Beamtree Holdings Limited (ASX:BMT) Analysts Are Pretty Bullish On The Stock After Recent Results

Beamtree Holdings Limited (ASX:BMT) shareholders are probably feeling a little disappointed, since its shares fell 4.3% to AU$0.22 in the week after its latest annual results. The statutory results were mixed overall, with revenues of AU$23m in line with analyst forecasts, but losses of AU$0.028 per share, some 3.1% larger than the analyst was predicting. Earnings are an important time for investors, as they can track a company's performance, look at what the analyst is forecasting for next year, and see if there's been a change in sentiment towards the company. With this in mind, we've gathered the latest statutory forecasts to see what the analyst is expecting for next year.

View our latest analysis for Beamtree Holdings

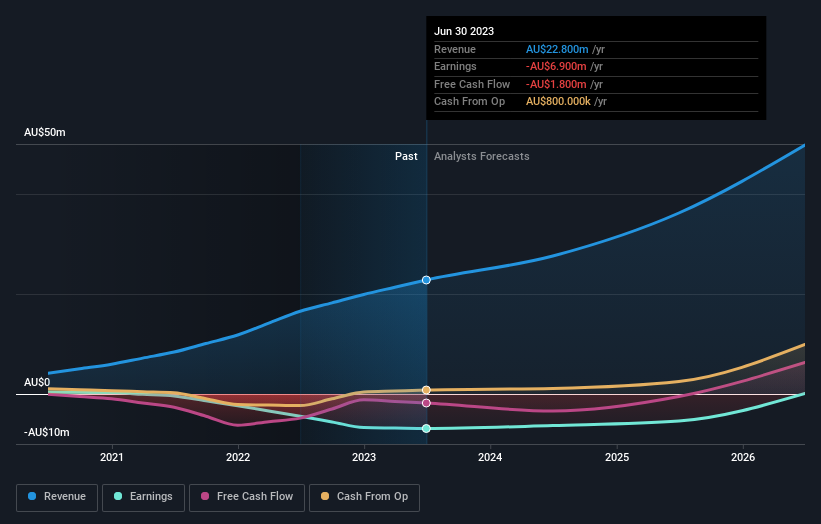

Taking into account the latest results, the consensus forecast from Beamtree Holdings' solitary analyst is for revenues of AU$27.6m in 2024. This reflects a substantial 21% improvement in revenue compared to the last 12 months. Before this latest report, the consensus had been expecting revenues of AU$28.0m and AU$0.023 per share in losses. Overall, while the analyst has reconfirmed their revenue estimates, the consensus now no longer provides an EPS estimate. This implies that the market believes revenue is more important after these latest results.

Additionally, the consensus price target for Beamtree Holdings rose 17% to AU$0.70, showing a clear increase in optimism from the the analyst involved.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Beamtree Holdings' revenue growth will slow down substantially, with revenues to the end of 2024 expected to display 21% growth on an annualised basis. This is compared to a historical growth rate of 51% over the past five years. Compare this to the 23 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 19% per year. Factoring in the forecast slowdown in growth, it looks like Beamtree Holdings is forecast to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analyst reconfirmed their revenue estimates for next year, suggesting that the business is performing in line with expectations. Happily, there were no real changes to revenue forecasts, with the business still expected to grow in line with the overall industry. There was also a nice increase in the price target, with the analyst clearly feeling that the intrinsic value of the business is improving.

One Beamtree Holdings broker/analyst has provided estimates out to 2026, which can be seen for free on our platform here.

You should always think about risks though. Case in point, we've spotted 2 warning signs for Beamtree Holdings you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.