Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Mineralys Therapeutics (NASDAQ:MLYS) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Mineralys Therapeutics

When Might Mineralys Therapeutics Run Out Of Money?

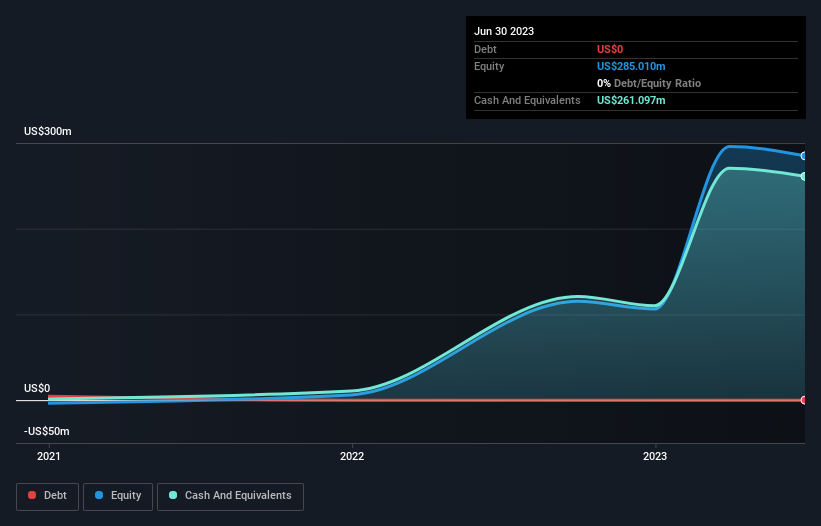

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2023, Mineralys Therapeutics had cash of US$261m and no debt. In the last year, its cash burn was US$50m. That means it had a cash runway of about 5.2 years as of June 2023. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Is Mineralys Therapeutics' Cash Burn Changing Over Time?

Mineralys Therapeutics didn't record any revenue over the last year, indicating that it's an early stage company still developing its business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. The skyrocketing cash burn up 142% year on year certainly tests our nerves. That sort of ramp in expenditure is no doubt intended to generate worthwhile long term returns. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Mineralys Therapeutics Raise Cash?

While Mineralys Therapeutics does have a solid cash runway, its cash burn trajectory may have some shareholders thinking ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Mineralys Therapeutics has a market capitalisation of US$436m and burnt through US$50m last year, which is 12% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Mineralys Therapeutics' Cash Burn?

As you can probably tell by now, we're not too worried about Mineralys Therapeutics' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 3 warning signs for Mineralys Therapeutics (2 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.