This article is edited by Oriental Securities: a list of Science and Technology Innovation Board's first 25 companies, Bank of China International Securities: Science and Technology Innovation Board's first 25 companies Tour, Shen Wan Hongyuan: a panoramic Perspective of Science and Technology Innovation Board's first batch of listed companies

Abstract: on the first day of Science and Technology Innovation Board, the first batch of 25 enterprises soared across the board. From the point of view of the increase, the top prize, second place and flower exploration were Anji Science and Technology, Western Superconductor and Cardiac Medicine, respectively. Judging from the results in the first half of 2019, the income growth rate of 25 enterprises was slightly higher than that of the whole year 2018, but the deducted non-net profit decreased to a certain extent, of which the net profit of Platinum decreased five times compared with the same period last year, and the loss expanded. Bank of China International pointed out that although Science and Technology Innovation Board's trading rules and the liberalization of finance and finance have given speculators room, Science and Technology Innovation Board is by no means a speculative tool.

1. Science and Technology Innovation Board rose sharply on the first day

On July 22, the listing ceremony of Science and Technology Innovation Board's first 25 companies was held in the trading hall on the fifth floor of the Shanghai Stock Exchange. Ying Yong, deputy secretary of the Shanghai Municipal CPC Committee and mayor, said at the listing ceremony that the opening of Science and Technology Innovation Board today is a milestone in the development of the capital market, a historic breakthrough in the field of scientific and technological innovation, a new path of financial reform and opening up, a new journey of the capital market, and a new atmosphere of scientific and technological innovation and entrepreneurship.

The first batch of 25 enterprises rose sharply on the first day of listing. Judging from the increase, the top prize, second place and flower exploration were 400% of Anji Technology and 267% of Western Superconductor, respectively.Heart pulse medical treatment is 242%, of which 16 have doubled and 4 have more than doubled.

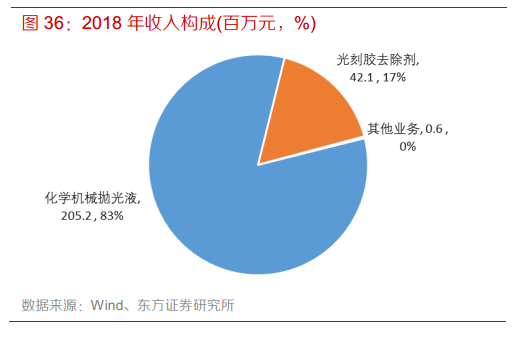

No.1 Anji Technology: a domestic leader in key semiconductor materials such as CMP polishing fluid

The company's main products include chemical mechanical (CMP) polishing solution, photoresist remover and other key semiconductor materials, which are used in integrated circuit manufacturing and advanced packaging and other fields, of which CMP polishing fluid contributes more than 80% to revenue. The company achieved an income of 248 million yuan in 2018, a compound growth rate of 12.3% in the past three years, and a net profit of about 45 million yuan, a compound growth rate of 10%.

No. 2 Western Superconductor: domestic high-end titanium alloy enterprises focusing on the military market

Western Superconductor was founded in 2003, started from the ITER project, and completed the development of a new type of high-performance structural titanium alloy for fighter aircraft with NbTi superconducting wire technology, which filled the gap of high-performance aviation titanium material. Titanium alloy business has now become the company's main source of income. The company is the main titanium alloy supplier of the new generation of fighter and transport aircraft in China, the only commercial manufacturer of low temperature superconducting wire rod in China, and the only whole process manufacturer of niobium titanium spindle rod, superconducting wire rod and superconducting magnet in the world.

Exploring the heart pulse medicine: the leader in the field of domestic aortic intervention

Cardiopulmonary Medicine is mainly engaged in the research, development, production and sales of aortic and peripheral vascular interventional medical devices, including aortic covered stents (thoracic aortic stents, abdominal aortic stents, etc.). Intraoperative stents (intraoperative stent system used in thoracic aortic dissection surgery) and other products such as peripheral vascular stents and balloon dilatation catheters in 2018 The revenue of the aortic stent business is 189 million, accounting for 81.81% of the company's total revenue.

2、The growth rate of the semi-annual report has dropped to a certain extent.

Graham, the teacher of American stock god Warren Buffett, said, "the stock market is a voting machine in the short term and a weighing machine in the long run." To put it more vividly, the stock market is a slow weighing machine, the weighing object is the value of the listed company, and the weighing figure is the stock market value of the listed company.

As of July 21, the first batch of 25 Science and Technology Innovation Board companies, except 6 companies (Rongbai Technology, Lan Qi Technology, China General account, Zhongwei Company, Traffic Control Technology, Hongsoft Technology) have disclosed the 2019 mid-term report, and these six companies have also published the 2019 mid-term report notice:Judging from the median performance forecast for the first half of 2019, the income growth rate is slightly higher than that for the whole of 2018, and the performance growth rate has declined to a certain extent.

Judging from the growth rate of revenueThe median revenue growth of all 25 companies in the first half of 2019 was 41%, slightly higher than the median revenue growth rate of 40% in 2018. The top five are Aerospace Hongtu + 282%, Ruichuang Weinar + 119%, Jiayuan Technology + 69%, Huaxingyuan Chuang + 71%, and China Micro + 70%.

Judging from the growth rate of deducted non-net profitIf you exclude China Micro (turnaround), Hanchuan Intelligence (turnaround), Aerospace Grand Plan (loss reduction), and Platte (loss expansion), the median growth rate is 22 per cent, down from 43 per cent for the whole of 2018. The top five are Jiayuan Technology + 278%, Tianzhun Technology + 96%, Ruichuang Weiner + 72%, Traffic Control Technology + 67%, Lan Qi Technology + 47%.It is worth noting that the net profit of platinum semi-annual report decreased by 514.09% compared with the same period last year, and the loss expanded.

3. High ROE and high PB

After that, let's take a look at the valuation.

From the perspective of the PB-ROE system, the ROE-2018 before dilution of the first batch of Kechuang board is 14.2%, exceeding the typical white horse index such as Shenzhen 100, Shanghai 50 and Shanghai and Shenzhen 300.If the China sign is removed, the ROE-2018 before the dilution of the first Kechuang board is as high as 18.1%, much higher than the main index of the A-share market.

However, while the profitability is strong, the PB valuation of Science and Technology Innovation Board's offering is relatively high. The PB (2018) of the first batch of Science and Technology Innovation Board's offering price is 4.57, which is close to that of the gem (where the main indices of the A-share market are compared with PB (LF)).But if the China General account is excluded, the PB corresponding to the first batch of Science and Technology Innovation Board's offering price is as high as 8.52, which is also significantly higher than all the major indices in the A-share market.

4. Summary

For investors, a correct understanding of the significance of launching Science and Technology Innovation Board and the registration system at the present time will help to better grasp Science and Technology Innovation Board's development prospects and the overall market trend. Science and Technology Innovation Board has shouldered the mission of scientific and technological innovation. China's economy has entered the "six-era", with slowing growth, insufficient power, prominent structural problems and weakening demographic dividends. There is an urgent need for scientific and technological development to open up new growth space.

In the long run, Science and Technology Innovation Board is committed to helping start-ups through the development period, and eventually build a number of scientific and technological backbones of China's economy, injecting new vitality into growth. The launch of the short-term venture board has dredged the flow of venture capital, improved the efficiency of capital flow, and optimized the allocation of resources.

From the perspective of Science and Technology Innovation Board's system design, regulators intend to achieve de-retail and marketization. On this basis, Science and Technology Innovation Board's future development follows the trend of strict supervision and the introduction of long-term funds.Bank of China International pointed outAlthough Science and Technology Innovation Board's trading rules and the liberalization of finance and finance have given speculators room, Science and Technology Innovation Board is by no means a speculative tool, but a booster of China's economy and a testing ground for capital market reform.

Edit / jasonzeng