(henry / tr. by Phil Newell)

Edit / Grace

Tencent's 2019Q1 financial report shows that 19Q1 income is 85.465 billion yuan, up 16% from the same period last year; adjusted net profit is 20.9 billion yuan, up 14% from the same period last year; revenue from mobile games is 21.2 billion yuan, down 2% from the same period last year; and revenue from games on PC is 13.8 billion yuan, down 2% from the same period last year.

The results fell short of expectations, and Tencent's share price fell all the way from HK $370 to around 320.

Photo source: Futu Securities

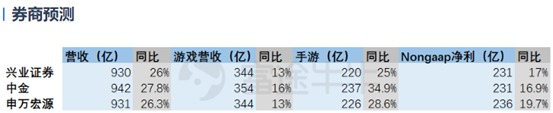

However, 2019Q2, Tencent's performance will begin to rebound, according to the forecasts of several brokerages:

The income growth rate is more than 26%, and the adjusted net profit growth rate is more than 17%, of which the game business has made a considerable recovery.

In addition, according to Bloomberg's forecast:

Tencent's 19Q2 income was 93.4 billion yuan, which was + 26.8% compared with the same period last year.

The adjusted net profit was 229 yuan, + 16.4% compared with the same period last year.

Source: Bloomberg

First, the return of the king of game business

The first quarter can be said to be the trough of Tencent's games, with seasonal factors superimposed and the number of new games released decreasing. Tencent's game business revenue fell 2% in the first quarter compared with the same period last year.

Source: Futu Securities

However, in the second quarter, the release of the domestic game version number is still slow, NetEase, Inc's game business has done nothing (NetEase, Inc's game business growth rate of 13.6% in the second quarter was lower than expected), and Tencent's game business can be described as "Golden Rooster Independence" with a month-on-month decline in revenue.

Therefore, this quarter, Tencent's biggest focus should be the game.

According to GameLook data, although the industry is in the general environment of general regulation and control, and the total number of approved new games is limited, according to GameLook data, the number of products issued by Tencent from January to August this year has reached 22, and the total number of new games released in a single month has fluctuated between 3 and 4, and even released 5 new games in May.

Although among the 22 new games released by Tencent this year, there are many subdivided and independent game products that Aurora Mobile Limited plans to act as agents, but a number of high-income products have emerged, especially "Perfect World", "Game for Peace" and "Crazy Racing Kart Rider". The performance is the most prominent and stable.

These games will continue to lead Tencent's game business to grow by leaps and bounds in the second half of the year. According to Sensor Tower's forecast, Tencent's mobile game revenue in July 2019 increased by 39% compared with July 2018, an increase of 27% month-on-month, excluding Android revenue in China. Tencent's monthly income in appstore and Google play in July reached US $679 million (RMB 4.8 billion).

In addition, it is reported that Tencent intends to increase the revenue share of his games after they are sold in Android mobile phone stores in the mainland, from 50% to 70%. If an agreement is reached, the gross profit margin of the company's game business will continue to rise.

Second, under the pressure of supply and demand, the advertising business is facing uncertainty.

In the first quarter, under the influence of macro factors, the advertisements of the major Internet companies in 1Q19 all showed a slowdown, which was lower than market expectations.

Tencent's advertising revenue grew 25% in the first quarter compared with the same period last year, which is also a three-year low.

Source: Futu Securities

On the one hand, due to tighter upstream regulation, leading to a reduction in the supply of movies and TV dramas, and delays in popular TV shows on Tencent's video platform, on the other hand, it is also related to market competition (an increase in advertising space) and the decline of the entire advertising market in the first quarter. According to the data, in 2019, the fluctuation of advertisers' confidence in the overall economic market caused China's advertising market to enter a period of adjustment again. China's advertising market as a whole fell 11.2% in the first quarter, while advertising spending by Internet media fell 5.6% in the first quarter compared with the same period last year.

This situation is likely to continue into the second quarter.

Societe Generale Securities believes that Tencent online advertising business due to macro-environmental factors advertising budget reduction, is expected to be lower than expected, especially media advertising. Downgrade the growth rate of 19Q2 advertising business to 22.3%, (previous forecast: 27.9%) it is expected that 19Q2 media advertising will decline compared with the same period last year, among which: 1) due to the delay of the 19Q2 Tencent video series, 2) advertisers have reduced the relatively low media advertising investment in ROI; in addition, social advertising is expected to grow by about 35%, which is basically the same as the previous forecast.

Shen Wan expects Tencent 2Q19 advertising revenue to grow 21.8% year-on-year, of which media advertising revenue is expected to grow 1.1% year-on-year, and social advertising revenue is expected to grow 32.2%.

Financial technology and enterprise service business

Last quarter, Tencent brought out the payment and cloud computing businesses that previously belonged to "other" businesses, highlighting the status of his to B business.

Source: Tencent Financial report

Due to the impact of the reserve, 2019Q1's interest income decreased and its overall income increased by 44 per cent. Tencent of To B business is still growing rapidly, and the number of monthly active users more than doubled in the last quarter compared with the same period last year. Not surprisingly, this quarter continues its growth trend.

So, focus on a few points:

1. Growth of payment business and cloud computing (if disclosed)

2. Internet companies begin to cut marketing expenses and subsidy expenses, and whether the profit margin of payment business is improved.

3. Mini Program ecological scene continues to infiltrate, paying attention to the market share of Tencent's payment business.

Summary

Through the awkward time window of the first quarter, Tencent's game business is expected to return in the second quarter, while the advertising business still faces uncertainty due to supply and demand. Financial technology and corporate services business, as Tencent's second largest business, is still growing rapidly, the proportion is expected to continue to expand, looking forward to it to bring us more surprises.

For the whole year, it is expected that the second half of the year is better than the first half of the year, Tencent may start a feast of "eating chicken".