Venus Metals (ASX:VMC) adds AU$2.8m to market cap in the past 7 days, though investors from three years ago are still down 3.7%

It's nice to see the Venus Metals Corporation Limited (ASX:VMC) share price up 15% in a week. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 44% in the last three years, significantly under-performing the market.

While the stock has risen 15% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Venus Metals

With just AU$46,084 worth of revenue in twelve months, we don't think the market considers Venus Metals to have proven its business plan. You have to wonder why venture capitalists aren't funding it. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, investors may be hoping that Venus Metals finds some valuable resources, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

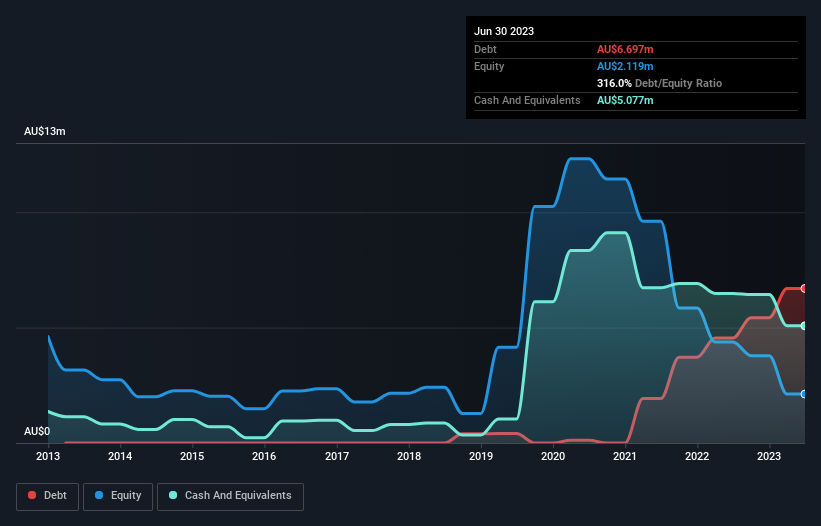

Venus Metals had liabilities exceeding cash by AU$2.1m when it last reported in June 2023, according to our data. That makes it extremely high risk, in our view. But since the share price has dived 18% per year, over 3 years , it looks like some investors think it's time to abandon ship, so to speak. You can see in the image below, how Venus Metals' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Venus Metals' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Venus Metals' TSR, at -3.7% is higher than its share price return of -44%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

It's nice to see that Venus Metals shareholders have received a total shareholder return of 52% over the last year. That gain is better than the annual TSR over five years, which is 6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with Venus Metals (including 2 which can't be ignored) .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance