Take a chance and turn a bicycle into a motorcycle.

The road to investment has always been nothing more than "adding leverage against the trend". Many investors hope to improve the speed of asset growth through accurate market judgment, supplemented by highly leveraged trading instruments. In addition to the turbo CBBC with Hong Kong characteristics that many Hong Kong stock investors love very much, options are also a valuable investment tool for many investors. This issue of Futuo Niuniu class will continue to open the door to derivatives stock options, focus on the basic trading strategies of options, and teach you how to play options in the stock market. First of all, simply pass the definition of options:

Option is a kind of option, which stipulates that the buyer has the right to buy or sell the subject matter at a specific price at a specific time after paying a certain amount to the seller, and the seller needs to perform the corresponding obligations.

By reviewing the definition of options, under the decomposition, in fact, the core of options is to pay funds to obtain rights and harvest funds to undertake obligations.

The ratio between the contract amount of options and the price of royalties can be approximately understood as the leverage multiple of options, the limited input of royalties, and the infinite imagination brought by leverage, which is the game charm of options.

As a trading tool, options have a very wide range of applications in the financial field, but daily, individual investors have more contact with stock options, so the following article will take the individual stock options of BABA (BABA.N) as an example to popularize science.

Watch the Futuo avocado video "basic options Trading Strategy":Https://live.futunn.com/course/1188

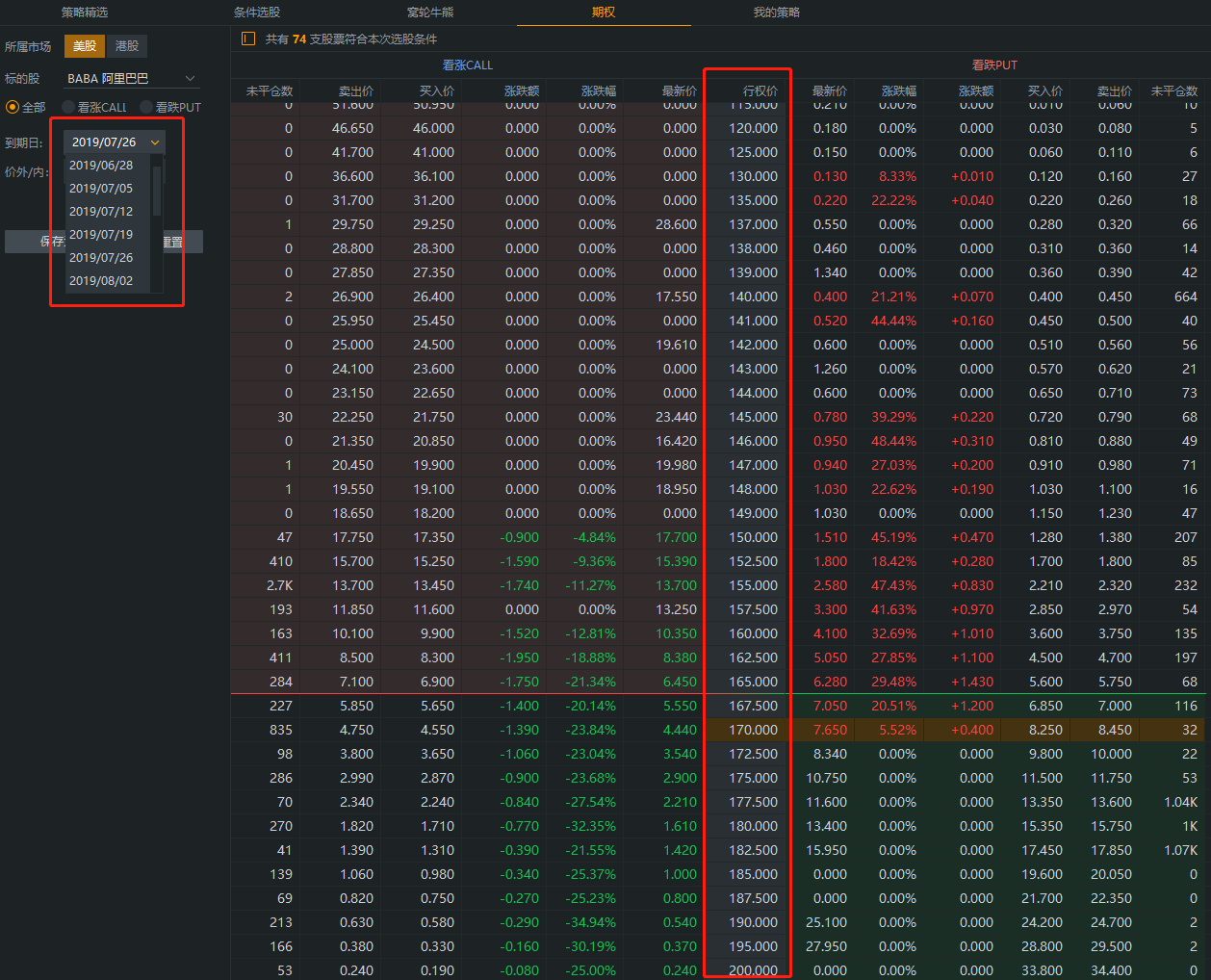

The biggest advantage of options is that they are standardized trading products. For example, BABA has very rich options with exercise time (14 dates) and exercise price (40 bidirectional prices) for investors to choose from. This is the flexibility advantage of option investment. Through FutuNiu's option filter, you can easily query and screen individual stock options in Hong Kong and the United States.

Source: Futuo Niuniu

I. the main types of options

According to the rights of options, there are two types of call options and put options. Coincidentally, this is the most basic trading unit of options: call options (Call Options) and put options (Put Options).

Academic definition is easy to look at dizziness, or just look at how to apply, the entry-level operation of options is based on the judgment of the future, buy options in the corresponding direction, in order to achieve small and broad leverage trading.

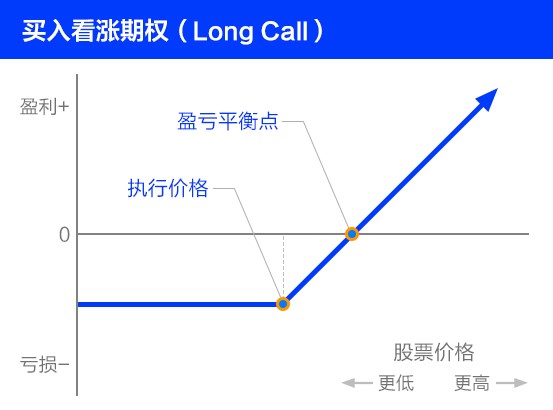

1) buy call options (Long Call)

When investors are bullish on the future, but the amount of capital is small, or when the certainty is very high, they can intervene in the transaction by buying call options. because of the characteristics of the options, investors bear the risk of limited royalty losses. you can get theoretically unlimited income expectations, and when the stock price rises above the break-even point (exercise price + royalty), the stock price continues to rise. Available profit (stock price-exercise price-royalty), the income curve is as follows:

Take BABA's call option (Call) expiring on July 26th with an exercise price of US $170. the option price is US $4.44. if the investor is very bullish on BABA's big rise in the short term and successfully trades at US $4.44. the option fluctuates with the underlying stock during the holding period. to the expiration date, if the stock price is less than $170, the out-of-price option becomes waste paper, such as the stock price exceeds $170. the in-price option loses money. But there is still a certain residual value, if it exceeds the break-even point of $174.44 (170-4.44), the option begins to make a profit, the profit space depends on the rising extent of BABA's stock, and the option rises with the corresponding leverage multiple.

Call options (Long Call) offer leveraged long instruments that are relatively cheap and have controllable exposure.

2) buy put options (Long Put)

Very often, if investors are bearish on the future, they can often make a profit by selling short. However, short selling by borrowing securities often faces the risk of soaring stock prices, and there is also the risk of securities firms recalling borrowed stocks. The risk of naked short is relatively large. In the past, there was no shortage of stories about investors being shorted. For example, Germany's millionaire Adolf Merkler, once ranked fifth in Germany, lost his fortune on shorting Volkswagen. As a result, many investors can only be bearish rather than short, with artificial meat brother Beyond Meat (BYND.O) abusing bears to do whatever they want.

Source: Futuo Niuniu

However, buying a put option is an ideal tool for investors to profit from the fall in the underlying stock price. By taking on the risk of limited royalty loss, they can gain a larger profit space (theoretically, the stock price can fall to close to zero). When the stock price falls beyond the break-even point (exercise price-royalty), if the stock price continues to fall, the theoretical profit is (exercise price-stock price-royalty). The yield curve is as follows:

Take the option data of BABA's put option (Put), which expires on July 26th, with an exercise price of US $170. the option price is US $7.65. if the investor is very bearish on BABA in the short term and successfully trades and changes the option at US $7.65. the option fluctuates with the underlying stock during the holding period. to the expiration date, if the stock price is higher than US $170, the out-of-price option becomes waste paper, and the stock price is less than US $170. the in-price option loses money. But there is still a certain residual value, if it exceeds the break-even point of $162.35, the option begins to make a profit, the profit margin depends on the decline of BABA's stock, and the option falls by the corresponding leverage multiple.

Buy put options (Long Put) offer leveraged short selling tools that are relatively cheap and have controllable exposure.

Second, the cooperation between options and stock.

In the US market, stock options account for 38 per cent of portfolio trading (combined with spot market portfolio operations), less than 27 per cent for speculation and 24 per cent for arbitrage and hedging. Hong Kong market arbitrage, arbitrage and speculative trading accounted for 15%, 50% and 35% respectively, and speculation accounted for about 1/3.

The birth of options is to help investors manage risks, so high-level option players hold positive shares to cooperate with options for portfolio operations. for most investors dominated by bulls, options also have the following two common strategic applications:

1) Buy protective put options (Protective Put)

When investors hold a large number of positive shares, as the market fluctuates, worried about the possible downside risks in the future, the position is very large, and the impact cost of adjusting positions is very high. Without selling the underlying shares, by buying put options corresponding to the size of the contract, if the stock price unfortunately falls, the put options rise sharply to hedge against the falling losses of the underlying stocks, locking in the downside risks of the positive stocks during the contract period, which is tantamount to insuring the stocks. Theoretically, the maximum loss is limited (exercise price-stock purchase price + royalty), and the yield curve is as follows:

This strategy is mainly used to protect heavy stocks, or to hedge against the impact of significant events (such as financial disclosure), to avoid the impact on net worth.

2) sell call options (Covered Call)

The most frequently used scenario of this strategy is that investors are still bullish on the underlying stock, but feel that the market may enter a slightly volatile market before the option expires, and earn royalties by selling options. At the same time, investors can also enjoy all the benefits of holding the underlying stock (such as dividends and voting rights). The biggest loss risk is the loss of the underlying stock, and there is no unlimited rising exercise risk of naked Call. If the stock price fluctuates or falls under the break-even point, the return is (the stock rises or falls + the royalty earned). If the stock price rises sharply and exceeds the break-even point, after the option is exercised, the return is (the difference between the royalty + exercise price and the stock purchase price), and the income curve is as follows:

Most investors are mainly long-term thinking. for long-term investors, if they make good use of these investment strategies, they can effectively reduce the risk of their positions, have a good sleep and have a good investment mood.

Of course, the strategies of options are as great as stars, which can not be completed by a popular science article. Other common strategies will be introduced one after another. The main strategies introduced in this paper are risk-controllable strategies, leverage, and slow entry into the boundary. after you are familiar with the characteristics of option trading through a simple strategy, then play the difficult multi-option combination strategy.