This article is edited from Shen Wanhongyuan: "the financing of real estate enterprises is tightened and expanded to foreign debt to maintain a low rating", Huatai: "how much do you know about off-balance-sheet liabilities of real estate enterprises?" "

Abstract: the stock prices of listed companies plummet from time to time due to debt default, such as Kang Dexin at the beginning of the year. Recently, the real estate financing policy continues to tighten, the national attitude of "housing speculation" is very clear, and the potential risk of capital chain rupture of real estate enterprises is rising. Huatai believes that compared with the liabilities of real estate enterprises on the balance sheet, what really worries investors is the "big thunder" of the "hidden liabilities" of housing enterprises.

I. overall tightening of real estate financing policy

Last Friday (July 12) evening, the National Development and Reform Commission announced that foreign debt issued by real estate companies can only be used to replace medium-and long-term foreign debt due in the coming year. This is another measure to control the financing of housing enterprises after tightening corporate bonds, trust financing and bank loans since June this year.Shen Wanhongyuan pointed out that all financing channels of housing enterprises have been regulated, and the country's attitude of "housing speculation" is very clear.

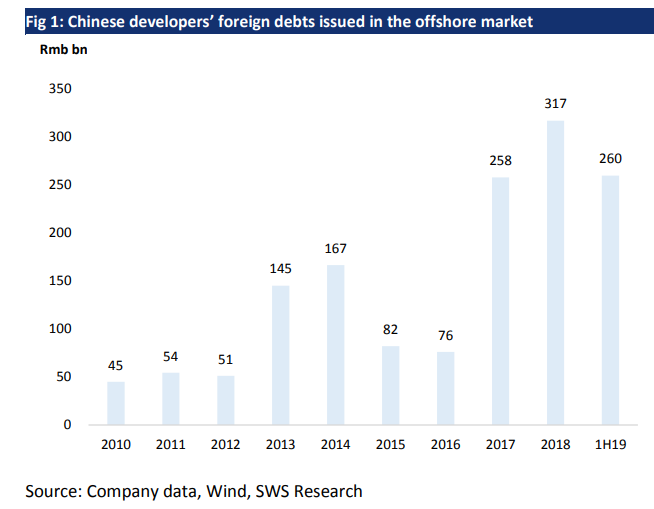

From the following data, we can feel the urgent need for funds of real estate enterprises:From January to June this year, Chinese real estate enterprises issued a total of about US $38.5 billion in new and additional US dollar high-interest bills abroad, an increase of 28% over the same period last year, exceeding the amount issued for the whole of 2017, equivalent to 80% of the total amount issued in 2018. The amount of US dollar debt due in the same period is about 16.5 billion US dollars.

Second, "hidden debt", the "big thunder" of real estate?

The general environment of real estate has changed, and it is difficult to finance, which makes investors naturally think of the potential capital chain break and debt default risk of real estate enterprises in the future.Huatai pointed out that compared with the liabilities of real estate enterprises on the balance sheet, what really worries investors is the "hidden liabilities" of real estate enterprises-off-balance sheet financing.

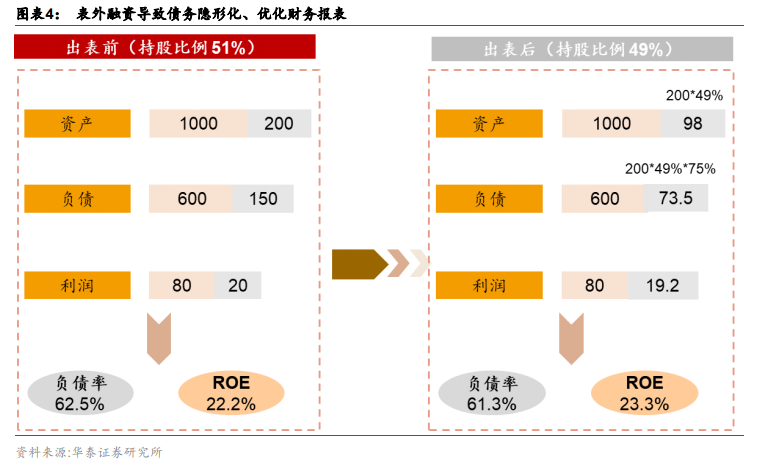

Off-balance sheet financing is an important financing channel supplement for real estate enterprises, but off-balance sheet financing makes debt invisible, optimizes corporate financial statements, beautifies corporate debt and profits and other relevant financial indicators, and enhances the financing ability of enterprises on the balance sheet, but at the same time, it will also increase the financial risk of real estate enterprises; off-balance sheet financing increases the scale of contingent liabilities of enterprises, which will mislead users to overestimate the debt paying ability of real estate enterprises.

For example, suppose that A real estate enterprise has total assets of 120 billion, liabilities of 75 billion, and net profit of 10 billion. B was originally a consolidated subsidiary of A real estate company, and A holds a controlling proportion of 51% of B's assets, liabilities, and net profits of 2 billion.

If the statement is achieved by selling 2% of the shares in company B, then in A's financial statements, the assets will become 109.8 billion, the liabilities will be 60 billion, the net profit will be 9.92 billion, and the corresponding asset-debt ratio will change from 62.5% to 61.3%. ROE changed from 22.2% to 23.3%.

Third, the "demining" method of "hidden debt"

Which real estate enterprises have "hidden debt"? Huatai summed up the common routines of "off-balance sheet liabilities" of real estate enterprises:

1. Financing through non-consolidated companies

The specific financing mode is that the real estate enterprise An and B hold a certain equity to the project development enterprise D at the same time, but because A's shareholding proportion is low or the actual control over the project is weak, D is reflected as the non-merged table enterprise of A. therefore, the financing carried out by the project company D is not reflected in the statement of the real estate enterprise A, but in fact, the real estate enterprise An also has the corresponding obligation to repay this part of the debt.

Identification method:If the real estate enterprise chooses not to merge the project company, the consolidated statement only reflects the investment of the real estate enterprise, which is reflected in the long-term equity investment. specifically, we can pay attention to the disclosure of joint venture and joint venture in the notes.

For example:A real estate development company is among the joint ventures disclosed by a housing enterprise. through an upward analysis of A's ownership structure, it is found that B Investment Company holds 53% of the shares of A real estate development company. according to the speculation of some financial enterprises among A's shareholders, it is more likely to take An as the main body to carry out "clear stock and real debt" financing in accordance with "mode one".

2. Real debt financing of Ming shares

At the group level, real estate enterprises can finance debt equity instruments such as perpetual debt and preferred stock, which is relatively small in scale; real debt financing is relatively common at the project company level.

The specific financing process is that investors first subscribe for relevant asset management plans, such as collective trust plans and private equity funds, and then the asset management plan invests in the project company B of the real estate enterprise, establishes a SPV with the housing enterprise A, and agrees with investors on fixed return or special dividend terms (capital management plan, trust collective products, private equity fund investors enjoy capital guarantee and project priority income. An or B enjoys inferior after-income), and the real estate enterprise A guarantees the asset management plan, and finally An or B buys back the share of the equity trust held by the investor according to the terms of the contract.

Identification method:

A, if the real estate enterprise chooses and lists its subsidiary company and the accountant considers it as an equity investment at the consolidated statement level, but in essence it is a debt attribute, then the investment of the investor is reflected in the minority shareholders' equity.On the one hand, we should focus on whether there are frequent and large-scale changes in minority shareholders' rights and interests in real estate enterprises; on the other hand, we can pay attention to the nature of minority shareholders' rights and interests disclosed in notes or public information, if they are funds, asset management, trusts, etc., it means that there is a higher probability of off-balance sheet liabilities.

For example:The scale of minority shareholders' rights and interests of a real estate enterprise is relatively large, focusing on the nature of its minority shareholders. It is disclosed in its audit report that An investment management company is the minority shareholder of E real estate development company and B trust is the minority shareholder of F real estate development company. Because An and B are both financial enterprises, it means that the possibility of financing by E and F is increased.

B, pay attention to the difference between minority shareholders' profit-loss / net profit ratio and minority shareholders' equity / owners' equity.If there is a long-term difference between the profit and loss / net profit ratio of minority shareholders and the minority shareholders' equity / owner's equity ratio, it shows that the profit and loss of minority shareholders is not equal to the equity ratio * net profit (that is, it is distributed according to the performance of the enterprise), but there are other ways of distribution, at this time, the enterprise is more likely to have clear shares and real debts.

C, pay attention to the scale of external guarantee of real estate enterprises. Because the scale of the parent company is the largest and the external recognition to the parent company of the real estate company is high, most of the real debt projects need to be guaranteed at the parent company level. if the proportion of external guarantee of the parent company is too high, it means that the enterprise is more likely to have hidden off-balance sheet liabilities.

3. Financing from related parties in the form of accounts payable

Real estate enterprises can use operating liabilities instead of financial liabilities by borrowing from related parties, so as to reduce the scale of their interest-bearing liabilities, which are usually reflected in the form of transactions of related enterprises in other payables, but it is true that enterprises need to bear the cost of financing. In addition, the use of tools such as financial leases can also reflect debt payables in subjects such as "long-term payables", but they are not included in interest-bearing liabilities.

Identification method:As the development cycle of the real estate development project is relatively long, and the income payment cycle agreed with the investors is relatively short, the revenue recognition of the project company lags behind the return of sales cash.

Therefore, it is recommended to pay attention to the scale of other payments and other accounts payable, the difference, and the flow of funds of specific subjects.If the scale of the current account is large, there are a large number of funds occupied by the parent company and related funds with financial enterprises, it means that there is a greater possibility of off-balance sheet liabilities.

For example:The scale of other receivables and other accounts payable of a housing enterprise is relatively large, and there is a situation of occupation of its funds. Analysis of the notes to its financial statements shows that there are accounts payable to A trust company in other payables, which represents a greater possibility of the existence of off-balance sheet liabilities to A trust company.

4. Housing enterprises reduce interest-bearing liabilities or make statements by issuing all kinds of ABS.As the information is relatively public, it is only necessary to restore the ABS financing of enterprises to interest-bearing liabilities when analyzing interest-bearing liabilities.

IV. Carding of off-balance sheet financing of key housing enterprises

Huatai selected the top 80 real estate companies with existing bonds to analyze the "hidden liabilities" of house prices.

1. From the average point of view, the index of state-owned housing enterprises is generally better than that of private housing enterprises.

2. Among the state-owned housing enterprises, the relevant indicators of Greentown and Minmetals Real Estate are weaker than other enterprises, followed by Financial Street and Xinda Real Estate.

3. Among the private real estate enterprises, the relevant indicators of Jianye Real Estate are on the high side, followed by Rongchuang, Metro Holdings, Contemporary Real Estate, Jinke, Xinhu Zhongbao, Xiexin and R & F.

It is worth noting that the enterprise financial indicators are affected by the business model and other factors, the use of single or partial financial indicators analysis has a certain one-sidedness. In addition, if the company does not fully disclose the joint venture or joint venture, some subjects will not be included in the scope of the analysis, thus underestimating the scale of off-balance sheet liabilities.

Edit / jasonzeng