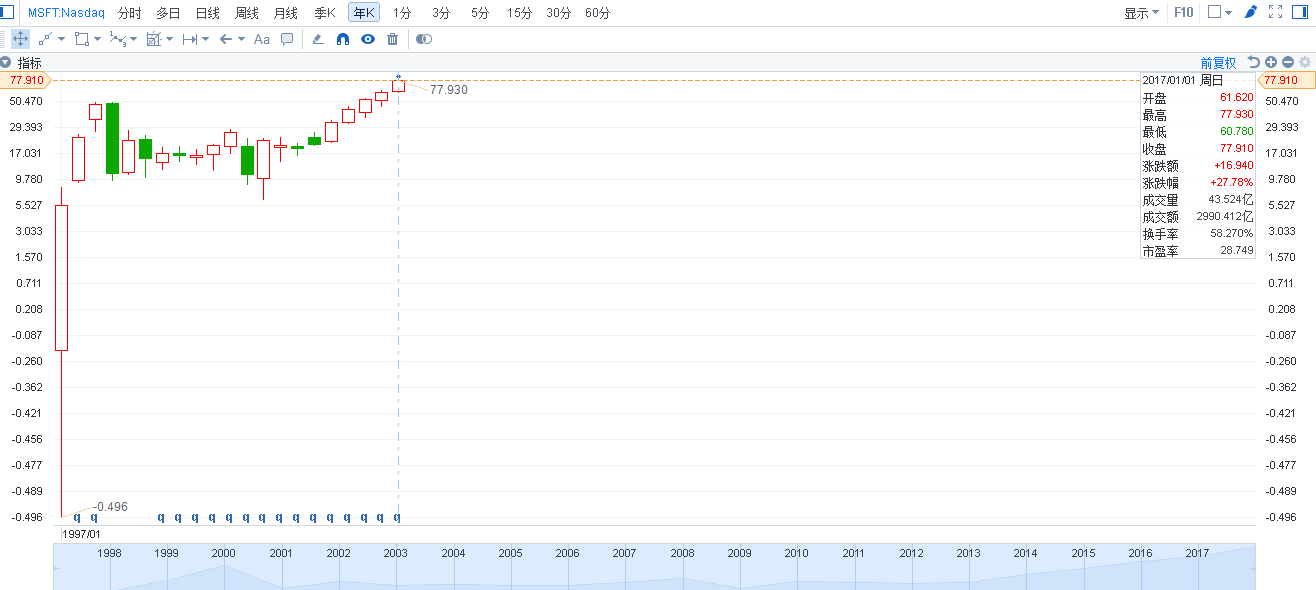

Breaking 600 billion US dollars again after 17 years, Microsoft Corp cloud computing has become a giant.

Microsoft Corp's market capitalization closed above $600 billion on Thursday for the first time since the dotcom bubble in 2000. The company's market capitalization last hit $600 billion on January 3, 2000, before the dotcom bubble burst. With a market capitalization of $600 billion this time, Microsoft Corp has become a giant in the field of cloud computing under the leadership of Indian CEO Satya Nadella. The company's shares closed up 0.4% at $77.91 on Thursday, up a further less than 1% in after-hours trading.

Morgan Stanley released a report on Oct. 19, continuing to maintain Microsoft Corp's "overweight" rating while keeping the target share price unchanged at $80.

Microsoft Corp's share price has risen more than 25 per cent so far this year, outperforming the 14.4 per cent in the s & p. Microsoft Corp is currently the third largest listed company in the world, after Alphabet Inc-CL C's parent company Alphabet and Apple Inc, according to Bloomberg data.

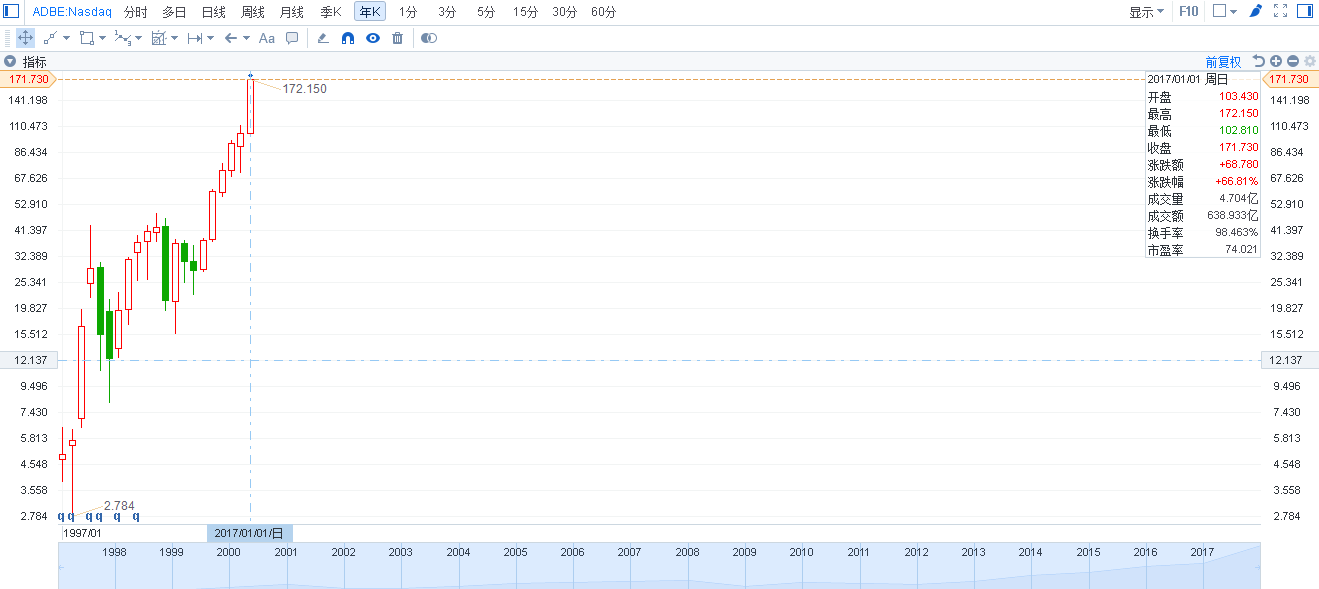

Adobe Inc's transformation of cloud business has achieved results, and the stock price has reached a new high since going public for 20 years.

Driven by the rapid growth of the cloud business, Adobe Inc, a veteran technology stock, raised its revenue and profit forecasts for fiscal 2018 to above market expectations, pushing the company's shares up 12.24% to close at $171.73 on Thursday, a 20-year high.

Adobe Inc said on Wednesday that the company expects revenue of $8.7 billion and earnings per share of about $5.50 for fiscal 2018. On average, Wall Street analysts had expected Adobe Inc to earn $5.21 per share on revenue of $8.68 billion in fiscal year 2018.

Moving the business model to a cloud-based subscription model allows Adobe Inc to sell software through the subscription model, no longer relying on sales software suites, and providing it with a more predictable revenue stream. Adobe Inc said the company expects revenue from its digital media division, including Creative Cloud, to grow 23 per cent from a year earlier. In addition, Adobe Inc experience Cloud booking, which belongs to the digital marketing department, is expected to increase by 20 per cent over the previous fiscal year.

Bank of America Corporation raised Adobe Inc's target price from $184 to $213. Adobe Inc has risen 64.8 per cent so far this year. (editor / Zeng Shang)

Risk Tips:The speeches of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will try its best but cannot guarantee the accuracy and reliability of the above content, and will not bear any loss or damage caused by any inaccuracy or omission.