Main points of investment

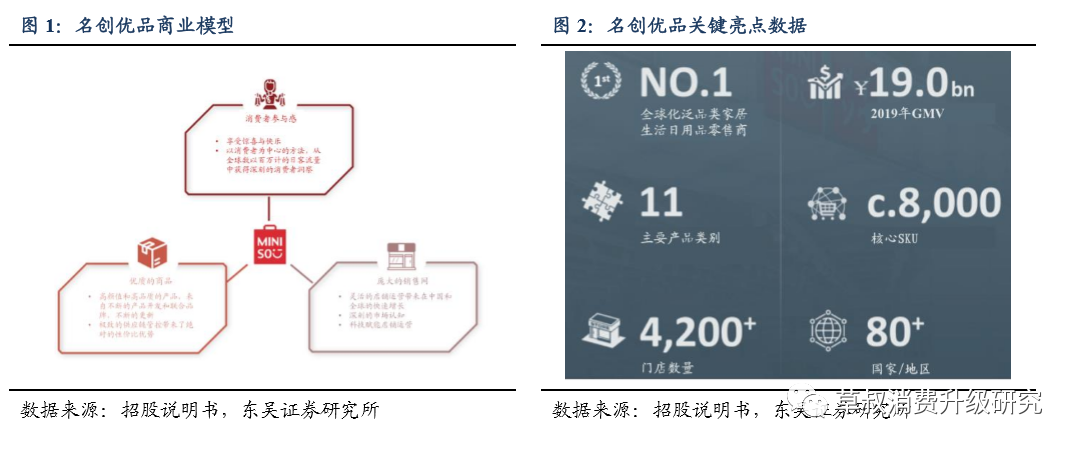

MINISO Group (MNSO.US) 7 years 4, 000 stores, become China's first universal commodity brand: founded in 13 years, MINISO Group, relying on domestic developed light industry to the global export, to create "three high, three low" products, combined with strong control to join the model, light assets rapid expansion, has more than 80 regions in the world's 4330 stores, of which overseas accounts for about 40%.

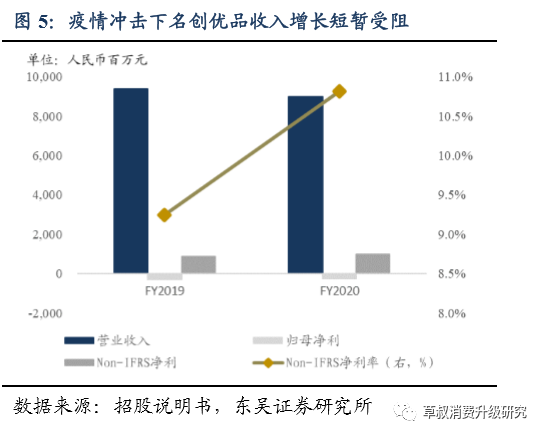

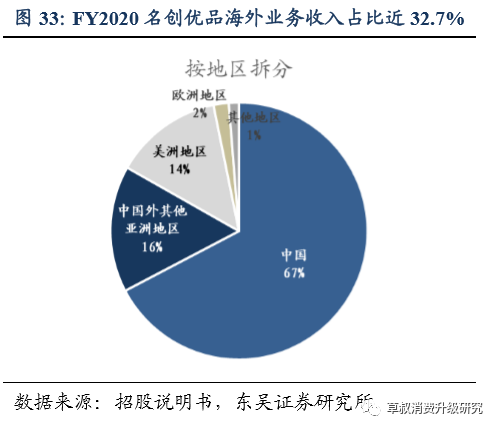

In 1919, GMV reached 19 billion yuan, making it the number one ubiquitous commodity brand in China. Affected by health events, FY19-20 achieved revenue of 93.94 / 8.979 billion yuan (32.7% overseas), but its profitability increased against the trend, realizing Non-IFRS net profit of 8.69 / 971 million yuan respectively, and Non-IFRS net interest rate increased from 9.25% to 10.81%.

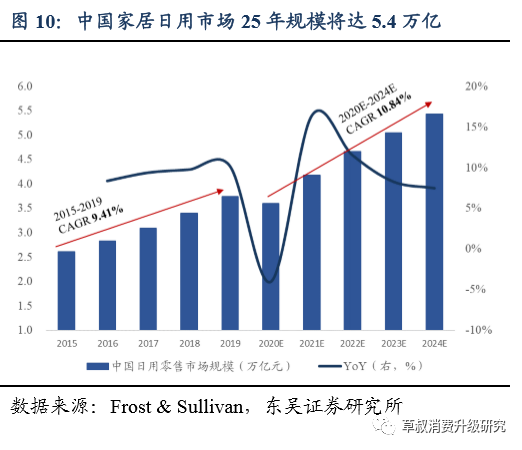

Household daily "ten yuan shop": broad space, good track, good business through the cycle.According to Frost & Sullivan, China's household market is one of the fastest growing tracks in retail, with a size of 3.7 trillion in 19 years and is expected to grow by 10.8% to 5.4 trillion in the next five years. On the other hand, the ten-yuan store, which focuses on young consumers and focuses on household daily use, is a good business with strong vitality and can grow through the cycle, and the concentration of the giant can be enhanced.

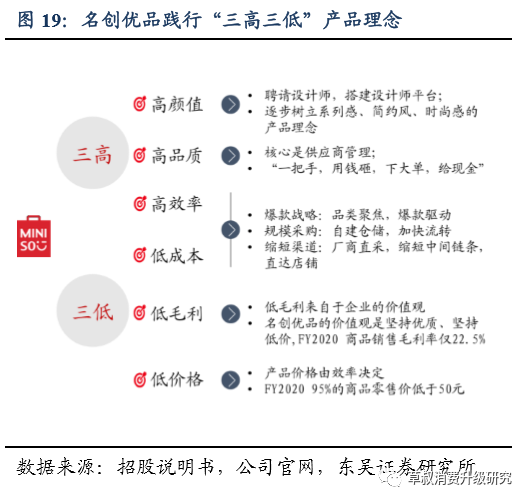

The concept of "three high and three low" is to build a moat in which the product is king + extremely cost-effective + extreme efficiency.

The concept of "three high and three low" is to build a moat in which the product is king + extremely cost-effective + extreme efficiency.

Product side:Design-driven, establish a sense of series, simple style, fashion sense of the product concept, adhere to the "711" philosophy, every 7 days on the new rapid iteration, maintain product diversity and uniqueness, superimposed well-known IP cooperation, FY20 launched 2300 joint SKU to enhance brand awareness and image.

Supply chain:Under the unique cooperation mode of "pricing by quantity, buyout and customization, no pressure on payment", we establish long-term cooperation with more than 600 high-quality suppliers to realize the low price strategy, 95%SKU retail price

Logistics and digital systems:Self-building warehousing and outsourcing logistics, establishing an efficient warehousing logistics system under centralized procurement and unified distribution mode, FY20 logistics costs account for less than 2%; on the other hand, digital management improves operational efficiency, forms online and offline experience resonance, and creates technology-based retail.

The "one-stop" strong regulatory franchise system drives the rapid expansion of light assets.MINISO Group project is not so much to join, in fact, it is more like physical finance; the franchisee assumes the role of capital, and the store operation is fully managed by the company to achieve strong control of the store. Under the commodity margin and the next-day profit sharing mechanism, it can achieve the characteristics of stable cash flow, 12-15 months' capital recovery and high rate of return, enhance the franchisee's investment willingness and brand loyalty (67% cooperation for more than 3 years), and drive the company to expand at a high speed under light assets.

Profit forecast and investment rating:Referring to the United States and Japan, the daily "ten-yuan store" is bound to give birth to one or more giants in the future, and MINISO Group, as the current representative of the domestic "ten-yuan store", is a good company in the good track. We expect that FY21-FY23 will respectively realize the net profit of 8.7 yuan / 1.82 billion yuan for Non-IFRS, corresponding to the dynamic PE in 49-30-23, and is optimistic about the prospects for the company to expand stores in the sinking market and overseas exports.For the first time, coverage gives an "overweight" rating.

Text

1. MINISO Group: global Universal Household chain Brands under extreme thinking

MINISO Group, who was founded only 7 years ago, relies on domestic developed light industry to export extreme cost-effective products to the world, creates a "three high, three low" global brand, combines a "one-stop" light asset expansion model, and grows rapidly under the guidance of extreme thinking. In 2019, the company's GMV reached 19 billion yuan (according to Frost & Sullivan), of which the domestic GMV is about 11 billion yuan, with a market share of about 10.9%. To become the number one global household household brand in China.

1.1 focus on "ten yuan" daily necessities, expanding more than 4300 stores in seven years

MINISO Group was founded in 2013, focusing on the "ten yuan store" format, focusing on fashion daily necessities, covering 11 categories, such as household decorations, small electronic appliances, textiles, accessories, etc., with more than 8000 core SKU, relying on domestic developed light industry to export extreme cost-effective products to the world, to create a "three high, three low" global brand.

Over the past seven years, through the "one-stop" light asset expansion model, the number of MINISO Group stores has grown rapidly in more than 80 regions around the world. As of September 30, 2020, the company has 4330 stores, including 2633 at home and 1697 overseas. According to Frost & Sullivan statistics, the company's GMV reached 19 billion yuan in 2019, of which the domestic GMV was about 11 billion yuan, with a market share of about 10.9%, making it the first global household brand in China.

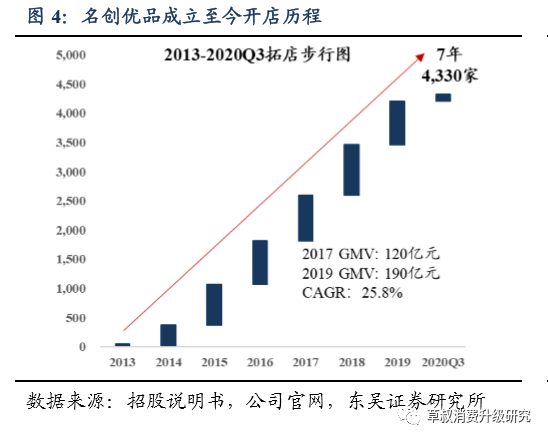

MINISO Group has achieved amazing growth through extreme mode and operation in only 7 years since its establishment. Reviewing the development process of MINISO Group, it has roughly gone through the following three stages:

(1) A blockbuster start-up period (2013-2014): the MINISO Group brand was officially established in July 2013; in November of the same year, MINISO Group's first store opened in Guangzhou's Zhonghua Square and became a hit. Inspired by the excellent performance of the first store, MINISO Group focused on Guangdong and began to expand stores. By the end of 2014, the number of stores had exceeded 300, ranging from "0" to "1".

(2) the growth period of global expansion (2015-2016): in March 2015, MINISO Group announced a comprehensive upgrade of the brand. In July of the same year, MINISO Group reached a comprehensive cooperation with the Philippines and officially opened the road of overseas export. In October 2015, the number of MINISO Group official account fans exceeded 10 million. In May 2016, the two flagship stores in Malaysia opened magnificently at the same time, and the first overseas store landed. During this stage, the company has successively reached comprehensive strategic cooperation with the United States, Thailand, Australia, Russia, Iran, the United Arab Emirates and other countries to open flagship stores in the Philippines, Laos, Mongolia and other countries, and the number of stores exceeded 1800 at the end of 2016.

(3) the improvement period (from 2017 to now): on September 30, 2018, the company received 1 billion investment from Tencent and Hillhouse Capital, and made great progress with the support of capital. While maintaining the high-speed expansion of stores, the company always adheres to the concept of "product is the king" and accelerates the promotion of independent research and development, so as to continuously improve the speed and quality of new products. At the same time, the company has repeatedly won product design awards, including 4 products won the German Red Dot Design Award in 2018, 3 creative products won the 2019 German iF Design Award in March 2019, and 3 products won the 2019 Italian A'Design Award Design Award in May 2019.

On the other hand, MINISO Group joined hands with makeup giant Yingtri to launch the MINI PONI people-friendly make-up series in September 2017. after that, the company successively partnered with Marvel, Kakao Friends and other well-known IP to launch joint products to further attract customers. In terms of the number of stores, as of September 30, 2020, MINISO Group has 4330 stores, including 2633 at home and 1697 overseas.

Growth was temporarily blocked under the impact of health events, which jointly led to the increase of gross profit margin and net profit margin. From 2015 to 2019, MINISO Group maintained the rate of expanding 60-70 stores per month (720,840 per year). The continued expansion of the number of stores has also led to the high growth of overall GMV and income. According to the data released by MINISO Group Global Awards ceremony in 2018, MINISO Group's annual revenue (presumably GMV) reached 12 billion yuan in 2017, while GMV reached 19 billion yuan in 2019, with an annualized compound growth rate of about 25.8 percent, according to the prospectus.

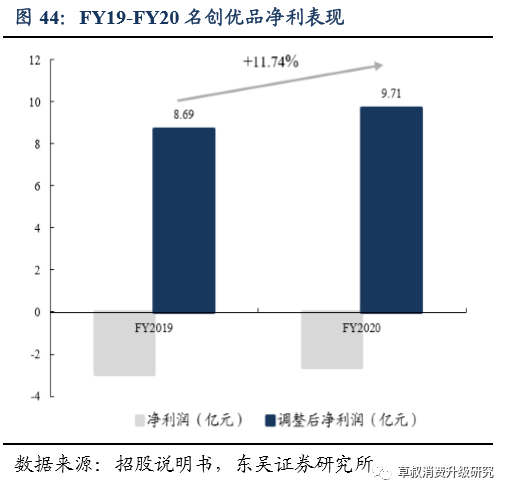

On the revenue side, MINISO Group took June 30 as the fiscal year, and FY2019 and FY2020 achieved operating income of 9.394 billion yuan and 8.979 billion yuan respectively. The decline in income scale was mainly affected by health events, while the profitability increased against the trend driven by high gross profit joint products. The company's FY2019 and FY2020 achieved a net profit of-290 million yuan and-262 million yuan, respectively, while Non-IFRS net profit was 869 million yuan and 971 million yuan, respectively. Non-IFRS net interest rate increased from 9.25% to 10.81%

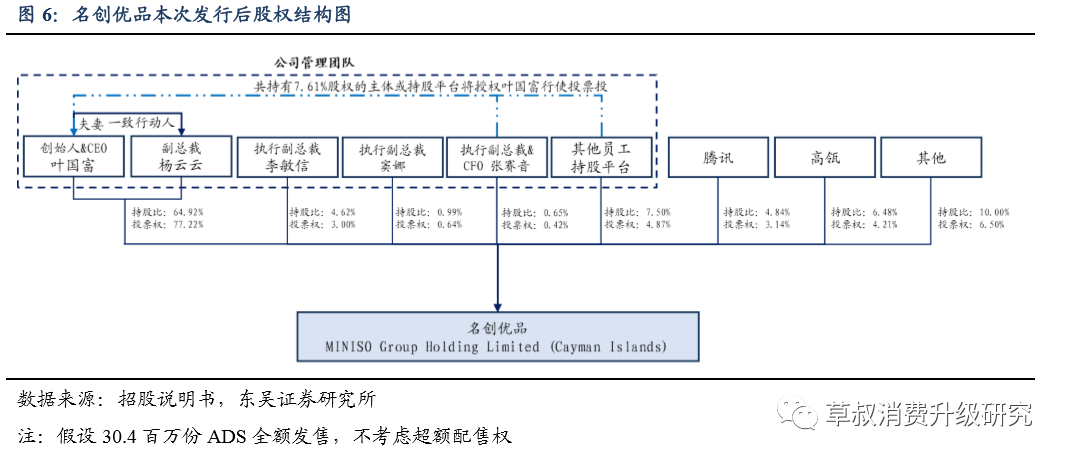

Ownership structure: founder control is stable, employee motivation is sufficient, Tencent Hillhouse shares in a strong alliance

Founder Ye Guofu is a continuous entrepreneur with 20 years of retail experience and a successful business track record. Ye Guofu founded the trendy jewelry brand in 2004, alas, to capture the opportunity of upgrading social high-quality consumption and introduce the new lifestyle collection store model to the Chinese market. More than 2000 chain stores have been realized.

In 2013, Ye Guofu founded MINISO Group, a "young people love shopping" collection store in Guangzhou, China, relying on his product development experience, supply chain and channel resources accumulated while running fashion chains. The company's management team has more than 16 years of relevant industry experience; from China's leading retail companies, they have extensive expertise in a wide range of business areas such as commodities, finance, store operations and supply chain management.

The founder's shareholding is concentrated, and the different rights of the same shares ensure stable governance. This time IPO has actually issued 30.4 million copies of ADS. If the over-allotment right is not considered for the time being, founder Ye Guofu and his wife Yang Yunyun (the two acting in concert) will hold 64.92% of the company, and the shares will still be concentrated. At the same time, after the issue, the company will immediately start different right structures of the same shares, and 27% of the shares held by Ye Guofu and Yang Yunyun will be converted into Class B shares, with voting rights equal to 3 Class A shares.

In addition, the 7.61% stake held by part of the company's equity incentive platform (representing 4.94% of the voting rights) will authorize Ye Guofu to exercise the voting rights, so Ye Guofu's actual voting rights will total 82.2%, and the corporate governance structure will remain stable. The equity incentive is sufficient, and the employees and the company grow together. In September 2020, the company updated the equity incentive plan and granted employees restricted stocks and options, of which the maximum number of equity incentives was about 147 million shares. including 92.586 million shares issued to the employee shareholding platform through restricted stocks and options and 54.715 million shares to be issued in the future.

As of the date of disclosure of the prospectus, the company has granted 14.0575 million shares (about 1.16% of the post-offering) options (20% of the exercise exercise for 5 years and 20% of the annual exercise). You can buy one Class A share at a price of 36 cents per share) and 77.1846 million restricted shares (about 6.35 percent after this offering). Full equity incentive binds the interests of the company with the interests of employees, drives employees' enthusiasm and grows together with the company. Tencent Hillhouse enters the bureau, and the combination of strong and powerful forces can grow in the future.

On September 30th, 2018, Tencent and Hillhouse Capital invested 1 billion yuan in MINISO Group, each with a 5.38% stake. Hillhouse continues to subscribe for 5m ADS shares in the offering, so its stake will reach 6.48 per cent after the offering, while Tencent's stake will be diluted to 4.84 per cent. After Tencent and Hillhouse buy shares in MINISO Group, they will bring more possibilities to MINISO Group's future.

In April 2020, MINISO Group jointly signed Tencent's national mobile game "Arena of Valor" and launched hundreds of products, attracting a large number of fans. In the future, in addition to the possibility of more IP co-signatures, there is the possibility of in-depth cooperation in many dimensions such as WeChat Mini Programs Mall.

two。 Household daily "ten yuan shop": broad space, good track, good business through the cycle

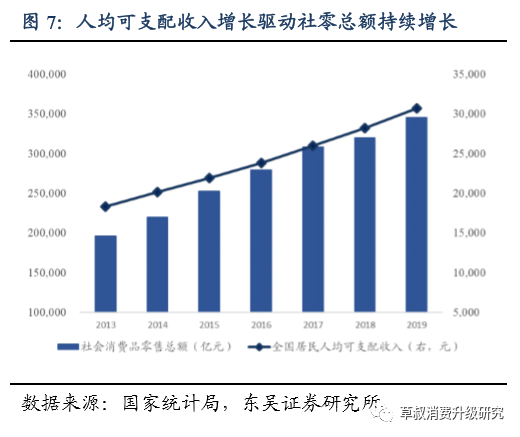

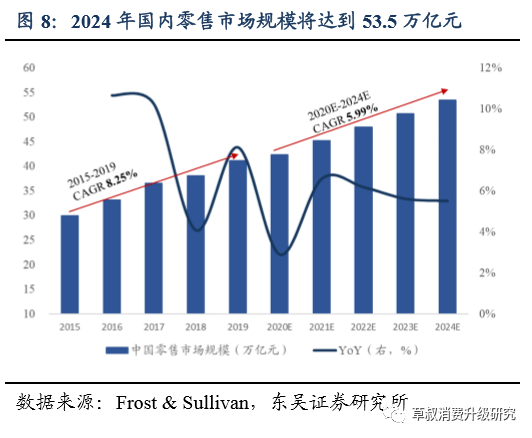

With the rapid growth of China's GDP, China's retail market has achieved rapid development in the past 30 years. According to the National Bureau of Statistics, the per capita disposable income of residents increased from 18310.8 yuan in 2013 to 30733 yuan in 2019, with a CAGR of 7.5 percent, driving the sustained growth of household consumption expenditure. According to the forecast of Frost & Sullivan, the domestic retail market of 20E-24E will maintain a compound growth rate of nearly 6% and reach 53.5 trillion yuan in the next five years.

2.1 Home daily use: a high-growth blue ocean market, a promising track

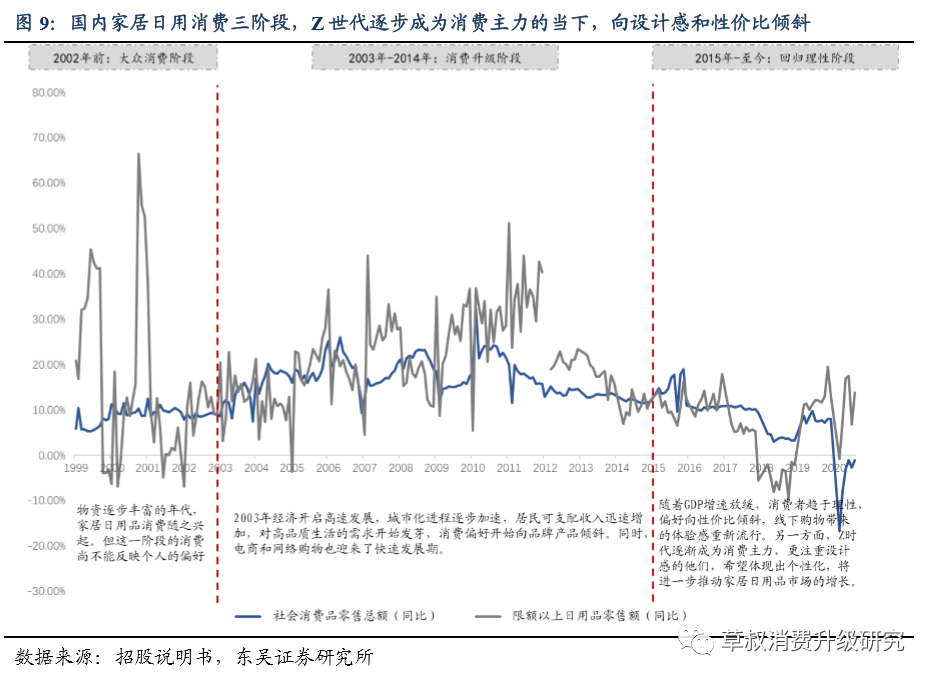

Daily necessities usually refer to a variety of consumer household products, such as personal care products, bags and accessories, small electronic products, textiles, toys, stationery, digital accessories and consumer goods. In the past two decades, with the promotion of excellent brands and products such as Ikea, it has also achieved rapid development. According to the Frost & Sullivan report, the development of China's daily necessities market can be divided into three stages:

(1) the stage of mass consumption (before 2002): with the gradual abundance of materials, household commodity consumption is on the rise. However, consumption at this stage does not reflect personal preferences, and hypermarkets are more popular. With the economic development and the improvement of residents' living standards, the brand awareness of Chinese consumers began to be established.

(2) consumption upgrading stage (2003-2014): in 2003, the economy began to develop rapidly, the process of urbanization gradually accelerated, the disposable income of residents increased rapidly, the demand for high-quality life began to sprout, and consumer preferences began to tilt towards brand products. At the same time, e-commerce and online shopping have also ushered in a period of rapid development.

(3) returning to the rational stage (from 2015 to the present): in 2015, the growth rate of China's real GDP slowed down, consumers tended to be rational, and their preference for more cost-effective and functional daily necessities; at the same time, the sense of experience brought by offline shopping became popular again. On the other hand, Z era has gradually become the main force of consumption, and they, who pay more attention to the sense of design, hope to reflect personalization, which will further promote the growth of China's household commodity market.

Household daily use high growth good track, is expected to give birth to industry giants. According to Frost & Sullivan, China's household retail market is one of the fastest growing segments of the retail market, growing from 2.6 trillion in 2015 to 3.7 trillion in 2019, with CAGR reaching 9.4%, faster than the retail market as a whole.

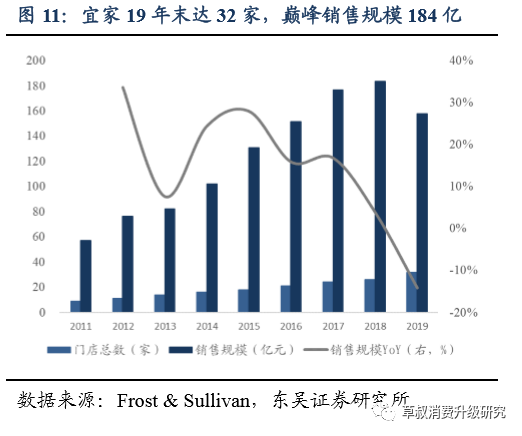

According to Frost & Sullivan, it will grow from 10.8% CAGR to 5.4 trillion in the next five years, and there is plenty of room for industry growth. At the same time, the daily home track is still in a blue sea. Ikea has developed in China for more than 20 years, with 32 stores at the end of 2019 and a sales peak of 18.36 billion in 2018, with an estimated market share of only 0.5 per cent. Therefore, it is expected that giant enterprises will be born in the household daily racetrack.

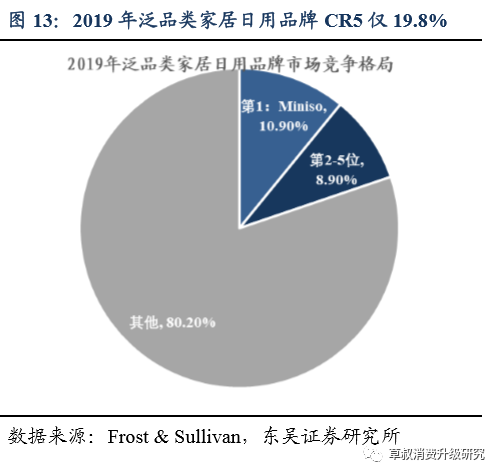

The market pattern of ubiquitous household household brands is scattered, and the leading concentration can be improved. In terms of subdivision, the household retail market can be subdivided into three categories: universal household household brands, single-category brands and hypermarkets. MINISO Group belongs to the universal household daily brand, selling multi-category private brand products, through fashionable design and excellent performance-to-price ratio to attract young consumers.

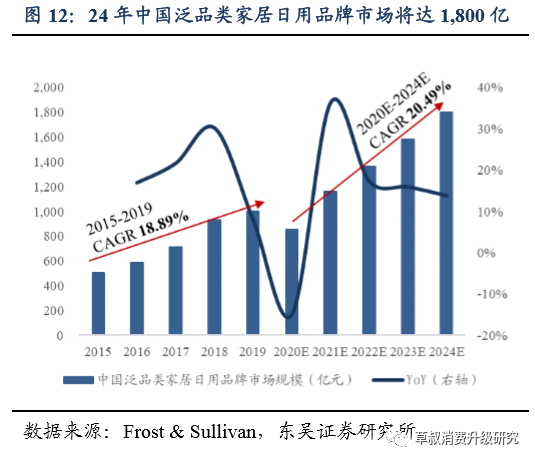

According to Frost & Sullivan statistics, the CAGR of the market has reached 18.9% in the past five years, while it will continue to maintain a compound growth rate of about 20.5% in the next five years, and the market size is expected to reach 180 billion yuan in 2024. At present, the market pattern of this subdivided track is extremely fragmented. At present, there are more than 1000 players in the domestic market, while MINISO Group occupies 10.9% of the market share with 11 billion GMV in 2019, becoming the first in the industry. The combined market share of 2-5 competitors is about 8.9%, still less than that of MINISO Group. In line with the industry trend, the ultimate product power of excellent design and performance-to-price ratio will become the source of brand strength, combined with extreme supply chain and extreme logistics and digital system will build a leading moat and continue to enhance the market share of the industry.

2.2 "Ten Yuan Store": a good format with counter-cyclical growth and strong vitality.

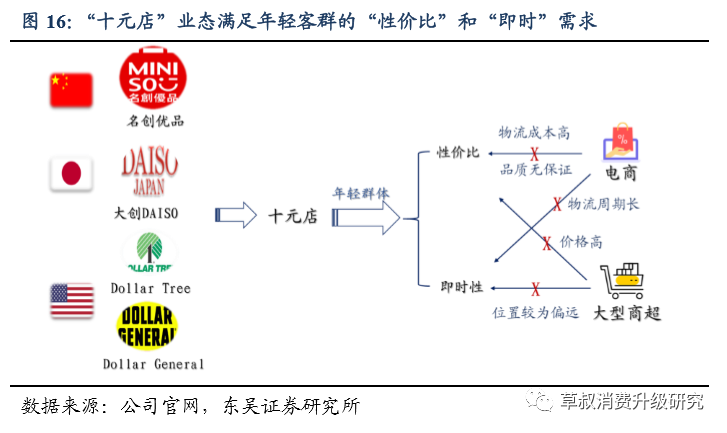

The Japanese hundred-dollar store represented by Dachang, the American one-dollar store represented by Dollar Tree and Dollar General, and the Chinese ten-yuan store represented by MINISO Group are essentially the same. After exchange rate conversion, the prices of the three types of stores basically coincide with each other, all around 10 yuan. The "ten yuan stores" are relatively close in terms of location, selection and customer base, and most of them are located in commercial districts with large passenger flow, focusing on high-frequency and low-order daily necessities, such as towels, slippers, paper towels, small snacks, small digital accessories, etc., mainly aimed at students, small white-collar workers and other young consumers.

2.2.1 "Ten Yuan Store": strong vitality and extensive prosperity in different countries and cultures

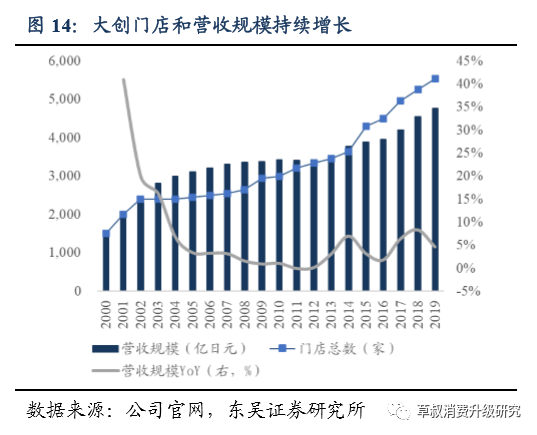

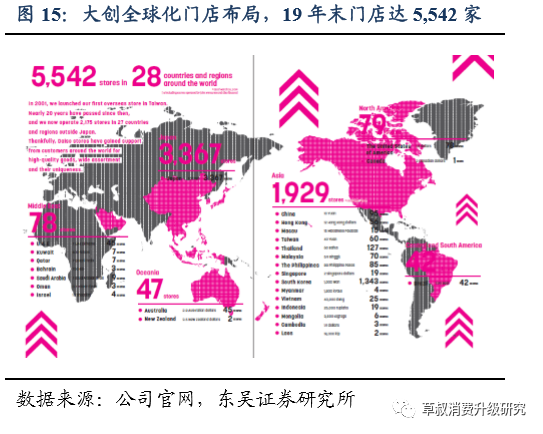

The format of "ten yuan store" has strong vitality and is widely prosperous in different countries and cultures. In Japan, "Ten Yuan Store" represents Dacheng DAISO to open a total of 5741 stores (as of February 20, there are 3493 in Japan and 2248 in 26 countries and regions), with a revenue scale of more than 30 billion yuan (March 31, 2019). Together with Seria, CanDo and Watts, they constitute Japan's four 100-yuan store giants.

In the United States, the typical dollar store represents Dollar tree and Dollar general, which currently have a market capitalization of more than $20 billion and $50 billion, respectively. MINISO Group, a representative of China's "10-yuan store", has opened more than 4300 stores in more than 80 countries and regions in the world in only seven years, with a 2019GMV of 19 billion yuan. So what kind of magic does the "ten-dollar store" have to develop widely all over the world?

The core is that the "ten-yuan store" meets the "cost-effective" and "real-time" needs of consumers for high-frequency and low-cost household products.Consumers can buy all the household necessities they need at one time in the rich SKU of the "ten yuan store" at a lower cost. Compared with other channels, the logistics cost of e-commerce is higher, American consumers usually have to bear the freight of $3 to $4, and it is difficult for consumers to buy the shopping list at one time in the same online store, which also means additional logistics costs.

Japan, like the United States, has high logistics costs, and its e-commerce development itself is slow. In 2019, China's e-commerce accounted for 24.7% of total social retail sales, 11.0% in the United States, and no more than 10% in Japan. Back home, although e-commerce may be even lower in price, there is a lack of guarantee in quality. Therefore, in terms of performance-to-price ratio, the business format of "ten-yuan store" is better.

And "immediacy", e-commerce and shopping malls and other channels are also difficult to meet. "Ten Yuan Store" mainly focuses on young customers. MINISO Group FY2020 more than 80% of customers are under 40 and 60% are under 30. This group has less living space and less hoarding, so consumption habits tend to be sporadic rather than planned. E-commerce needs to wait for logistics and distribution, while large supermarkets such as Walmart Inc are usually located in the suburbs of Europe and the United States, the transportation convenience is low, and can not meet the "immediacy". Therefore, the "Shiyuan Store" accurately meets the rigid needs of young customers, so it has a strong vitality to thrive in different regions and cultures.

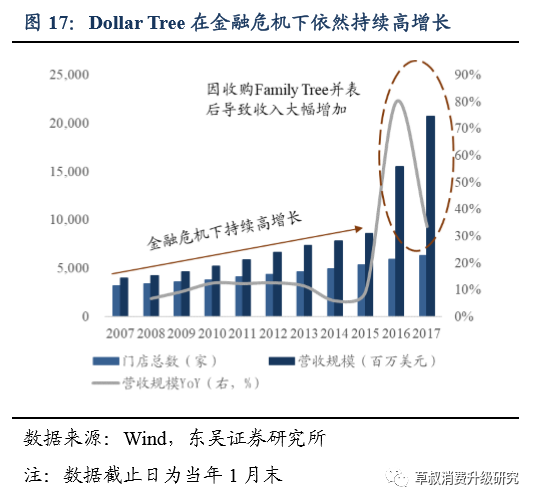

2.2.2 counter-cyclical growth: in the economic downward trend, the "ten-yuan store" is expanding against the trend.

On the contrary, the economic downward cycle is a good opportunity for the development of the "ten-yuan store" format. Japan's Dacheng DAISO is rising in the "lost 20 years". By streamlining the intermediate links of the supply chain, reducing costs, and vigorously expanding SKU, Dacheng provides consumers with rigid demand products with the ultimate performance-to-price ratio, thus achieving rapid growth against the trend.

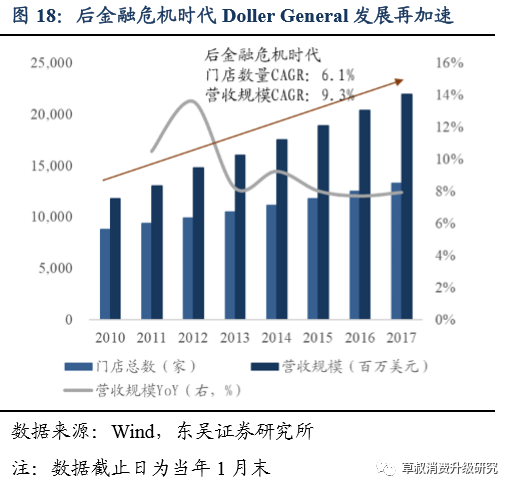

In the decade from the 2008 financial crisis to 2018 in the United States, the representatives of Dollar tree and Dollar general "dollar stores" have also achieved rapid counter-cyclical expansion, second only to Amazon.Com Inc in the retail industry. Low-cost access to shopping happiness and satisfaction is the fundamental reason for the "ten-yuan store" to reverse the trend in the downward cycle. "Ten Yuan Store" has rich SKU format, fashion design sense and high performance-to-price ratio, which can stimulate people's offline demand for "shopping", and the subsequent desire to buy will provide "buy" satisfaction. Although e-commerce has a variety of categories and low prices, the online experience is still unable to provide consumers with the enjoyment of "shopping" and the satisfaction of "buying".

To sum up, the household daily use market is a vast market with a scale of one trillion yuan, and the competition pattern in the industry is scattered at present. In the future, high-quality enterprises comply with the development trend of the industry, build a deep moat, and continue to increase the market share, thus the birth of one or more industry giants can be expected. On the other hand, the format of "ten yuan store" is a good business with strong vitality and can grow through the cycle. at the same time, the extreme performance-to-price ratio and extreme supply chain pursued by "ten yuan store" coincides with the development trend of household daily use market. Therefore, MINISO Group as the current China's "ten yuan store representative", universal household brand leader is a good company in the good track, the future can be expected.

3. Moat: product is king + extremely cost-effective + ultimate efficiency

MINISO Group's values are to adhere to high quality and low prices, rely on the domestic developed light industrial system, focus on the polishing of high-quality products, combine the extremely efficient supply chain system, and adhere to high performance-to-price ratio. ploughing deeply in a good track for daily use of young customers and homes, so as to build a deep moat.

3.1 products are king: practice the concept of "three high and three low" and build competitive advantage with high performance-to-price ratio.

"Product is king" has always been MINISO Group's most important corporate strategy, and the company's product view is to restore the essence of the product, retreat from flashy, return to the original, and make it more fashionable, more reliable and cheaper. Therefore, the company continues to practice the "three high and three low", that is, the product concept of high quality, high appearance, high efficiency and low cost, low gross margin and low price.

As of June 20, MINISO Group has a total of about 8000 core SKU, covering 11 categories of household household items, including household decorations, small electronic appliances, textiles, accessories, beauty tools, cosmetics, toys, personal care, snacks, perfumes, stationery and so on.

3.1.1 Design-driven to create sustainable and high-quality products

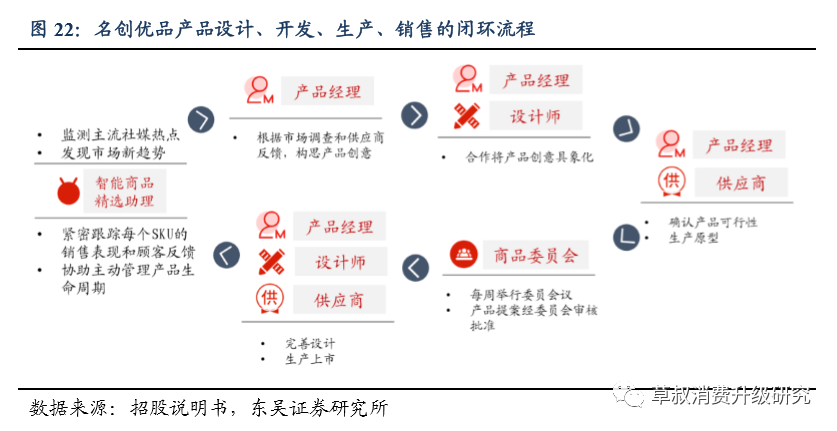

"MINISO Group's most successful place is design," said Ye Guofu, founder of MINISO Group, many times. Through internal and external designers and building designer platforms, the company has gradually established a product concept of series sense, simple style and fashion sense. As of June 20, the company has 100 product managers and 49 internal designers headed by Miyake Shunya, and has also established cooperation with 25 internationally renowned designers and studios from 8 countries. The company will pay for the design on a fixed basis or in the form of sales commission (with a cap), and own the complete intellectual property rights of the design.

As of June 20, the company has won 28 international design awards, including iF, Red Dot Award and so on. The company has established a platform design team and a mature closed-loop process of product design, development, production and sales. Under the continuous original design output, the company will maintain the long-term product strength advantage and adhere to the essential strategy of "product is the king".

3.1.2 "711" philosophy, quickly iterate up to the new, close to the trend of consumption

7 days on the new, fast iteration, to maintain the diversity and uniqueness of the product. MINISO Group now has 8000 core SKU, but the company has not stopped the pace of innovation and iteration, adhering to the "711" philosophy of its selection, that is, every 7 days, 100 new SKU are carefully selected from a creative library of as many as 10000 products to iterate and update existing products. FY2020, the company launches more than 600 new SKU per month, demonstrating amazing product development and iterative capabilities.

At the same time, Mingchuang's merchandise team has special personnel responsible for product buyers and R & D personnel, capturing the most cutting-edge information in the world, delving into the design and development of new products, and paying close attention to the core customer base, that is, the consumption trend of young people. As short as 7 days of the new cycle means that there will be new products on the market every week, continue to stimulate consumers' sense of freshness and desire to buy.

3.1.3 continue to launch joint fashion styles in cooperation with the world-renowned IP

As of June 2020, MINISO Group has successively worked with 17 world-renowned IP including HelloKitty, Naked Bear, Pink Panther, Sesame Street, Imperial Palace Culture, Marvel, Mickey Mini, Coca-Cola Company and so on. Through the cooperation with the well-known IP, the joint popular style is launched to reach more consumers and enhance the recognition and influence of the brand. FY2020, the company launched a total of 2300 joint SKU, but also to launch blind boxes and other popular product forms to stimulate consumers' desire to buy. The company will continue to promote IP cooperation and joint merchandise in the future.

On May 16, 2020, MINISO Group officially announced Wang Yibo and Zhang Zifeng as the global spokesmen of the brand, and launched a new brand slogan: "just go wild, MINISO Group", which means that if everyone can cast a little wild, the world will be a better place. Once again, MINISO Group shows his vision of becoming an attitude and warm consumer brand with a better understanding of young people, which is expected to attract more young consumers.

3.2 extremely cost-effective: in-depth cooperation to establish an efficient supply chain system with long-term mutual benefit with suppliers to enable the supply chain to achieve the "ultimate cost performance" product strategy.

Relying on the strong domestic light industry system, MINISO Group has established cooperative relations with more than 600 high-quality suppliers through the unique supplier cooperation model of "pricing by quantity, buyout and customization, and non-pressure payment". Direct mining mode, shorten the intermediate chain, effectively reduce the cost. The company purchases directly from suppliers, omits all intermediate links, forecasts market demand through the grasp of market trends and trends in product development, forms large-scale procurement, sets prices by quantity, and reduces procurement costs.

Ninety-five percent of FY2020's goods retail for less than 50 yuan. Introduce suppliers to deeply participate in product development to form an exclusive source of goods. In MINISO Group's product development and design process, suppliers are not only external manufacturers, but also work closely with the company's product managers and designers to quickly iterate and customize new global trend products to form an exclusive high-quality supply. No pressure on the payment, the formation of long-term mutual trust with suppliers. The company implements rapid settlement for suppliers and does not owe suppliers. The turnover of accounts payable by FY2020 is only 31.4 days. The company will also help suppliers improve production efficiency and cost control, and establish long-term mutual trust and reciprocity with suppliers.

Under its unique supply chain system, the company has attracted a wide range of well-known high-quality suppliers, such as Yingtri (Dior, YSL, Chanel, etc.), Chihuaton (perfume suppliers for Hermes, Dior, Chanel, etc.) and Ka-shing Industries (one of the largest manufacturers of stainless steel tableware in China). These suppliers all have rich experience in cooperation with international brands. It has the ability to meet the production needs of the brand with low cost and high efficiency.

With the support of high-quality suppliers and efficient supply chain system, the company has formed an extremely cost-effective product matrix with high quality and low price. On the other hand, through extensive cooperation, the company realizes that the supply proportion of a single supplier is no more than 10%, fully reducing the risk of relying on a single supplier.

3.3Ultimate efficiency: warehouse Logistics + IT system to establish efficient Operation system

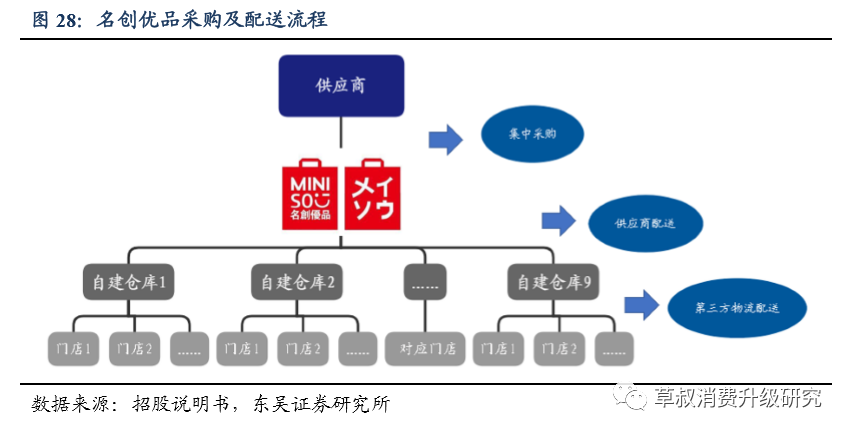

3.3.1 self-built warehousing covers the whole country and outsourced logistics, greatly improving the efficiency of distribution

If the store is the appearance, the commodity is the soul, then the warehousing logistics and system is the nerve and brain. Most of MINISO Group's stores are about 200m2, and the outer warehouse is very small, and the average inventory of the store is only about two days, which means that it needs to be delivered once every two days on average, which is highly dependent on the operation of the supply chain. small batch, high-frequency distribution often means higher error probability and logistics costs. MINISO Group established an efficient warehousing and logistics system under the centralized procurement and unified distribution mode through self-built warehousing and third-party logistics. As of June 30, 2020, MINISO Group has 18 warehousing centers, 9 of which are located in China, mainly located in Guangzhou, Jinhua, Wuxi, Wuhan, Chengdu, Xi'an, Langfang, Shenyang and other places, all of which are large warehouses with an area of more than 20, 000 square meters. The largest warehouse in Wuhan is 30, 000 square meters.

After centralized procurement, the company will send the products to the designated warehouse through the supplier and bear the corresponding logistics costs, and then distribute the products to each store through the third-party logistics company. Under the mature mode of centralized procurement and unified distribution, MINISO Group's commodity turnaround time has been shortened to the maximum, of which the turnaround time in China is no more than 21 days. On the other hand, in the mode of distribution, MINISO Group chose small batch and high-frequency distribution, and achieved a distribution error rate of only 3/100000 under this mode, and the logistics expenses of FY2020 accounted for less than 2% of the revenue.

3.3.2 go deep into the digital management of the operation system and build technology-based retail

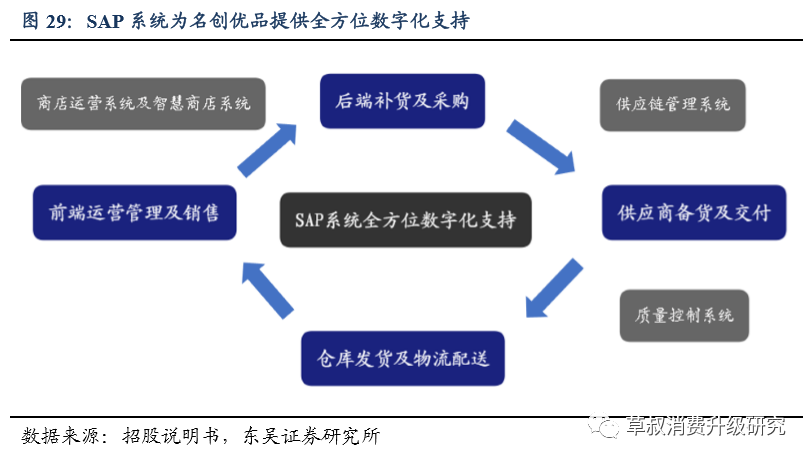

Cooperate with SAP and IBM to improve the efficiency of operation and management with the help of cutting-edge software and hardware technology. Since 2018, MINISO Group has worked with IBM Services to build a global business operation service platform with SAP S4/HANA as the core system, and through big data's analysis and decision-making, it has realized omni-directional digital changes, including commodity planning, supply chain, retail operation, finance, logistics, human resources, etc., in order to realize the fine operation of global integration. at present, unsalable goods have been halved in online countries. The inventory turnover is increased by 1/3 and the human efficiency is doubled.

This SAP ERP system has different subsystems and related modules, and can also be integrated with other technical systems, so as to achieve data sharing and better coordinate functions. Under the SAP system, MINISO Group can adjust the moving line of products at the front end through the data center, and achieve accurate purchasing and replenishment, rapid turnover and omni-directional digital change at the back end.

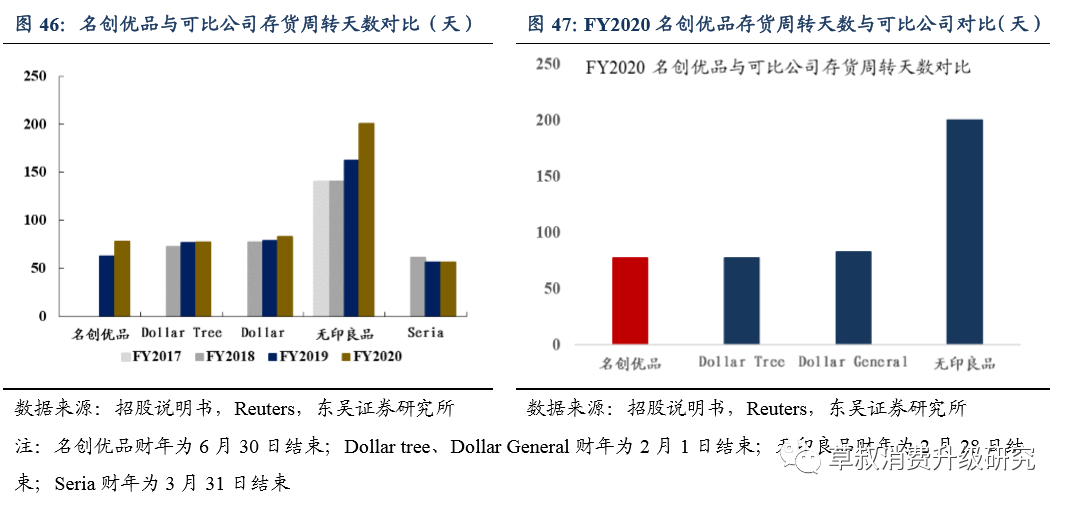

(1) supply chain management system: connect suppliers to coordinate production and achieve efficient inventory management. According to the real-time inventory level and store sales, the sub-commodity display and purchasing module of the system can automatically generate certain scale orders and reorders to suppliers; the automatic replenishment module can adjust the inventory replenishment process of stores and adjust the stores with slow flow of SKU in time to reduce inventory risk. MINISO Group's average inventory turnover days in FY2019 and FY2020 are 63 and 78 days respectively, which is lower than that of comparable companies such as Dollar Tree, Dollar General and MUJI.

(2) online quality control system: realize the visualization of standard quality inspection program. Under this system, MINISO Group's suppliers and franchisees can detect and correct any product quality problems.

(3) Smart Store system: improve the operation and management of most Chinese stores. The intelligent store system can realize data collection, consumer behavior pattern analysis and remote store management. Based on the purchase and access records of big data, it can identify the consumption trend of each customer group and adjust the purchase category and product display of the store. As of June 30, 2020, the smart store system has covered about 60% of MINISO Group stores in China.

(4) Store operation management system: it is mainly used to assist the daily management of stores, such as manager assistant program, mobile store workstation, etc., which can provide the manager with real-time inventory, product trends, price changes and other important operational indicators and analysis.

3.3.3 Digital boost the development of new online channels, forming online and offline experience resonance

Expand cooperation with third-party e-commerce platforms to enhance consumers' sense of shopping experience. The company is committed to providing consumers with omni-channel seamless shopping experience. Consumers can directly use the "Mingchuang Code Shopping" Mini Program's "self-service cashier" function to scan the code and settle the bill, eliminating the need to wait in line for checkout.

In addition to shopping at the store, consumers can also choose a suitable store in "MINISO Group" Mini Program to place an order and enjoy "intra-city express delivery", "goods free delivery" and other concessions. Conforming to the new era of marketing, WeChat Mini Programs started live streaming with goods. In the "studio" section of "MINISO Group" Mini Program, consumers can watch live broadcasts and playback of products to enhance the experience of online shopping. Membership programs enhance the sense of consumer participation.

In addition, MINISO Group continues to upgrade the membership program, such as providing members with full discount, birthday gifts, preemptive purchase of IP goods and other benefits, to further expand the membership base and enhance brand loyalty, thus further promoting the increase of customer flow and single-store GMV.

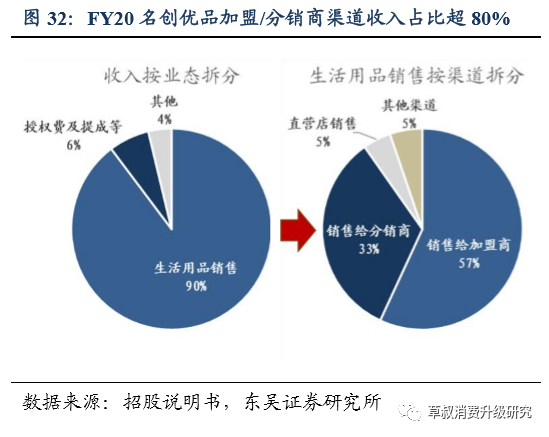

4. Business model: "one-stop" strong control franchise system drives the rapid expansion of light assets

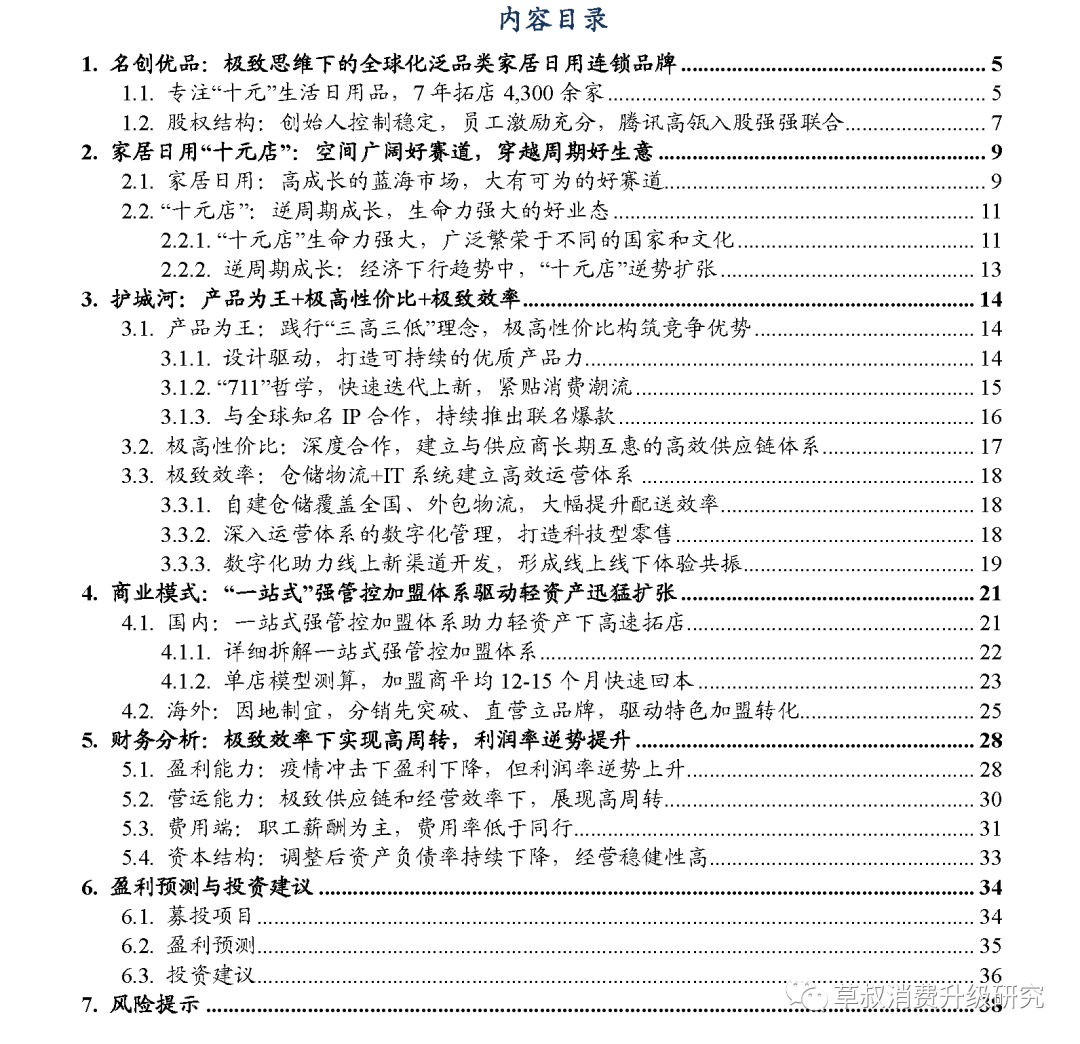

Behind the fast-growing number of global stores and revenue scale is MINISO Group's core business model: an one-stop franchise model with strong management and control features, so that the company can expand rapidly while still operating with light assets. In terms of income composition, MINISO Group's main source of income is the sale of furniture daily necessities through franchisees / distributors, with FY2020 joining / distribution channels accounting for 80.9 per cent and direct operations accounting for only 4 per cent. From a regional point of view, FY2020's domestic and overseas revenues account for 67.3% and 32.7% respectively. In different regions, the expansion model of famous creative products is also different.

4.1 domestic: one-stop strong management and control joining system helps to develop high-speed stores under light assets

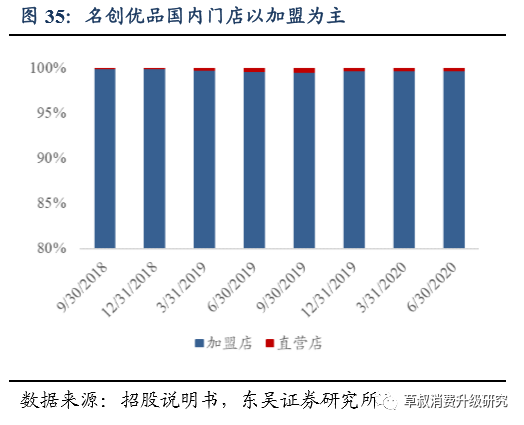

As of June 30, 2020, MINISO Group had 2533 stores in China, 99.7% of which were franchise stores and only 7 self-owned stores. Relying on the franchise model, the company maintained an average of 77 new stores per quarter before the health event.

4.1.1 disassemble the one-stop strong management and control alliance system in detail

One-stop strong control joining mode helps light asset expansion. MINISO Group calls his characteristic joining model "MINISO Group retail partner" model, which combines the respective advantages of the traditional joining model and the direct operation model, which not only realizes the rapid expansion under joining, but also ensures that the brand strength will not be damaged.

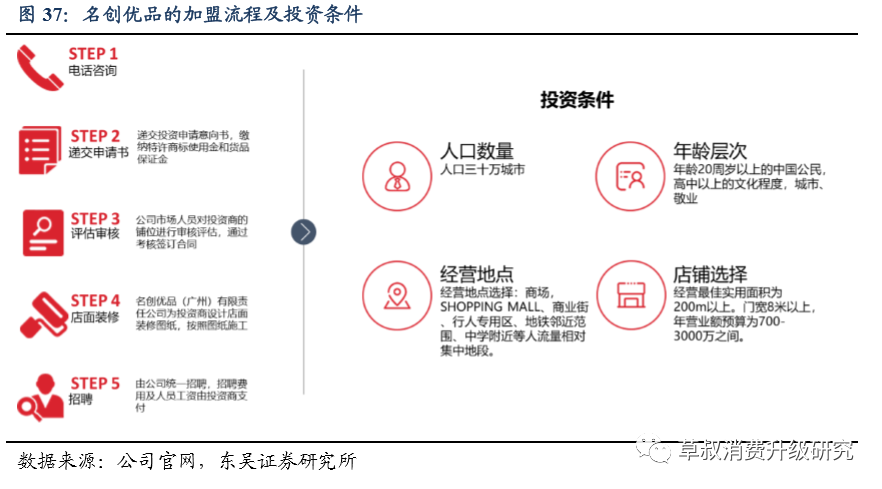

Franchisees generally sign a contract with MINISO Group for 3 years. Among them, the franchisee mainly assumes the role of the capital side. The franchisee pays MINISO Group 80, 000 yuan per year (in the case of a single store) for the use of the licensed trademark, and undertakes the initial investment in opening the store (including store decoration, shelf equipment, etc.), as well as the main daily operating expenses of the store (including rent, labor, electricity, industry and commerce and taxes), so that the company can expand in a light asset mode. On the other hand, the store operation is comprehensively managed and exported by MINISO Group, and MINISO Group will be responsible for the background operation of the store (including background system, logistics and distribution, etc.), fully responsible for store design, recruitment and training of shop staff, and other store operation affairs, thus realizing MINISO Group's strong management and control of the store.

Further, under MINISO Group's joining mode, the core is:

(1) the system of margin for goods. Commodity margin is a mechanism widely used by international fast fashion brands such as Himm, ZARA, Uniqlo and so on. Under this mechanism, the franchisee pays an one-time deposit (750000 yuan per store) at the time of joining, including the first distribution and the deposit for each purchase. After payment, payment will never be charged for each purchase. Therefore, franchisees no longer need to bear inventory pressure and market operation risks; supply and inventory management are undertaken by MINISO Group. Therefore, the rate of return of franchisees is much higher than the traditional buyout system. After the expiration of the contract, MINISO Group will refund the deposit in full.

(2) the system of allocating profits according to turnover the next day. Without taking inventory risk, the franchisee's income comes from MINISO Group's investment profit distribution policy. MINISO Group will transfer 38% of the daily turnover (deducting VAT, additional tax, etc.) (33% for food) as the franchisee's income and transfer it to the franchisee's account the next day.

Through this joining mode, MINISO Group provides the franchisee with an one-stop joining experience, which does not need the franchisee to bear the pressure of store operation and inventory, but also realizes the strong control of the store and ensures MINISO Group's brand strength. At the same time, through the distribution system to protect the interests of franchisees, to achieve MINISO Group and franchisees win-win.

Strong management and control to ensure brand strength, committed to long-term growth. Compared with the traditional "loose" joining, MINISO Group's one-stop strong control joining model can better control the quality and ensure the brand strength. In the traditional joining mode, the brand only charges the brand usage fee and is responsible for shipping, and the franchisee is responsible for the specific operation and management. At this time, franchisees may damage the long-term value of the brand because of their own interests.

4.1.2 according to the single store model, the franchisee pays back quickly in 12-15 months on average.

MINISO Group's investment joining process is simple and clear, and the investment conditions are mainly for the assessment of store property, which requires that the area of the store is about 200m2, and the location needs to be concentrated in shopping malls, commercial streets and other places; at the same time, in order to ensure store passenger flow, the company will not open a second store within 2.5km of a store.

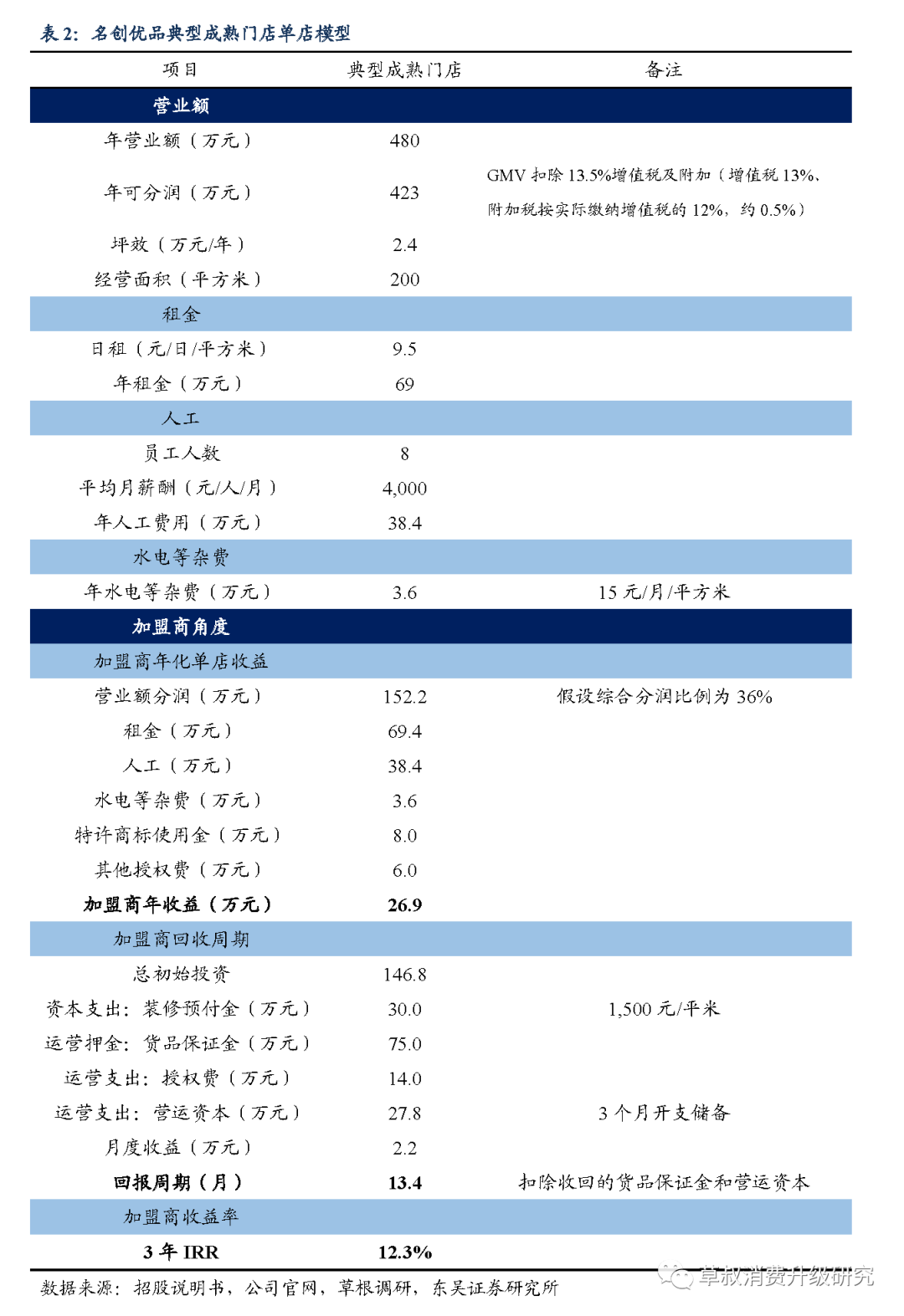

MINISO Group has an average of 2378 stores in China in 2019, corresponding to 11 billion yuan in GMV, and the average turnover per store is about 4.18 million yuan. Considering the net opening of 289 stores in 2019, the turnover of mature stores is about 4.8 million yuan. We take the single store with an annual turnover of 4.8 million yuan as a reference to disassemble the single store model.

From the franchisee's point of view, MINISO Group project cash flow stability (the next day settlement profit, the average annual income of about 269000 yuan), fast return cycle (about 13.4 months), high long-term yield (three-year IRR up to 12.3%), while famous quality products provide one-stop management output, but also bear the risk of inventory, therefore, MINISO Group's "franchise store" is more like an excellent financial product with entities. Under the background of the lack of sufficient high-quality investment channels in the current market, especially in the sinking market, MINISO Group is undoubtedly a great attraction to franchisees.

Fast payback in 12-15 months, high yield to enhance brand loyalty. According to Frost & Sullivan, under MINISO Group's one-stop franchise system, franchisees can usually recover fixed investment costs within 12-15 months after opening a store; excellent returns correspondingly increase franchisees' brand loyalty. As of June 20, 488 of the company's 742 retail partners had joined Mingchuang for more than three years, accounting for 65.7%.

4.2 overseas: according to local conditions, distribution is the first to break through, directly run the brand, and drive the characteristics to join and transform.

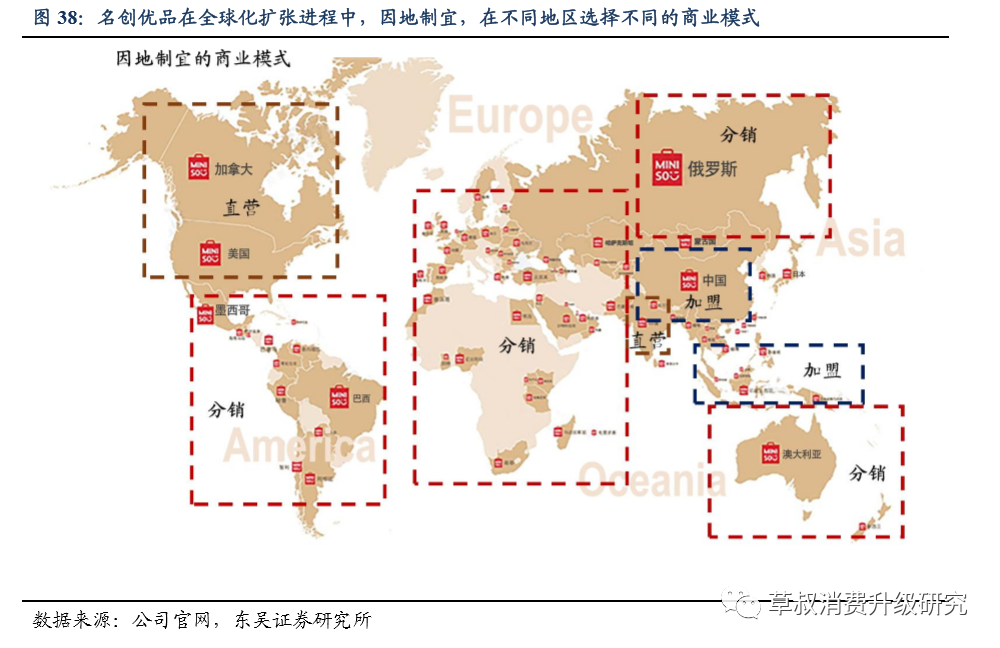

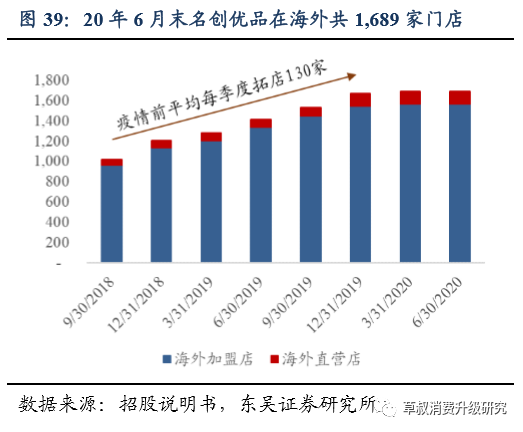

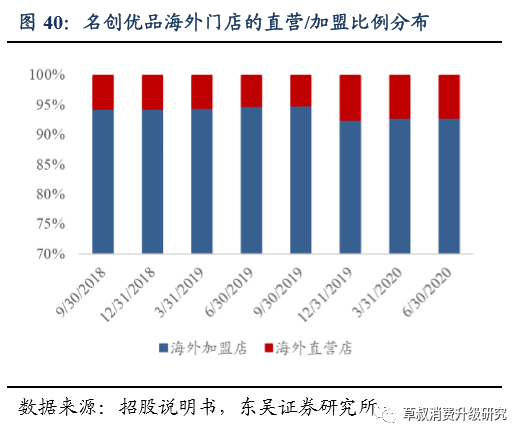

MINISO Group began to expand globally in 2015, expanding rapidly in Southeast Asia, America, Eastern Europe, the Middle East and other places. As of June 20, it has covered more than 80 countries and regions, and the company has opened an average of about 130 stores overseas every quarter before the health incident. In different countries and regions, the company also adopts different business models, mainly including direct marketing, distribution and joining.

As of June 30, 2020, MINISO Group has a total of 1689 stores overseas, of which 122 are directly operated stores, mainly in populous countries such as North America and India, while 1567 stores are franchisees, but most of them are traditional "loose" franchise-distribution models. in Indonesia and other regions mainly adopt the "one-stop" franchise model.

The core advantage of MINISO Group going out to sea is still the domestic developed light industry supply chain. At present, China has incomparable light industrial production capacity and supply chain advantages compared with other countries or regions, not only the cost can be controlled, but also excellent quality and variety. Based on this, MINISO Group's entry into overseas markets is also along the weak light industry in "Belt and Road Initiative", such as Southeast Asia, Eastern Europe, the Middle East and so on. Under the background of insufficient supply of local low-cost light industrial products, MINISO Group stimulates local consumer demand with a variety of categories and a very high performance-to-price ratio.

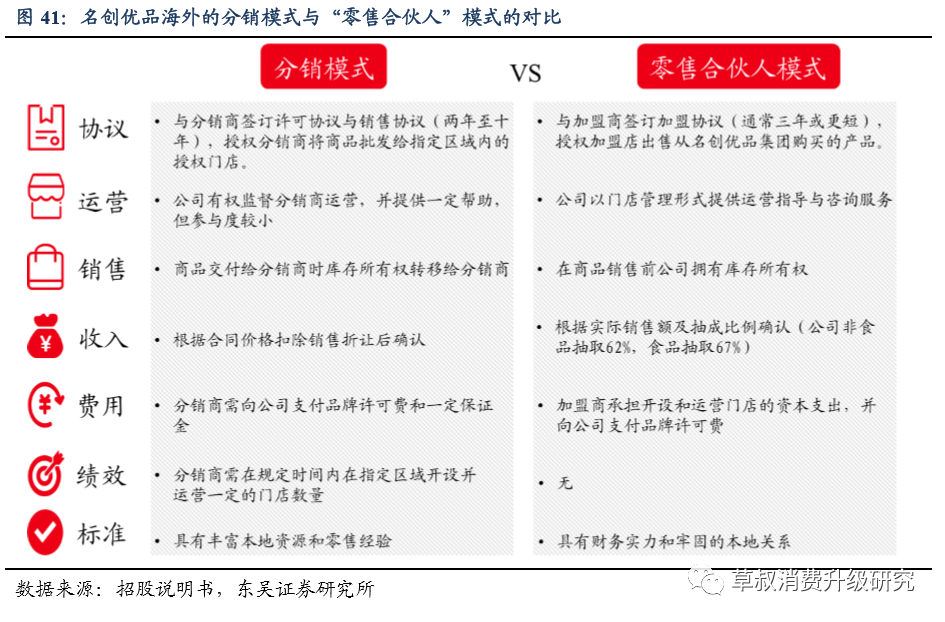

The overseas model adapts measures to local conditions, giving priority to the distribution model, supplemented by direct marketing, driving the transformation to the franchise mode. For large populous countries such as North America and India, due to the large market potential, the company will choose to enter the local area with direct operation mode, establish brand and awareness, and drive more stores to be transformed into franchise mode in the future. While other countries take into account the potential market brought by the local population environment and the comparison of direct investment resources, combined with the local language and cultural conditions, most companies choose the distribution model when going out to sea.

Compared with the distribution and the company's one-stop strong control joining mode, the distribution model is closer to the traditional "loose" joining mode. The company selects local distributors or agents with rich local resources and retail operations to cooperate, and the distributors buy out the goods and distribute them to the authorized stores in the designated area, while MINISO Group has less participation in the distributors. Under the current overseas model, direct stores and authorized stores under distribution are expected to attract potential franchisees with excellent performance and transform to strong regulatory franchisees.

Compared with China, MINISO Group's overseas profit situation will be better. In a highly competitive country, MINISO Group must maintain its cost-effective product power advantage. But in regions where light industrial products are scarce and incomes are relatively high, such as the Middle East, consumers are less sensitive to prices, and MINISO Group is expected to make higher profits.

5. Financial analysis: achieve high turnover under extreme efficiency and increase profit margin against the trend

5.1 profitability: profits decline under the impact of health events, but profit margins rise against the trend

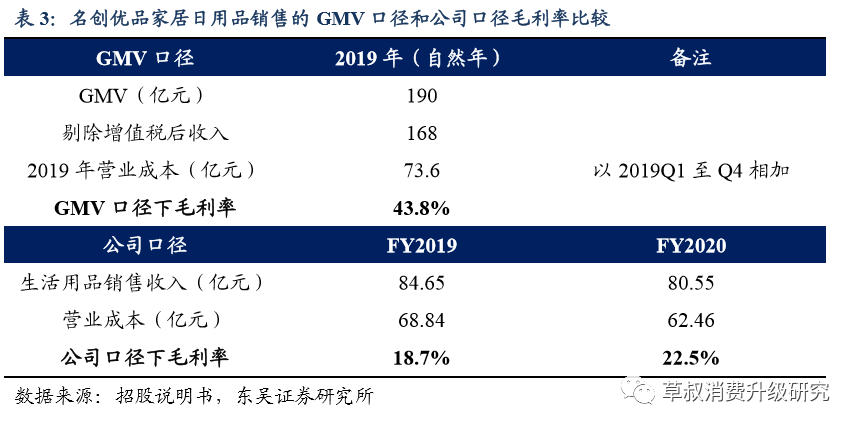

Relying on the domestic developed light industrial system, the gross profit margin under the GMV caliber can reach about 43.8%. Since the company's main business costs are actually the sale of inventory, the gross profit of the company's products can be calculated based on this. Under the GMV caliber, if the company's GMV reaches 19 billion yuan in 2019, the income after excluding VAT is about 16.8 billion yuan, corresponding to the operating cost of about 7.36 billion yuan, and the gross profit margin reaches 43.8%. Under the caliber of the company, FY2020 achieved an income of 8.055 billion yuan in daily necessities sales, a corresponding cost of 6.25 billion yuan, and a gross profit margin of 22.5% (+ 3.8pct), mainly due to the launch of more FY2020 joint products with high gross margins.

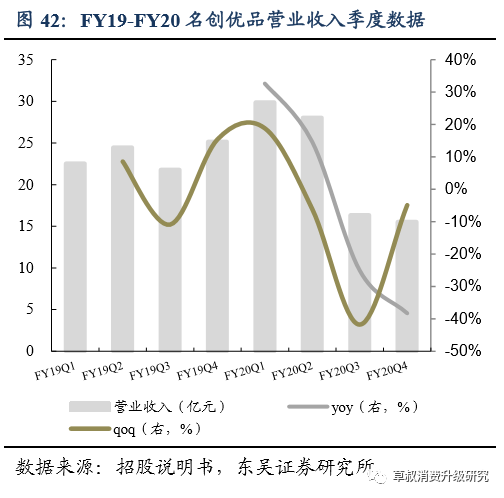

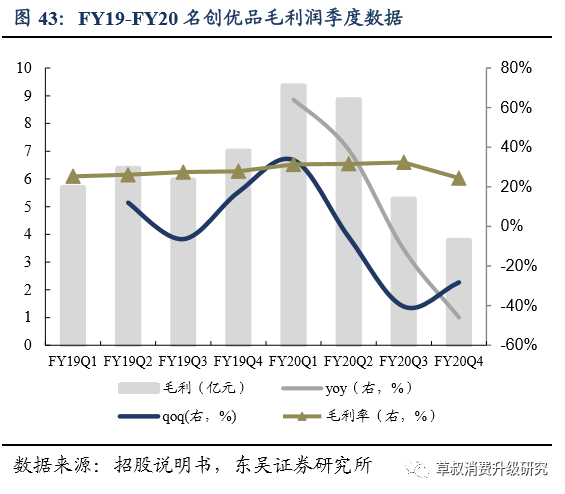

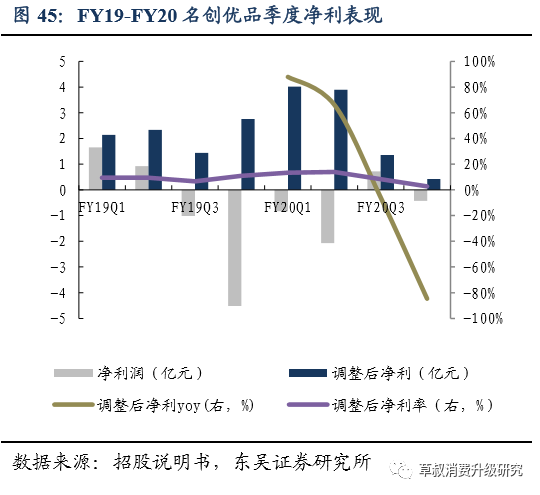

The profitability of the company improved steadily before the health event, and the net profit was still positive after the adjustment under the health event. Judging from the quarterly data, MINISO Group maintained a rapid growth momentum before the health incident. FY20Q1/FY20Q2 's operating income is 28.89 / 2.804 billion yuan (+ 32.65% picket 14.62%) and gross profit is 9.37 / 887 million yuan (+ 64.11% picket 38.78%). The company's gross profit margin increases steadily over the quarter. FY19Q1-FY20Q2 gross profit margin is 25.4% FY19Q1-FY20Q2 26.1% FY19Q1-FY20Q2 27.5% 27.9% 31.4% 31.7%, mainly due to:

1) as a result of the scale effect brought about by store expansion, the total number of global stores has increased rapidly from 3178 at the end of FY19Q1 to 4222 at the end of FY20.

2) further optimize the supply chain cost management; 3) continue to launch a series of joint products with higher gross profit margin. In 2019, the company launched 2000 peripheral products in cooperation with Marvel, and was authorized by South Korea's Kakao Friends to develop joint products. In 2020, the company launched hundreds of joint products jointly with Arena of Valor. As retailers dominated by offline sales, the performance of FY20Q3 and FY20Q4 was significantly affected by health events. FY20Q3/FY20Q4 's operating income was 16.33 / 1.553 billion yuan (- 25.07% Charley 38.27%), and its gross profit was 5.28 / 379 million yuan (- 11.68% Compal 45.96%).

As most of the company's products are high-frequency and low unit price products, the consumption habits of residents in the post-health event era will pay more attention to performance-to-price ratio, and it is expected that there will be a stronger recovery after the relaxation of health incident prevention and control measures; domestic health incident prevention and control effect is better, store data will be the first to recover, overseas markets still need to observe the situation of health events.

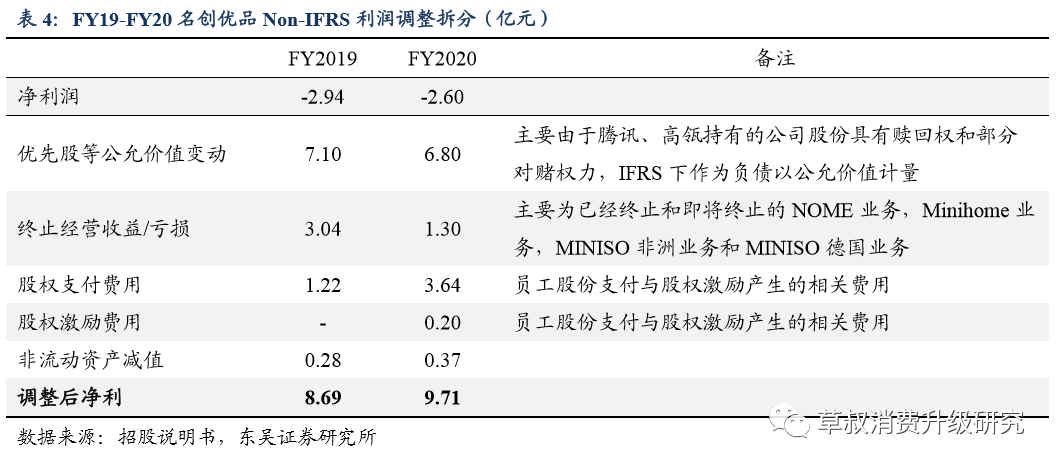

Under the IFRS standard, the company's FY2019/FY2020 net profit is-2.94 /-260 million yuan respectively, while the adjusted net profit is 8.69 / 971 million yuan, and the adjusted net interest rate is 9.25% 10.81%. During non-health events, the adjusted net profit rate of FY20Q1/FY20Q2 is 13.47% and 13.9%, respectively. The company still has good profitability under the cost-effective strategy.

Take FY2020 as an example, the Non-IFRS adjustment part includes: the fair value change of 680 million yuan (mainly because the company shares held by Tencent and Hillhouse are preferred shares with redemption rights and some gambling rights. IFRS includes fair value changes), loss of 130 million yuan (mainly from terminated and soon-to-be terminated NOME business, Minihome business, MINISO Africa business and MINISO German business), share payment fee of 364 million yuan and irrevocable dividend distribution of 20 million yuan related to restricted stocks that have not yet met the grant conditions, and impairment of non-current assets of 37 million yuan.

5.2 operating capacity: show high turnover under the extreme supply chain and operational efficiency

The company has a short turnover time, reflecting strong supply chain and internal management capabilities. The average inventory turnover days of FY2019/FY2020 are 63 days and 78 days (the increase in FY2020 is mainly affected by health events), mainly due to the company's efficient supply chain system:

1) supply chain direct acquisition, reduce intermediate links, establish good relationship with large quantities of suppliers, and improve turnover capacity

2) through digital system docking supply chain management, suppliers can access real-time sales data, dynamically optimize production planning, and reduce turnover days and inventory risk.

3) the supply chain is deeply involved in product design, working with designers and product managers to quickly iterate popular products according to market conditions, so as to meet the changing tastes and preferences of consumers in the global market and ensure that the company's products are marketable. In horizontal comparison, the inventory turnover days of MUJI 2017-2019, which is similar to MINISO Group's style, is 140,162days and 200days during the sanitary incident, which is much higher than that of MINISO Group 63amp 78.

Compared with the overseas 10 yuan store brand, MINISO Group's inventory turnover days are also lower than the American market "dollar store" brand Dollar Tree/ Dollar General, and only slightly higher than the Japanese "dollar store" brand Seria. Considering that the average price of famous products after calculating purchasing power parity is higher than that of "chain dollar store", the category is richer, showing a significant turnover advantage, especially on the basis of the company launching an average of 600 new SKU per month. It is even more valuable to maintain a low inventory turnover. At the same time, the company's working capital management capacity is being further improved. The turnover days of accounts receivable of FY2019 and FY2020 are 18 and 15 days respectively.

5.3 expense side: staff and workers are mainly paid, and the expense rate is lower than that of their peers.

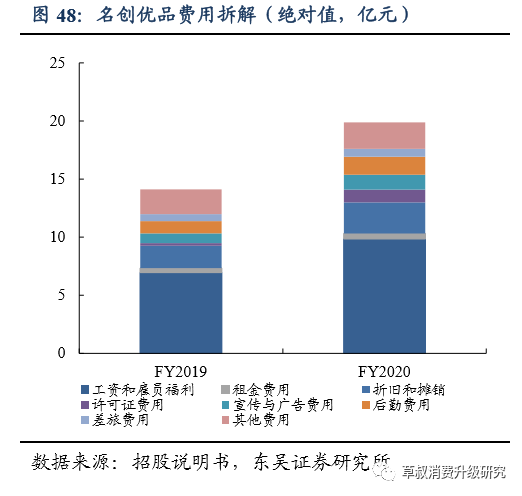

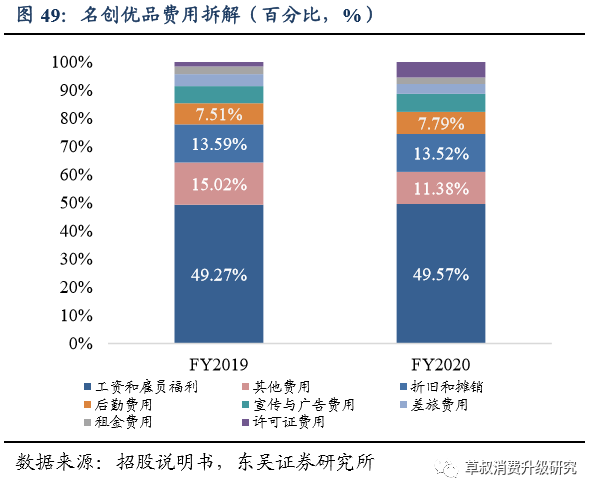

MINISO Group's expenses are dismantled, mainly based on the salary of the staff and workers. The company's sales expenses increased from 818 million yuan of FY2019 to 1.191 billion yuan (+ 45.5%) of FY2020, and the sales expense rate was 8.71% / 13.26%. Excluding the fees incurred by share payments, the adjusted sales expenses were 7.85 / 1.063 billion yuan (+ 35.3%), mainly due to:

1) the company is rapidly expanding its brand cooperation, so the license fee has increased from 22 million yuan to 110 million yuan.

2) the expansion of overseas stores brings higher depreciation and amortization; 3) the cost of promotion and advertising has increased from 86 million yuan to 128 million yuan. The management fee of the company increased from 593 million yuan of FY2019 to 796 million yuan of FY2020 (+ 34.3%), and the rate of management fee was 6.31% / 8.87%. Excluding the fees incurred by share payments, the adjusted management fee was 5.04 / 560 million yuan (+ 11.0%).

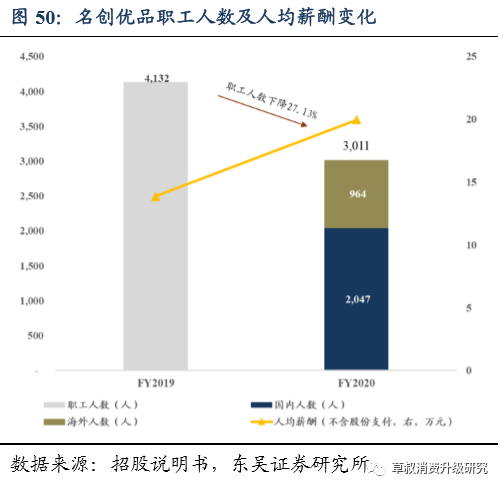

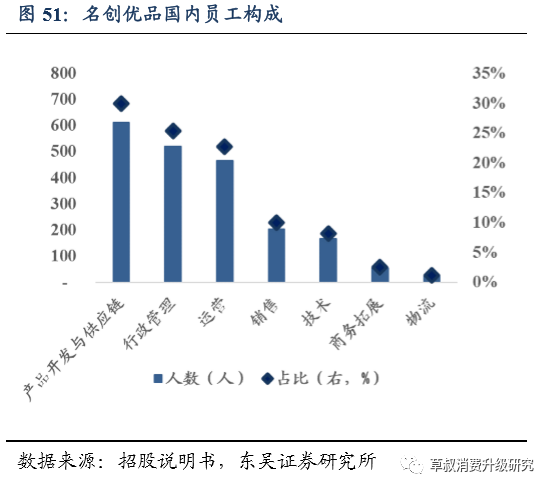

It is worth mentioning that FY2020 has made a great simplification and optimization of the salary of the employees who account for the largest proportion of expenses. The number of employees in the company decreased from 4132 at the end of June 19 to 3011 at the end of 20 years, while the per capita annual income (excluding share payment) increased from 139000 yuan to 200000 yuan, and the employee structure was transformed and optimized in depth. From the perspective of the company's business model, the franchise model has a high operating leverage, so the increase in store expansion is not expected to significantly increase personnel costs, and the company's expense rate has room for further decline.

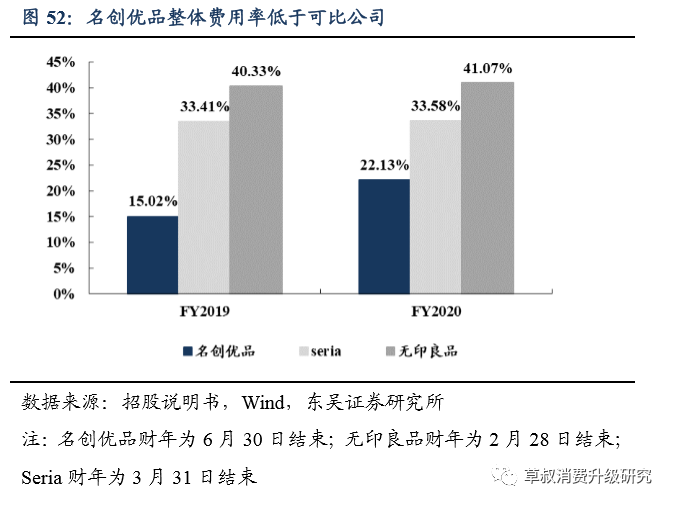

Horizontal comparison, MINISO Group's overall expense rate is still far lower than that of the same industry. Combined with sales expenses and management expenses, the expense rates of MUJI and Sarie are both 30-40%, while those of MINISO Group FY19 and 20 are only 15.02% and 22.13%. The lower expense rate reflects the company's digital penetration advantage and fine management ability in the process of operation.

5.4 Capital structure: after adjustment, the asset-liability ratio continues to decline, and the operation is highly robust.

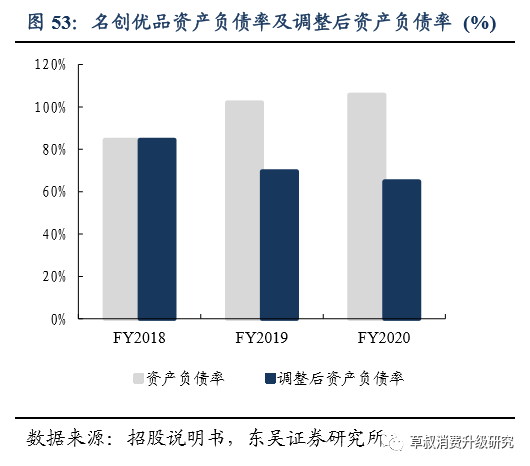

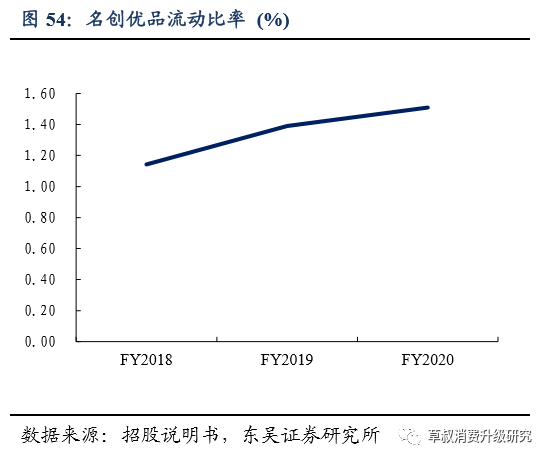

At the same time of rapid expansion, the company's adjusted asset-liability ratio (assuming that the equity held by Tencent and Hillhouse is included in equity) is still declining year by year, and the current ratio continues to improve. At the end of FY2018-2020, the asset-liability ratio of the company was 84.51% / 102.18% / 105.77%. If you exclude the liabilities related to preferred shares (the rights and interests held by Tencent and Hillhouse are included in the liabilities), the adjusted asset-liability ratio is 84.51% / 69.63% / 64.88%, which has decreased steadily in the past three years, and the capital structure has been continuously optimized. On the other hand, the current ratio of FY2018-2020 is 1.14 / 1.39 / 1.51 respectively, which ensures the abundance of current assets.

6. Profit forecast and investment suggestion

MINISO Group officially landed on the New York Stock Exchange on October 15, 20, and issued a total of 30.4 million ADS at an issue price of US $20.0 / ADS. After deducting underwriting discount and commission of about 28 million yuan, the final fund raised was about 580 million yuan. In this issue, the underwriter has the right to exercise the over-allotment right of 4.56 million copies of ADS. If all rights are exercised, after deducting underwriting discount and commission of about 33 million yuan, the final fund raised is about 666 million yuan.

6.1 fundraising project

After deducting the issuance expenses, the company will invest in the following projects:

(1) 30% is used to further expand the store network: the domestic market: plans to further expand the domestic store network, seize the opportunities of low-line cities, and further infiltrate the covered cities. In addition, the company plans to add more larger stores in the future because they have a richer SKU and provide a better shopping experience. Overseas market: actively looking for suitable partners, the company will continue to use flexible store business model, further expand the store network according to the local conditions of each market, and will continue to develop and penetrate more deeply into the strategic market. especially in North America and India.

(2) 30% investment in warehouse and logistics network: the company will further develop global purchasing capacity to enhance supply chain capacity. The company will also integrate suppliers more deeply through its supply chain management system to shorten delivery time and speed up reordering, ultimately improving the efficiency of the entire supply chain.

(3) 20% is invested in technology and information systems: the company will further develop technology to improve operational efficiency. In particular, the company will continue to make further use of data analysis throughout the operation to promote product design and supply chain processes, customize goods according to consumer needs, and optimize inventory management.

(IV) the rest for other operational needs: may include investment in sales and marketing activities, expansion of office space through the purchase of land for the construction of office buildings, funding for working capital requirements and potential strategic investments and acquisitions, etc. Actively enhance consumer participation and promote omni-channel experience: the company will continue to improve its membership program and expand its membership base. At the same time, continue to use popular social media platforms to launch innovative marketing activities to strengthen ties with consumers and improve the company's brand awareness.

The company plans to expand the company's online products and broaden the company's online sales channels by further developing its own e-commerce channels and cooperating with more third-party e-commerce platforms. The company will also use the consumer community network of stores on Wechat to make it easy for consumers to place orders at MINISO Group stores of their choice, providing them with a seamless omni-channel shopping experience. Use existing competitive advantages to explore new business opportunities: the company plans to use its main competitive advantages to explore new business opportunities, such as launching new brands.

6.2 profit Forecast

The application scene is broad, and there is plenty of room for store expansion. Under the extreme thinking, MINISO Group has built a mature expansion model and a deep moat, and will continue to complete the expansion of stores by attracting franchisees in the future, so as to drive the sustained growth of income.

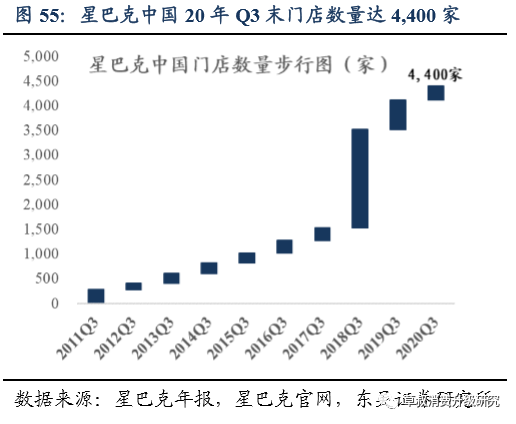

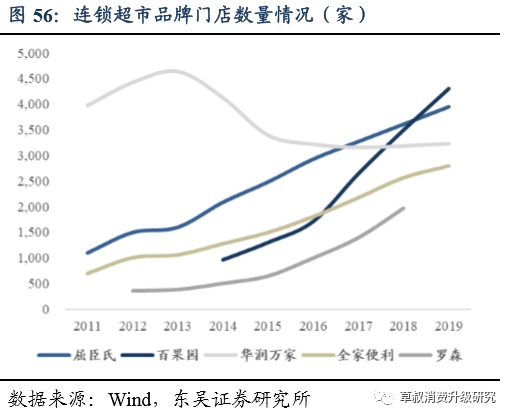

Starbucks Corp, the leader of the reference chain, Starbucks Corp has also started a rapid expansion in China over the past decade, expanding an average of 458 stores a year from 278 stores in 2011 to about 4400 at the end of the third quarter of 2020. In the past 20 years, the number of Q3 quality products in China is 2633, which is only about 60% of the number of Starbucks Corp stores.

Compared with Starbucks Corp, MINISO Group model applies to a wider range of scenarios, whether in first-and second-tier cities or sinking markets, there will be demand for MINISO Group's products. From a micro point of view, MINISO Group, who specializes in cost-effective household commodities, is undoubtedly bigger than Starbucks Corp's coffee on the basis of the masses. therefore, MINISO Group's store expansion ceiling is very high, and it is likely to exceed the number of Starbucks Corp's stores in the future.

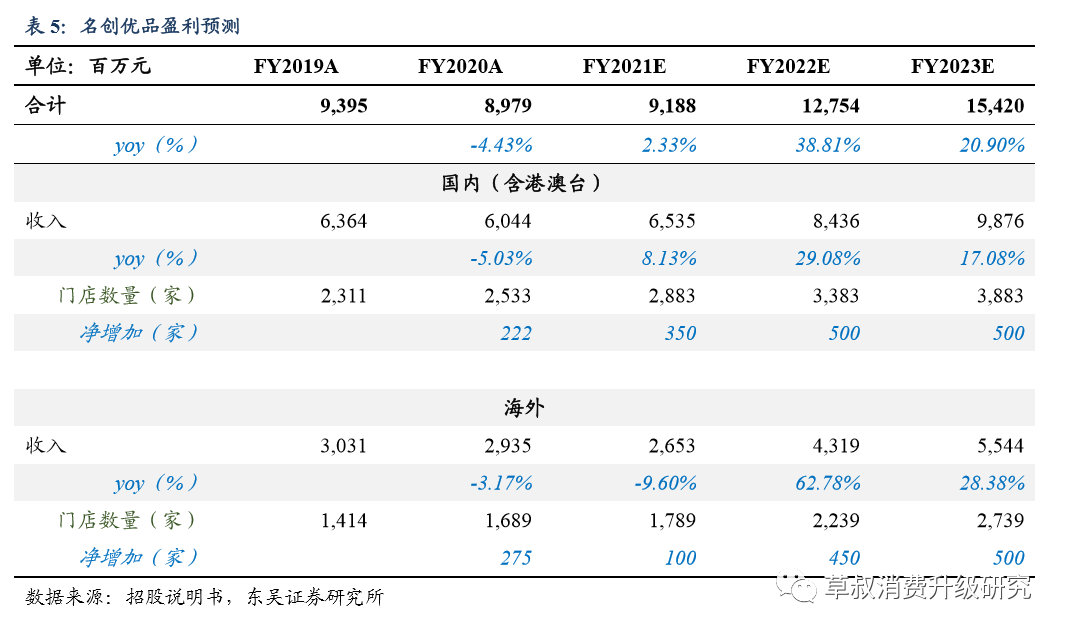

Core hypothesis: we split MINISO Group's business into domestic and overseas sectors.

(1) domestic: at present, the prevention and control of health events in China has basically entered a stable period. In the past 20 years, Q3 (that is, the first quarter of FY2021) has achieved a net opening of 100 stores and began to resume store expansion. We expect that the company's FY2021-FY2023 will expand its 350Comp500 and 500 stores respectively, while the single store GMV will continue to recover from the decline caused by health incidents.

(2) overseas: assuming that overseas business continues to be affected by health events, 100 new stores will be opened overseas in 2021, while single-store GMV will also decline; while after the health incident moderates, the company will return to the high growth track in FY2022 and FY2023, with the expected opening of 450 new stores and 500 new stores respectively, while single-store GMV will continue to recover.

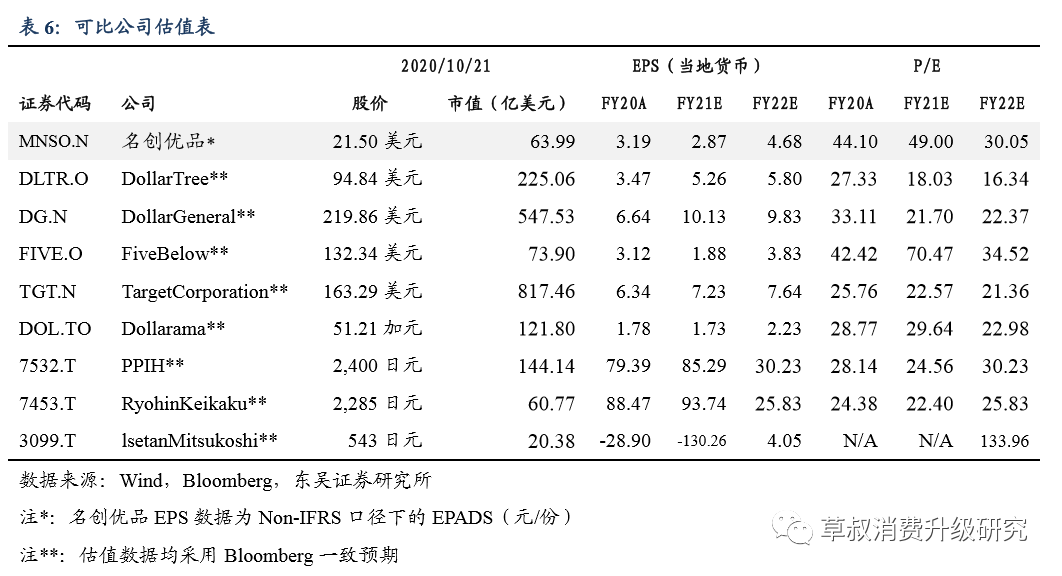

At the same time, due to the impact of health incidents, it is expected that at FY2021, while the company's store expansion slows down, the GMV of individual stores will also be affected accordingly, so the company's net profit growth this year will be even lower than the revenue growth rate. It is expected that FY2022 and FY2023, after the health incident is stable, the company's expansion will return to the high growth track, single-store GMV will also return to the normal level, while the company's light assets join the expansion model, highlighting high operating leverage, so net profit growth will be faster than revenue growth. We expect the company's FY2021-FY2023 to achieve a net profit of 7.48 / 13.22 / 1.749 billion yuan respectively, corresponding to the net profit of 8.72 / 14.22 / 1.821 billion yuan for Non-IFRS, and a dynamic PE 49 / 30 / 23 times at the closing price of $21.05 on October 21.

6.3 Investment advice

The household daily market is a vast market with a scale of trillions, and it is expected that one or more industry giants will be born in the future. And the business format of "ten yuan store" is a good business with strong vitality and can grow through the cycle. at the same time, the extremely high performance-to-price ratio and extreme efficiency pursued by "ten yuan store" coincides with the development trend of household daily use market.

In the good track such as household daily use and "10 yuan shop", MINISO Group has relied on the strong domestic light industry chain system and the product concept with "three high and three low" as the core in the seven years since its establishment in 2013. to create products as the king + extremely cost-effective brand power and moat, through the unique one-stop strong control joining mode to achieve rapid expansion under light assets. Is an excellent household brand merchant. We are optimistic about the company's long-term global store development prospects, covering the "overweight" rating for the first time.

「三高三低」理念,构建产品为王+极高性价比+极致效率的护城河。

「三高三低」理念,构建产品为王+极高性价比+极致效率的护城河。