This article is edited by China International Capital Corporation: "interest rate cut is expected to strengthen, second-quarter results are still down", China International Capital Corporation: "Historical experience and impact of Federal Reserve interest rate cut in 1998"

Abstract: this week, the US stock Q2 financial report officially began, and a large wave of important companies' financial reports are on the way: semiconductor equipment giant ASML on Wednesday, Microsoft Corp on Thursday, Netflix Inc on Friday and so on. China International Capital Corporation pointed out that although US stocks continue to reach new highs, they are mainly due to the rise in valuations brought about by loose expectations. From a fundamental point of view, the growth of Q2 performance of US stocks will still be weak, among which the performance of technology stocks may "lead the decline". From the valuation point of view, U. S. stocks are currently at a relatively high level, and U. S. stocks are in the overbought area. In addition, global capital flows into the bond market are accelerating, so it is necessary for investors to consider hedging and fasten their seat belts during the disclosure of Q2 results in US stocks.

1. interest rate cuts are expected to strengthen and US stocks reach a new high.

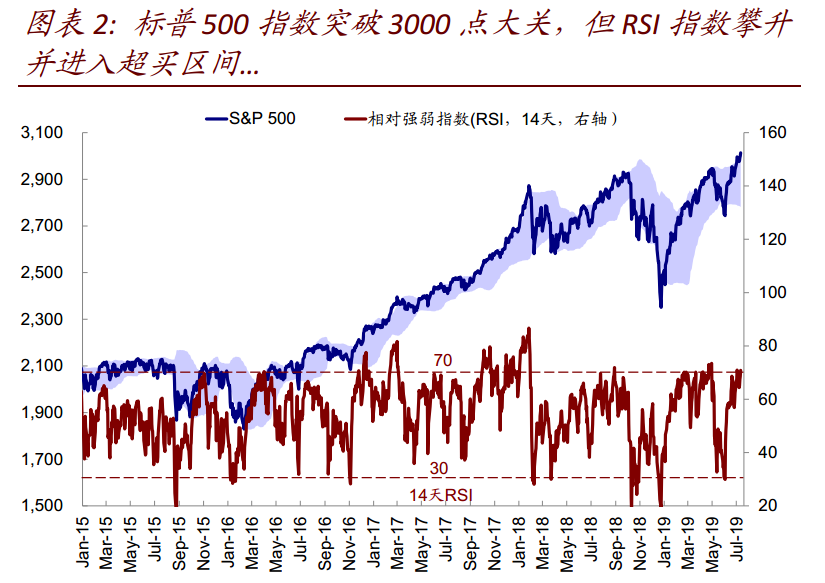

Last Wednesday, the dovish testimony of Federal Reserve Chairman Powell in congressional testimony further strengthened the interest rate cut expectation of FOMC in July (July 30-31). The current probability of interest rate cut in July included in CME interest rate futures is 100%, of which the probability of cutting interest rates by 50 basis points rises again to 23%. It also led to a comeback of trading around loose expectations, with US stocks hitting new highs and the S & P 500 above the 3000-point mark.

Last Wednesday, the dovish testimony of Federal Reserve Chairman Powell in congressional testimony further strengthened the interest rate cut expectation of FOMC in July (July 30-31). The current probability of interest rate cut in July included in CME interest rate futures is 100%, of which the probability of cutting interest rates by 50 basis points rises again to 23%. It also led to a comeback of trading around loose expectations, with US stocks hitting new highs and the S & P 500 above the 3000-point mark.

2. the performance growth of US stocks in the second quarter is still weak, and technology stocks are likely to lead the decline.

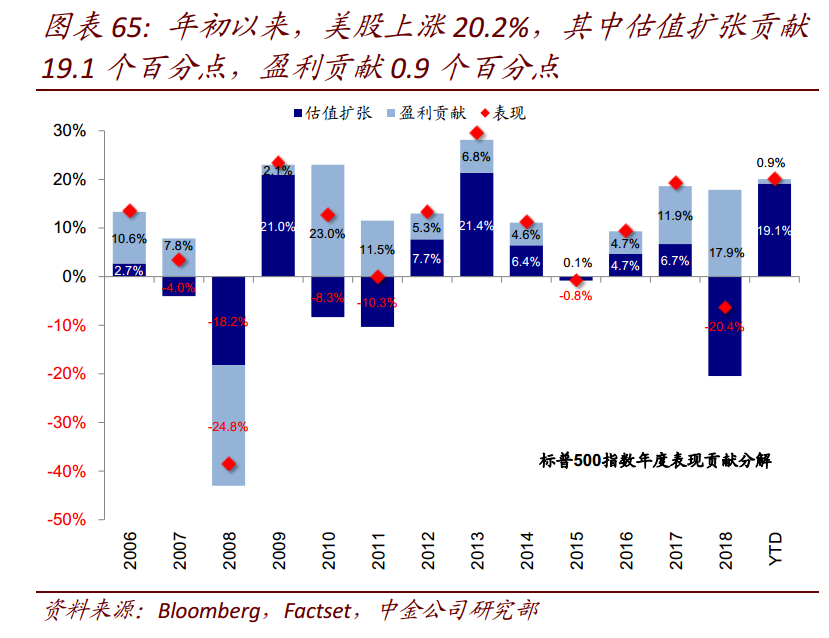

But it is worth noting that the surge in U. S. stocks since the start of the year is mainly due to rising valuations.Next, let's see the time for "who's swimming naked":Starting from mid-July, US stocks will begin a period of intensive disclosure of second-quarter results for about a month.

China International Capital Corporation pointed out that from the current market consensus expectations, growth in the second quarter is still facing downward pressure, especially semiconductors, science and technology hardware, raw materials and other sectors.

Industrial economy is an important foundation of American economy. PeterBoockvar, chief investment officer of BleakleyAdvisory, told CNBC last ThursdayThe poor performance of MSCIndustrialDirect and Fastenal, the world's leading industrial equipment distributors, in Q2 shows that the business environment is declining and that the recent strong performance of the US market lacks the basis.

"these companies can be called the core forces of our industrial world," Boockvar said. "In addition to the sluggish performance of traditional industries, the performance of the IT industry and materials industry is expected to decline the most. According to FactSet statisticsThe expected year-on-year decline in the materials industry expanded from 3.2 per cent to 16.2 per cent, a record drop.

3. Us stocks are overbought, and global capital flows into the bond market at an accelerated pace.

While US stocks have recently hit record highs, global money has returned to US stocks, in sharp contrast to the continued outflow of other markets, especially emerging markets, but it has also pushed the US stock market back into the overbought range and valuations have been higher than the historical hub.

China International Capital Corporation also pointed out that although from the perspective of the stock market, capital flows from emerging markets into US stocks.But if you look at a wide range of assets, global capital flows into bond funds are accelerating.

In addition, copper bears hit their highest level since mid-2016.

4. The "race" between downward growth and loose policy.

The current environment facing the US stock market is that under the background that EPS continues to decline as a "numerator", the discount rate as a "denominator" will provide support if it can decline faster and more sharply.To put it simply, corporate profits are falling fast, but the central bank hopes to stop the recession by releasing water faster than corporate profits.

China International Capital Corporation believes that in the current race between downward growth and monetary easing, policy response speed is the key. If the policy can respond in time, it will play a positive role in alleviating the downward pressure on growth under the persistent trade friction and supporting the performance of the market.This is similar to 1998, when the Fed cut interest rates in time after the yield curve was upside down, thus avoiding a recession.

After five times of inverted yield curves since 1978, the Fed has started an interest rate reduction cycle, but most of the time the interval is long, with a median of nine months, but 1998 is an exception.The Fed began to cut interest rates just 18 days after the first reversal of the yield curve (at the end of September 1998), the fastest response to pessimistic growth forecasts since 1978.

After the start of the interest rate reduction cycle, manufacturing PMI began to pick up rapidly in 1999, while the real GDP growth rate only slightly slowed down in the second to third quarters of 1998, and then returned to a high level of growth.Thanks to the Fed's rapid response, the rate cut is the only case in which a recession has been successfully avoided since 1978 after the yield curve has been reversed.In fact, in addition to 1998, the interest rate cut cycle in July 1995 was similar to that in 1998, when the US also faced fears of a slowdown in growth, and the Fed responded "ahead" before the 3m10s spread was upside down, thus avoiding further deterioration in fundamentals.

Historical experience shows that market sentiment and risky assets usually get a boost during this period. China International Capital Corporation stressed that the "ceiling" of this path is a rise in valuations to a bubble state or a sharp deterioration in fundamentals, but there is no clear sign yet.

Edit / jasonzeng

上周三(7月10日)美联储主席Powell国会证词的鸽派表态再度强化了7月FOMC(7月30~31日)的降息预期,当前CME利率期货计入的7月降息概率为100%,其中降息50个基点的概率再度升至23%。这也使得围绕宽松预期的交易「卷土重来」,美股再创新高,标普500指数突破3000点大关。

上周三(7月10日)美联储主席Powell国会证词的鸽派表态再度强化了7月FOMC(7月30~31日)的降息预期,当前CME利率期货计入的7月降息概率为100%,其中降息50个基点的概率再度升至23%。这也使得围绕宽松预期的交易「卷土重来」,美股再创新高,标普500指数突破3000点大关。