Source: Wind

Tencent is planning to buy a 10 per cent stake in Universal Music, a unit of Vivendi SA, and the two sides are in preliminary talks on the acquisition, the Hong Kong-based Wande news agency reported. Universal Music is one of the largest record companies in the world. Famous European and American artists such as Lady Gaga, Taylor Swift and Madonna are all owned by Universal, and many Chinese music singers such as Li Keqin, Eason Chan and Wu Yifan are also among them.

Vivendi SA shares soared on Tuesday, rising 6.3 per cent to 25.50 euros at one point in intraday trading, driven by the good news of the acquisition.If the deal goes through, it will give Universal Music an initial valuation of 30 billion euros ($33.6 billion), and Tencent will have an one-year subscription option with a 10% stake in Universal Music in the future.

Analysts at Citi said the initial stake was lower than expected and Universal Music Group had an initial valuation of 30 billion euros, below the upper limit of the range. Bulls are expected to value between 30 billion and 40 billion euros.This is a big deal, and holding a stake in one of the three major music brands will enable Tencent to gain strategic insight into how the industry develops from an important upstream business perspective.

In addition to the 30 billion euro acquisition, Vivendi and Tencent are also considering strategic business cooperation to help Universal Music Group seize the growth opportunities of digitization and opening up new markets, so that more young singers can have the opportunity to realize their dreams. Wei Wandi expressed the hope that the cooperation between the two sides can create more value for Tencent and Universal Music.It is self-evident that the future will bring convenience and advantages to Tencent Music in music copyright.

Why choose Universal Music?

Universal Music is the world's largest record company, and its copyright once accounted for about 1/4 of the world's recorded music library. Until 2017, it was the only record company among the "big three" in the world that had not been bought exclusively. Universal Music's recorded music business hit an all-time high of 4.828 billion euros in 2018, up 9.8% from a year earlier.

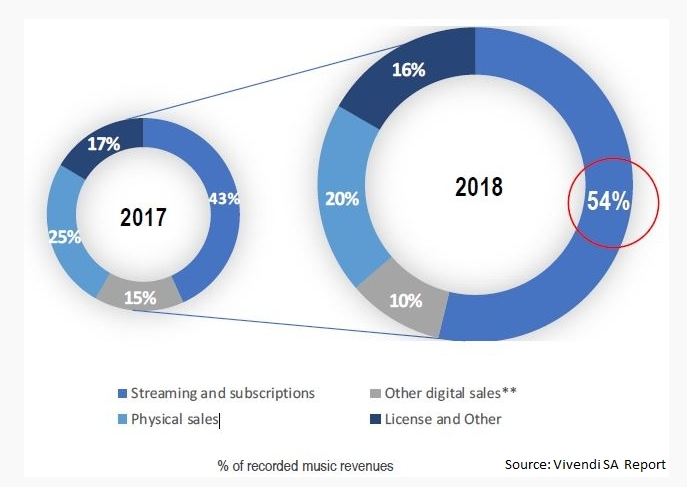

At present, Universal Music recording music business is divided into streaming revenue (Streaming and subscriptions), recording music licensing (License and Other), paid download income (Other digital sales,Mainly downloads), and physical income (Physical sales). According to the data, streaming revenue accounted for more than half of the entire recorded music business for the first time in 2018, reaching 54%, or 2.596 billion euros.

At the same time, in the situation of paid download revenue and physical income showing a sharp decline (- 26.6% and-16.1% respectively), the growth of streaming business led to an increase of 9.8% in the whole recorded music business and accounted for 43.1% of the total revenue of Universal Music Group.

In 2017, Universal Music rejected streaming behemoth Spotify and Apple Music and chose to work with Tencent, mainly focusing on the dividends of Tencent Music's 600m users and recognition of its TME business model.Today, Tencent Music's business segment is more comprehensive and diversified, including copyright licensing, fan economy, paid subscriptions and so on. Universal Music, as a traditional record company, although it has a huge global music resource library, it needs better communication channels. The alliance is another bet of Universal Music on the Chinese market.

In response to the rapid development of the music industry in the future, Universal Music announced in June that it was working with artificial intelligence tool startup Super Hi-Fi to provide Universal Music artists with new AI tools. AI technology will allow users to have a smoother transition between the songs they listen to, adjust the order of songs in the playlist according to their characteristics, adjust the volume for users, eliminate clicks and gaps between tracks, integrate audio ads to make them smoother in the listening experience, and maximize their interaction and listening experience. Industry insiders predict that once the program is applied, Universal Music will have more advantages in the field of streaming media in the future.

Tencent Music's business layout has shifted from domestic to overseas.

In fact, Tencent Music's acquisition and expansion has never stopped in recent years. In 2016, Tencent acquired a controlling stake of about 44 per cent of Ocean Music Group, increasing its controlling stake from 16 per cent to about 60 per cent. In 2018, Spotify and Tencent Music jointly cross-owned shares, and Tencent holds shares in Spotify7.5%. At the beginning of this year, it was also reported that Tencent had planned to buy Spotify, a streaming music service platform, but the other party rejected Tencent because of listing considerations.

As Tencent's vision shifts from domestic to international, the global strategic layout is obvious, and the performance is also rising. According to Tencent Music's financial results, the number of mobile MAU (monthly active users) of online music services in the first quarter of 2019 was 654 million, up 4.6 percent from 625 million in the same period last year, and the number of paying users of online music services was 28.4 million, up 27.4 percent from 22.3 million in the same period last year.

Edit / Phoebe