Edited by CITIC: "A-share Policy focus: inflection Point is coming, active configuration"

Summary:CITIC believes that A-share inflection point is coming.From the perspective of liquidity, the inflection point of global monetary policy is clear, the northward capital inflow is expected to maintain a sustained net inflow, and the domestic policy camera is obviously loose; with the G20 summit in Japan approaching, the differences between China and the United States are expected to be eased; and under the support of policies such as infrastructure, fundamentals are expected to bottom out in June.Three main lines are worth paying attention to:Big consumption, big finance; infrastructure catalyzed by counter-cyclical policies; A-share growth leader under Science and Technology Innovation Board mapping.

I. the turnaround of external liquidity and internal policies is clear.

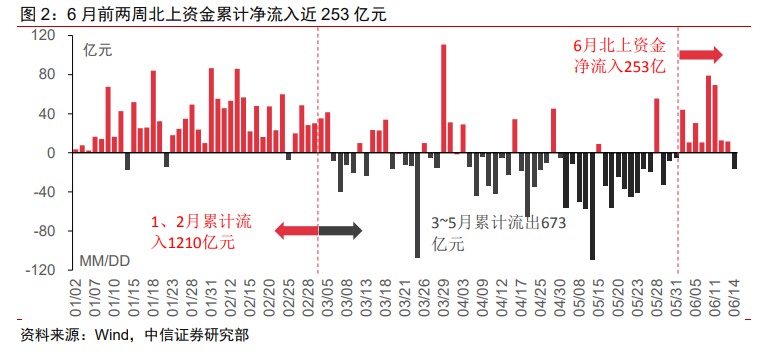

The inflection point of global monetary policy is clear and northward capital inflows are expected to continue.The expectation of the Fed to cut interest rates this year has further strengthened, and the implied probability of a rate cut in federal funds futures has reached 99.5%, of which the probability of FOMC cutting interest rates is 30.8% on June 20 and 87.5% in July. Australia, Russia and India have cut interest rates, the European Central Bank has kept interest rates low, global monetary policy has been loosened, the repair of capital risk appetite has been sustained, and northward capital inflows have returned to nearly 25.3 billion yuan in the first two weeks of June. a relatively stable net inflow can be maintained in the future.

The domestic policy camera is obviously loose, and the management expectation is as important as the underpinning economy.On the one hand, the policy of supporting consumption and infrastructure support has been implemented in June; on the other hand, the expected management of financial stability and risk prevention has been continuously strengthened in the near future.The risks of some short-term financial institutions are only individual cases, and the derivative liquidity risks have sufficient policy room to deal with them. On June 14, the central bank launched a targeted operation on small and medium-sized banks. In addition, according to the calculation of the collection group of CITIC Research Department, the bonds that may involve structured issuance of credit risk are expected to be only on the order of 10 billion, accounting for a relatively small proportion in the bond market.

Second, the differences between China and the United States and the turnaround of fundamentals will also be settled.

1) the inflection point of differences between China and the United States is approaching, and the negotiation window will be opened after the G20 summit in Japan.We have put forward and reiterated our judgment that the US tax increase list of US $300 billion is unlikely to land in June, and it is expected that the G20 will once again open a two-to three-month negotiation buffer period in order to reach a more pragmatic intermediate agreement. The differences between China and the United States will take a turn for the better after the G20 in Japan at the end of June.

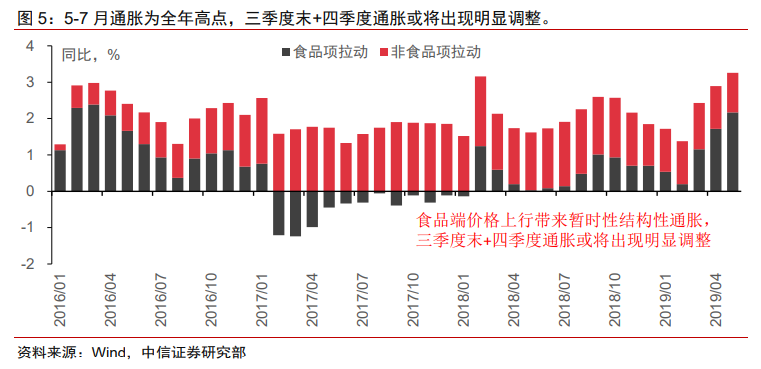

2) under the support of policies such as infrastructure, fundamentals are expected to bottom out in June.The domestic fundamental data in May is still at the bottom. With the countercyclical adjustment policy of special bonds, the infrastructure support is clear. April and May are expected to be the stage lows of fundamentals and will rise in June. The macro group of CITIC's research department judged that the growth rate of infrastructure investment will pick up significantly in the third quarter compared with the same period last year, rising to more than 8 per cent by the end of the year, and social finance growth will reach the highest point of the year in July and August, which may exceed 11 per cent in the short term.

Third, pay close attention to the three main lines and seize the opportunities behind the turnaround.

1) continue to take big consumption and big finance as the bottom position, and pay special attention to the leading varieties preferred by foreign investors.The risk preference of global capital has improved, and northward capital can maintain a relatively stable net inflow, and the allocation of bottom positions is still recommended to be dominated by foreign capital preferences in large financial and consumer sectors.

2) under the catalysis of counter-cyclical policies, the prosperity of the infrastructure sector has picked up.The new policy of special debt improves the financing environment for infrastructure construction, the recovery of infrastructure investment leads to the restoration of the industrial chain, considering valuation and institutional positions, recommending state-owned enterprise construction companies that benefit more from the current financing environment, and design companies that pay attention to regions or sub-areas.

3) pay attention to the A-share growth leader under the mapping of Kechuang board.Loose liquidity expectations are conducive to the growth theme. Science and Technology Innovation Board's schedule is gradually clear, as of June 14, there have been 9 companies that have applied for Kechuang board listing. In the short term, it is recommended to pay attention to the theme market of A shares mapped by Kechuang Board, including integrated circuits, semiconductor chips and biomedicine.

Edit / jasonzeng