There are two ways for stocks to rise 100% in one day:

First, from 0% to 100%

Second, first drop 90%, then rebound to 80%, and so on.

Of course, this is what can only happen in the Hong Kong stock market or in the European and American markets.

So, the question is, which way is simpler and rougher?

01

Since June, a number of low-priced stocks in Hong Kong have staged a flash crash, including a divine operation that plummeted 98%. Without exception, this batch of low-priced stocks are basically all old shares, the main board, gem should have.

Although on the moral level, the vast majority of investors hate these old shares, the problem is that few people will understand them before the share price flash, and many people's so-called views are linear thinking at best. It doesn't stand up to scrutiny.Behind this flash collapse, if you are not really involved, it is difficult to know the cause and process.

But it doesn't matter. As an investor, you don't need to know much.Many collapsing stocks have no so-called fundamentals at all.

In fact, because of the institutional factors in the Hong Kong stock market, the sudden collapse of share prices is actually an excellent short-term trading opportunity. For example, the rebound from "- 98%" to "- 96%" is already a 100% increase. And the point is that there are routines for this kind of opportunity.

According to traditional wisdom, investment can make four kinds of money: money for growth, money for misunderstanding, money for market sentiment, and silly money. ObviousHowever, there is no growth and understanding deviation in the vast majority of the sudden collapse of stock prices in the Hong Kong stock market, so we can only judge the opportunities for short-term trading from the perspective of market sentiment and foolishness.

This means that you have to be patient and calm. Second, you have to make sure you're not the last one. In a word, you need to have a very clear understanding of probability and odds, especially odds, odds, odds.

02

Let's start with the odds.

As mentioned earlier, there are no fundamentals behind the vast majority of share price crashes, and mainland investors must not think that a 99% plunge in share prices is the limit, not even to HK $0.01.

On the one hand, 0.01 yuan is the lower limit of share price trading set by the Hong Kong Stock Exchange, butIn practice, major shareholders can apply for suspension of trading and then "raise" the stock price to 0.1 yuan or 0.5 yuan through divine operations such as [10 in 1] or [50 in 1]. And the share price after the partnership can still fall to 0.01 yuan in theory, such a cycle, continuous harvest.

On the other hand, even if the stock price plummets 99%However, as long as the stock price does not fall to the theoretical limit of 0.01 yuan, there is room for the stock price to fall to 0.01 yuan in theory the next day.For example, if the share price of stock An is 2 yuan, and the T-day suddenly plummets 99%, and the closing price is 0.02 yuan, then the stock price of T + 1 is theoretically 50% lower than 0.01 yuan.

So, very cruel to sayTo some extent, trying to "bottom" the collapse of thousands of shares is a game of Total Loss, even if you buy the lowest share price of the day!

So, the problem is,It is only worthwhile to take part in "one for a few".

The answer to the question believes that everyone has different ideas. After all, everyone has different capital costs, income expectations and risk preferences. As for me personally, if there is no space from "1 to 3" to "1 to 5", I will not participate in it.

Of course, some investors will say, don't star stocks such as Kingsley plummet suddenly?

Believe me,If this kind of star stock suddenly enters the decline list TOP 5 one day, it is the time to be more vigilant! There are usually two situations, either being shorted or something wrong with the enterprise itself.

So, if you lack the deepest understanding of the star stock, you'd better go to the theatre. Don't underestimate the short sellers'IQ and efforts, and overestimate their psychological endurance. A short report basically takes months or even last year.And many institutions have made it clear that when short positions are encountered, they choose to sell first and then study the specific logic.

In addition, star stocks have another headache for short-term speculators, which is the intraday application for suspension of trading.And if you can't judge the response of the company during the suspension and the subsequent sustained attack points of the bears (which many investors may not have thought of at all), then you will at least lose the time cost during the suspension. Even the trend after the final review is negative.

To put it simply, the risk-return ratio is not enough.Huishan Dairy used to be an excellent example, and it is estimated that there are a lot of bottom hunters.

03

The second is probability.

Although in theory, bottoming flash stocks may be total loss's game (probability is 0), but if through orderly data access, referred to as tricks, can improve the probability to a certain extent.

First, you need to judge whether there is the possibility of a flash collapse.

It is not difficult to understand that even if it is a flash crash, it requires a process, often by 20%, 50%, and so on. At this time, you must have a good sense of smell.

First of all, let's look at the trading volume. We must know that in mature markets such as Hong Kong stocks and Europe and the United States, not all stocks are like small and medium-sized stocks in the A-share market, with daily turnover of tens of millions or hundreds of millions, but zero turnover! And the bid-ask spread is so exaggerated that some stocks can fall by 20% by 30% as little as tens of thousands of yuan.

On the contrary, if there is a trading volume of millions or even nearly 10 million, it is very noteworthy.

Second, you need to judge whether there is a possibility of stock pledge.

As a matter of fact, the vast majority of such "vicious incidents" in the world's mainstream exchanges take place in Hong Kong. "shell stocks" and "fairy stocks" are rampant in the Hong Kong stock market.Thus derived from the "shell", "shell", "fried shell" and other alternative business models.

Second, these alternative funds usually mortgage a large number of stocks held to intermediaries in exchange for cash, and then operate another stock or batch of stocks in the same way.

Therefore, we can inquire about the shareholding distribution of stocks through the Central Clearing system holding record Enquiry Service of the HKEx.If the vast majority of shares in a stock are concentrated in an unknown brokerage (mostly in Hong Kong), then it is very likely that the major shareholders of the company have mortgaged their shares to the brokerage.

Source: easy disclosure; Central Clearing system shareholding record inquiry service

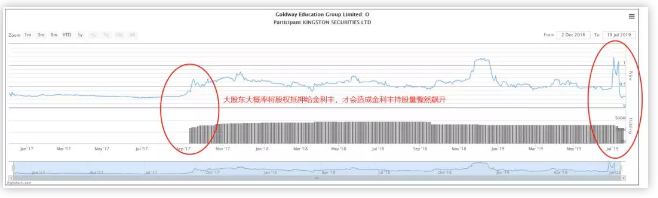

For example, Goldway EDU, which plummeted 78 per cent in mid-July, had nearly 75 per cent of its shares concentrated in seats in Hong Kong's best-known shell stock master, according to webb-site.com. Equity trusteeship here, we can almost conclude that the stock has been pledged. (have the opportunity to write about the magical past of Jin Li and Feng)

Source: webb-site.com

On the other hand, sometimes the pledge of major shareholders is not needed.The exposure of shareholders who only need to hold a sufficient number of shares in a company can also cause share prices to flash, such as 3%, 5% and so on.

Similarly, we can inquire about the shareholding distribution of stocks through the HKEx's Central Clearing system shareholding record Enquiry Service. Similarly, taking Goldway EDU as an example, we can clearly see that 2-5 shares held by the company before the stock price flash are all relatively unfamiliar securities firms, among which Chen Securities is also an "expert" in the equity pledge market of local penny stocks in Hong Kong, which is "famous" for its strict enforcement of risk control.

Source: easy disclosure; Goldway EDU shareholding distribution; 20190710

So, if you find that there are a large number of strange brokerage seats in TOP 5 or TOP 10 of a stock, you need to pay attention to the chopping behavior after the stock price has plummeted (it can be judged by selling seats). If there is a brokerage cut-off, then speculators can seriously consider whether to participate.

Why?

The essence of copying the bottom and collapsing thousands of shares lies in the word "flash", which is the effect that can only be caused by the cutting of positions by brokerages.

Third, you need to judge the difficulty and magnitude of the stock price rebound.

In fact, the difficulty is not so mysterious, the stock price is the relationship between supply and demand in the short term, if the equity of a stock is highly concentrated, it means that only a small amount of capital can determine the stock price trend. In fact, it is precisely because of this that shareholders who hold a small number of shares are cut off, which can cause the share price to flash.

Specific equity concentration can be disclosed through webb-site.com or HKEx, of which webb-site.com is the most efficient and has helped investors to accumulate positions in specific seats.

Of course, the high concentration of equity does not mean that it is easy to pull up, on the contrary, because of the high concentration of equity, the sharp fall in share prices often leads to several brokerages to cut their positions collectively. For example, after the collapse of Goldway EDU, not only did the number of TOP 10 seats fall from 95.67% to 86.11%, but the seats also experienced a major purge, resulting in a highly dispersed supply of goods.

Source: webb-site.com;Goldway EDU shareholding distribution; 20190710

Source: webb-site.com;Goldway EDU shareholding distribution; 20190719

In addition, as mentioned earlier, players of these thousands of shares tend to operate several stocks at the same time, so it also means that once one of the stocks collapses, it is extremely prone to the tragedy of "burning serial ships" because of leverage.

As a result, sometimes there will be a collective collapse of a number of stocks, including companies with fundamentals. At this point, what you need to do is to determine who is the source. Then avoid the source and follow the previous routine to buy the implicated target. For example, Chengxing International Holdings, which plummeted a few days ago, led to some shareholders of Yadi Holdings and TPV Technology being implicated.

In terms of scope, as shown in the following figure, although it is said that buying is the best scenario (near Point B) after the brokerage has closed its positions, there are always some silly leeks in the world that inexplicably rush in at this stage of Amurb, represented by seats of Internet brokerages such as Futu, Tiger and Huasheng.

So, the question is like, "how many sets of bars does Amurb have at this stage?" "

Is it hard to tell?

Actually, it's not difficult.Specific indicators directly look at the turnover rate, combined with trading volume to judge.

If the turnover rate is low, such as the number of low and medium units, and the turnover of millions to nearly 10 million, it can be judged that only a small number of retail investors are involved, and the influx of a large number of retail investors is basically at the time prompted by the brokerage software. at that time, it will cause the daily turnover to soar to tens of millions or even hundreds of millions.

Of course, this does not mean that low turnover and appropriate "low volume" can be bought in the Amurb stage. The safest thing is to do the trend trading on the right side of the BMY C phase.

If you really want to judge the range of point B, then using the [1 minute line] may be a good choice, and using the [1 minute line] as the BMI C stage is also suitable. To investigate the reason, this kind of short-term speculation itself needs to race against time, and mature speculators do not care about the development of the plot after 1 day or a few days, the only thing they care about is the trend of the stock price after a few minutes!

If you miss the B Mel C stage, and if the follow-up trend of D-point does not break through the C-point, then I am sorry to tell you that you have missed this opportunity.

The core factor, the reason why the rebound in the BMY C stage is so rapid is that there are only a small number of fastening plates in the Amura B stage, but because there are a large number of short-term speculators in the Bmurc stage, the C point will cause a large number of fastening traps! At this moment, the only idea of this group of tied-up funds is to reduce losses as much as possible, or even escape! Therefore, it will cause the subsequent uptrend of D-point to face heavy selling pressure.

Of course, the most important thing is that the risk-return ratio of buying after D point has been greatly reduced, and it is leek behavior to rush in again at this time. Do not foolishly think that stocks that have plummeted by 90% can regain their original position in one day.

Finally, the friend asked, "aren't you afraid to write this out without cutting leeks, or even being cut leeks?" "

I answer."the most interesting thing about the stock market is that even if there is an open-book exam, someone will get a zero. "

Edit / Iris