Edited by Guosheng Securities: "New opportunities in the Core Industry chain from 5G"

On June 6, 2019, the Ministry of Industry and Information Technology officially issued formal 5G commercial licenses to the four major operators, revealing the starting point of the first year of 5G in China.

Who are there in the 5G industry chain?

According to operators' capital expenditure estimates, China may achieve 100000 or more 5G base station construction in 2019, while the number of base stations required for the entire 5G era will be about 5 million macro base stations according to our Guosheng Electronics estimates. It is expected that the number of macro base stations or micro base stations will far exceed that of 4G era.

Corresponding to the core industrial chain of 5G, Guosheng Securities believes that it will benefit deeply from the construction frenzy of 5G and usher in a huge round of development.

Second, what are the development opportunities?

1. RF, memory and FPGA ushered in opportunities for development.

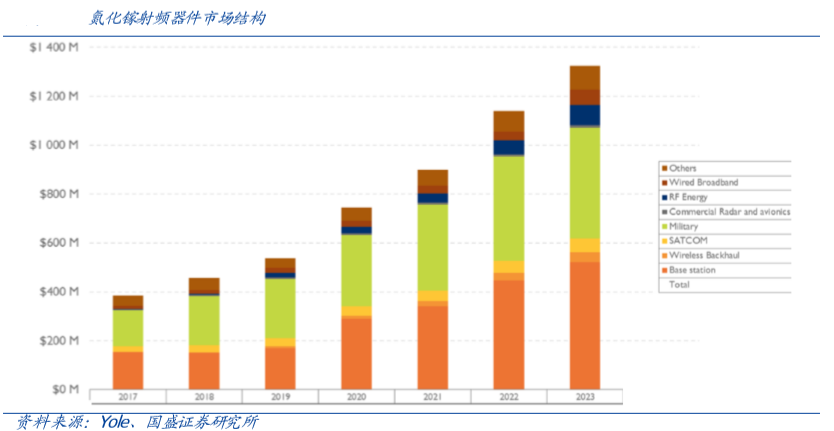

The application prospect of radio frequency is broad.In the field of communication radio frequency, compound semiconductors are mainly used in power amplifiers, radio frequency switches, filters and other devices. Gallium arsenide (GaAs), gallium nitride (GaN) and silicon carbide (SiC) semiconductors are the representatives of the second and third generation semiconductors, respectively. Compared with the first generation semiconductors, gallium arsenide (gallium arsenide), gallium nitride (gallium nitride) and silicon carbide (SiC) semiconductors have much better high-frequency performance and high manufacturing cost.

5G greatly spawned the demand for data storage.Guosheng SecuritiesThe three core innovation drivers that continue to emphasize the fourth wave of silicon content improvement cycle are supported by 5G.AI, Internet of things, Intelligent drivingFrom the human generation of data to the automatic generation of data by access equipment, the data increases exponentially.Memory accounts for more than 70% of the semiconductor market.

With the progress of the current 5G era and the speed of AIMRFR predicts that FPGA is expected to reach about $12.521 billion by 2025.In 2013, the global FPGA market size was 4.563 billion US dollars, and by 2018, the global FPGA market size has gradually grown to 6.335 billion US dollars.

2. 5G leads the market growth of spare parts such as antennas.

Under the trend of Massive MIMO, the number of antennas in a single base station will increase greatly. According to the current 64-channel scheme, 192 oscillators need to be integrated on one side, and the current price of the oscillator is about $1. The domestic market size of 5G macrostation oscillator in 2019 is about 300-400 million yuan. Considering the annual price adjustment, the CAGR is expected to reach more than 70% by 2022. At the same time, the filter market is expected to grow by nearly 20%.

3. The peak of construction in the first year of 5G, the deep benefit of PCB

PCB has benefited from 5G construction and has made a qualitative leap in terms of unit price, area and number of base stations. The unit price benefits from the demand of high frequency and high speed, which leads to the increase of product requirements; the area benefits from the structural adjustment and the influence of high frequency band; and the number of base stations also needs more base stations because of high frequency. As an indispensable part of the core supply chain in 5G construction, PCB under 5G construction will develop better in the future.

Third, risk tips

Downstream demand is lower than expected:If the growth rate of the downstream market is lower than expected, the operating performance of 5G-related supply chain companies will be adversely affected.

Marginal deterioration of the macro environment:If the external environment changes sharply, or even deteriorates further, it will have a further impact on the downstream market and the overseas upstream and downstream supply chain, thus adversely affecting the relevant domestic supply chain companies.