Source | this article is compiled and written by IPO early know (ID:ipozaozhidao). The views in this article are for reference only.

Editor | Uncle C

Typesetting | Uncle C

Since the launch of the feasibility study in 2015, there has been repeated news of the "landing" of Shanghai-London Stock Connect, which has finally become a reality this time.

At the 11th Lujiazui Forum held last Thursday, David SCHWIMMER, chief executive of the London Stock Exchange Group (CEO), said that the regulatory framework of Shanghai-London Stock Exchange has been put in place and cross-border rules have confirmed that some issuers are ready to take action and will soon launch the Shanghai-London Stock Exchange.

Huatai submitted a letter of intent on June 4, which was approved on the 11th, and the issue price was finalized on the 14th. With a series of intensive actions, the birth of the first GDR announced the arrival of the era of Shanghai-London Stock Connect.$Huatai (06886.HK) $Will also becomeThe first "A+H+G" listed securities firm。

Flowers fall in Huatai

Many market participants have doubts: why is the first issuer of Lungang Link Huatai?

From September to October last year, Huatai successively passed relevant motions to issue GDR on the LSE at the board of directors and shareholders' meeting, disclosed the letter of intention to list on the LSE in November, and was approved by the CSRC to issue GDR in December. Then, there was no real progress.

Foreign media said a lack of clarity from regulators on key technical issues led Huatai to delay the launch of GDR, but analysts said the delay could also be due to the negative impact of uncertainty over Brexit.

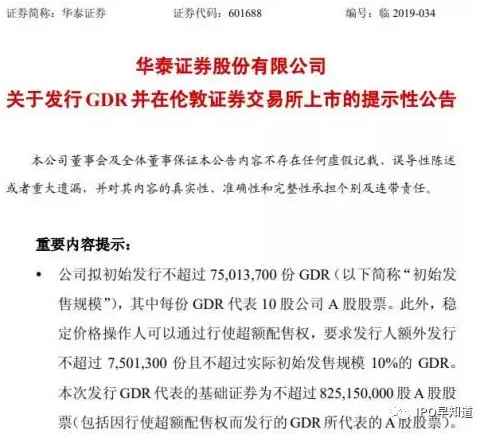

It was not until June this year that Huatai restarted the GDR offering, with no more than 75.0137 million GDR and no more than 7.5013 million oversubscribed GDR, each of which represents 10 A shares of the company.The amount of funds raised has changed from the previous "minimum fund-raising amount of not less than US $500m" to US $1.6503 billion to US $2.0216 billion.

According to people familiar with the matter, if oversubscribed, this Huatai GDR will beThe largest IPO in the UK since 2017, the largest IPO in the global depositary receipt market since 2013, and the largest pure IPO financing in the European market since 2012.

The GDR of this issue is all derived from the company's new shares, and existing shareholders are not expected to sell any securities as part of the offering.Conditional trading began on June 17th.

According to the data, Huatai was founded in Nanjing in December 1990 and has a history of 28 years. Huatai has made many successful transformations and continuous expansion during this period, and has now become a leading technology-driven securities group, and was listed on the Shanghai Stock Exchange and the Hong Kong Stock Exchange in 2010 and 2015 respectively.

According to international accounting standards, Huatai's total income in 2016, 2017, 2018 and 2019 was 24.6 billion yuan, 31.3 billion yuan, 24.5 billion yuan and 7.3 billion yuan respectively, while net profit in the same period was 6.5 billion yuan, 9.4 billion yuan, 5.2 billion yuan and 2.6 billion yuan.

In 2017, Huatai ranked with a net worth of 85.101 billion yuanSecurities firmRanked fourth on the list of net assetsAnd was rated as AA in the latest securities regulatory commission classification rating 2014-2018, HuataiThe trading volume of stock funds ranks first in the market for five consecutive years.。

It is worth mentioning that Huatai also received a fixed increase of 14.2 billion yuan in August 2018, including strategic investments such as BABA, SUNING, Sunshine property Insurance, etc. Recently, Huatai America, a wholly owned subsidiary of Huatai International in the United States, has obtained the qualification to carry out brokerage dealer business in the United States.

Reveal the secrets of Shanghai and Luntong.

With the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect, many people think that the Shanghai-London Stock Connect is a replica of them, but in fact it is not. The biggest differences are:Shanghai Luntong can buy each other's products in the local market, while Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect can only buy products when capital flows to each other's market.

Due to the connection between the two markets, there are different time zones, different market characteristics and great differences in systems.Depositary receipts (Depositary Receip, DR)Has been introduced very well.

Shanghai and London Stock Exchange, that is, the Shanghai Stock Exchange and London Stock Exchange interconnection mechanism, qualified listed companies in the two places in accordance with the laws and regulations of each other's market, issue depositary receipts and list on each other's market. Through the arrangement of cross-border conversion mechanism between depositary receipts and basic securities, the interconnection between the two markets can be realized.

Shanghai Luntong existsEast service and west serviceEastward business refers to the listing of Chinese depositary receipts (CDR) by companies listed on the London Stock Exchange, while business to the west refers to the listing of global depositary receipts (GDR) by A-share companies listed on the Shanghai Stock Exchange.

The trading model of the Shanghai-Hong Kong Stock Connect is as follows: investors entrust local securities firms to declare to overseas exchanges through securities trading service companies established by local exchanges, and buy and sell overseas listed stocks within the prescribed scope, foreign exchange and fund transfer shall be carried out by their respective clearing parties, that is,"investors cross borders, but the subject matter does not cross borders."The transactions between the two markets are synchronous.

Shanghai-London Stock Connect has relatively high requirements for investors, one of which is"in the 20 trading days before the opening of the application authority, the assets in the securities account and capital account shall not be less than RMB 3 million yuan per day."While 3 million yuan does not include funds and securities incorporated into margin trading.

Although it was proposed for the first time in 2015 to solve the technical problem by the end of 2017, the actual implementation of Shanghai Luntong Stock Connect has been much slower than expected, the most typical of which is the delay of December 14 last year.

Until the two sessions this year, Fang Xinghai, vice chairman of the Securities Regulatory Commission, said in an interview with the media that this mainly depends on the situation in the UK; at the end of March, London City Mayor Ai Silin revealed that all the testing work of the London Stock Exchange had been completed, and London has also passed regulatory regulations.

by contrast,The speed of business development to the east is much faster than that to the west. On June 13, the Shanghai Stock Exchange announced that JPMorgan Chase & Co Securities Co., Ltd. and ICBC Standard Bank Public Co., Ltd., two companies, Shanghai Luntong Global Depositary receipts UK cross-border conversion agency for the record, together with the previous filings of Citic CLSA UK, Haitong International UK, Barclays Bank and China International Capital Corporation UK a total of 6.

Can you copy the popularity of the Shanghai-Hong Kong Stock Connect?

Some people hope that the opening of the Shanghai-Hong Kong Stock Connect can replicate the popularity after the opening of the Shanghai-Hong Kong Stock Connect. It is true that the stock market has risen after the opening of the Shanghai-Hong Kong Stock Connect, but it is more related to the policies of Xiaobai Maimai Inc, which is more related to macroeconomic factors. Blindly relying on the Shanghai-Lun Stock Connect to remove the trap of A-shares may be reluctant.

The Shanghai Stock Exchange commented on Huatai's approval of issuing GDR, believing that this means that Shanghai-London Stock Connect has taken a substantial step forward in its business and is of very positive significance in promoting the integration of domestic institutions into the global core capital market and promoting cooperation between the two financial centers of Shanghai and London.

From an objective point of view, Shanghai and Luntong is a process of mutual benefit.

On the one hand, with the landing of Shanghai-London Stock Connect, high-quality Shanghai stock companies are expected to list on the London Stock Exchange, which also provides a new way for enterprises to list overseas; at the same time, high-quality enterprises of the London Stock Exchange are expected to issue CDR (Chinese Depositary receipts) in A-shares, participate in the A-share market, and promote the opening and internationalization of the domestic capital market.

On the other hand, the Brexit incident caused some financial institutions to leave London and return to the European continent. London faces the risk of declining status as an international financial center. Britain also needs to open a Shanghai Link to alleviate this situation.

But the short-term influence is limited.3 million yuan is a hard threshold, and Shanghai Luntong may be more suitable for institutional players than individual investors.Both eastward and westward selected stocks come from high-quality blue chips, and there is no so-called blood-drawing effect, but Shanghai Luntong can further magnify the role of financial institutions and promote their transfer to the role of depositors and custodians.

The purpose of Huatai's fund-raising is to replenish the capital after deducting the issuing expenses. It includes supporting the endogenous and epitaxial growth of international business, expanding overseas distribution, continuing investment and further strengthening the company's existing main business, and further replenishing the company's working capital and other general corporate uses.

Therefore, Huatai will achieve a new breakthrough in the international business layout and further enhance the company's core competence and international competitiveness while entering one of the world's most influential capital markets through GDR.