Buffett's Berkshire Berkshire Hathaway could issue the first-ever yen-denominated bond as soon as early September.

1. Berkshire issues yen-denominated bonds for the first time

According to news, Berkshire is looking for new ways of financing, and the total value of bonds issued in September could exceed 100 billion yen ($939 million) with a maturity of five years or more, according to the Nikkei News on the 20th. Details are uncertain. These bonds are expected to be paired with ultra-low coupon rates.

Although Berkshire is targeting Japanese institutional investors (such as asset managers, life insurers, etc.), it will also be open to overseas investors in the form of global bonds.Standard & Poor`s rated Berkshire's debt as "AA", higher than "AA-" by Toyota Motor Corp (Toyota Motor).

It is worth noting that large US companies have issued bonds before: Apple Inc issued 250 billion yen in 2015, Starbucks Corp issued 85 billion yen in 2017, and MetLife issued yen bonds earlier this year.

Goldman Sachs Group (Goldman Sachs), JPMorgan Chase & Co (JPMorgan Chase), Bank of America Corporation Merrill Lynch (Bank of America Merrill Lynch) and Mizuho America (Mizuho Americas) have been appointed lead underwriters.

Most of Berkshire's investment is in the United States, and the money raised through the new offering is likely to be converted into dollars. Doing so would increase foreign exchange costs, but having more different sources of funding would enable Berkshire to set more favourable terms for its investments during market turmoil.

2. Why do American companies, which have a lot of cash, still issue Japanese yen debt to borrow money?

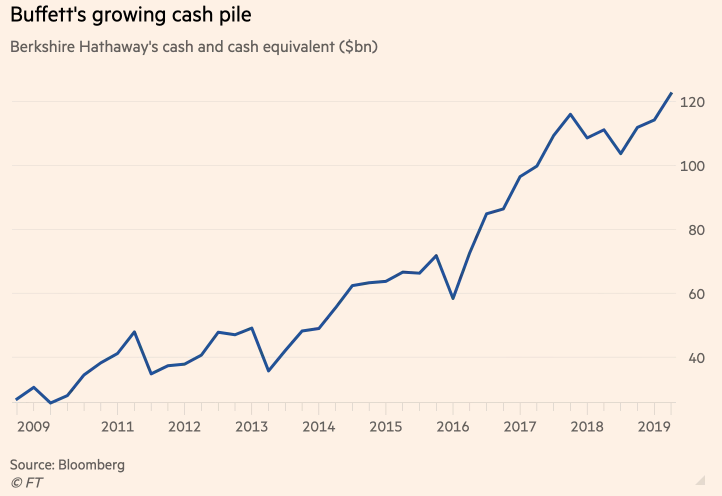

Why do American companies like Berkshire and Apple Inc, which are sitting on a lot of cash, issue Japanese bonds to borrow money?One of the very important reasons is that the interest rate is low, which means not to borrow for nothing. Berkshire's cash reserves have soared to a record $122 billion, according to Berkshire's latest earnings data.

Source: financial Times

Apple Inc, who also has a lot of cash, issued 250 billion yen of bonds of about US $1.6 billion in 2015, also because interest rates on Japanese bonds were quite low. As for the proceeds from the financing, Apple Inc will be used to buy back shares to return to shareholders and to expand his business in Japan. Take Japanese treasury bonds as an example, the yield has been negative for a long time, and the interest rate of corporate bonds issued by enterprises is usually increased on the basis of treasury bond yields.

Source: Yingwei Financial situation

Apple Inc has such a high cash reserve, why not directly use it to buy back shares? It is reported that of Apple Inc's nearly $200 billion in cash reserves, $170 billion is overseas cash, and Apple Inc needs to pay considerable taxes to the US government if overseas cash is transferred back to the United States. As a result, Apple Inc has been avoiding transferring overseas profits back to the United States and raising cash through other means of financing.

3. Take advantage of the "negative interest rate" to "borrow"?

According to Deutsche Bank, as of mid-July, of the euro-denominated bonds rated "AA" by the letter, the yield of 2% of the euro-denominated bonds had fallen below zero. In addition, yields on bonds rated An in more than 1amp 3, BBB bonds in excess of 1x5, and BB bonds (that is, junk bonds) close to 1x10 also turned negative. At present, government bond yields have fallen to negative values in many countries, including Germany, the European economic locomotive.

More than that.Around the world, about $17 trillion in bond yields have turned negative, a record high.

Source: zerohedge

Edit / jasonzeng