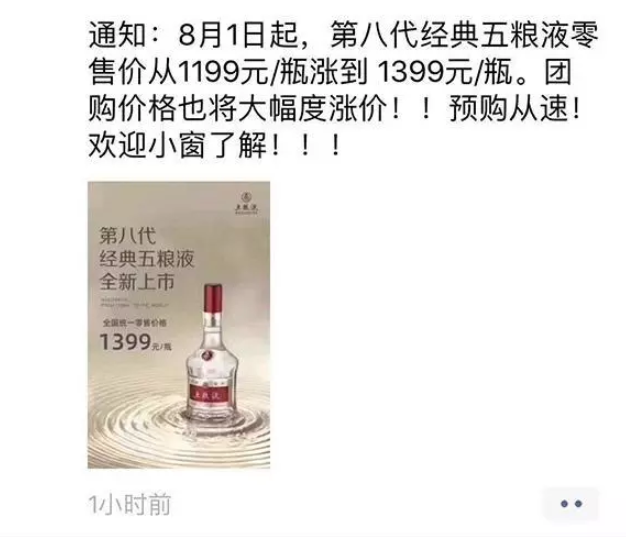

Futu News on July 16, according to market reports, the eighth generation of classic Wuliangye (eighth generation Puwu) decided to raise the terminal retail price from 1199 yuan per bottle to 1399 yuan per bottle.

Screenshot of online supplier's moments.

The eighth-generation P5 went on sale in June this year, replacing the seventh-generation P5, with a terminal suggested retail price of 1199 yuan per bottle and a terminal supply price of 959 yuan per bottle.But just two months later, the terminal retail price of the eighth generation of P5 will be raised by 200 yuan.A number of dealers said that the current terminal supply price remains unchanged, still maintaining 959 yuan per bottle.

2019 is the most intense year of "famous wine price war" for the liquor industry.Famous wines have begun another upsurge in prices..Every year, May, June, July and August belong to the traditional off-season of liquor sales, and the major liquor manufacturers tend to be relatively "conservative" in these months. However, this year, there has been a special situation: the leading liquor enterprises have increased their prices against the trend in the off-season. The price of Maotai liquor has exceeded 2000 yuan, and in some areas it has reached 2300 yuan.With the market price of Maotai liquor exceeding 2000 yuan, liquor brands are competing for the core price band of 1000 yuan.Yanghe, Luzhou laojiao and Lang Liquor have announced price increases, with a number of wines selling for more than 1000 yuan.

A food and beverage industry analyst said that Maotai is a bellwether for the liquor industry, and its price is stable at a high level, so the price space behind it is bound to be preempted by other famous spirits.For liquor enterprises that attach importance to the value of brands, price increases can add points to brands and give products a sense of scarcity and value.

However, Li Hua, secretary-general of the Information Committee of Shaanxi Liquor Industry Association, believes that this round of liquor price increases has little to do with Maotai, but a continuation of the overall rise of the industry since the second half of 2016. The underlying reason is that after economic development, consumption becomes more rational, and liquor consumption also needs to match its own positioning. Drinking less and drinking good wine has become a new trend of consumption.

Huang Ning, a marketing expert, believes that the increase in the off-season price of first-line liquor is, on the one hand, laying the groundwork for the arrival of the peak season in September; on the other hand, it is the need to enhance the value and influence of its own brand; of course, the scarcity of first-line brands such as Maotai is also one of the important reasons. The competition of first-line high-end liquor has entered the typical game between head brands, and it is particularly important for newcomers to keep up with it. For high-end liquor, the off-season should be market-oriented, calm down to be the channel and customer group, only when the channel is mature, can we get a larger market share when the peak season comes.

As retail prices rise, share prices also rise, and liquor stocks represented by Guizhou Moutai are still refreshing record highs. But it's alsoSome brokerages expressed concern that, after all, there are no stocks that only rise but not fall, and they may face some pullback pressure in the future.

Edit / emily