban pipeline networks and the construction of urban lifeline safety projects prompted the industry to continue to release demand. The company relies on measurement digital solution capabilities to strengthen R&D investment, enhance innovation capabilities and core technical strength; optimize marketing system construction, and enhance the company's market competitiveness. The “Digital Gas and Digital Water” business achieved steady growth during the reporting period.

[Chuan Ning Biotech: Net profit forecast to increase 118.70% — 140.57% in 2023]

Chuan Ning Biotech announced that it expects net profit of 900 million yuan to 990 million yuan in 2023, an increase of 118.70% to 140.57% over the previous year.

[Covex shares: net profit forecast to increase 85.50% — 95.80% in 2023]

Covex Co., Ltd. announced that the net profit due to mother is expected to be 720 million yuan to 760 million yuan in 2023, an increase of 85.50% to 95.80% over the previous year. During the reporting period, with the steady increase in the company's market position and the continued increase in market demand for sunscreen products, as well as the increase in the company's overall capacity utilization rate and the rapid release of new product production capacity represented by new sunscreen agents, it helped increase the company's main business revenue and gross margin level, thereby increasing net profit attributable to shareholders of listed companies in the current period.

[Three squirrels: pre-profit of 200 million yuan to 220 million yuan in 2023, a year-on-year increase of 54.97%-70.47%]

Three squirrels announced a pre-profit of 200 million yuan to 220 million yuan in 2023, an increase of 54.97%-70.47% over the previous year. The company firmly and thoroughly implements the overall strategy of “high-end cost performance” and basically builds a new “all-category, omni-channel” basic market. The main measures are to focus on changes in the external market environment, actively promote the optimization of the entire supply chain, implement two-way adjustments to the category structure and channel structure, and achieve continuous and steady revenue growth since June. In particular, in the context of the New Year's goods festival moving backwards in the fourth quarter, it still achieved double growth.

[Tongling shares: pre-profit of 190 million yuan to 215 million yuan in 2023, a year-on-year increase of 64.21%-85.81%]

Tongling Co., Ltd. announced a pre-profit of 190 million yuan to 215 million yuan in 2023, an increase of 64.21% to 85.81% year-on-year. The new installed capacity of global solar photovoltaic power plants will continue to develop strongly in 2023. The China Photovoltaic Industry Association predicts that in 2023 the new installed capacity of global photovoltaic power plants will be 345-390 GW, a significant increase over 2022, and the demand for solar photovoltaic auxiliary materials will expand accordingly. In 2023, the company continued to expand sales channels, consolidate product sales prices, and improve product performance and layout. Its competitive advantage in brand, product, R&D, etc. continued to increase, gain market and customer recognition, and increase its business scale. At the same time, the company actively adopted various measures such as increasing the self-supply ratio of major materials and improving production efficiency to effectively control raw material costs, and the company's profitability was further enhanced. The estimated impact of non-recurring profit and loss on net profit in 2023 is approximately RMB 17.00 million, mainly due to government subsidies received and cash management income from idle funds raised.

[Bojun Technology: Net profit is expected to increase 95%-120% year-on-year in 2023]

Bojun Technology announced its performance forecast. It is expected to achieve net profit of 288 million yuan to 325 million yuan in 2023, an increase of 95%-120% over the same period last year. During the reporting period, the company had sufficient orders, and revenue increased significantly over the same period.

[Dongfang Electric Heating: Net profit is expected to increase 95.53%-131.99% year-on-year in 2023]

Dongfang Electric announced that it expects net profit of 590 million yuan to 700 million yuan in 2023, an increase of 95.53%-131.99% over the previous year. The main reason for the year-on-year increase in the company's performance during the reporting period was that the new energy sector continued to gain strength and continued market promotion of nickel-plated battery materials.

[Jin Litai: Expected net profit of 13.3 million yuan to 192 million yuan in 2023, reversing year-on-year losses]

Jinlitai released a performance forecast. It is expected to achieve net profit of 13.3 million yuan to 192 million yuan in 2023, and a loss of 106 million yuan in the same period last year. During the reporting period, the company's comprehensive gross margin increased significantly compared to the previous year. In 2023, the company's comprehensive gross margin was about 26.31%, up 11.64% from the same period last year.

[Longhua New Materials: Net profit is expected to increase 77% — 105% year-on-year in 2023]

Longhua New Materials released a performance forecast. It is estimated that the net profit to the mother will have a pre-profit of 225 million yuan to 260 million yuan in 2023, an increase of 77.19% to 104.75% over the previous year. The company rationally plans the industrial layout, enriches the product structure, provides customers with more consumption scenarios, and gives full play to the company's marketing network market development capabilities and product delivery capabilities. During the reporting period, the production capacity of the 360,000 tons/year high-performance polyether polyol expansion project was fully released; in 2023, the company sold about 541,600 tons of polyether polyol products, an increase of 82.91% over the same period last year.

[Polaroid: Net profit is expected to increase by 102.58%-113.25% year-on-year in 2023]

Polaroid announced that it expects to achieve net profit of 95 million yuan to 100 million yuan in 2023, an increase of 102.58% to 113.25% over the previous year. During the reporting period, the company completed the merger and acquisition of Xiamen Luyi, adding advantages of products such as white masterbatches in addition to superior products such as black, color, and functional masterbatches, and enhancing new momentum for development.

[Intel Group: Net profit in 2023 is expected to increase 18.58% — 37.25% over the same period last year after restructuring]

Intel Group announced that net profit due to mother is expected to be 470 million yuan to 544 million yuan in 2023, an increase of 121.46% to 156.33% over the same period of the previous year before the restructuring; an increase of 18.58% to 37.25% over the same period of the previous year after the restructuring.

Contract & Project Award

[Libert: Wholly-owned subsidiary signs major contracts totaling about 650 million yuan]

Libert announced that Shanghai Libert Engineering Technology Co., Ltd., a wholly-owned subsidiary, recently signed the “7,000 tons/year SOOC Project General Contract Agreement” and the “41,000 tons/year optical resin project construction general contract agreement” with Zhejiang Tuoen Optical New Materials Co., Ltd. (“Tuoxene Optics”). The contract prices are about 300 million yuan and 350 million yuan respectively.

[Chengfa Environmental: Subsidiary Wins Bid for Integrated Sanitation Franchise Project]

According to Chengfa Environmental Notice, Chengfa City Service Technology (Henan) Co., Ltd., a wholly-owned subsidiary, is the contractor of the “Anyang Beiguan District Environmental Health Service Center Sanitation Integrated Franchise Project” with a bid amount of 516 million yuan and a service period of 8 years. Chengfa Environmental announced at the same time that the domestic waste incineration power generation project in Daqing City has officially entered the operation period. The domestic waste incineration power generation project in Daqing City is built and operated by Daqing City Control Electric Power Co., Ltd., which is wholly owned by Chengfa Environmental. The domestic waste incineration power generation project has an investment of about 800 million yuan.

Stock price changes

[Yahua Electronics: No business revenue related to Hongmeng]

According to Yahua's electronic announcement, no specific Hongmeng medical care scenario application has been implemented, and no business revenue related to Hongmeng has been generated.

other

[Fosun Pharmaceutical: Holding subsidiary approved for clinical trial of XH-S004 tablets]

Fosun Pharmaceutical announced that Zhejiang Xinghao Pengbo Pharmaceutical Co., Ltd. (“Xinghao Pengbo”), a holding subsidiary of the company, recently received approval from the State Drug Administration for clinical trial approval of XH-S004 tablets for the treatment of non-cystic fibrosis bronchiectasis. Xinghao Pengbo plans to conduct phase I clinical trials of this new drug in China (excluding Hong Kong, Macao and Taiwan regions) when conditions are met.

[Jianyou Co., Ltd.: The subsidiary product oxaliplatin injection was approved by the US FDA]

Jianyou Co., Ltd. announced that its subsidiary Jianjin Pharmaceutical Co., Ltd. recently received ANDA approval notices for oxaliplatin injections, 50 mg/10 mL and 100 mg/20 mL (5 mg/mL) (single dose) from the US Food and Drug Administration (“US FDA”). Oxaliplatin injection is a platinum drug used in combination with fluorouracil and folic acid for adjuvant treatment of stage III colon cancer patients with complete primary tumor resection and treatment of advanced colorectal cancer.

[Sharp Ace: Passed the GMP compliance check for pharmaceuticals]

ShapeAce announced that the P2 line of the company's single-dose eye drop workshop and P3 line of the single-dose eye drop workshop passed the drug GMP compliance inspection.

[Gengxing Co., Ltd.: The China Securities Regulatory Commission decided to file a case against the company due to suspected illegal disclosure of information]

Gengxing Co., Ltd. announced that it received a “Notice of Case Filing” issued by the China Securities Regulatory Commission. The China Securities Regulatory Commission decided to file a case against the company because the company suspected illegal disclosure of information.

[Chifeng Gold: Wholly-owned subsidiary obtains mining license]

Chifeng Gold announced that Chifeng Jilong Mining Co., Ltd., a wholly-owned subsidiary, obtained a mining license for the Aohanqi Shanzi Gold Mine of Chifeng Jilong Mining Co., Ltd. through exploration and conversion.

【北方华创:2023年净利预增53%-76%】

【北方华创:2023年净利预增53%-76%】