Source: Dai Qing Strategy Research

Author:Dai Qing,Wang Yifan

The US inflation data fell more than expected. Recently, the market is trading to ease liquidity after interest rate hikes stopped, and it is expected that the Q2 Fed will begin cutting interest rates as soon as 2024. This article reviews the last four rounds of the Fed's interest rate hikes, as well as the timing, background, and price performance of major asset classes before and after. The equity market mostly showed gains after the last rate hike, but there is a risk of a pullback within 1-2 months after the interest rate cut, and interest rate cuts are often accompanied by a recession in the US economy. Both Chinese and US bond yields declined, gold strengthened, and crude oil diversified.

1. Hong Kong stocks fluctuated upward last week

Hong Kong stocks fluctuated upward last week, with sectors such as media, automobiles, and software and services leading gains. China and the US issued a statement that US inflation has cooled down beyond expectations, and the Hong Kong government has implemented stamp duty cuts. Multiple favorable factors boosted Hong Kong stock market sentiment. Hong Kong stocks soared on November 15, and Hong Kong stock sentiment declined somewhat in the following two trading days. The Hong Kong stock Hang Seng Index rose 1.46% cumulatively last week, the Hang Seng State-owned Enterprises Index rose 1.25%, and the Hang Seng Technology Index rose 2.25%. In terms of sectors, media, automobiles, software, and services showed the highest gains, while the retail and durable goods consumer sectors underperformed.

2. Market performance before and after the end of interest rate hikes

Recently, the market is trading and interest rate hikes have stopped. Historically, after interest rate hikes have ended, the stock market has often rebounded rapidly in the short term, resulting in a “fill-in-hole” market. Before the past four rounds of interest rate hikes stopped, the equity market, which was suppressed by liquidity, showed a downward trend. After interest rate hikes were stopped, favorable liquidity improvements caused the stock market to rebound rapidly in the short term. The latest US inflation data has fallen beyond expectations. Recently, the market is trading the Fed to end interest rate hikes.

Recently, the market is trading and interest rate hikes have stopped. Historically, after interest rate hikes have ended, the stock market has often rebounded rapidly in the short term, resulting in a “fill-in-hole” market. Before the past four rounds of interest rate hikes stopped, the equity market, which was suppressed by liquidity, showed a downward trend. After interest rate hikes were stopped, favorable liquidity improvements caused the stock market to rebound rapidly in the short term. The latest US inflation data has fallen beyond expectations. Recently, the market is trading the Fed to end interest rate hikes.

3. The timing and context from the end of the Fed's interest rate hike to interest rate cuts

Whether to cut interest rates after stopping interest rate hikes depends on whether the US economy is in recession, while whether the market can continue to rise after a short-term rapid rebound is affected by both concerns about economic prospects and improved liquidity. Currently, the market expects the Fed to begin cutting interest rates in the first half of 2024. This article reviews the timing and background of the last four rounds of interest rate cuts, and the price performance of major asset classes before and after interest rate cuts.

The first interest rate cuts in the last four rounds were July 6, 1995, January 3, 2001, September 18, 2007, and August 1, 2019, respectively. Interest rate cuts are often accompanied by signs of economic recession, such as a slowdown in consumption and a weakening of the job market.

First round: The last rate hike on February 1, 1995, and the first interest rate cut on July 6, 1995. The time span is 6 months. At the interest rate meeting in February 1995, the Federal Reserve predicted that future economic growth would slow, saying that interest rates would remain unchanged starting in the second quarter. Economic activity has slowed, and high financing costs have reduced corporate investment expenses. The Federal Reserve began cutting interest rates in July.

Second round: the last rate hike on May 16, 2000, and the first interest rate cut on January 3, 2001, over a period of 8 months. Consumption has cooled, real estate sales have declined, and industrial growth has slowed. Most of the June 2000 interest rate meeting supported keeping interest rates unchanged. The internet bubble then burst, and interest rate cuts began in January 2001.

Third round: the last rate hike on June 29, 2006, and the first interest rate cut on September 18, 2007, over a period of 15 months. In June 2006, the job market cooled down, consumption slowed, and real estate continued to decline. Although oil prices made inflation resilient, most officials supported keeping interest rates unchanged. Following the financial crisis and economic downturn the following year, the Federal Reserve began cutting interest rates in September 2007.

Fourth round: The last interest rate hike on December 19, 2018, and the first interest rate cut on August 1, 2019. The time span is 8 months. Although the job market was strong in December 2018, the decline in manufacturing combined with falling energy prices caused inflation expectations to fall. At that time, the market still expected to raise interest rates twice. Since then, energy prices have continued to fall, inflation has fallen short of expectations, economic growth has slowed, and interest rate cuts began in August 2019.

4. Performance of major asset classes before and after interest rate cuts

4.1. Equity markets

1) Hong Kong stocks and MSCI emerging markets: Hong Kong stocks and MSCI emerging markets showed mostly gains after the last rate hike, but there is a risk of a rapid pullback within 1-2 months after interest rate cuts began. After the last interest rate hike, Hong Kong stocks and MSCI emerging markets showed an upward trend, mostly boosted by improved liquidity.

However, after a rapid rise until the first interest rate cut, the Hang Seng Index and the MSCI Emerging Markets Index both showed a rapid correction within 1-2 months. It is more necessary to observe whether the US economy can have a soft landing. If there are concerns about a recession, the equity market is also often affected by molecular shocks.

2) A shares: A shares rose slightly after the last interest rate hike, and there was a short-term correction within 1-2 months after interest rate cuts began. After the last interest rate hike, the Shanghai Composite Index generally rose slightly. Among them, the third round (2006) rose significantly. The increase reached 60% in the six months after the interest rate hike ended, but there was a correction within 1-2 months after the first interest rate cut.

3) US stocks: US stocks rose overall after the last interest rate hike, and there was a short-term correction within 1-2 months after interest rate cuts began. After the last rate hike, the S&P 500 rose overall. The second round (2000) was affected by the bursting of the internet bubble and still fell six months after the last rate hike. Similarly, there was a pullback within 1-2 months after the initial interest rate cut.

4.2. The bond market

1) US bonds: US bond yields are declining, and the US bond index continues to strengthen. US bond yields usually entered a downward trajectory before the last interest rate hike. After the last rate hike, US bond yields continued to decline, corresponding to the strengthening of the US bond index.

2) Chinese bonds: The yield of Chinese bonds declined, but the margin was more moderate than that of US bonds, and their relative attractiveness increased. The yield on Chinese bonds rose slightly within 1-2 months after the Federal Reserve cut interest rates for the first time and then declined, but the decline was smaller than that of US bonds, the spread between China and the US widened, and its attractiveness increased compared to US bonds.

4.3. commodities

1) Gold: After the Fed ended its interest rate hike, gold overall strengthened. The Fed's interest rate cut is usually accompanied by a slowdown in economic growth and a rise in risk aversion in the market, so gold tends to strengthen after the last rate hike. Gold rose significantly in the six months after the end of the last two rounds (2007 and 2019) of interest rate hikes, which were 8.3%/7.0%, respectively.

2) Crude oil: Crude oil price trends diverged after interest rate cuts. In the six months after the past four rounds of interest rate cuts, crude oil prices each accounted for half of the rise and fall. Although interest rate cuts meant a slowdown in the economy, since crude oil prices were affected by other factors, the oil price trend did not show a clear pattern after interest rate cuts.

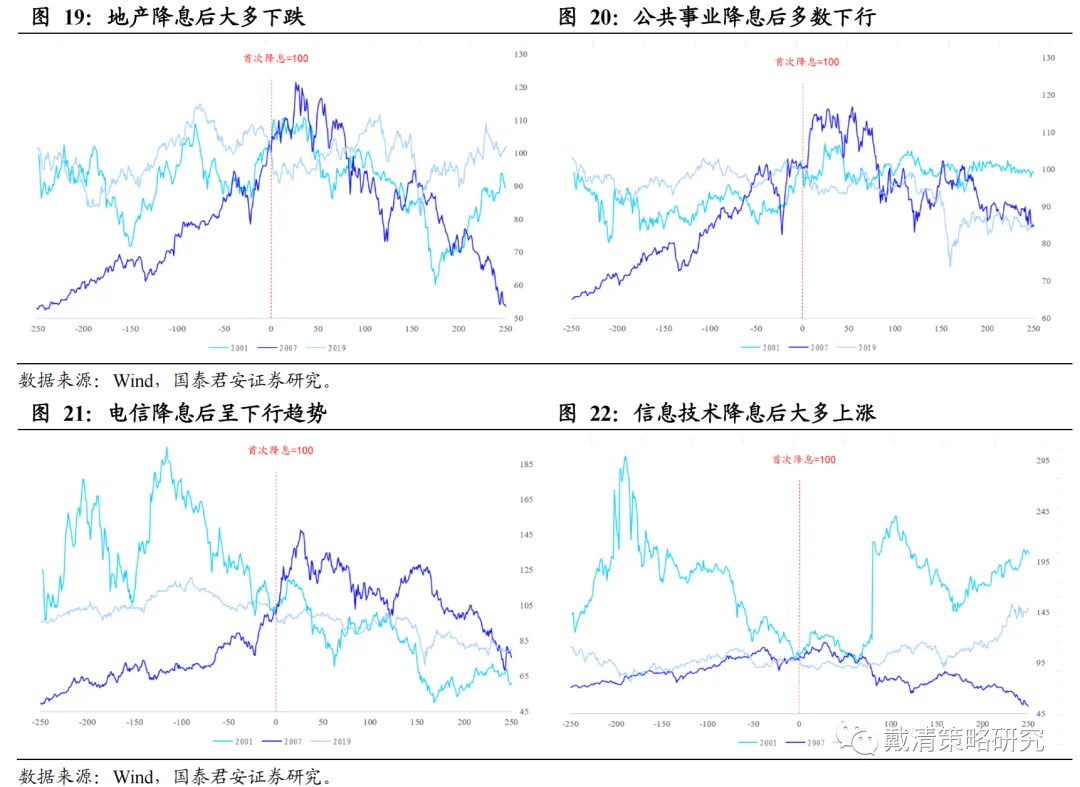

5. Performance of the Hong Kong stock industry before interest rate cuts

Within 3 months after the end of the last two rounds of interest rate hikes, most of the Hong Kong stock industry rebounded. After the Fed began cutting interest rates, most industries adjusted. During the rebound period, the industries with the highest gains in Hong Kong stocks were materials, telecommunications, and daily consumption, with an average increase of 31%/30%/29%. It is worth noting that due to the bursting of the Internet bubble, the information technology sector declined significantly in the second round, but the average increase in the last two rounds was higher.

6. Investment strategy for Hong Kong stocks in the fourth quarter

Investment strategy for the fourth quarter: “Three factors” resonate with a bullish view of Hong Kong stocks. 1) What to buy when Hong Kong stocks rebound? Short-term marginal overseas liquidity improved. The rebound period was dominated by growth styles. The index side focused on the Hong Kong stock Hang Seng Technology Index, and the sector side focused on innovative drugs, electronics, semiconductors, internet retail, automobiles, etc. 2) Increase dividend assets on medium- to long-term dips, and be optimistic about high-dividend varieties with high stability, such as communication operators, energy, and utilities.

6.1. Focus on the Hang Seng Tech Index and Internet retail during the rebound period

Factors affecting the relative performance of Hong Kong stock value/growth style can be matched to construct comprehensive indicators that explain market style changes more strongly.

We applied different weights to the three factors of the domestic economy (incremental TTM for social finance, manufacturing PMI), overseas liquidity (10-year US bond yield), and risk appetite (Hong Kong stock risk aversion index) to construct a comprehensive style factor index with a stronger explanation, which can better explain the change in Hong Kong stock market style.

In Q4, if domestic policy expectations heat up, combined with marginal easing of overseas liquidity, the growth style represented by the Hang Seng Technology Index may be more dominant.

6.2. Medium- to long-term deployment of new core assets for Hong Kong stocks - high dividends

What are the advantages of a high dividend strategy for Hong Kong stocks?

Hong Kong stocks and central state-owned enterprises have the advantages of having diverse targets (in many traditional industries), being cheaper than A-shares (the proportion of central state-owned enterprises with PB less than 1 is higher), and higher dividends (considering dividend tax is also attractive), which means that the market will last longer and there is more room. Standing on a longer-term perspective, relying on their ability to balance offense and defense and adapt to the times, we believe that dividend assets will become the new long-term “core asset” of Hong Kong stocks.

6.3. Innovative drugs for Hong Kong stocks

If you trade liquidity in the short term, you can focus on liquidity-sensitive industries, such as pharmaceuticals, semiconductors, etc. By studying the seven different stages of US bond yield trends in this round of interest rate hikes, we have determined that the liquidity-sensitive industries include: pharmaceuticals, biotechnology and life sciences, semiconductor and semiconductor production equipment, technical hardware and equipment, healthcare equipment and services, retail (platform economy), and automobiles and auto parts; in a period when the industry's profit growth is expected to be relatively stable, medium- and short-term investors can obtain short-term gains through market liquidity in these industries.

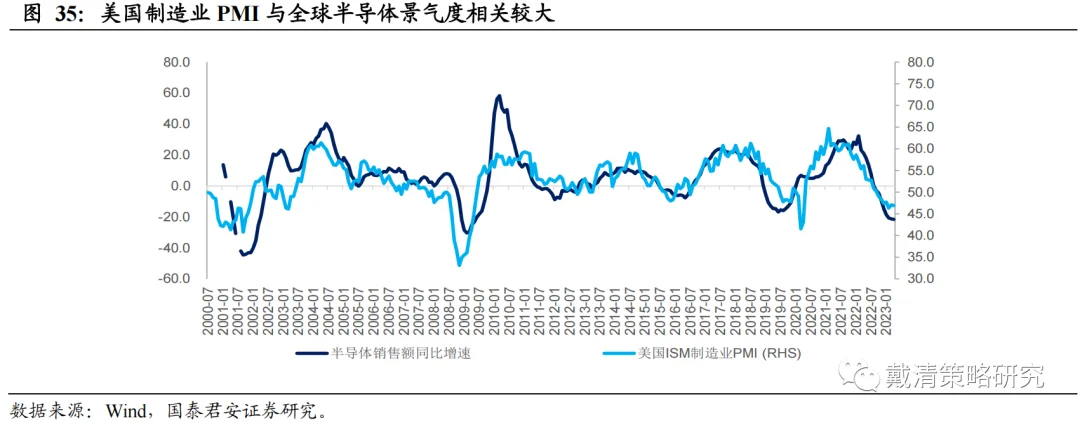

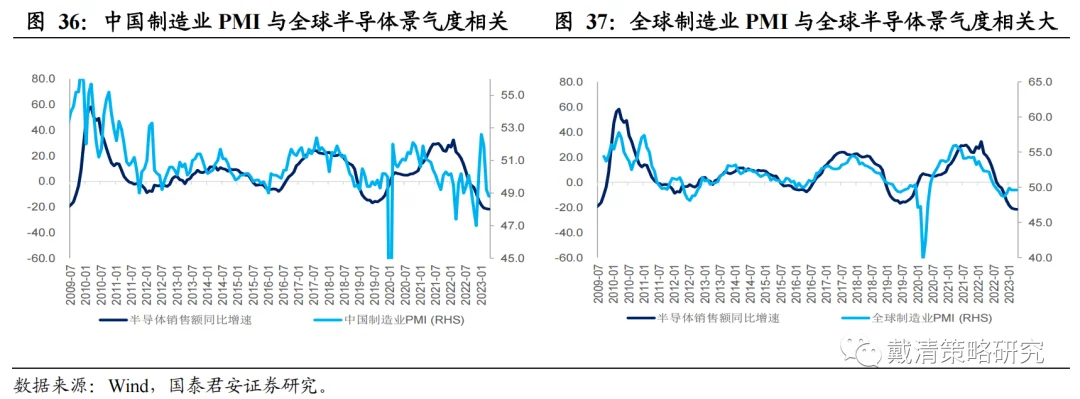

6.4. Hong Kong Stock Semiconductors and Consumer Electronics

There is room for repair in short-term valuations, but the inflection point on the medium- to long-term profit side will have to wait 2024. The global and US manufacturing PMI indicators have a strong guide to the prosperity of the global semiconductor industry. The entry of manufacturing PMI into a downward cycle indicates a downward trend in the semiconductor industry cycle. Although in the future, once liquidity expectations ease, there will be a large rebound in industry valuations, but in terms of long-term investment, we still need to wait for a reversal on the profit side.

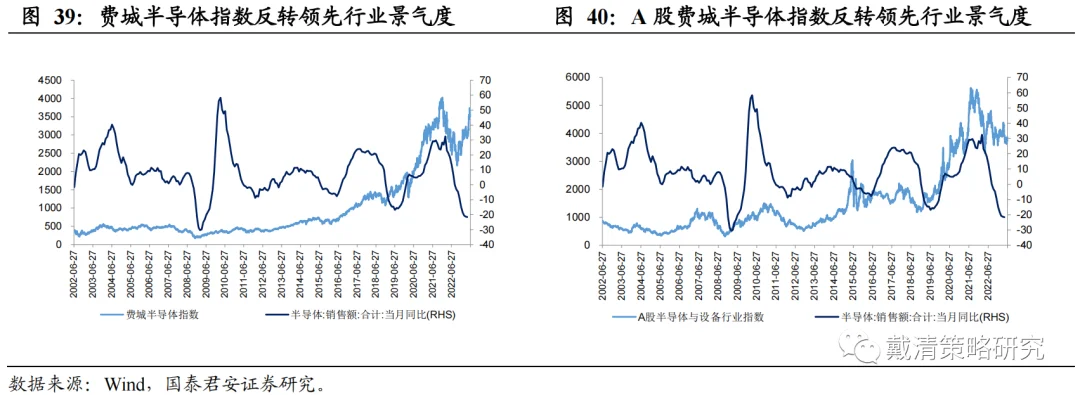

The semiconductor industry index reversed from the bottom earlier than the industry sentiment. By analyzing the relationship between the year-on-year growth rate of global semiconductor sales and the semiconductor index performance of Hong Kong stocks, US stocks, and A shares, we found that whether in the Hong Kong stock, US stock, or A share market, the semiconductor industry index bottomed out and rebounded before the industry sentiment.

6.5. Hong Kong Stocks Gold Stocks

Benefiting from declining interest rates on US bonds in the short term, it may return to more than 2,000 US dollars/ounce in the medium term. Looking at the medium to long term, in an environment of high interest rates and high inflation, the momentum of the US economy is still weakening. Combined with the risk of credit crunch, it will still take time to evaluate. The Fed's policy may change, and gold is expected to stabilize at 2,000 US dollars/ounce.

7. Risk Factors

1) Sino-US relations have repeatedly exceeded expectations; 2) US core inflation has exceeded expectations.

Editor/Somer

Comment(1)

Reason For Report