Summary of contents

Report Guide/Core Views

As Europe and the US enter the traditional influenza season in the fourth quarter, public health incidents have also recently been concentrated again, and the economic recovery rate in Europe and the US will slow down. We believe that the recurrence of this round of health incidents will not cause a recurrence of the liquidity crisis in March. The probability that European and American stock markets will continue to decline is small, but there is also limited room for improvement. The limiting factors are risk aversion and difficult fiscal stimulus plans due to uncertainty about the US election.

Health incidents in Europe are more intense than in spring. Currently, quarantine measures are mainly focused on service-oriented consumption

On the US side, repeated health incidents since September have led to stricter epidemic prevention measures in some major economic centers, and states that have not yet been tightened may also face escalation of control measures in the future. The intensity of the recurrence of this round of health incidents in Europe is higher than the level of the previous spring. Judging from the latest epidemic prevention measures currently issued by major European countries, overall prevention and control efforts are still relatively relaxed compared to spring, and are mainly concentrated in the service-oriented consumption sector. Enterprise production has not yet been significantly affected, but it is not ruled out that subsequent control measures will further escalate as health incidents intensify.

On the US side, repeated health incidents since September have led to stricter epidemic prevention measures in some major economic centers, and states that have not yet been tightened may also face escalation of control measures in the future. The intensity of the recurrence of this round of health incidents in Europe is higher than the level of the previous spring. Judging from the latest epidemic prevention measures currently issued by major European countries, overall prevention and control efforts are still relatively relaxed compared to spring, and are mainly concentrated in the service-oriented consumption sector. Enterprise production has not yet been significantly affected, but it is not ruled out that subsequent control measures will further escalate as health incidents intensify.

Health incidents have seriously recurred in some major US economies, but the current quarantine measures have not impacted production

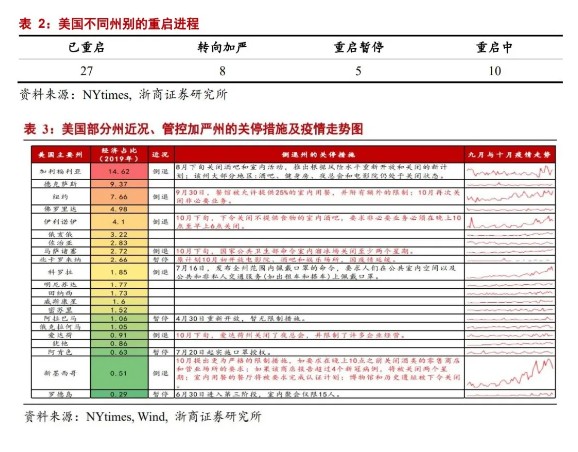

Currently, measures have been upgraded, including major economic centers such as California, New York, and Illinois, which account for 14.62%, 7.66%, and 4.1% of GDP, respectively. The new management measures mainly focus on shutting down some service-oriented and entertainment venues, such as bars, restaurants, ice rinks, etc., and do not involve production enterprises.

There are a total of 12 states where management measures have been tightened after the recurrence of this round of health incidents. Some states that have not yet issued shutdown measures may also restart the ban in the future. Take Texas (9.37% of the US GDP) as an example. The average number of new cases per day in the last week was the highest among all US states, reaching 6,375. In order to curb the spread of health incidents, the state government may enact stricter control measures in the future, shut down measures in extreme cases, or extend them from service-oriented sites to production sites.

The rate of economic recovery in Europe and the US will slow down as health incidents recur again

The current economic recovery in the US is not complete, and it shows the typical characteristics of the consumer side being better than the enterprise side (retail data continued to improve in September or due to “residents' savings eating old capital”) and the demand side being superior to the supply side. The recurrence of health incidents combined with the breakdown of fiscal stimulus measures such as unemployment benefits and PPP may have the following effects on the US economy: First, the recovery of consumer and retail data may stagnate, and permanent unemployment in employment data will continue to worsen. Second, the number of corporate bankruptcies may continue to rise in October, the industrial production index will take a U-turn downward, and the repair of orders for core capital goods may stall.

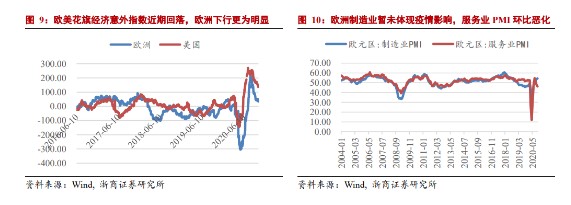

The current health incident in Europe recurred earlier, and the degree of economic impact was higher than that of the US. According to the Citigroup Economic Accident Index, Europe's decline is even more significant. However, the impact of the recurrence of this round of health incidents on the Eurozone is temporarily concentrated in the service-oriented consumption sector, but we need to be wary that the escalation of the blockade measures will have a further impact on manufacturing and Europe's supply capacity. The deflationary trend in the Eurozone is likely to continue due to health events.

Due to the impact of this health incident, the possibility of a recurrence of the March liquidity crisis is limited

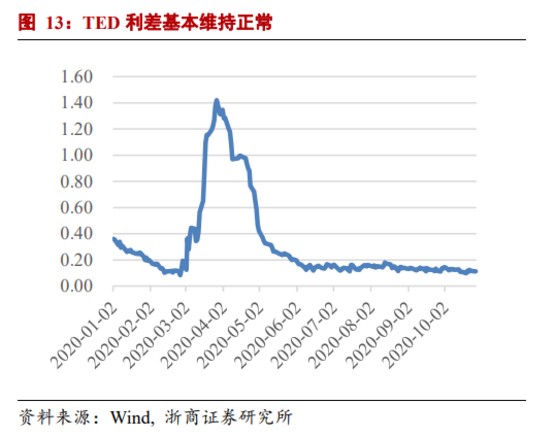

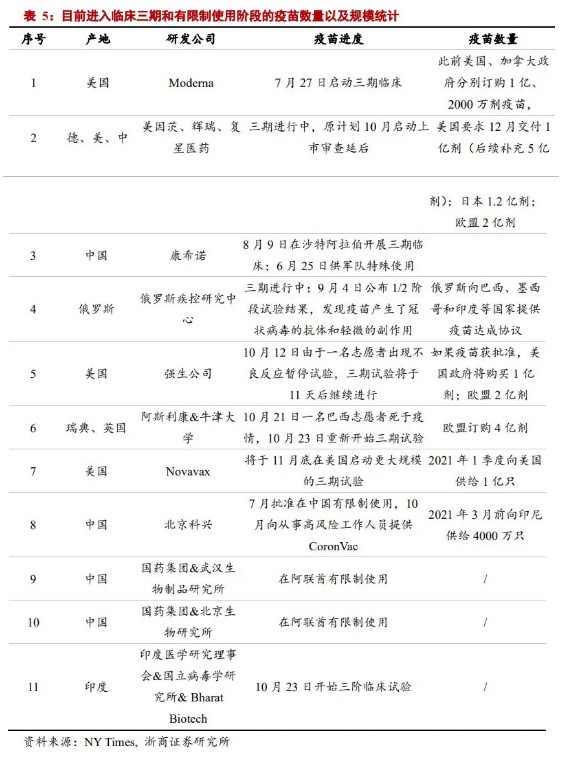

Despite the recent panic decline in overseas equity markets, we believe there is a limited possibility that the liquidity crisis in March will be repeated due to the impact of this health incident. The reason is as follows: First, compared to the early days of the outbreak, countries currently have more experience in dealing with health incidents and have relatively mature isolation and management mechanisms. Second, vaccine research and development progress is progressing steadily. Currently, 11 vaccines are in phase III clinical stages worldwide. Of these, 6 vaccines have entered the stage of restricted use, which can play a role in stabilizing market expectations. Third, the current LIBOR-OIS and TED spreads show that there has been no change in the liquidity of the US dollar; during the July Federal Reserve interest rate meeting, the Federal Reserve extended the validity of the currency exchange arrangement until March 2021, so it can start dealing with liquidity tension at any time, and the probability that the US dollar liquidity crisis will recur is small.

Three major impacts of this recurrence of health incidents on capital markets

First, the possibility that European and American stock markets will continue to decline sharply is limited. The decline will stop in the short term, but no sharp rebound is expected, mainly because the US election and fiscal stimulus plans were blocked.

Second, expectations for increased easing by the ECB and negative interest rates by the Bank of England have strengthened.

Third, gold is likely to rise. As mentioned above, risk sentiment will continue to be suppressed by multiple factors in the short term. In a situation where there may be political uncertainty at the election level, the dollar's safe-haven status is less than that of gold.

Risk warning: The risk of the general election exceeded expectations and led to a political crisis in the US; the outbreak of health incidents due to the mutation of the virus exceeded expectations

Main text

Europe and the US became the epicenter of this round of health incidents

Current quarantine measures in Europe are mainly focused on service-oriented consumption

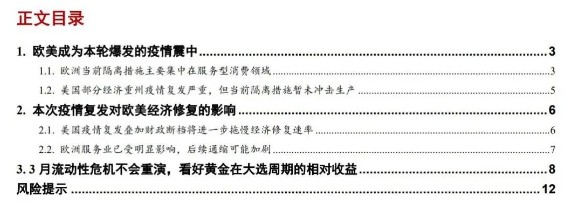

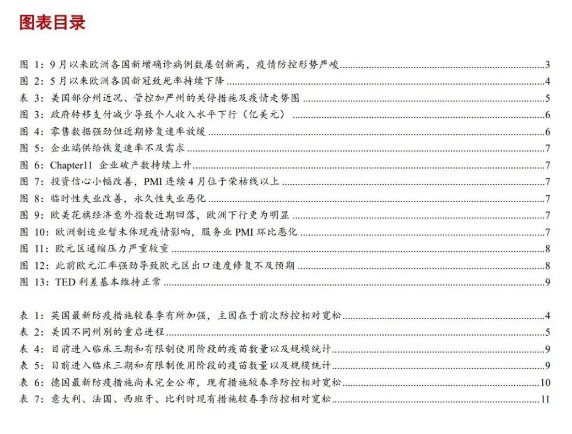

As Europe enters the traditional influenza season, winter temperatures drop, and the virus becomes active. Since September, the number of new confirmed cases in European countries has repeatedly reached new highs, and the health incident prevention and control situation is grim. As of October 28, the number of new confirmed cases in France reached 36,000, 7.7 times the peak number of new confirmed cases in a single day in spring. Countries such as Germany, the United Kingdom, Italy, Spain, and Belgium have also repeatedly reached new highs. The number of new confirmed cases in a single day reached between 13,000 and 25,000, respectively. However, judging from the fatality rate, it is generally on a downward trend, mainly due to advances in medical technology and an increase in the number of confirmed cases. As of October 28, fatality rates in Germany, the United Kingdom, France, Italy, Spain, and Italy were 2.16%, 4.84%, 2.90%, 6.43%, 2.97%, and 3.18%, respectively. Since October, in response to the second health incident, European countries have begun strengthening health incident prevention and control policies that are relaxed during the summer. For example, the Italian government has decided to extend the state of emergency that is about to expire until January 31, 2021, and make it mandatory for people all over the country to wear masks in public places; the Belgian government announced a new round of prevention and control measures, including strict restrictions on gatherings of people and the closure of places such as bars and cafes; and the German government extended the ban on large-scale gatherings such as sporting events and concerts until the end of the year. On October 28, German Chancellor Angela Merkel held a summit meeting with the governors of various federal states, and will implement a stricter ban on social contact than current measures from November 2. The provisional implementation period is for the whole of November.

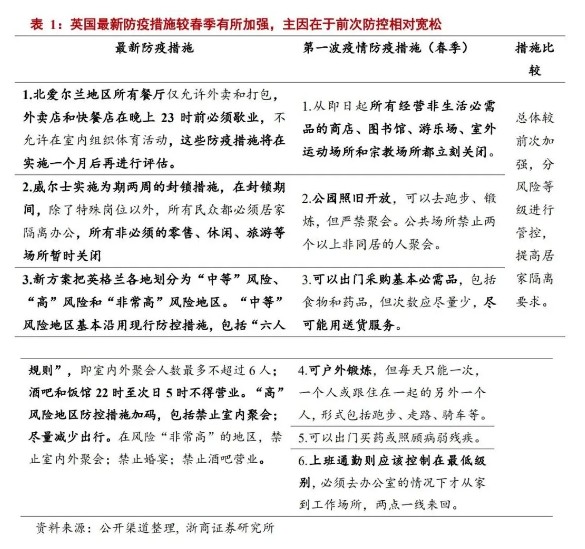

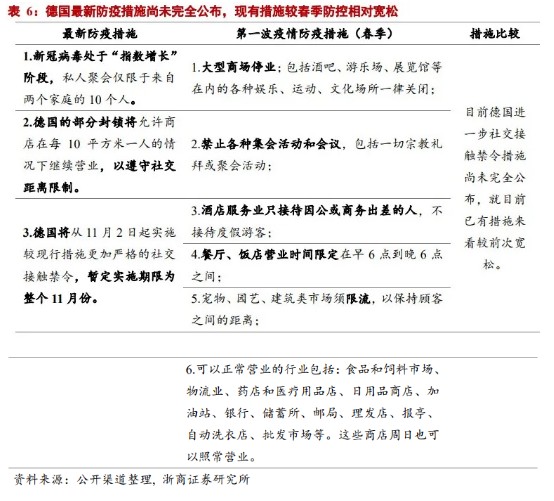

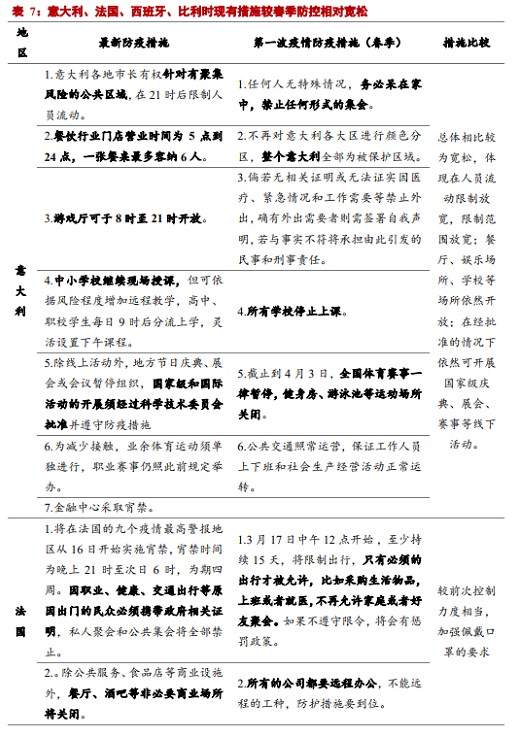

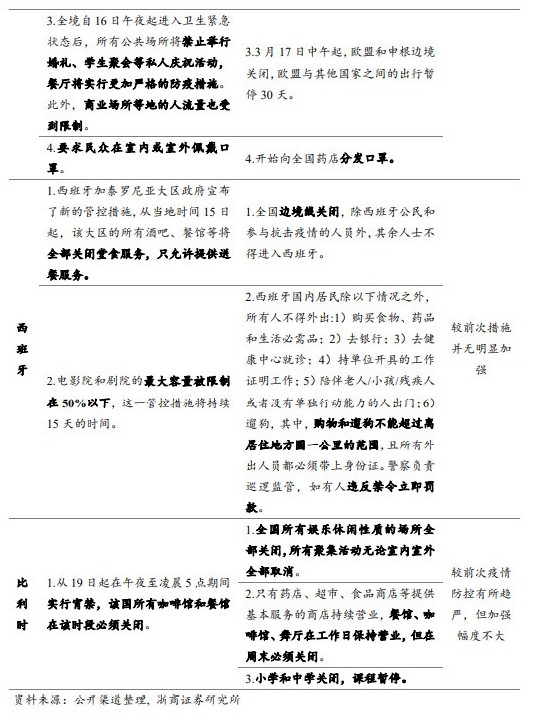

Judging from the latest epidemic prevention measures currently issued by major European countries, the overall level of prevention and control measures is still relatively relaxed compared to spring, and is mainly concentrated in the field of service-oriented consumption. Enterprise production has not been significantly affected yet, but it is not ruled out that subsequent control measures will further escalate as health incidents intensify. Judging from specific country cases, at present, only Britain is generally stronger than the previous one, changing the prevention and control ideas that were too relaxed in the early stages, aligning prevention and control efforts with other countries, dividing risk levels to control people, and raising home quarantine requirements. Germany's further social contact ban measures have not yet been fully announced. Looking at the measures currently in place, they are relaxed compared to the previous one. Italy is generally relatively relaxed, as reflected in the relaxation of restrictions on the movement of people and the relaxation of the scope of restrictions; restaurants, entertainment venues, schools, etc. are still open; offline events such as national festivals, exhibitions, and competitions can still be carried out with approval. France has taken similar control compared to the previous one, and has mainly strengthened the requirement to wear a mask. Spain's measures have not been significantly stricter than the previous one. Belgium has strengthened in terms of comparable rules, but the strengthening has not been significant. (See attached table below for detailed control measures in some European countries)

Health incidents have seriously recurred in some major US economies, but the current quarantine measures have not impacted production

On the US side, repeated health incidents since September have led to stricter epidemic prevention measures in some major economic centers. States that have not yet been tightened may also face escalation of control measures in the future, and the resumption of work and production in the US has once again come to a standstill. Similar to Europe, the US is currently also in a trend where the number of confirmed cases increased on the same day but the death rate is declining. The speculation is that the reason is basically the same as Europe. As of October 28, 82,721 new cases were confirmed in the US on the same day, continuing to grow at a high rate. However, the current death rate is about 2.56% and has continued to be in a downward channel since May. Since the health incident recurred in late September, a total of 14 states across the US have re-tightened management measures, including major economic centers such as California, New York, and Illinois, which account for 14.62%, 7.66%, and 4.1% of GDP, respectively. The new management measures mainly focus on shutting down some service-oriented and entertainment venues, such as bars, restaurants, ice rinks, etc., and do not involve production enterprises.

Furthermore, it is still worth noting that due to the intensification of health incidents, some states that have not yet enacted shutdown measures may also restart the ban. Taking Texas (9.37% of the US GDP) as an example, Texas had the highest average number of new daily cases in the US in the last week, reaching 6,375. In order to contain the spread of health incidents, the state government may later issue stricter control measures. At that time, the shutdown measures may be extended from service-oriented sites to production sites, causing the resumption of work and production in the US economy to stall again.

The impact of this recurrence of health incidents on economic recovery in Europe and the US

The recurrence of health incidents in the US combined with fiscal disruptions will further slow the rate of economic recovery

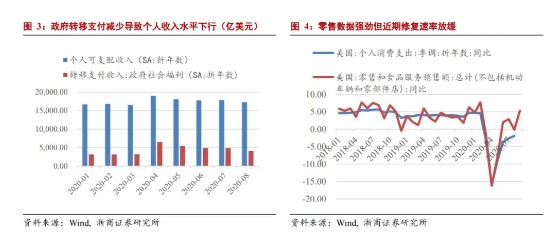

The current economic recovery of the US is not complete, and it shows typical characteristics that the residential side is superior to the enterprise side and the demand side is superior to the supply side. Looking at consumption data, retail data recovery is relatively good. Retail and food service sales rose 5.31% year on year in September; personal consumption expenditure was -1.92% year on year in August, and is expected to rectify almost in September. The rapid recovery of personal consumption data after health incidents has mainly benefited from fiscal incentives under the US CARES Act, and government transfers have become an important source of income for residents after losing their jobs. However, at present, many of the US fiscal stimulus packages have expired and been cut off. First, the wage protection plan, which plays an important role in supporting employment, expired on August 8. Since the plan was introduced, it has supported more than 1/3 of the nation's jobs. Second, the unemployment benefit policy for the first round (additional $600 per week) expired on July 31; the second round of unemployment benefits (an additional $400 per week) paid by Trump through the signing of an executive order and freeing up the Disaster Relief Fund (DRF) has been gradually exhausted since September 5. Among them, many states such as Arizona, Texas, and Iowa have stopped paying them.

On the one hand, the US retail sales data, which was still strong in September, benefited from rising residents' incomes driven by the resumption of work and production; on the other hand, it actually “eats old money.” Various financial relief measures in the second and third quarters of this year provided large subsidies to residents, but in the context of a lack of consumption scenarios, the residents' savings rate increased dramatically. Compared with the same period last year, the total additional savings funds (number of seasonal adjustment years) were nearly 15 trillion US dollars in March-August, which converted to about 1.25 trillion US dollars after the fiscal break. This can provide a buffer for 1-2 months for residents' consumption after the fiscal break.

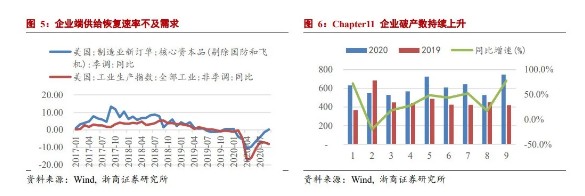

Judging from investment data, new orders for core capital goods in the enterprise manufacturing industry grew 0.27% year on year in September, the first correction after the health incident; the manufacturing PMI index has been above the boom and bust line for 4 consecutive months since June. The corporate sentiment has improved markedly from month to month but is still weak. The number of companies that went bankrupt in Chapter 11 rose nearly 80% year on year in September. Meanwhile, the current supply-side repair rate of the US is clearly lower than that of the demand side. The US industrial production index continued to shrink in September, with a year-on-year growth rate of -8%.

Against the backdrop of another recurrence of the current health incident in the US, the resumption of work and production has once again stalled. The economic recovery process will slow down, and the combined fiscal stimulus package will be difficult to produce before the general election. The expected impact on the economy is as follows: First, the recovery of consumer and retail data in October may stagnate, and non-farm payrolls data may show a worsening trend in both total volume and permanent unemployment. Second, the number of corporate bankruptcies may continue to rise in October, the industrial production index will take a U-turn downward, and the repair of orders for core capital goods may stall.

The European service sector has been clearly affected, and subsequent deflation is likely to intensify

Overall, the current health incident in Europe recurred earlier. Germany began upgrading its epidemic prevention measures in late September. The impact on the economy was higher than that of the US. According to the Citigroup Economic Accident Index, Europe's decline is even more significant. The latest Eurozone service sector PMI index for October was 46.2, which worsened again compared to September. The Eurozone manufacturing PMI was 54.4 in October. Since July, it has improved continuously for 4 months, and the impact of the health incident has not yet been reflected.

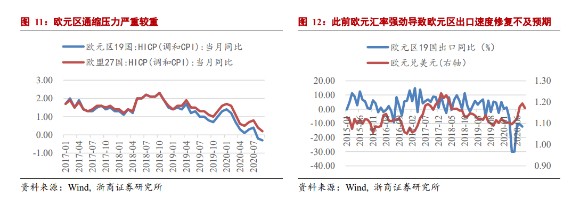

The PMI structure also fully reflects that the impact of the recurrence of this round of health incidents on the Eurozone is temporarily concentrated in the service-oriented consumption sector (restaurants, hotels, bars, etc.). Judging from the control measures, large-scale manufacturing enterprises have not yet been shut down, but we still need to be wary that the relevant upgrade of lockdown measures will have a further impact on manufacturing and European supply capacity. Affected by the recurrence of health incidents and the strong euro exchange rate, the HICP of the 19 Eurozone countries has been deflating for two consecutive months, and this trend is likely to continue in the future.

The monthly liquidity crisis will not be repeated. I am optimistic about the relative return of gold during the election cycle

Despite the recent panic decline in overseas equity markets, we believe there is a limited possibility that the liquidity crisis in March will be repeated due to the impact of this health incident. The reason is as follows: First, compared to the early days of the outbreak, countries currently have more experience in dealing with health incidents and have relatively mature isolation, management and response mechanisms. Second, vaccine research and development progress is progressing steadily. Currently, 11 vaccines are in phase III clinical stages worldwide. Of these, 6 vaccines have entered the stage of restricted use, which can play a role in stabilizing market expectations. Third, the current LIBOR-OIS and TED spreads show that there has been no change in the liquidity of the US dollar; during the July interest rate meeting, the Federal Reserve extended the validity period of the currency exchange arrangement until March 2021, so it can start dealing with liquidity tension at any time, and the probability that the US dollar liquidity crisis will recur is small. In summary, we expect the impact of the recurrence of this health incident on the capital market as follows:

First, the possibility that European and American stock markets will continue to decline sharply is limited. The decline will stop in the short term, but it is not expected that there will be a sharp rebound, mainly due to the blocking of the US election and fiscal stimulus plans. At the US election level, the poll gap between Trump and Biden has recently come close again, and uncertainty about the election results has risen again. The Senate officially sent conservative Judge Barrett to the US High House this week with a 52: :48 vote result, thus determining the 6:3 vote advantage of conservatives over liberals. As stated in our previous report, when judicial advantage is determined, there is a high probability of triggering judicial disputes and generating risk aversion in the US stock market under an anxious election situation (Trump recently temporarily overtook public opinion polls in Florida, Ohio, etc.), so there is limited room for a rebound in the US stock market. Furthermore, in the context of the recurrence of health incidents, the fiscal stimulus package will further weaken expectations of economic recovery due to continued difficulties in production before the general election.

Second, expectations for increased easing by the ECB and negative interest rates by the Bank of England have strengthened. On the Eurozone side, with the second recurrence of health events in Europe, the possibility that the ECB will step up quantitative easing has increased. Furthermore, although Lagarde made it clear that the exchange rate will not be the target of monetary policy, the euro's deflation trend, which was previously strongly boosted by the euro, will still force the ECB to pay attention to exchange rate trends, and may respond through monetary policy adjustments if necessary. Subsequently, we expect that the ECB may “increase” quantitative easing and follow the example of the Federal Reserve in shifting the monetary policy framework to an average inflation target. The ECB is a single-target central bank. Its core policy goal is to maintain price stability, that is, the Eurozone Harmonized CPI (HICP) growth rate was slightly below 2% year on year. At the ECB monetary policy resolution in September and the ECB seminar on September 23, Lagarde and his team discussed the possibility of an average inflation target system. On the Bank of England side, in early October, the Bank of England sent a letter inquiring about the business viability of commercial banks in a negative interest rate scenario. This expectation will be further strengthened after the health incident recurs.

Third, gold is likely to rise. As mentioned above, risk sentiment will continue to be suppressed by multiple factors in the short term. In a situation where there may be political uncertainty at the election level, the dollar's safe-haven status is less than that of gold.

Risk warning

The risk of a general election exceeded expectations, leading to a sovereignty crisis; a mutation in the virus led to a second outbreak of health incidents.

美国方面,九月以来卫生事件反复导致部分经济重镇防疫措施转向加严,尚未加严的州后续同样可能面临管控措施升级。欧洲本轮卫生事件复发的剧烈程度超过此前春季水平。从当前欧洲主要国家发布的最新防疫措施来看,总体相较春季防控力度仍然相对宽松,且主要集中在服务型消费领域,企业生产暂未受明显影响,但不排除后续管控措施伴随卫生事件加剧进一步升级。

美国方面,九月以来卫生事件反复导致部分经济重镇防疫措施转向加严,尚未加严的州后续同样可能面临管控措施升级。欧洲本轮卫生事件复发的剧烈程度超过此前春季水平。从当前欧洲主要国家发布的最新防疫措施来看,总体相较春季防控力度仍然相对宽松,且主要集中在服务型消费领域,企业生产暂未受明显影响,但不排除后续管控措施伴随卫生事件加剧进一步升级。