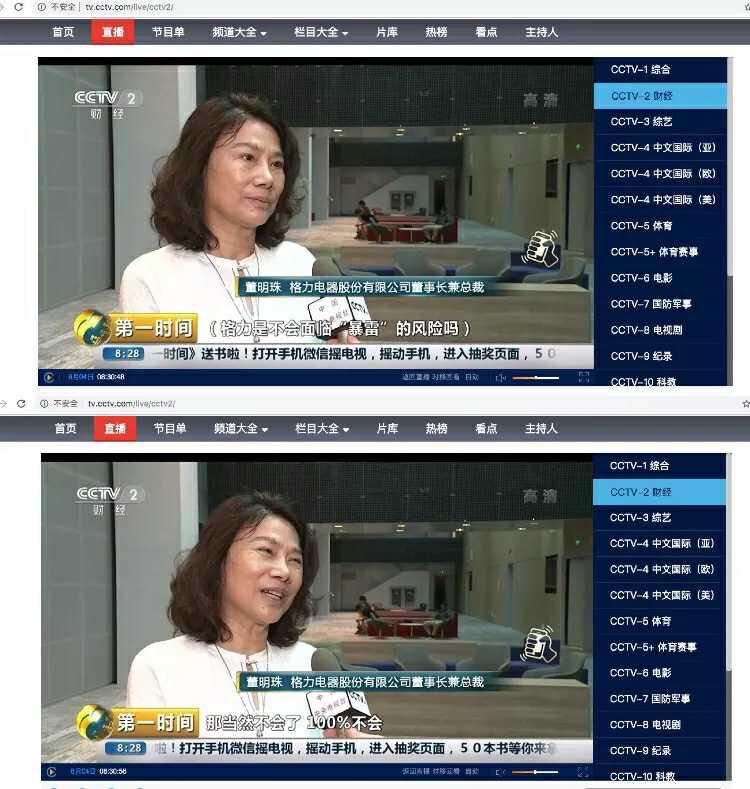

In the CCTV financial "first time" program on the morning of August 4, the reporter asked: "now there are a lot of thunderstorms in white horse stocks?" Dong Mingzhu replied: "that is not a real white horse stock, it is a fake." "

The reporter continued to ask: Gree will not face the risk of "thunderstorm"? Dong Mingzhu replied, "of course not, 100% will not. In the process of the development of enterprises, a key is to cultivate themselves, the government is only to create a fair environment for you. "

However, recently, an investment self-media published an article: "Gree Electric Appliances reported that the probability of lightning explosion is 70%!" "" Why do I always think Gree Electric Appliances is going to explode? The author analyzes the possibility of negative growth in Gree's report from the perspective of data and logic.

-Editor's Note

2019 is a very different year in my investment career. It surpassed the big stock market crash of 2015 and the big bear market of 2011-2014. The thunder resounded through the sky!

This year's corporate fraud is really unbearable, especially those big white horses' record-breaking fraud. Coupled with the serious decline in the performance of many blue chip stocks, investors' hopes for a bull market in 2019 may be greatly dashed after the market soared in the first quarter.

Kang Dexin and Kangmei Pharmaceutical Industry made great fraud in their performance.

The performance of Oufeiguang and Dazhong laser has plummeted.

Haikangwei sees a slowdown in performance growth.

Let's take a look at today's protagonist-Gree Electric Appliances. A-share white horse stocks, will there be a slowdown in the reported performance or a sharp decline?

The torn war between Gree and Ox

Gree's 2018 annual report and 2019 quarterly report, the difference between the two statements is very big. In 2018, Gree air conditioning achieved a high growth of 26.15% while the air conditioning market grew by only 4.5% for the whole year.

It seems that Gree Electric Appliances has not been affected by the slowdown in the industry at all, but also widened the gap with the second place, feeling that other air conditioners are rubbish to Gree.

In the first quarter, the company achieved a total revenue of 41.006 billion yuan, an increase of 2.45% over the same period last year. The growth rates of net profit and non-return net profit are 1.62% and 22.16% respectively, which is Gree's quarterly report of very poor performance in recent years. In particular, the net cash flow generated by operating activities was 7.733 billion yuan, a decrease of 46.15% over the same period last year. As for the significant decrease in net cash flow from operating activities, Gree Electric Appliances explained that it was mainly due to the increase in cash payments related to operating activities.

The pressure of performance is the main reason why Gree reported Ox. In general, when the industry boss begins to take up arms against his younger brother, it shows that the competition in the industry as a whole begins to deteriorate. The boss's market share was taken away by the younger brother, and it was taken away in a way that the quality of the product was not up to standard.Judging from the air-conditioning sales data in 2018, the competitive pressure in the air-conditioning industry is increasing.

With the quarterly report data, we can clearly see that Gree's air conditioner sales encountered "problems" at the beginning of the year, that is, the price war launched by Midea and Ox in March this year had a great impact on the market, and Gree did not actively respond. Midea and ox grabbed Gree's off-season market cake.

From the pre-disclosure of the A-share industry reports, the performance of the media, consumer electronics, automotive industry is relatively bleak, the consumer industry home appliances sector is difficult to be left alone. Of course, the performance reported by Gree Electric Appliances is not as good as it used to be. After all, problems have emerged in the entire consumer industry.

Gree, success is the channel, failure is also the channel!

Many Gree air conditioning dealers said frankly, "although in recent years, the air conditioning market is not easy, everyone also said that they can not live." But this year is really unable to survive, many Gree dealers are not moving, are looking for their own way out. Even many people have quietly started to implement the Internet direct sales model of the Ox air-conditioning business. Because Gree's desperate pressure on goods regardless of the attitude of businessmen makes us feel discouraged and too cold.

A few days ago, when Gree Electric Appliances publicly reported its peer Ox air conditioner under its real name, many Gree air conditioning dealers were unusual and did not completely stand on Gree's standpoint, but openly called on Gree Electric Appliance Chairman Dong Mingzhu. "When you spend half a year planning and preparing to report Ox air conditioners, can you spare some time and energy and some resources to care about the business and life and death of our loyal Gree dealers?」。

"on the one hand, it is impossible to sell goods in the first-tier market, and on the other hand, the agents are still desperately pressing the goods through policies, not only pressing the air conditioners, but also seizing ice to wash small household appliances, in a word: crush you to death.

On the one hand, we were given a promotion discount of 200 yuan in March, which became 800 yuan in May, and consumers were fooled to question the dishonesty of our promotion, and prices fell indiscriminately; on the other hand, agents did not bear round after round of price reduction promotions. All the losses let us pay out of our own pocket, "said the head of a Gree franchise store in Xi'an, Shaanxi Province.

A Gree agent from Yichang, Hubei Province, recalled the business of Gree air conditioners in recent years and directly described it as "miserable": the entire air conditioning market is falling and stagflating, but Gree is in order to Dong Mingzhu promised high growth revenue target, we are required to make money and pick up goods in accordance with the growth target of 20% or more.

The plates worth less than 130 million in 2016 sold 92 million yuan at the end of December of that year, lost 3 million in 2017, and lost more than 2.8 million in 18 years. This year, they are directly subcontracted to others and do not want to be trapped again. "

Gree air-conditioning agents in many areas have complained that although the market is not good since the beginning of this year, the growth target of various places has been maintained at or above double digits, layers of distribution, policy pressure goods, encountered terminal supply can not sell. "in order to follow the policy of foodie, many colleagues can only post points by themselves and sell Gree air conditioners directly through some consignment markets." there is really no way. The life of a large number of Gree franchise store owners is even more difficult. At present, Shandong, Henan, Hubei and other places have begun to reduce prices and promote sales, that is, to "tempt merchants to pick up goods again with low-price promotions." however, they do not make up for the inventory of franchised stores, which is to drive their dealers to a dead end.

Gree's channel is the strongest in A-shares. Many investors have made a lot of money on Gree, thinking that Gree's competitiveness is to master the core technology, in fact, Gree's control of the channel is the core competitiveness of stable growth.

In fact, if you observe carefully, you will know that there is not much Gree in the ordinary home appliance mall, because Gree takes the channel of specialty stores, and there are more than 30,000 in the country. It mainly sells air conditioners and other Gree products. And other white goods companies, such as Midea's Siemens. If they want to sell refrigerators, air conditioners and washing machines, they must go through KA channels such as Home Appliances Mall.

Take Mei, for example, he doesn't have a store like Gree. Midea and the home appliance mall are more about the relationship between the partners, while Gree and the store are more about the relationship between the boss and the staff. Gree to the stores of these dealers in a "rebate" way, and then control the distribution progress of stores.

The air conditioner itself is affected by the real estate cycle, but Gree has 30,000 stores such as reservoirs, which can easily put their own air conditioners in the store to curb such a cycle. And the Gree regional sales company of these 30,000 stores is also the second shareholder of Gree, with complete bundling of interests.

In the end, the store became the final 'receiver', and the air conditioner sold in a good year, which was overjoyed. But when the air-conditioning industry is in the present situation, the store will cry for its father and mother. Not only do you have to take on too much inventory, give the money to Gree. And can not be flexible with other air conditioners for price war, resulting in hindrance at both ends. In the end, the impact was passed on to Gree Electric Appliances itself.

Bad news for Gree.

Read Gree Electric Appliance's first quarter report, there are a lot of problems emerge, and these problems are difficult to ignore.

Accounts receivable increased by 3.44 billion, or 44.69%, in the first quarter, while advances increased by 2.093 billion, an increase of 96.81%. These two data correspond to the compromise made by Gree in the face of the upstream and downstream. In previous years, Gree settled the payment for the upstream and downstream in advance to maximize its own benefits. In such a form this year, Gree has to make some compromises to the stores and extend their payment terms, so that the financial pressure on the stores is not so great.

The increase in advance payments may be caused by the expansion of the market outside air conditioners, and it may also mean that the management team is making a gesture to potential controlling bidders.

This year's quarterly data, no matter from which point of view, Gree is suspected of pressing down on goods to the channel, and to a greater extent this year. From the accounts receivable and prepayments, we saw that Gree began to 'take care of' the store. From the 6 billion increase in inventory over the same period last year, we can see that Gree is really unable to pour water into this' reservoir'of the store. At the same time, coupled with the growth of debt, a series of problems began to emerge in the short term.

According to the survey of securities firms, it is known that:At the beginning of this year, Gree did not implement price reduction measures in time, resulting in a lot of market share, especially Midea's market share increased rapidly. Gree's performance this year will certainly be greatly affected, but Midea's income and performance will be more robust.

There is another phenomenon to explain. Please take a look at the following data:

After Dong Mingzhu took office, the total operating income was stuck in the round number of 10 billion for seven consecutive years. From 2012 to 2018, the total operating income was 1001.10, 1200.43, 1400.05, 1005.64, 1101.13, 1500.20 and 200.024 billion respectively.

Not surprisingly, the annual income is a round number, and it is very accurate. Even though Gree has complete control in the upper reaches of the channel, such accuracy is really difficult, and Gree's diversified business has begun, not only air conditioning, ah, this transfer of suspicion is very great!

At the same time, Gree Electric Appliances has a lot of financial doubts. Questions on the Internet also continue to appear, I hope these are not true!

(some questions about the financial aspects of Gree Electric Appliance on the Internet)

So at the end of the analysis, I think it is very difficult for Gree Electric Appliances to have a big growth or even a big drop in the newspaper. Because Gree's miscalculation of market share at the beginning of this year has become a reality, coupled with the fact that the growth of the air-conditioning industry this year will certainly not be good, there is a lot of pressure for stores to get rid of inventory. The combination of these factors (of course, there is no analysis of Gree Chairman Dong Mingzhu and its management), it is difficult to make Gree Electric Appliance report good-looking this year.

Then use the data and logic to see if Gree's report will have negative growth.

Domestic sales of air conditioning industry showed negative growth in the first half of the year.

The air conditioning industry as a whole sold 88.669 million units in the first half of 2019, an increase of 1.76% over the same period last year, but the domestic sales figure was 52.838 million, an increase of-0.56% over the same period last year.

On the whole, the growth of the air conditioning industry stagnated in the first half of 2019, which is no longer as high as before! (don't tell me it's hot in July this year, it's the second half of the year, not the first half of the year)

Looking at Gree's data, it is very tragic, domestic sales and overall are negative (only the domestic sales data increased by 0.005% from January to April). In addition, in the first half of the year, there was a price war among air-conditioning companies, which were all reducing prices.

According to the relevant information, Gree did not reduce the price, but the sales of air conditioners declined, so the income of air conditioners naturally declined (income = sales * unit price).Since income will decline, it will naturally lead to a decline in net profit under normal circumstances.

Coupled with the recession in the air-conditioning industry this year, the average air-conditioning company will be aware of the fierce competition in the industry. The usual practice will certainly increase fees to maintain the market share of existing and new markets, which will certainly increase over the same period and will also affect net profits.

I don't know if Gree Electric Appliances will be the same as the 'normal company' or will not increase the cost in the highly competitive air-conditioning market. If Gree Electric Appliances increases its expenses, it is bound to further affect the net profit of the enterprise and decline even faster!

The above data are based on the research report and industry online (of course, if the data are not true, it is for nothing! )

The possibility of the growth of Gree Appliances

It is clear that it is very hot in July this year. But do you know if it is hot in July in June? We ordinary people don't know.

If Gree and dealers can know in advance that July will be hot, then there will certainly be a lot of inventory in June to cope with the hot market for air conditioners in July, so Gree will naturally be able to 'sell' air conditioners to dealers in June.

But according to the report, Gree's sales declined in June, which is not the case. I'm sure Gree won't do the same, counting July's sales as June's. So in the first half of the year as a whole, Gree Electric's air-conditioning income is falling, the natural net profit is not good!

So is there any other possibility of growth in the air-conditioning business? I haven't thought of it yet. I hope you can leave a message for me!

Growth in other businesses

Although the air-conditioning business accounts for the majority, but Gree Electric Appliances not only air-conditioning business, but also other business!

We can see that although the air conditioning business accounts for more than 80% of the income. But other businesses are growing very fast, with the slowest smart devices growing at 46.19% in 2018, which is a very good trend. It shows that the growth of other businesses is very strong.

Unless there is a substantial growth in these non-air-conditioning business, there is no way to avoid the downturn in air-conditioning business, because the proportion of income is really very low. I predict that there may be negative performance growth in the air-conditioning business, and relying on these non-air-conditioning businesses will reduce the decline in air-conditioning performance. So that the overall performance will not decline significantly, and there may even be a certain growth, but the possibility of high growth is very small!

Great increase in R & D and management expenses

Gree's R & D expenditure in 2018 is very large, although sales expenses account for the majority. But we have also said that Gree's sales expenses are likely to increase rapidly in the first half of this year, because the best way for Gree to maintain its market share is to increase its sales expenses.

The increase in R & D expenditure is also inevitable. Gree is now preparing for diversification, and the premise of diversification is to develop new products, so the increase in R & D costs is normal.

Of course, there is another factor that I think is very important. Gree has a very strong sales channel. Many people in the market think that Gree has the possibility of using sales channels to smooth its performance. If it is true, then naturally the reported results will be smooth. I believe this is not true, if not, then there is no possibility of high growth of Gree's performance! (all I hear here is to make a hypothesis.)

To sum up, even if the non-air-conditioning business growth and cost savings, it is difficult to get rid of Gree air-conditioning sales decline in the first half of the reality.

The high growth in performance is really hopeless, but it is also difficult to see a sharp decline in performance. after all, the decline in air-conditioning sales is still within an acceptable range.

Low growth and non-growth are estimated to be the basic pattern of Gree's report, and there will even be a small decline in performance!

Edit / Iris