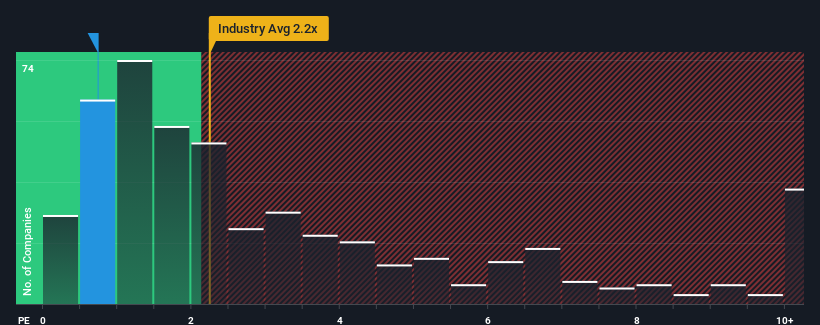

Zhejiang Xinan Chemical Industrial Group Co.,Ltd's (SHSE:600596) price-to-sales (or "P/S") ratio of 0.7x might make it look like a buy right now compared to the Chemicals industry in China, where around half of the companies have P/S ratios above 2.2x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Zhejiang Xinan Chemical Industrial GroupLtd

What Does Zhejiang Xinan Chemical Industrial GroupLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Zhejiang Xinan Chemical Industrial GroupLtd's revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhejiang Xinan Chemical Industrial GroupLtd.How Is Zhejiang Xinan Chemical Industrial GroupLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Zhejiang Xinan Chemical Industrial GroupLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. Regardless, revenue has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should generate growth of 14% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 31% growth forecast for the broader industry.

With this in consideration, its clear as to why Zhejiang Xinan Chemical Industrial GroupLtd's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Zhejiang Xinan Chemical Industrial GroupLtd's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Zhejiang Xinan Chemical Industrial GroupLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Zhejiang Xinan Chemical Industrial GroupLtd has 3 warning signs (and 1 which is potentially serious) we think you should know about.

If these risks are making you reconsider your opinion on Zhejiang Xinan Chemical Industrial GroupLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.