Editor / Futu Information Iris

On July 15, this is the first trading day after Guizhou Moutai released its main operating data for the first half of the year. Kweichow Moutai shares fell more than 3.5% at one point in morning trading, but rebounded before the morning market closed and are now down 0.77%.

Source: Futu Securities

Guizhou Moutai announced the main operating data for the first half of the year: the company completed the output of 34400 tons of Maotai base liquor and 10900 tons of series base liquor, and achieved a total revenue of 41.2 billion yuan, an increase of 16.9% over the same period last year. The net profit belonging to shareholders of listed companies was 19.9 billion yuan, up 26.2% from the same period last year. According to a rough calculation, Guizhou Moutai can earn an average of 110 million yuan a day in the first half of this year.

However, from July 12 to July 15, analysts from Sichuan Cai Securities, Southwest Securities, Northeast Securities, Ping an Securities and Guojin Securities all reported that the Q2 performance of Guizhou Moutai was lower than market expectations. The following are the main points of the analyst:

Chuancai Securities: although the growth rate is lower than expected, it is in line with the annual guidelines.

The growth rate of performance slowed in the first half of 19 years, and the growth rate of total operating income and net profit in the second quarter increased by 11.1% and 19.6% respectively compared with the same period last year. We believe that the main reason for the lower-than-expected performance is: 1) from the dealers' point of view, the company has cancelled more than 6000 dealers, and it is estimated that the corresponding quota of more than 6000 tons has not yet been put into the direct sales channel, thus reducing the overall quota of dealers; 2) from the perspective of direct marketing, the direct marketing channel has not significantly increased the volume of high value-added products such as vintage wines and fine wines.

The company's 19-year performance is expected to maintain rapid growth mainly due to: 1) the company's fixed dealer quota of 17000 tons, while the rest will be shipped through direct sales channels in the second half of the year, at the same time, increasing the proportion of non-standard wine will help to improve the overall average price, due to the low 18Q3 performance base, the lower growth rate of Q2 performance brings more flexibility to Q3; 2) in the series of wines, the company plans to achieve sales revenue of 10 billion yuan under the premise of unchanged sales volume. 3) the distributor finished the annual payment of the general distributor at the end of March, and the vintage wine and fine wine also finished the annual payment (some of the money returned by the big merchants) in June, taking into account the sufficient advance collection and excellent movable sales, the company's performance is expected to maintain a high growth rate throughout the year.

Southwest Securities: Q2 performance is slightly lower than expected, but does not change the company's long-term growth logic

Short-term affected by the channel, the performance is slightly lower than the market expectations. The second-quarter results were slightly lower than market expectations, mainly affected by some channels. According to the estimation that 95% of the total income is liquor income and 90% of alcohol income is Maotai revenue, the revenue of Maotai liquor in the first half of the year is 35.3 billion yuan, of which 19Q2 is 15.8 billion yuan. According to the planned volume of the company's channel guidelines in 2019, the price increase in 19 years is about 18% higher than that in 18 years. In the first half of the year, the average price of Maotai liquor was estimated at 2.38 million yuan / ton, and the corresponding statement confirmed nearly 15000 tons, of which 19Q2 confirmed 6600 tons. According to grass-roots research, the company's actual shipments in the first half of the year are slightly higher than the statement confirmation, Maotai actual shipments of nearly 16000 tons, year-on-year + 14%, of which Q2 shipments of about 6800 tons.

However, Southwest Securities expects the market volume to reach about 9000 tons in the third quarter, and the approval price is expected to adjust slightly. The company's annual Maotai liquor market input volume of about 34000 tons, the supply and demand structure is still tight, the fourth quarter pricing is likely to continue to rise.

Short-term performance below expectations does not break the long-term growth logic, and strong pricing power in the industry is expected to give a valuation premium. The second quarter performance is slightly lower than expected, but does not change the company's long-term growth logic, and Maotai liquor in the next 2-3 years is still in a tight supply state, the rise of the concept of old wine and collectible wine is better to smooth the cycle. At the same time, the strong pricing power of Maotai liquor in the liquor industry is expected to give a valuation premium.

Northeast Securities: although the Q2 performance is lower than expected, there is no doubt that the annual target will be achieved.

The apparent growth rate of Q2 revenue and profit is lower than expected, and the delivery progress is normal. The company's Q2 apparent revenue and profit growth rates were 11.1% and 19.6% respectively, lower than market expectations, but from the tracking of shipments, the progress of shipments in the first half of the year was faster than planned.

The reasons why the performance is lower than expected are as follows: 1) 18Q2 confirmed 3.2 billion yuan in advance, resulting in a higher base than the same period last year; 2) since the beginning of this year, the company has adjusted the channel, canceled the distribution rights of more than 400 dealers and recovered 6000 tons of planned volume, but the group marketing company responsible for the direct channel has not yet been fully put into operation, and the planned volume of the direct channel will mainly be put into operation in the second half of the year.

For the whole year, as the company requires dealers to concentrate on laying down half a year's income at the end of June, it has basically locked in the income in the second half of the year, coupled with the stable market demand for high-end liquor, Maotai wholesale prices remain at a high level of more than 2000 yuan, and dealers have sufficient profit space, so we think it is not a big problem for the company to exceed its annual revenue target of 14%, and the overall volume of Maotai liquor in the second half of the year is expected to be about 18000 tons.

Ping an Securities: 2Q19 is slightly lower than expected, and the full year plan is expected to be achieved.

It is estimated that 2Q19 revenue and return net profit both increased by 11% and 20%, which was lower than expected. We had expected 2Q19 revenue and return net profit to increase by 25% or 30%, or lower than expected due to interest income and series wine revenue. Revenue growth in the first half of the year exceeded the planned target of 14% for the whole year. Although the 2H18 base is high, considering that direct sales will push up the average price, the target of 14% growth for the whole year is expected to be achieved.

Guojin Securities: Q2 revenue is slightly lower than expected, which is expected to be mainly due to the limited year-on-year growth of Maotai liquor report confirmation and the lack of direct sales.

1) 18Q2's total revenue is + 45.56% compared with the same period last year, and a higher base in the same period will have a certain impact on 19Q2 performance. 2) We expect Q2 report to confirm shipments slightly less than actual shipments. According to channel research, Maotai Q2 actual shipments are about 7000 tons, while statement confirmation is expected to be about 6000 tons, year-on-year growth may be limited. 3) Maotai has cancelled more than 800 dealers, and nearly 6000 tons of Pumao quota from illegal dealers have been recovered, and it is expected that the recovered quota has not been put into operation in the first half of the year; 4) according to channel tracking, the direct operation has not significantly increased the volume at present, only increasing the release of non-standard products.

The bullish performance of Maotai in the third quarter, on the one hand, lies in the low base (18Q3 revenue + 3.81%) in the same period, leaving more room for 19Q3; on the other hand, we expect that the confirmation volume on the reporting side of the third quarter may be slightly higher than the actual shipments, thus making a better performance in the third quarter. In addition, Maotai launched a second-half payment program for dealers in late June. The advance payment of dealers can stabilize the channel price system, withdraw funds as soon as possible, and at the same time lock in the annual sales target in advance. This will be reflected in the semi-annual report of the accounts received in advance, the second half of the year will be gradually recognized as income with the launch of products, annual performance growth is still worth looking forward to.

Conclusion

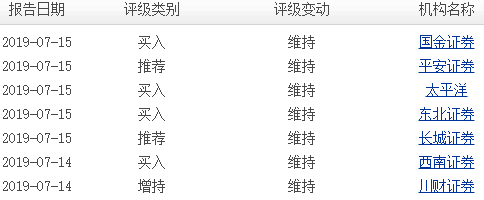

On the whole, the current market view is relatively consistent, with the exception of Pacific Securities that income and profit in the first half of the year is in line with expectations, several other newly reported institutions expect Q2 performance to be lower than expected, but unanimously maintain the rating unchanged. It is believed that investors do not need to worry about the realization of the full-year plan.

It can be seen that the panic selling caused by Maotai's performance fluctuations in a single quarter has become an opportunity for investors to "buy" in the eyes of some analysts.