① A total of 9 stocks were lifted, accounting for more than 50% of the total share capital; ② The lifting of the ban peaked on Friday, with a total market value of 29.433 billion yuan, including Lianhong Xinke, Youfa Group, Boqian New Materials, and Crystal Special Equipment.

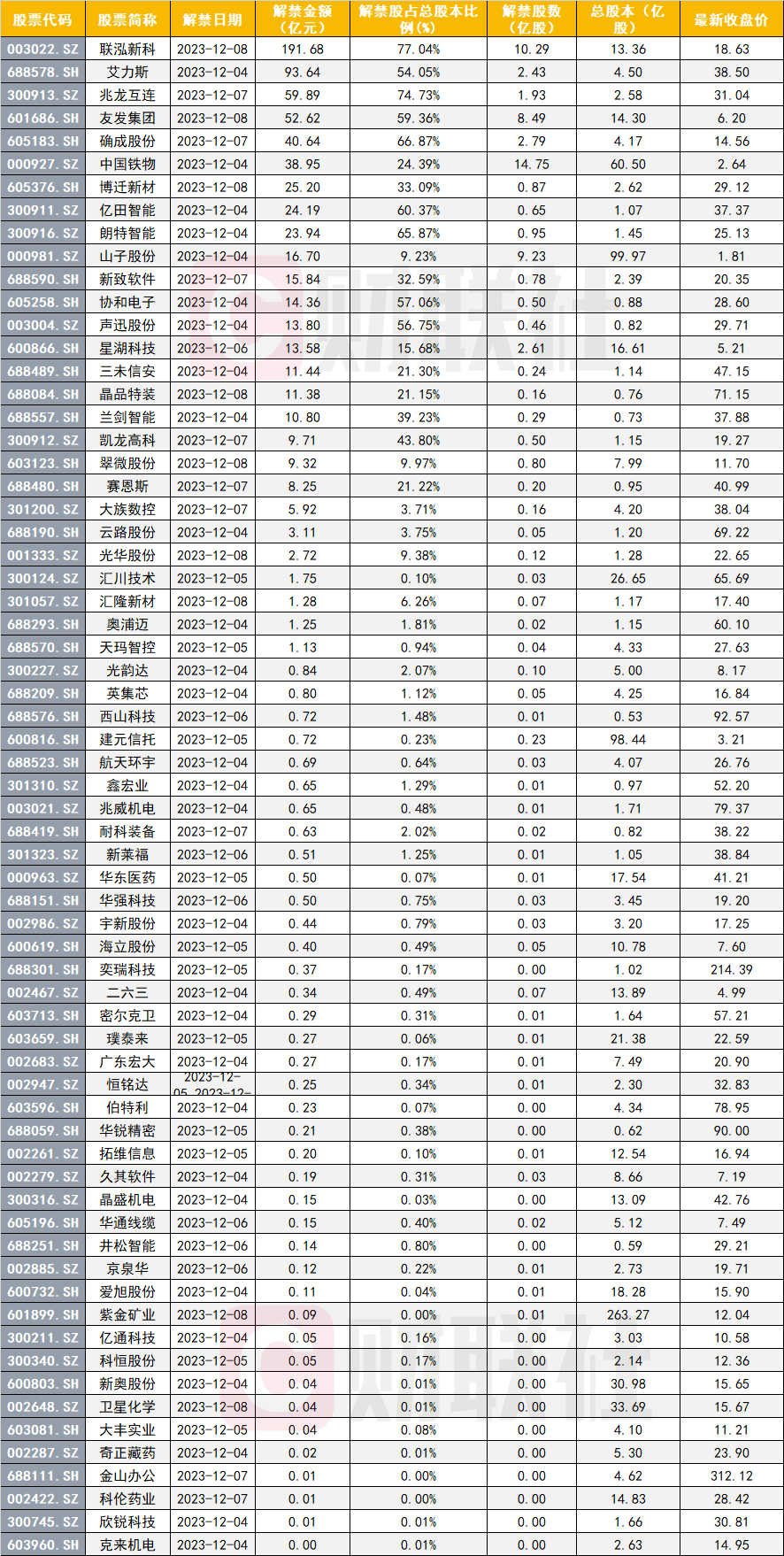

Financial News Agency, December 2 (Editor Wei Qi) According to public data, next week (December 4 to December 8), a total of 66 companies in the Shanghai and Shenzhen markets will lift the ban on restricted shares one after another, with a total of 6.019 billion shares. According to the latest closing price, the unbanned market value was 71,481 billion yuan, down from last week's 117.159 billion yuan. Among them, Lianhong Xinke, Alice, and Zhaolong Interconnect ranked in the top three market capitalization, which was 19.168 billion yuan, 5.989 billion yuan, and 5.873 billion yuan respectively.

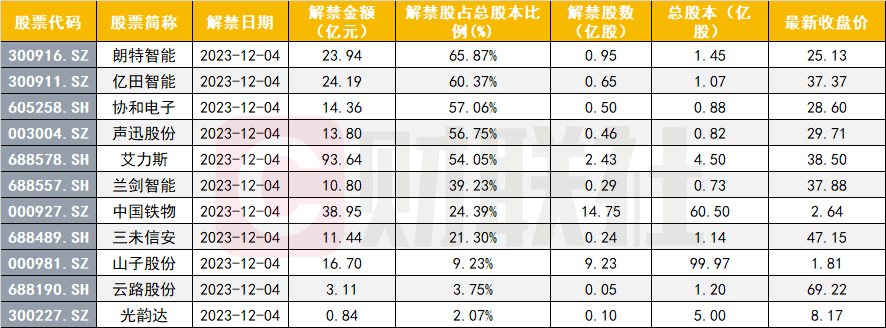

Judging from the lifting ratio, a total of 9 stocks unbanned accounted for more than 50% of the total share capital, in that order: Lianhong Xinke (77.04%), Zhaolong Interconnect (59.89%), confirmed shares (66.87%), Lante Intelligence (65.87%), Yitian Intelligence (60.37%), Youfa Group (59.36%), Kyowa Electronics (57.06%), Shengxun Shares (56.75%), and Alice (54.04%).

Judging from the lifting ratio, a total of 9 stocks unbanned accounted for more than 50% of the total share capital, in that order: Lianhong Xinke (77.04%), Zhaolong Interconnect (59.89%), confirmed shares (66.87%), Lante Intelligence (65.87%), Yitian Intelligence (60.37%), Youfa Group (59.36%), Kyowa Electronics (57.06%), Shengxun Shares (56.75%), and Alice (54.04%).

The lifting of the ban peaked on Friday, with a total market value of 29.433 billion yuan, including Lianhong Xinke, Youfa Group, Boqian New Materials, and Crystal Products.

Lianhong Xinke's 1,029 million shares limited for initial shareholders will be lifted on December 8. The company is the leading EVA photovoltaic material. The main products are EVA photovoltaic film materials, EVA wire and cable materials and high-end shoe materials, PP thin-walled injection molding materials, EOD special surfactants, large polyether monomers, and high-performance water reducing agents. The company's net profit for the first three quarters fell 48.01% year on year, which continued to deteriorate from the first half of the year (net profit for the first half of the year fell 28.36% year on year), and the corresponding company's stock price was adjusted by 38.21% year to date.

Alice's 254 million shares are also restricted shares for initial shareholders, accounting for 15.21% of the total share capital. The company strategically focuses on the research and development of innovative drugs targeting small molecules in tumors, mainly constructing R&D pipelines around common driver gene targets in non-small cell lung cancer, and is committed to becoming a leading innovative drug company in the field of small molecule targeted drugs for non-small cell lung cancer. Net profit in the third quarter increased by 614.22% year on year, and stock prices rose 68% from an August low, and currently in a high horizontal position.

从解禁比例来看,共计9只个股解禁比例占总股本比例超50%,依次分别为:联泓新科(77.04%)、兆龙互连(59.89%)、确成股份(66.87%)、朗特智能(65.87%)、亿田智能(60.37%)、友发集团(59.36%)、协和电子(57.06%)、声迅股份(56.75%)、艾力斯(54.04%)。

从解禁比例来看,共计9只个股解禁比例占总股本比例超50%,依次分别为:联泓新科(77.04%)、兆龙互连(59.89%)、确成股份(66.87%)、朗特智能(65.87%)、亿田智能(60.37%)、友发集团(59.36%)、协和电子(57.06%)、声迅股份(56.75%)、艾力斯(54.04%)。