As the second and final round of presidential debates came to an end last Friday, the countdown to the US election began. We have sorted out the concerns of the last week or so for investors to refer to.

i. The current poll gap is still large, and swing states have narrowed

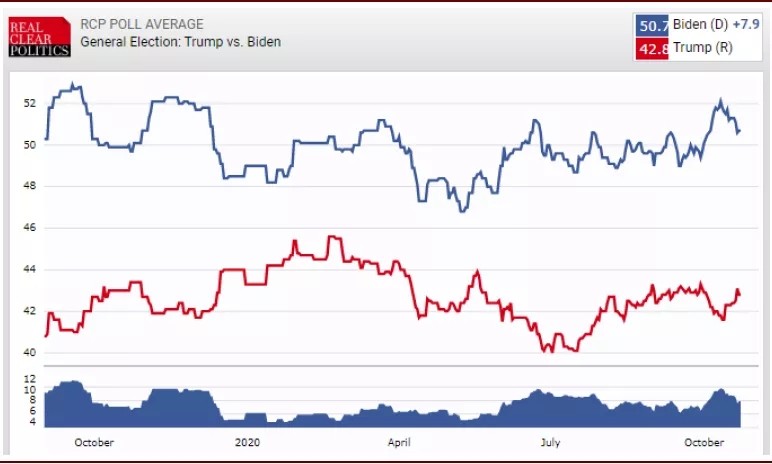

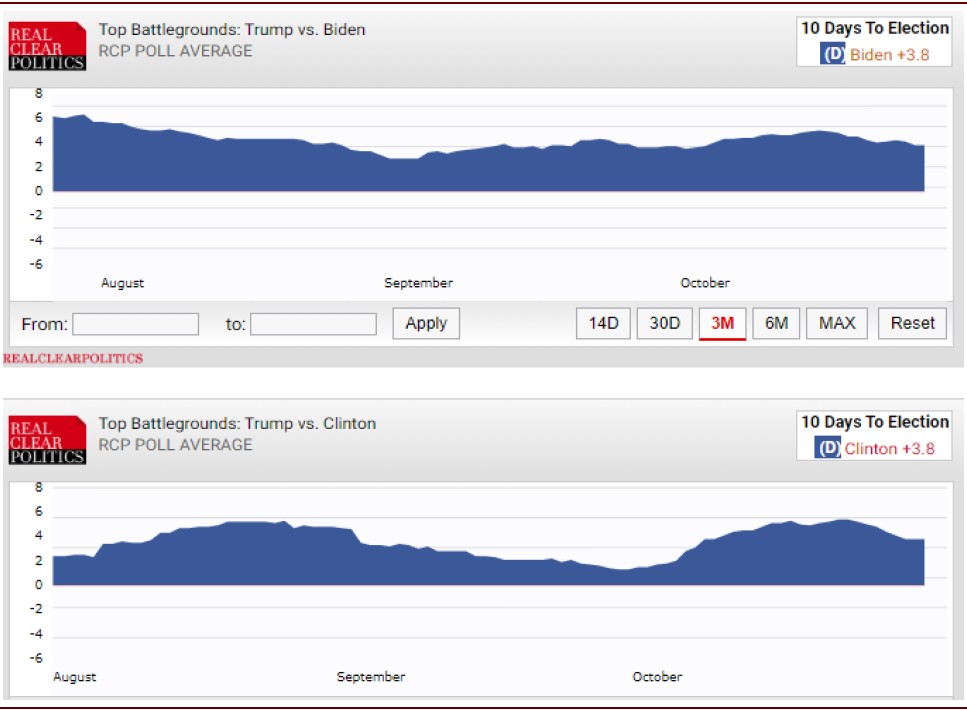

According to the latest poll data compiled by the RCP, despite recent convergence, the poll gap between Trump and Biden is still large. The national polls are 7.9% behind and betting odds are 30% behind, but the gap in key swing states has narrowed to 3.8%. In contrast, in 2016, at the same time as voting day for the general election, Hillary led 3.8% in the national polls, while key states led 3.8%, which is in line with the current level.

Chart: According to RCP data, the current difference in national polls is 7.9%

Chart: However, key states continue to narrow, and the difference is currently 3.8%

Chart: This level was basically the same as the 2016 election

ii. Early and mail-in voting has surged, and overall voter turnout is higher or complicating the election situation

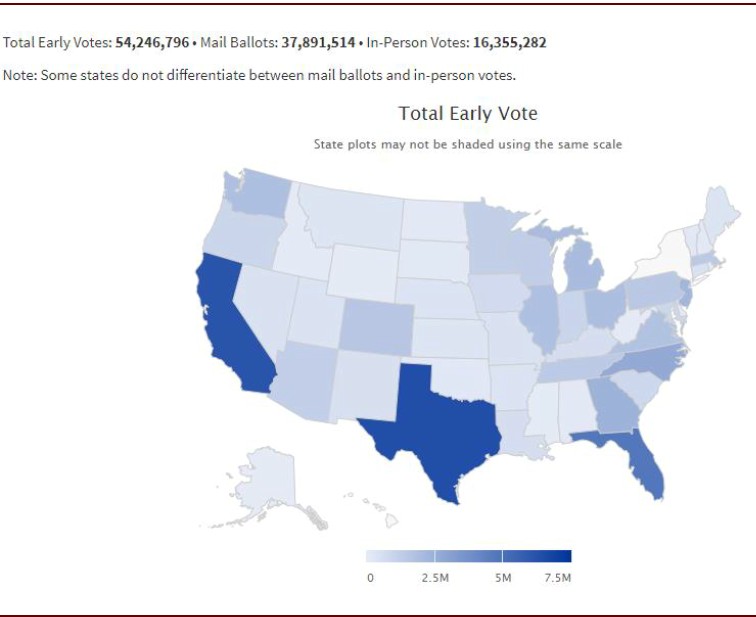

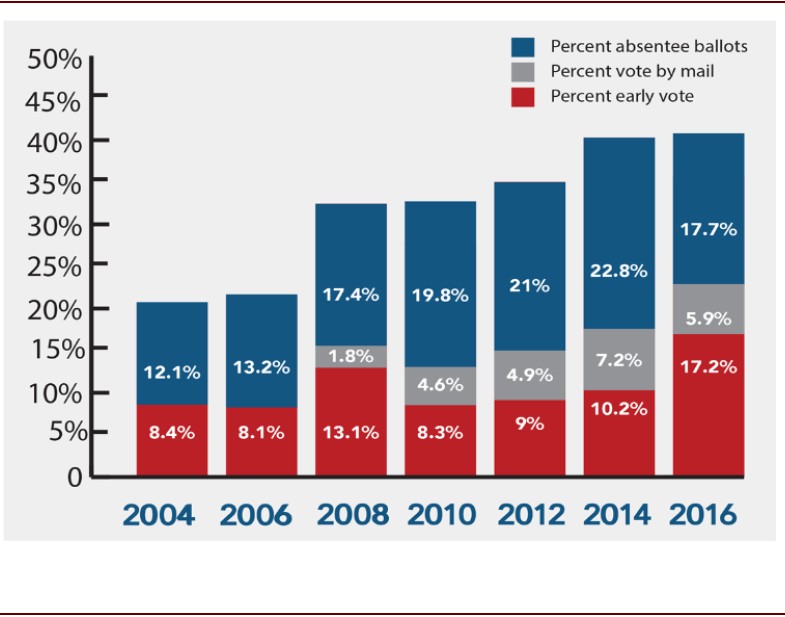

The public health events and racial issues involved in this general election have made the rivalry between the two camps even more acute, and may further lead to a sharp increase in early voting, mail-in voting, and overall voter turnout: 1) As of last Friday, 54.25 million people had completed voting, equivalent to 39.4% of the total number of votes in 2016; 2) 37.89 million mail-in ballots were completed, equivalent to 27.5% in 2016, while the total number of mail-in ballots was 86.06 million, accounting for 62.5%. Note that in 2016, early voting and mail-in ballots only accounted for 17.2% and 5.9%, respectively. We believe that this significantly higher ratio in turn indicates that this year's voter turnout may be significantly higher than 2016.

Chart: As of last Friday, 54.25 million people had voted, equivalent to 39.4% of total votes in 2016

Chart: In 2016, early voting and mail-in ballots accounted for 17.2% and 5.9%, respectively

Although these new phenomena cannot necessarily be used as a basis for huge surprises, they will certainly complicate the voting situation in this year's general election. For example, some key swing states such as Florida have a significantly higher proportion of mail-in ballots than before. This cannot be ruled out to cause some division and confusion if the election situation is unusually tight on the final voting day.

iii. The key swing states will be the winners and losers in this election

As we analyzed in our previous topic “US 2020 Election: Current Status, Evolution, and Impact”, the most critical ones are Florida (Biden leading 1.5%) and Texas (Trump leading 4%), combined with the current poll gap. Since Trump continues to lag behind Biden in the popular vote (similar to what is reflected in national polls), he can only win by “winner-take-all” electoral votes with a small advantage in some key swing states, so options are limited. In contrast, since Biden basically holds the popular vote of some populous states (such as California and New York), he needed a larger popular vote gap to finally secure the victory (in 2016, Hillary Lipp won 3 million votes, ~ 3% gap, but still lost the electoral votes), but he chose more than Trump.

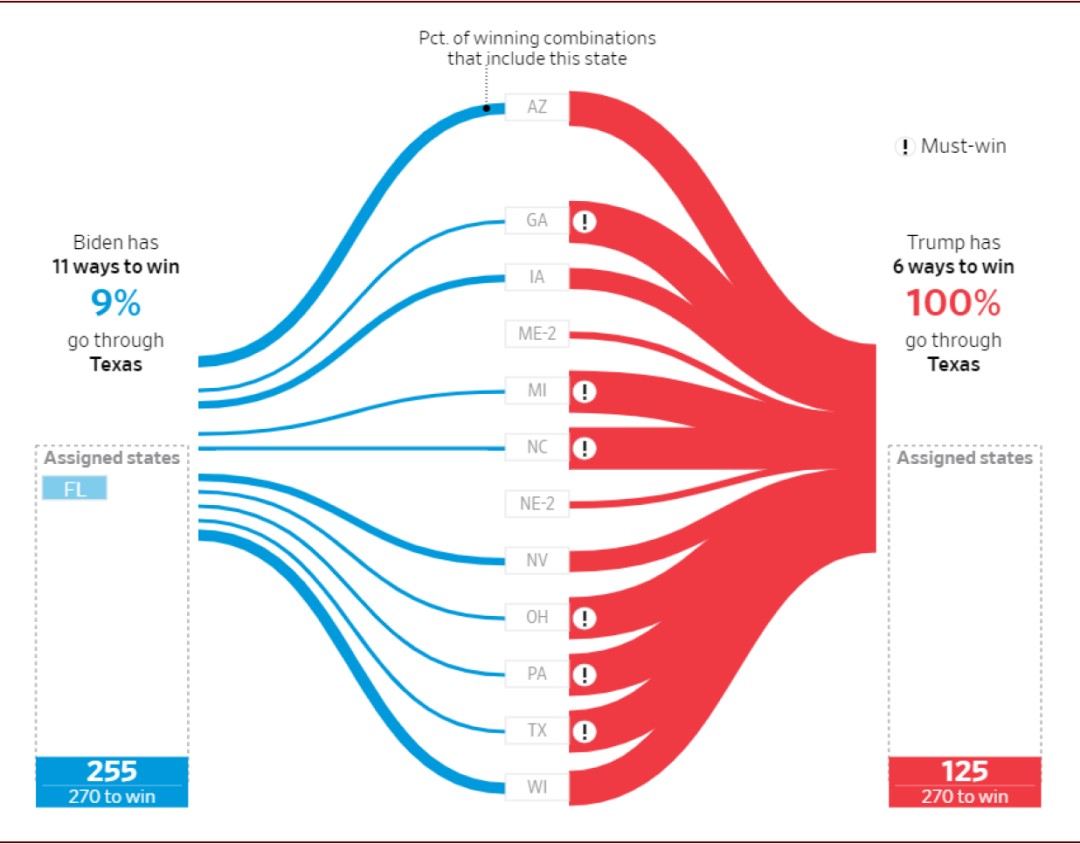

According to WSJ's simulation estimates, if Biden wins Florida, then Trump has only 6 ways to win the election; if Biden wins Texas, then Trump has only 1 way left to win the election; and if both are won by Biden, then there is basically no suspense.

Chart: If Biden wins Florida, Trump has only 6 ways to win the election, and he must win Texas

iv. The countdown to the general election market may continue to be dominated by wait-and-see

As the general election approaches, we expect that the market may still be mainly wait-and-see (“Allocation Strategy for the General Election Sprint Period”), waiting for the election results to finally come to fruition. At the beginning of last week, we also indicated that we observed some signs of risk appetite weakening again.

In our special report “Five Situations of the US Election”, we analyzed potential policy prospects based on the claims of Trump and Biden and differences in the functions of the two houses of Congress. As far as the market is concerned, unless there is a complete rivalry between the President and the two houses of Congress, and disorderly waiting and chaos with no results in the short term, we believe that short-term fluctuations will not change the medium-term trend of gradual deepening recovery. Whether the Democratic Party, which has a high probability of being swept away by the polls, or the Republican Party, which has a low probability of winning, is probably not bad for the market; while the Congress continues to split, it returns the market to its original logic of gradual restoration of fundamentals.