summary

Core findings:

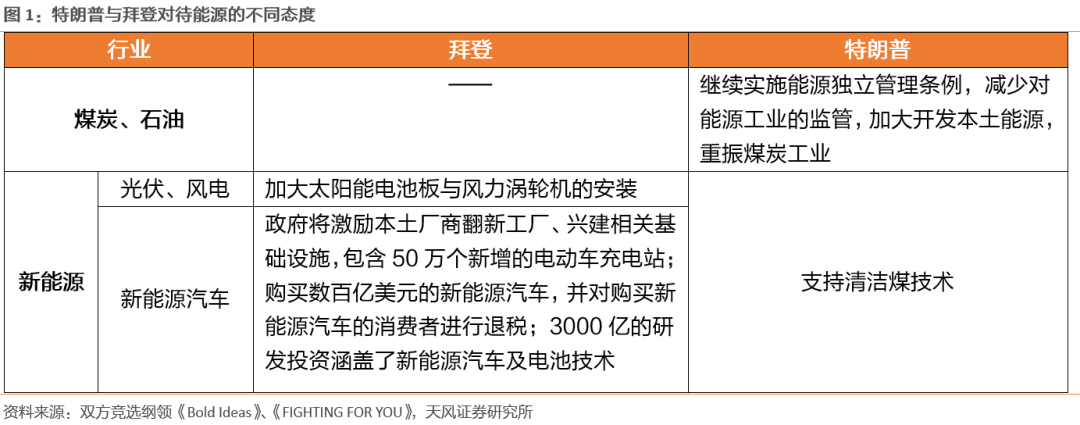

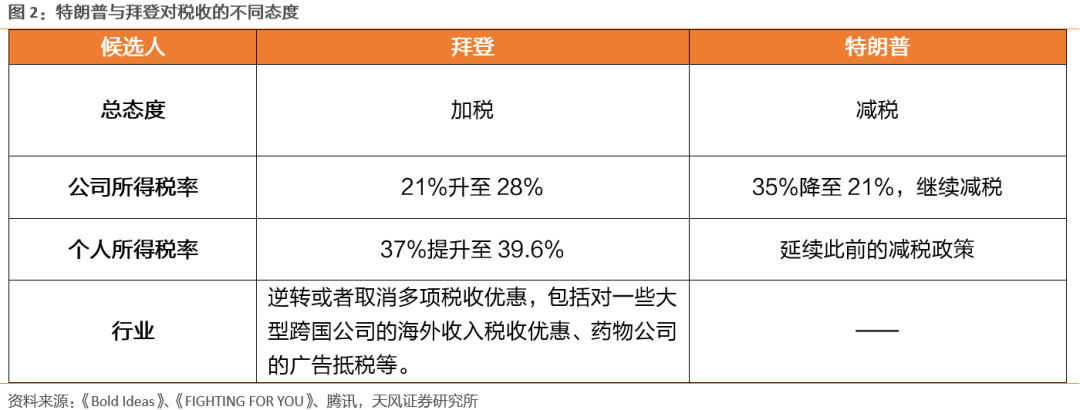

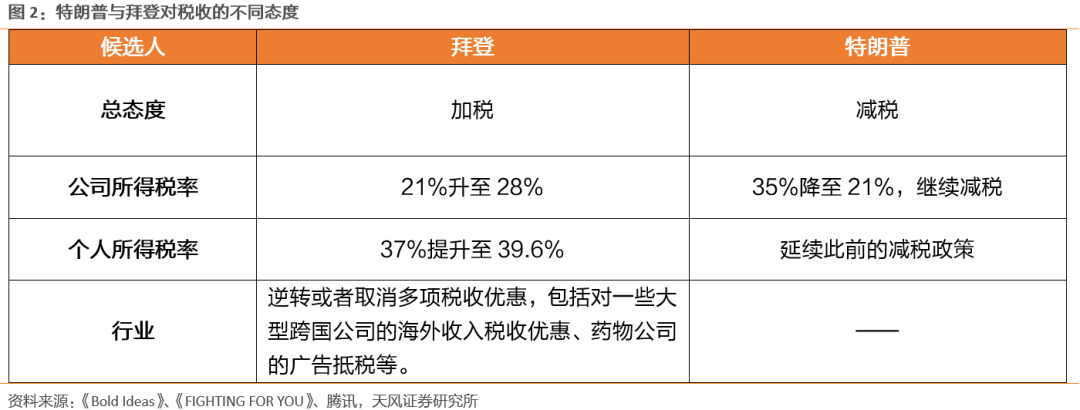

1. The differences between Trump's and Biden's policy propositions mainly focus on energy choices and attitudes towards taxation. In terms of energy choices, Trump wants to revive traditional energy industries such as coal and petroleum, while Biden wants to implement a clean energy plan and vigorously develop the new energy industry. On the tax side, Biden wants to raise taxes again, especially for the wealthy, while Trump wants tax cuts.

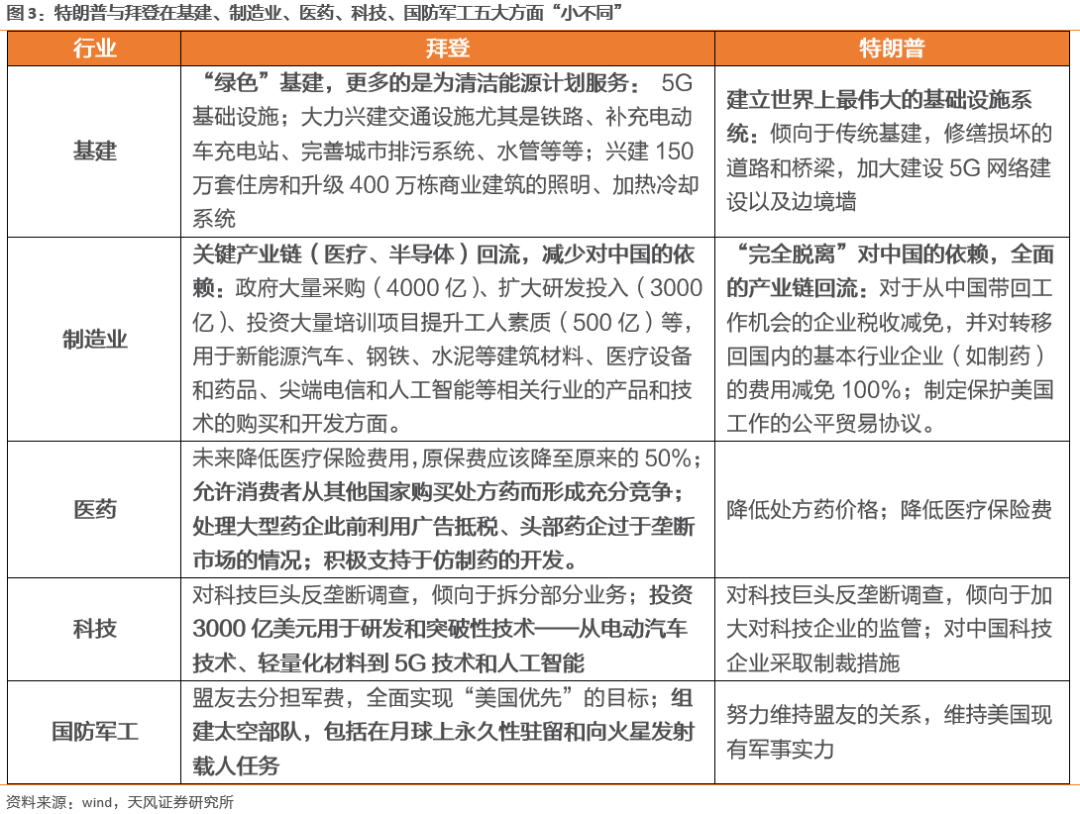

2. Compared to Trump, Biden's regulations on medicine and technology are more aggressive, but they will be more gentle on the return to the manufacturing industry. On the pharmaceutical side, Biden hopes to break the monopoly of pharmaceutical companies by abolishing tax incentives to support generic drugs; the two sides agree on the antitrust investigation of tech giants, but Biden and the Democrats prefer to split their business; in terms of the return of manufacturing, Trump wants to “completely break away” from dependence on China, while Biden places more emphasis on the return of key industrial chains to the US (healthcare, semiconductors).

3. Currently, implicit expectations in the market are the implementation of large-scale fiscal stimulus plans and Biden's entry into the White House. On the one hand, judging from the two sides getting closer to the target of the stimulus package and the declining sensitivity of the market to the rejection of the plan, the market is reflecting the expectations that the final fiscal stimulus plan will achieve, even after the general election. On the other hand, judging from public opinion polls and the expectations of major international financial institutions, Biden's approval rating and probability of winning are ahead, and higher voter turnout may make the polls more accurate. Furthermore, it is also a good proof that Trump's infection has not caused continued fluctuations in US stocks.

3. Currently, implicit expectations in the market are the implementation of large-scale fiscal stimulus plans and Biden's entry into the White House. On the one hand, judging from the two sides getting closer to the target of the stimulus package and the declining sensitivity of the market to the rejection of the plan, the market is reflecting the expectations that the final fiscal stimulus plan will achieve, even after the general election. On the other hand, judging from public opinion polls and the expectations of major international financial institutions, Biden's approval rating and probability of winning are ahead, and higher voter turnout may make the polls more accurate. Furthermore, it is also a good proof that Trump's infection has not caused continued fluctuations in US stocks.

4. In the short term, the final implementation of election results will benefit the recovery of global risk appetite, and we need to be wary of unresolved risks similar to those of 2000. If Biden wins, the implementation of a large-scale fiscal stimulus plan led by the Democrats is expected to boost market sentiment; if Trump wins, although the scale of fiscal stimulus may fall short of expectations, the trend towards tax cuts will also ease concerns about rising interest rates in the Federal Reserve. However, in the event of an unresolved situation similar to the 2000 election, market risk appetite will be suppressed.

5. In the medium to long term, attitudes towards taxation and changes in interest rates are key variables. If Trump is re-elected, the fiscal deficit widens under the tax cut policy, and tolerance for inflation increases, the Fed is likely to maintain low interest rates until 2023, which will provide strong support for the current global asset bubble; if Biden fights back, the US government enters a tax increase cycle, and tolerance for inflation declines as the fiscal deficit decreases, and the Fed may end the interest rate cut cycle early, which may kill the EPS and valuation of US stocks. As far as A-shares are concerned, once interest rates on US bonds rise again, core assets with a high preference for foreign investors may face pressure to lower their theoretical valuations.

6. At the industry level, focus on the industrial policy direction of both parties:

(1) If Biden wins, antitrust investigations may force traditional US internet giants to face break-up pressure. Furthermore, clean energy plans, the possibility of reducing trade frictions, and the rise of the middle class's consumption capacity will enable the A-share new energy industry chain, consumer-oriented export industry, and generic drug industries to obtain a more comfortable development environment.

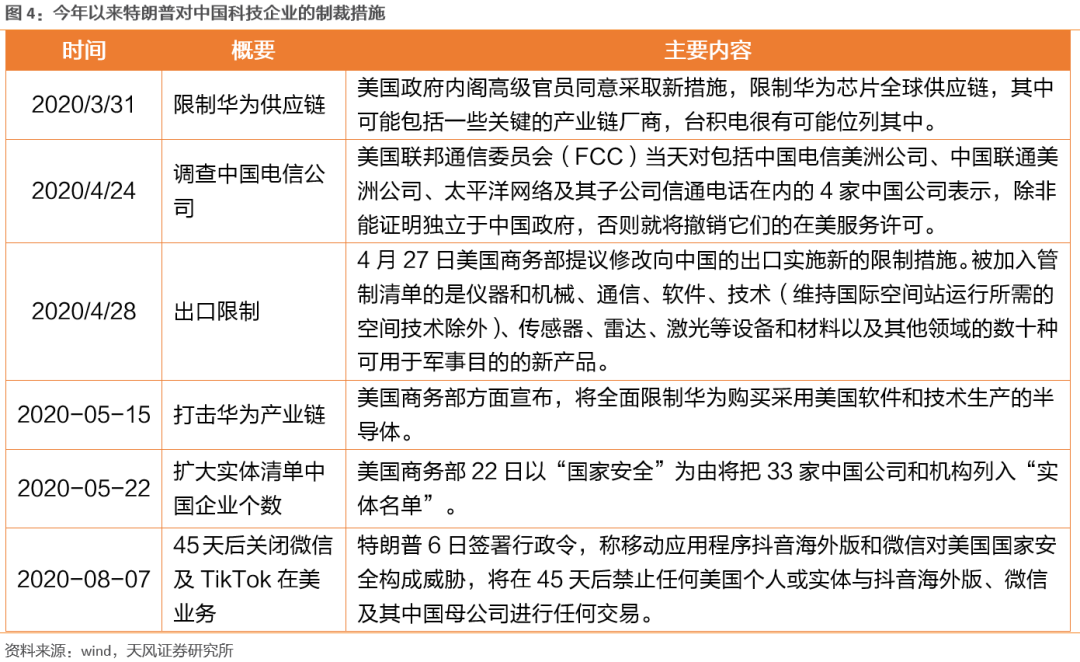

(2) If Trump wins, traditional energy industries such as coal, petrochemicals, etc. will receive phased support, but they will not be very sustainable in the face of insufficient global demand; the continuation of the science and technology war may accelerate the development of domestic alternative chains (military upstream, credit and innovation, semiconductors).

After Trump's diagnosis and two presidential candidate debates, the upcoming US election is still full of uncertainty. What impact will Trump's re-election and Biden's counterattack have on the market and industry, respectively? What kind of expectations are reflected in current market transactions? Under different circumstances, how will the A-share market be interpreted?

body

01 Trump vs. Biden

Combining the two sides' latest campaign platforms and opinions, we summarized the “big differences” between the two sides and the “minor differences” in the three areas, and then analyzed the different impacts on the energy, manufacturing, technology, and pharmaceutical industries.

1.1. “Energy Independence+Tax Reduction” vs. “Clean Energy Plan+Tax Increase”

The attitude towards traditional energy and new energy sources is one of the biggest differences between their campaign platforms. In Trump's second-term campaign program “FIGHTING FOR YOU,” Trump clearly mentioned that independent energy management regulations will continue to be implemented. In fact, as early as 2017, Trump denied the Obama-era “Climate Action Plan” and proposed the “America First Energy Plan”. Its core is to reduce regulation of the energy industry, increase the development of local energy, continue the shale revolution, support clean coal technology, and revive the coal industry. It can be seen from this that in terms of energy use, Trump continued his previous policy direction and continued to strengthen financial support for traditional energy companies such as petroleum and coal.

In contrast, Biden offered a very different choice. Biden presented a very detailed green energy plan in his campaign platform “Bold Ideas”. The core of implementation is research and development of new energy sources, widespread application, and upgrading of traditional energy alternatives. In addition to increasing investment in the wind energy and solar energy industry in the future, Biden is focusing on providing a package of development plans for new energy vehicles: in the midstream and upstream sector, the government will encourage local manufacturers to refurbish factories and build related infrastructure, including 500,000 new electric vehicle charging stations; in the downstream sector, the government will buy tens of billions of dollars of new energy vehicles, accelerate the upgrading of 3 million vehicles to new energy sources, and provide tax rebates to consumers who buy new energy vehicles; in the technology sector, 300 billion R&D investment covers new energy vehicles and battery technology.

The two also had opposite attitudes towards taxation. Trump mentioned in “FIGHTING FOR YOU” that tax cuts will continue to be implemented to raise residents' actual income, which is also a continuation of his previous policy direction. As early as 2017, Trump reduced the corporate tax rate from 35% to 21% through a “tax reform.” Biden, on the other hand, expressed hope to raise the corporate income tax rate to 28%, raise the personal income tax rate to 39.6%, and levy social security taxes on groups with an annual income of 400,000 US dollars or more. In the campaign platform, it can also be seen that Biden wants to reverse or eliminate a number of tax benefits, including tax benefits on overseas income of some large multinational companies and advertising tax credits for pharmaceutical companies.

1.2. Similarity and differences in infrastructure, manufacturing, healthcare, science and technology, defense, and military

In addition to the two completely different directions listed in 1.1, Trump and Biden also have “minor differences” in five areas, including infrastructure, manufacturing, healthcare, technology, and defense and military industry.

In terms of infrastructure, both sides have mentioned increasing investment in infrastructure, but the main focus is different. Trump mentioned in his campaign platform that he wants to build the greatest infrastructure system in the world, and judging from the investment direction of the 1 trillion dollar infrastructure plan that Trump is trying to launch in June this year, it mainly focuses on repairing traditional infrastructure such as damaged roads and bridges. Of course, it also includes 5G network construction and border walls. Meanwhile, Biden's infrastructure investment direction is more “green,” mainly serving his green energy plan. In addition to 5G infrastructure, Biden's green infrastructure plan also includes vigorously building transportation facilities, especially railways, supplementing electric vehicle charging stations, and improving urban sewage systems, water pipes, etc. In addition, Biden's green infrastructure plan also includes the construction of 1.5 million housing units and the upgrading of lighting, heating and cooling systems for 4 million commercial buildings. It can be seen from this that the two sides are in the same direction in increasing infrastructure investment and 5G investment, but in terms of specific focus, Trump is still focusing on traditional infrastructure, while Biden is more in line with his green energy plan.

The return of manufacturing is an important concern for both parties, but Biden is more gentle and more comprehensive than Trump. On the one hand, Trump wants to “completely break away” from dependence on China. It is a full return to the industrial chain, tax relief for companies that bring back jobs from China, and a 100% fee reduction for companies in basic industries (such as pharmaceuticals) transferred back home. This also means that the return of manufacturing and trade frictions continue, and the US and China are completely decoupled.

On the other hand, Biden placed more emphasis on the return of key industrial chains to the US (healthcare, semiconductors), and placed more emphasis on reducing dependence on China. Compared to Trump, this is also in line with Biden's criticism of trade frictions between China and the US initiated by Trump. In addition, Biden's manufacturing return and revitalization policy is more comprehensive. In addition to the return of key industrial chains, it also involves large-scale government procurement (400 billion dollars), expansion of R&D investment (300 billion dollars), and investment in large-scale training programs to improve the quality of workers (50 billion dollars), etc., for the purchase and development of products and technologies in related industries such as new energy vehicles, steel, and cement, medical equipment and pharmaceuticals, cutting-edge telecommunications, and artificial intelligence.

Lowering premiums and prescription drug prices is the direction of the two efforts, but Biden's policies relating to large pharmaceutical companies and generic drug companies are different, and Biden is relatively more aggressive. In both campaign platforms, it is mentioned that health insurance costs will be reduced in the future. Among them, Biden believes that the original premiums should be reduced to 50% of the original. In terms of lowering the price of prescription drugs, Biden even allows consumers to buy from other countries to form full competition, thus putting pressure on price cuts. Furthermore, in response to the previous situation where large pharmaceutical companies used advertisements to deduct taxes and leading pharmaceutical companies monopolize the market too much, Biden will take measures to resolve it, but Biden has a more positive attitude towards the development of generic drugs.

In terms of technology, the antitrust investigation of tech giants is a consensus, while in terms of new energy vehicles, artificial intelligence, and 5G technology, Biden has more clear investment in R&D. Judging from recent statements from both sides, whether the Trump administration will file an antitrust lawsuit against Google as early as October, or whether the Democrats' antitrust report accuses Google, Facebook, etc. of having “monopoly power” and putting their businesses at risk of being split, the two sides are quite consistent in the direction of antitrust investigations against tech giants. However, in Biden's campaign platform, it is planned to invest 300 billion US dollars in R&D and breakthrough technologies — from electric vehicle technology and lightweight materials to 5G technology and artificial intelligence, which is also beneficial to R&D in related industries.

In terms of defense and military industry, it is the agreement of both sides to continue to maintain America's military strength, but they have different attitudes towards allies and the development of the aviation industry. Trump wants allies to share military spending and fully achieve the “America First” goal, while Biden wants to work hard to maintain the allied relationship; in aviation, Trump separately emphasized the formation of a space force, including a permanent presence on the Moon and the launch of manned missions to Mars.

1.3. Summary of impacts on the industry

Overall, if Trump is elected, the policy direction will mainly clearly benefit traditional industries, and highly valued sectors can also continue to receive liquidity support:

On the one hand, traditional energy industries such as coal and petroleum will benefit from Trump's “Energy Independence Plan,” while the aerospace and military industry is also expected to be further supported by demand with the construction of the Space Force;

On the other hand, Trump will continue the trend of tax cuts after coming to power. Tolerance to inflation targets may continue to be maintained as government spending expands. The Federal Reserve is likely to maintain low interest rates until 2023, and highly valued sectors such as the technology sector are expected to continue to receive liquidity support, but considering antitrust investigations and the potential continuation of the science and technology war with China, the overall impact on the technology sector is neutral.

If Biden is elected, it will benefit some traditional industries, consumer industries, and the new energy industry chain that benefit from green infrastructure:

First, the implementation of the infrastructure component of the green energy plan will provide strong procurement and investment needs for steel, building materials, railways, utilities, real estate and other industries;

Second, policies such as R&D, procurement, and consumption tax rebates in the green energy plan will benefit the entire new energy industry chain, including photovoltaics, wind power, and new energy vehicles;

Third, as Biden pays more attention to social fairness (such as raising taxes on the rich), the middle class will rise again, driving the consumer industry into a boom cycle. Among them, household appliances (lighting, air conditioning) mentioned in the green energy plan are expected to benefit first;

Fourth, the pharmaceutical industry as a whole is facing disadvantages in the direction of anti-monopoly and overseas tax reversal policies, but generic drug research and development will benefit with Biden's support.

02 What are the current election expectations hidden in the market?

Judging from the current performance of the US stock market, there are mainly two major expectations — large-scale fiscal stimulus and the possibility that Democrats led by Biden will enter the White House.

2.1. Massive fiscal stimulus is only a matter of time

The core of the adjustment in US stocks in September came from the suspension of a new round of fiscal stimulus plans. The US health crisis broke out in March until the end of April. The US has implemented four fiscal stimulus plans, with a cumulative amount of 2.9 trillion US dollars. The Democratic Party then proposed a new round of $3 trillion stimulus package in May, but it was difficult for the two parties to reach consensus on this plan, especially in terms of the amount. As additional unemployment benefits authorized by Trump end in early September, the government's aid funds for businesses and individuals are gradually running out, highlighting the urgency of introducing a new round of fiscal stimulus plans. Meanwhile, on September 10, local time, a new round of fiscal stimulus with a total value of 500 billion US dollars was once again rejected by the Senate. Market expectations for strong policies to stimulate the economy fell to fruition. The S&P 500 index fell 1.76% on the same day. However, although the US economy is in the process of recovering due to the strengthening of PMI and other data, the failure of the fiscal stimulus plan has once again turned pessimistic, which has also deepened the correction in US stocks.

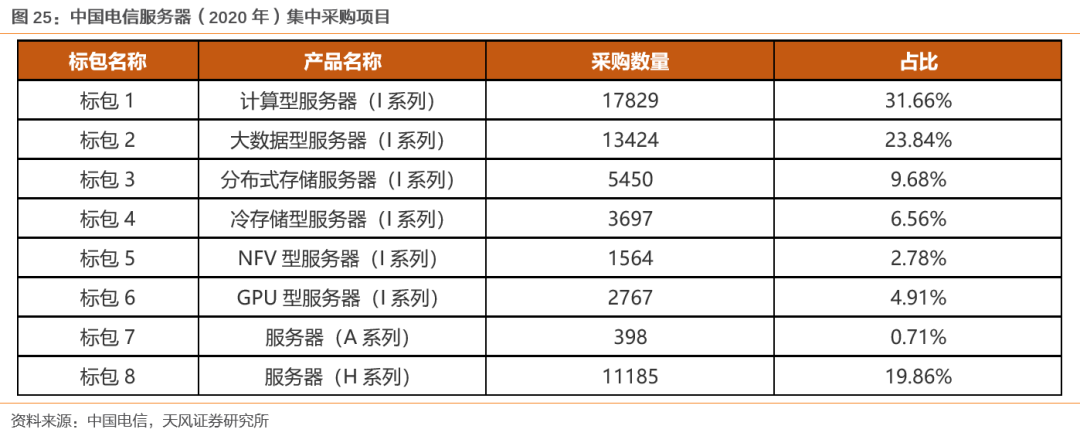

Although the current fiscal stimulus plan is still limited to an impasse, the market expects the final fiscal stimulus plan to be achieved, even after the general election. At the end of September, House Democrats announced a fiscal stimulus plan worth 2.2 trillion US dollars and passed it in the House of Representatives. Although it is still higher than the target expected by the Republicans, the scale of the expected stimulus plans of the two sides is gradually getting closer, which has once again boosted market sentiment. Meanwhile, on 10.9, Trump said he would be willing to accept a fiscal stimulus plan of 1.8 trillion US dollars or more. Although there are still objections within the Republican Party, the two parties have finally reached a new round of fiscal plans, which is reflected in market expectations. Therefore, although Mnuchin said that it may be difficult to reach a new round of fiscal stimulus plans before the US election, it seems that the market's delay in the stimulus plan was not significantly reflected. The overall US stock market continued its gains since the end of September, and the S&P 500 index has risen more than 7% since September 24. As the IMF Managing Director said in an interview last Thursday, “there is no doubt” that the US will introduce key fiscal stimulus measures, which also shows that the market has strong confidence in finally reaching a fiscal stimulus plan.

2.2. Democrats led by Biden will win the election

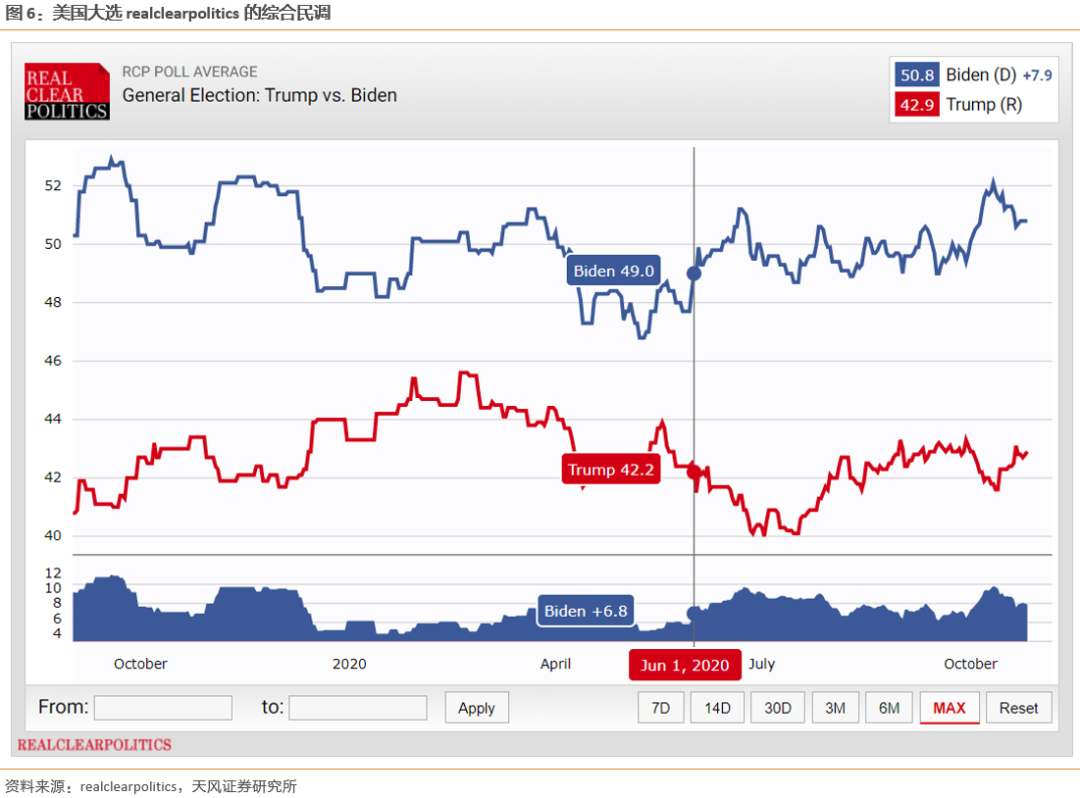

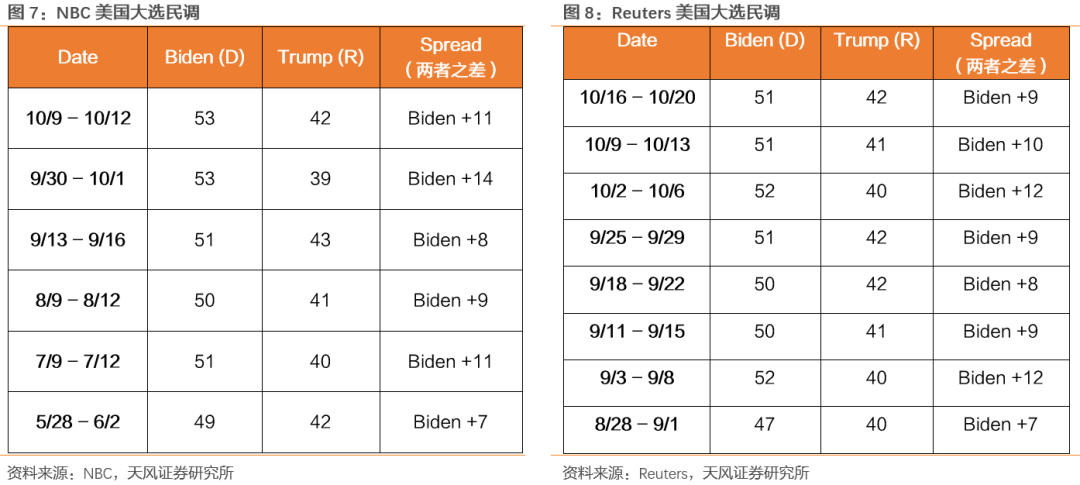

Judging from the polls, the probability of Biden winning in the end is constantly rising. We selected RealClearPolitics's comprehensive poll to observe. Currently, the approval ratings for Biden and Trump are 50.8% and 42.9% respectively. Compared with June of this year, Trump's approval rating has almost remained the same, while Biden's approval rating has risen significantly, widening the gap with Trump's approval rating to 8 percentage points.

The results of this comprehensive poll have also been verified by the results of other polls. Judging from the poll results of the NBC and Reuters media, compared to June, Biden's approval rating rose significantly in the second half of the year, and the approval rating was also basically 10 percentage points ahead of Trump's approval rating. Although the polls do not necessarily fully represent the current election situation, when voter turnout is likely to rise this year, the probability that the polls will be completely distorted is less than in 2016, which also lays the foundation for expectations that the capital market will transition to Biden's victory.

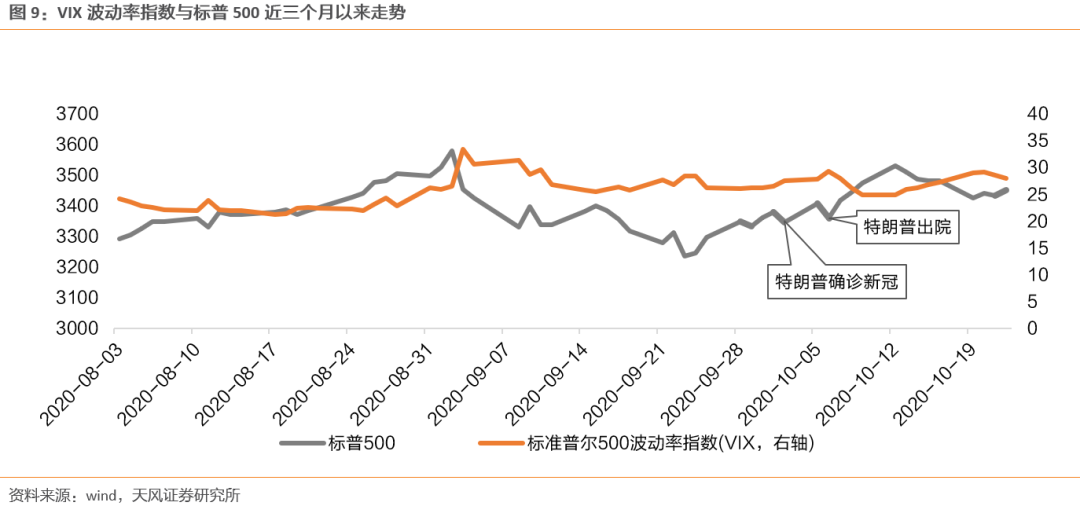

And after Trump diagnosed the virus, the market did not show excessive panic. The S&P 500 index fell 0.96% on October 2, then continued its upward trend; the VIX Volatility Index also remained below 30, and there was no significant risk aversion in the market. This also indicates that the market is gradually reflecting the expectations of the Democrats to eventually win the general election, which is also in line with the predictions of mainstream financial institutions in the US stock market:

(1) The CFO of J.P. Morgan Chase said in an interview on October 15 that investors expect the Democratic Party to win the White House and Senate in the November 3 general election;

(2) Rabobank strategist Piotr Matys said that the market is currently preparing for new fiscal stimulus and former Vice President Joe Biden winning the election, and more importantly, expectations that the Democrats may regain control of the Senate.

(3) According to a CBS report, in the past month, at least five senior Wall Street strategists have sent reports to investors predicting that the Democratic Party will sweep the country, while Tobias Levkovitz (Tobias Levkovitz), the top strategist of Citigroup, also set Biden's chances of winning at 65%.

03How are A-shares and the industry interpreted in different situations?

In terms of future campaign results, we analyze the short-term and medium- to long-term effects by dividing Biden's victory (large-scale fiscal stimulus plan led by the Democratic Party in the short term, tax increases in the medium term), Trump's victory (short-term Republican-led fiscal stimulus plan may fall short of expectations, and the Federal Reserve maintains low interest rates in the medium term), and Biden wins, but Trump refuses to acknowledge the three situations.

3.1. Market level: The certainty of election results and attitudes towards taxation are important influencing variables

3.1.1. In the short term: focus on the convergence of uncertainty in the election results

Market risk appetite will rise again from its current low after the election results are implemented. Whether Biden wins or Trump wins, the easing of uncertainty after the election will help boost the market's risk appetite. However, since the current market expectations are large-scale fiscal stimulus and Biden's counterattack, if Trump is re-elected, the relatively small fiscal stimulus plan led by the Republican Party will eventually be implemented, and the market may have to experience a restructuring of expectations, but maintaining a low interest rate environment with tax cuts will reduce market concerns about rising interest rates; if Biden fights back, the large-scale fiscal stimulus plan led by the Democratic Party is likely to eventually be implemented. This is also in line with current market expectations and may even exceed expectations, and the risk appetite for A-shares as a whole may be boosted.

In extreme cases, if Biden wins, but Trump does not acknowledge or question the reality of Biden's victory, unresolved uncertainty about the general election rises, which in turn may suppress global risk appetite.

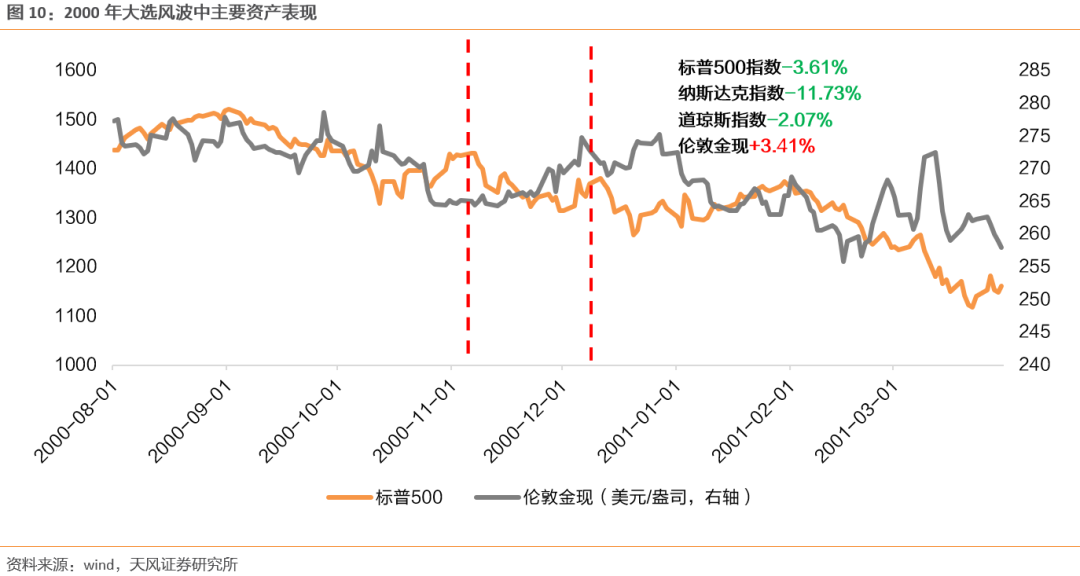

There has been a situation in US history where confirmation was not immediately possible after a general election. In the 2000 US election, Republican candidate Bush defeated Democratic candidate Gore. Among them, however, Florida was unable to determine whether the final machine count showed Bush's victory due to the proximity of the two. This also raised questions from the Democratic Party. Afterwards, the two sides got into a debate over whether the local states and counties needed manual vote counting. Until December 9 of that year, the federal court finally stopped manual vote counting, which also confirmed the legality of Bush's victory in the general election.

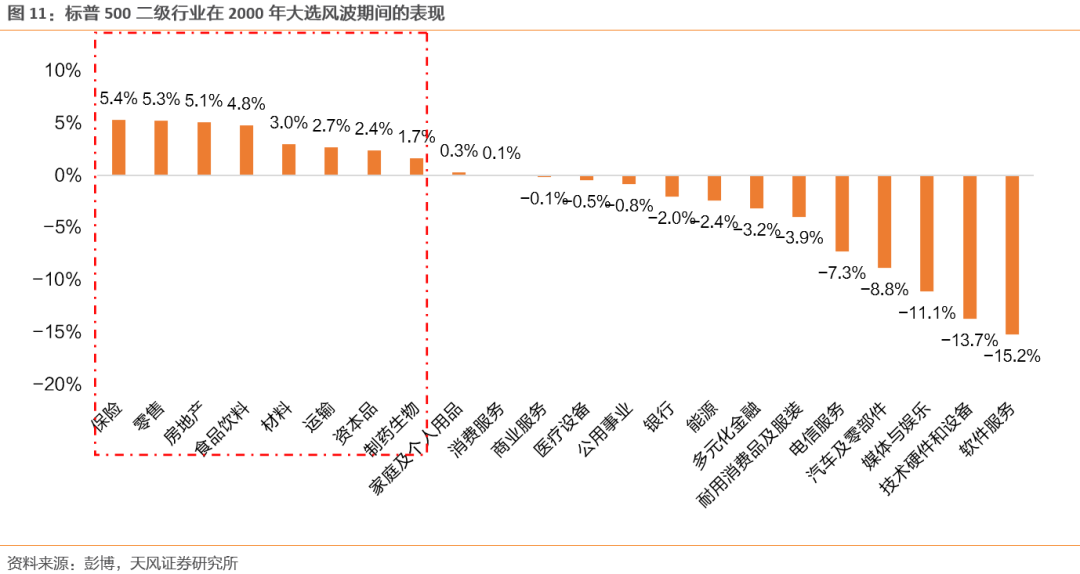

However, judging from asset performance during this period, capital risk aversion was strong. Due to election uncertainty, market risk appetite continued to decline. The Dow Jones Index, S&P 500 Index, and Nasdaq Index fell 2.07%, 3.61%, and 11.73% respectively during the 11.7-12.9 period, while the safe-haven asset gold bucked the trend, and London Gold's current price rose 3.41% during the period; judging from industry performance, insurance, real estate, retail, food and beverage, transportation, pharmaceutics, etc. performed well, while the highly elastic recovery of media entertainment, hardware and software declined sharply.

Judging from now on, the above dispute is likely to happen again, and if it does happen, it may be more complicated than it was at the time. Although on the 15th of this month, Trump said in an interview with the “Capitol Hill” that if Democratic presidential candidate Joe Biden wins the November 3 general election, he will accept the peaceful transfer of power. However, Trump also pointed out that he wanted this to be an “honest election,” and once again questioned the reliability of mail-in voting. In July, Trump already questioned the unfairness of mail-in ballots, which also paved the way for future uncertainties. Judging from the current distribution of nine federal court justices, after the death of Justice Ginsberg nominated by the Democratic Party, there were 3 nominees from the Democratic Party and 6 from the Republican Party, which is quite close to the distribution in 2000 (Republican nomination: Democratic nomination 7:2), and 3 of them were nominated by Trump. Therefore, once there is a dispute situation requiring a federal court ruling, it is not ruled out that the federal court will decide in favor of Trump, which also makes the election results in the case of dispute full of uncertainty.

Therefore, as far as the A-share market is concerned, with the Chinese and US capital markets becoming increasingly closely linked, the uncertainty of the US election will also suppress the risk appetite of A-shares.

3.1.2. Medium- to long-term impact: Focus on how strong tax increases and cuts support the asset market bubble

If Trump wins, the fiscal deficit is likely to remain high in the context of continuing or increasing its tax reduction policy, which will also increase the government's tolerance for inflation. The Fed will continue to maintain the current low interest rate until 2023, and loose liquidity will support the current global asset bubble; and if Biden wins, the US government will re-enter the tax hike cycle, the fiscal deficit will recede, and the government's tolerance for the level of inflation will decline. This is very likely to increase the pressure on the current asset bubble. adjustment pressure.

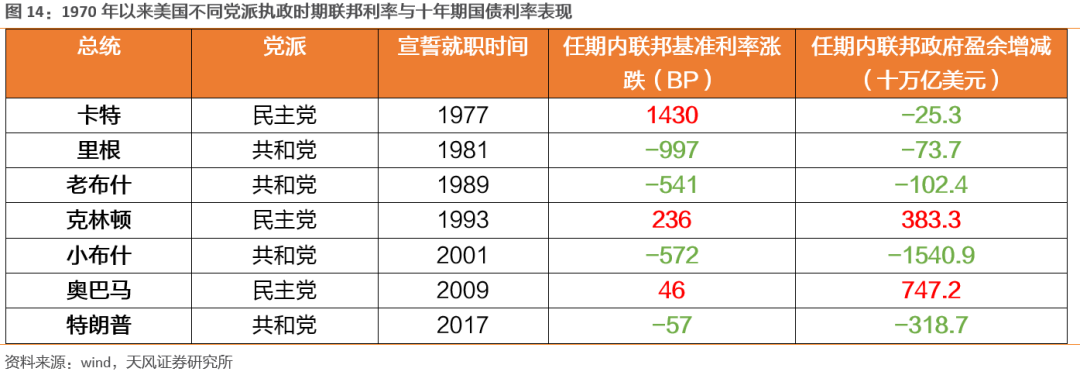

Judging from historical experience, tax increases and tax cuts are the policy orientations of the Democratic Party and the Republican Party, respectively, and the tolerance for dealing with inflation and the demand for federal interest rates are not the same. Judging from the past 50 years, the Republican Party and the Democratic Party have separate traditions of cutting and raising taxes. Typical Republican presidents such as Reagan lowered the top personal income tax rate from 70% to 28% and the top corporate income tax rate from 46% to 34% after implementing tax reforms in 1981. This also tripled the US fiscal deficit in 1990 to 220 billion US dollars. Later, George W. Bush even passed a tax cut bill of up to 1.35 trillion US dollars at the beginning of his term, making it one of the largest tax cuts in US history. Democrats, on the other hand, are more inclined to raise taxes. For example, Clinton made reducing the fiscal deficit the main task of tax policy, enacted the Deficit Reduction Act, the Annual Balanced Budget Act, and formulated a series of tax increase plans.

However, under these different policy orientations, the government's tolerance for inflation targets is also different, and demand for federal interest rates is also different. Looking at the past 50 years, during the Republican Party's administration, while tax cuts widened the fiscal deficit, it was often accompanied by a fall in federal interest rates; while the Democratic Party was in power, while raising taxes to cut fiscal deficits, federal interest rates often rebounded.

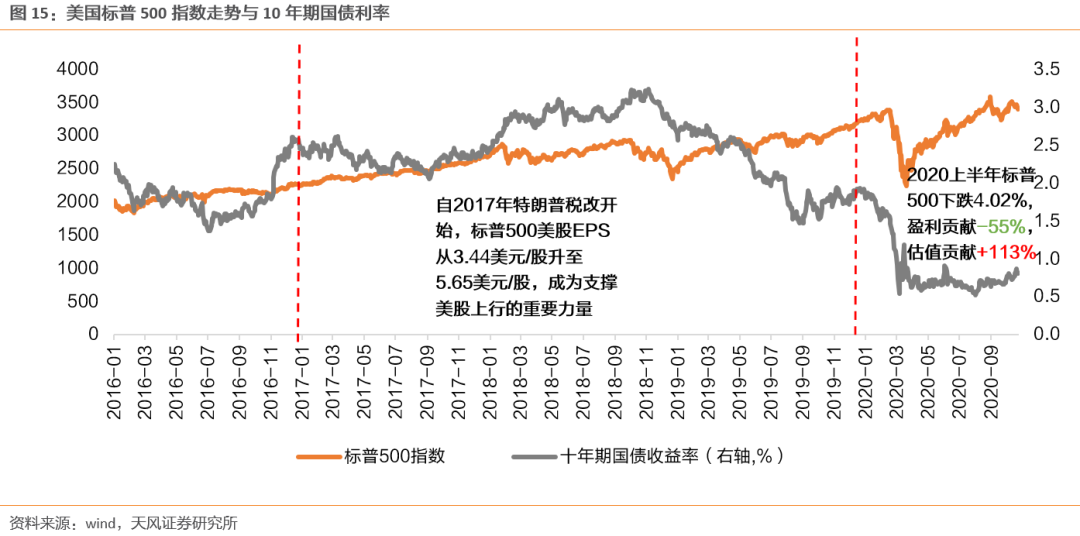

However, in the past four years, Trump's tax cuts and the Federal Reserve's interest rate cut policy have provided important support for US stock profits and valuations, and Biden's tax increase policy is likely to break through the asset bubble in the medium to long term. Since Trump's tax reduction policy began to be implemented in 2017, US stock corporate profits have entered an improvement cycle. The S&P 500 EPS (diluted, arithmetic average) rose from $3.44 per share in 2016 to $5.65 per share in 2019, becoming an important driving force for the upward trend of US stocks. However, in the first half of 2020, when the impact of health events was significant, easy liquidity became an important driving force supporting the upward trend in US stocks with negative year-on-year growth in profits. The S&P 500 index fell 4.02% in the first half of the year, with profit contribution of -55% and valuation contribution of +113%. Therefore, if Biden reverses tax policy and monetary policy after coming to power, the asset bubble in US stocks will most likely be pierced by rising interest rates and declining EPS.

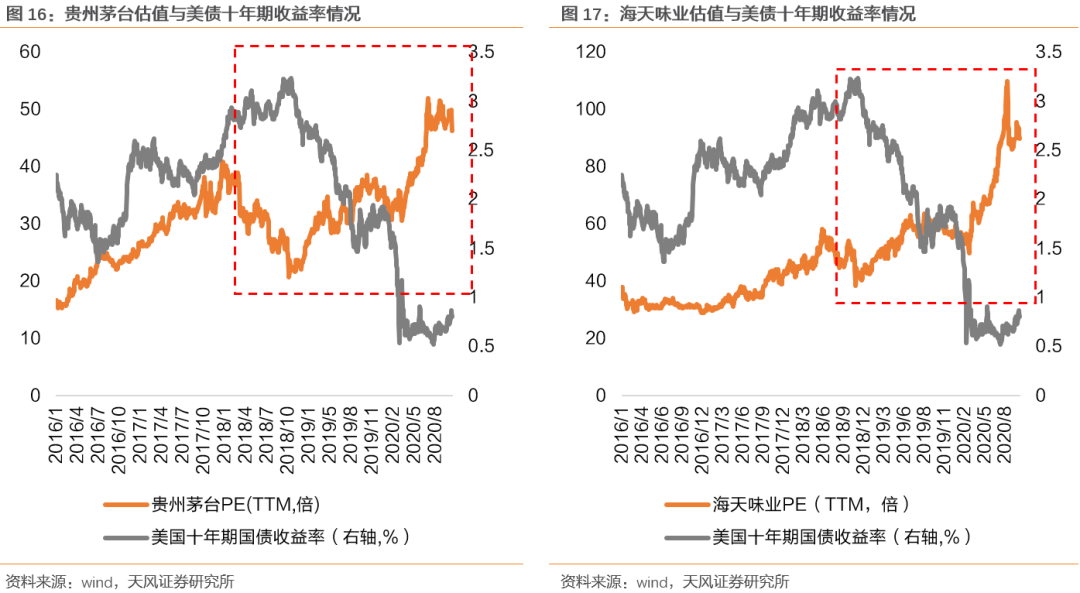

As far as A-shares are concerned, if Biden comes to power, a return in tax increases to lower interest rates will also put pressure on asset bubbles, especially for core assets with high foreign investment preferences. In the report “Revisiting Technology and Consumer Overvaluations — What Can Be Maintained? What are the risks?》 Among them, we mentioned that in the context of the continuous inflow of foreign capital, with changes in the A-share valuation system, macro discount factors have also gradually become an important influencing factor in the valuation of A-shares, especially Hakuba stocks, which have a high level of foreign investment preferences. We have seen that since 2018, the valuation level of Kweichow Moutai and Haitian Flavors have shown a significant negative correlation with the 10-year yield on US bonds. The reason behind this is that in the context of declining global macro discount rates, the theoretical valuation upper limit for high-quality domestic core assets by international investors has continued to rise. However, once the government's tolerance for inflation declines and the Federal Reserve ends the interest rate cut cycle early, the rebounding macro discount rate will depress the theoretical valuation level of core assets represented by Hakuba stocks, and A-shares may also face some adjustment pressure.

3.2. Industry level: Focus on the direction of policy support from both parties

3.2.1. Biden wins: Focus on export-oriented industries with strong consumer attributes, new energy industry chains, generic drugs and other industries

Judging from the industry structure, the new energy industry chain, the consumer-oriented export industry, generic medicine and other industries will have a more comfortable development environment:

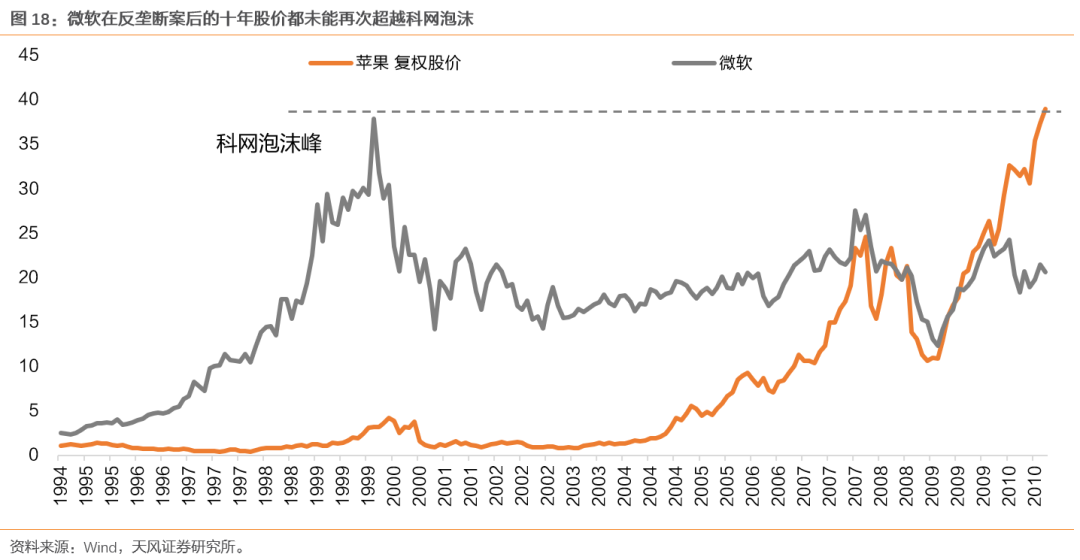

First, the division of the technology sector may intensify in the future, and traditional Internet giants may face pressure from business spin-off and adjustment. It is recommended to focus on the entire new energy industry chain. Compared to the Republican Party's emphasis on increasing supervision of internet giants, Biden and the Democratic Party put more emphasis on achieving antitrust goals by splitting up internet giants. After Biden wins the election, anti-monopoly legislation on tech giants such as Google, Amazon, Apple, and Facebook is also expected to be implemented within the next 3-6 months. Referring to the situation in the 2000 Microsoft antitrust case, although Microsoft and the Ministry of Justice eventually settled and were spared from being split, the investigation of the antitrust case caused both Microsoft's profits and valuation to be hit hard, and continued to decline over the next few years. Therefore, once antitrust legislation against Internet technology giants is enacted, the technology sector, and Internet companies in particular, may face a major impact. Furthermore, due to Biden's tendency to raise taxes, the Fed's current low interest rate market environment is difficult to maintain. The Fed's interest rate cut cycle is likely to end early after inflation tolerance is reduced, and support for the highly valued technology sector may weaken under the tightening of global liquidity. This will also further exacerbate the prosperity and valuation differentiation of the technology sector. Among them, the new energy industry chain is expected to continue to rise with policy support.

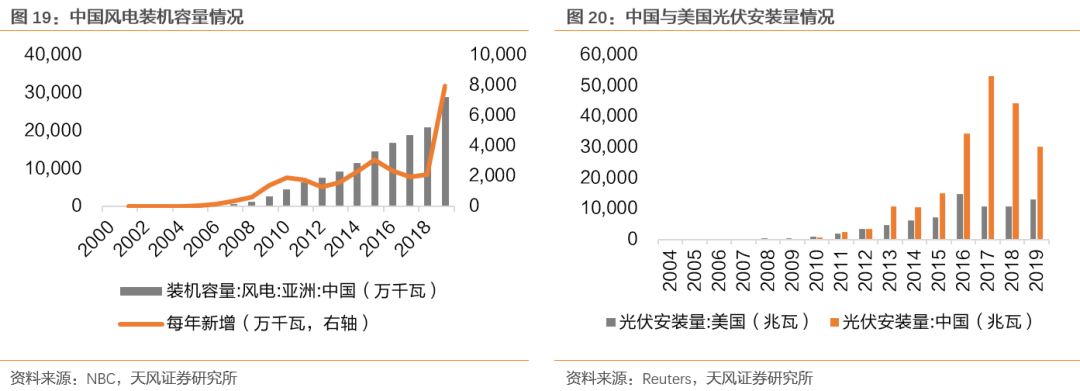

In the new energy industry chain, photovoltaics, wind power, and new energy vehicles are expected to be the first to benefit. On the one hand, under the green energy plan, Biden will increase the construction of solar panels and wind turbines, and the global demand for installed photovoltaic wind power will increase simultaneously. On the domestic side, as the “14th Five-Year Plan” approaches, the average annual increase in domestic photovoltaic and wind power installations is expected to exceed expectations. For example, at the 2020 Beijing International Wind Energy Conference, the “Beijing Declaration on Wind Energy” promised to add more than 50 million kilowatts of installed capacity per year in the “14th Five-Year Plan”, which is nearly double that of 2019. Therefore, boosted by domestic and foreign policies, photovoltaics and wind power will enter a new cycle of accelerated installation.

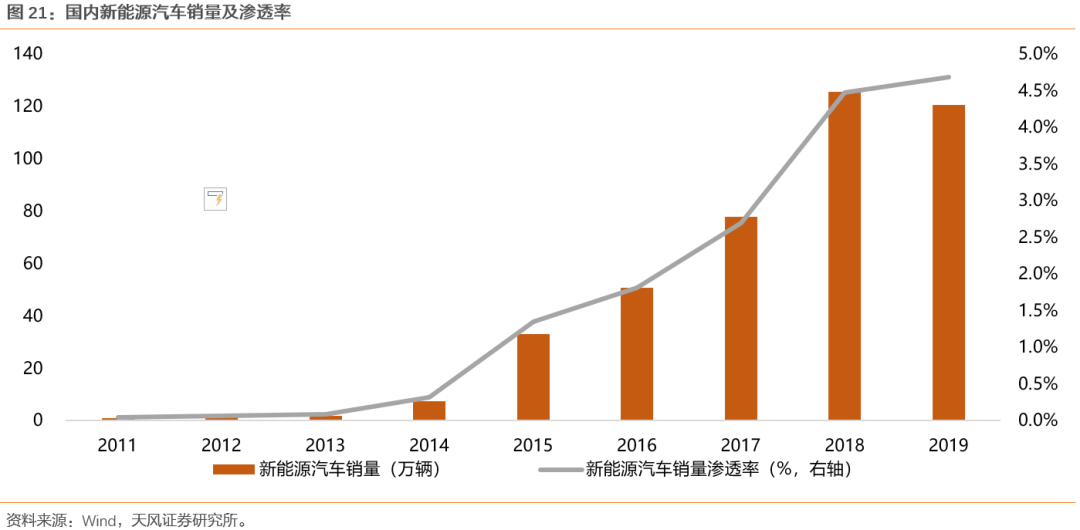

On the other hand, the A-share NEV industry chain is also expected to usher in a phase of accelerated increase in penetration rate. In the green energy plan, Biden provides policy support for NEVs in all areas, including infrastructure improvement, battery technology research and development, parts manufacturing plant renovation, and tax rebates on NEV purchases. This will also drive the world's NEVs into a rapid development cycle. According to data from China's energy storage network, global NEV sales in 2019 were 2.2 million units, with a market share of about 2.5%; in 2019, China sold 25.77 million vehicles, of which 1.06 million NEVs were sold, and the NEV penetration rate was only 4.68%. According to the Ministry of Industry and Information Technology's NEV industry development plan (2021-2035), the NEV penetration rate will reach 25% in 2025, and it is expected that the domestic NEV market will have broad room for growth in the future.

Second, Biden's negative attitude about Trump's use of tariffs to cause trade frictions and only hopes for the return of key manufacturing industries will push for a temporary suspension of trade frictions. This will promote the restoration of industry performance damaged by the heavy pressure of trade frictions. Among them, sectors with strong consumer attributes are expected to benefit more from the rise of the American middle class.

(1) Biden only emphasized the return of key industrial chains to the US, not the entire industrial chain that Trump emphasized leaving China, which created a relatively friendly environment for China's manufacturing industry chain;

(2) Biden is more inclined to return to global organizations and opposes Trump's resolution of trade issues through trade frictions and additional tariffs. This also makes future trade frictions likely to stop, and export-oriented industries previously suppressed by trade frictions are expected to recover their performance;

(3) Biden's tendency to raise taxes on the wealthy and support the rise of the middle class is expected to unleash the consumption potential of the middle class. In the long run, industries with strong consumer attributes will benefit even more from the A-share export industry.

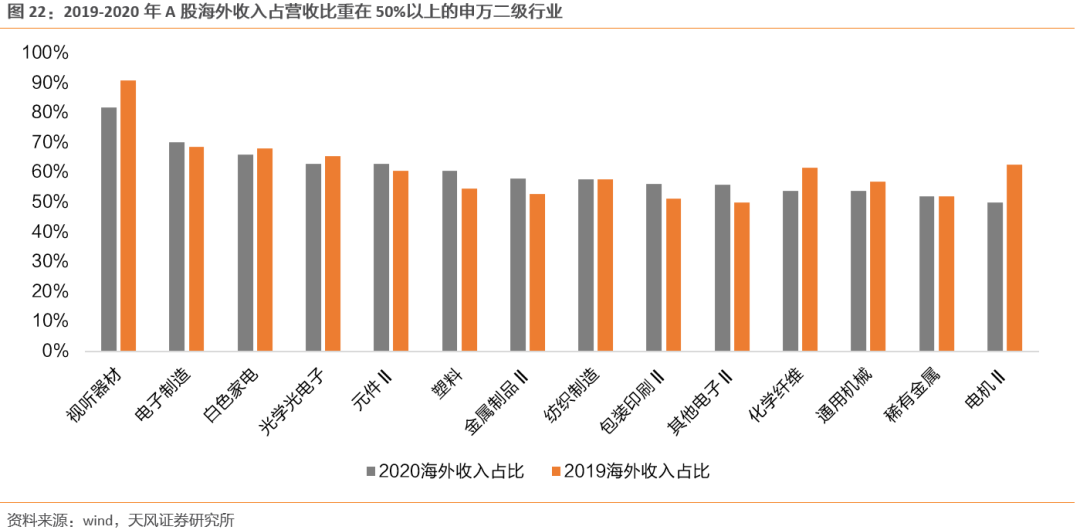

Judging from the share of overseas revenue in the 2020 mid-year report, the household appliances industry (audiovisual equipment, white goods), electronics (electronic manufacturing, optical and optoelectronics, components, other electronics), chemicals (plastics, chemical fibers), machinery and equipment (metal products, general machinery), textiles and clothing (textile manufacturing), light industry (packaging and printing), non-ferrous (rare metals), and electrical equipment (motors). Among them, the main industries with strong consumer attributes are audiovisual equipment, white goods, plastics, textile manufacturing, packaging and printing, and chemical fibers.

Third, Biden's crackdown on America's leading pharmaceutical monopoly will help domestic pharmaceutical companies expand their market share. Among them, generic drugs may benefit first. Judging from Biden's determination to lower the price of prescription drugs, allowing consumers to buy prescription drugs from abroad has laid the foundation for domestic pharmaceutical companies to expand their share of the US market. Among them, generic drugs have benefited in particular. According to Biden's campaign platform, the development of generic drugs will receive support. In particular, generic drugs will be allowed to obtain samples, which will provide more convenience for domestic generic drug companies.

3.2.2. Trump wins: Focus on the traditional energy sector and domestic substitution chain

From an industry perspective, traditional energy industries such as coal, petrochemicals, etc. will receive phased support; the continuation of the scientific and technological war may accelerate the development of domestic substitution chains, and the domestic aerospace and military industry may welcome more policy support as US investment expands; the continuation of trade frictions will continue to suppress industries with a relatively high share of exports.

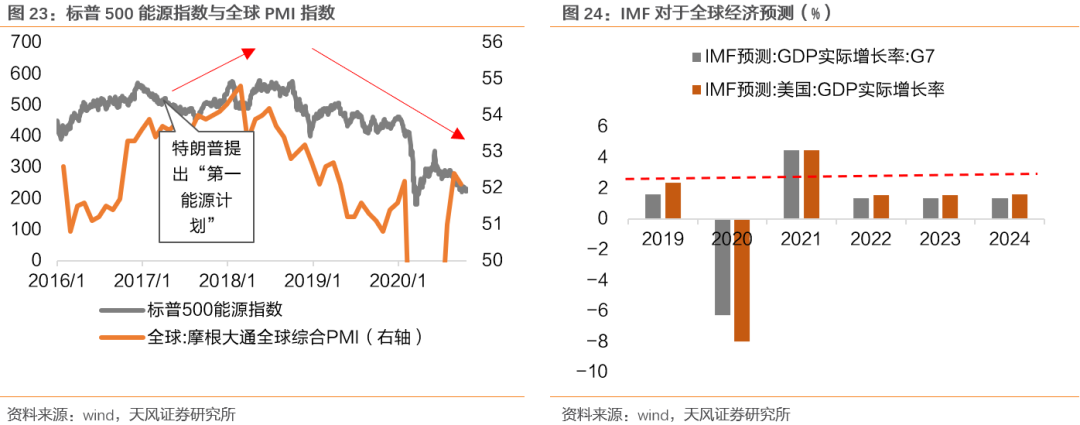

First, Trump's promotion of traditional energy and economic recovery after the health incident subsides may provide phased support for traditional energy industries such as coal and petrochemicals. Judging from the S&P 500 energy industry index, although there was a phased rebound after Trump proposed the first energy plan, as the global PMI index declined in the second half of 2018, weak demand eventually led to a continued decline in the S&P 500 energy index. Therefore, although Trump's support for traditional energy and the recovery of the economy after the impact of the health incident may provide phased support to the global energy industry and the domestic traditional energy industry, in the context of poor sustainability of global energy replacement and economic recovery, especially when the IMF is pessimistic about the global economic growth rate in the next few years, the coal, petrochemical and other industries are more likely to strengthen in stages, but sustainability is weak in the case of long-term optimization and upgrading of the domestic industrial structure.

Second, if Trump is re-elected, Trump will continue to increase his crackdown on domestic technology companies, and the technology sector's risk appetite will be suppressed, so the technology sector is also facing differentiation. It is recommended to focus on sectors such as upstream military (raw materials, components), Xinchuang (chips, operating systems, office software), semiconductor equipment, etc., which increase the penetration rate as the degree of substitution of domestic production increases.

In the military industry sector, with Trump forming a space force and increasing investment in the aerospace industry, the domestic aerospace and military industry sector is expected to receive further policy support, especially in the current industrial chain that is highly dependent on the US. Considering that the US BIS added military industry central enterprises to the prohibited list, the first domestic replacement response is in the field of military electronic components, such as infrared detectors, passive components, power devices, and logic integrated circuits; in addition, China has purchased aviation mainframe products such as civil aviation aircraft, general purpose helicopters, etc., and their maintenance materials account for 0.5% of GDP, or will benefit from replacing some domestic aviation civil aircraft with foreign products. Currently, regional civil aviation aircraft, helicopters, and aircraft body maintenance consumables are more mature.

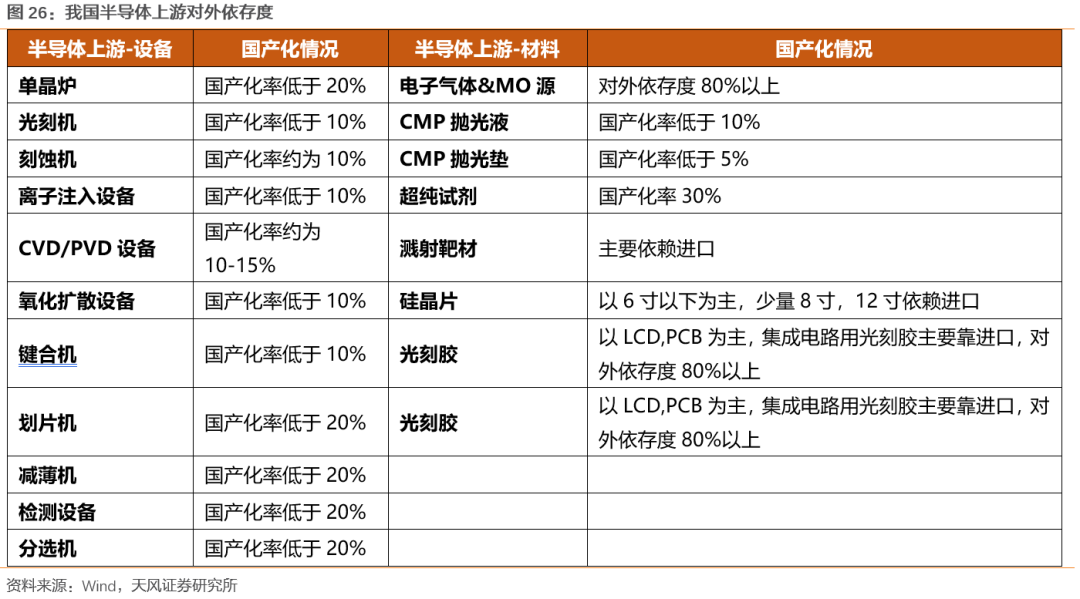

In the field of innovation, hardware looks at chips, and software looks at operating systems and office software. Domestic substitution in the innovation sector is also a gradual process, but in the medium to long term, the market capacity is large, and leading domestic manufacturers will continue to benefit from the promotion of localization. In the short term, it is expected that progress will be made in replacing domestic party and government office systems involving national security. The bidding situation of operators and major state-owned banks since May also shows that the bidding situation for the party and government office system has exceeded market expectations. A representative event is the 2020 server tender and collection situation announced by China Telecom. The H series (CPU type is Kunpeng 920 series or Zhongke Shuguang Haiguang series processor) produced nationwide accounted for 19.86%. The first nationwide tender for production servers received 19.86% of the share, or indicates that the server localization replacement process will accelerate.

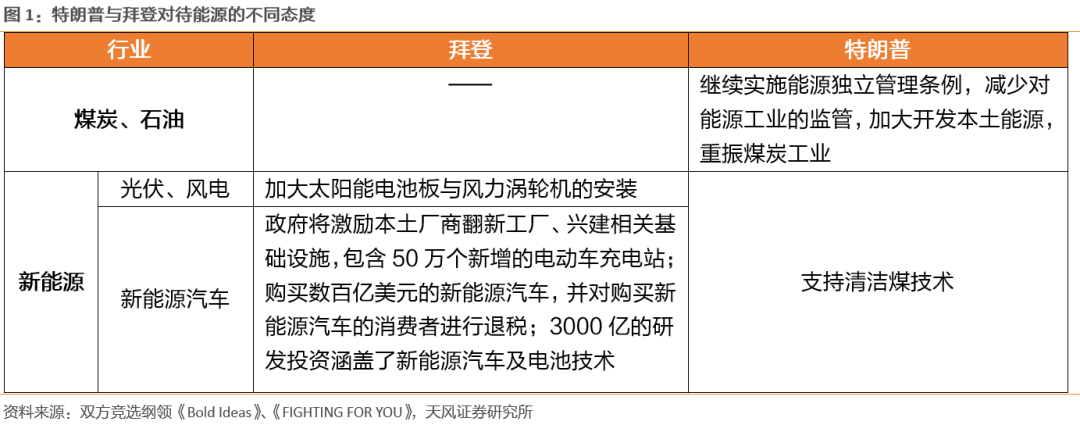

Semiconductor equipment, semiconductor design, is one of the best-performing technology sectors since last year, mainly due to the rising prosperity of the industry itself, and the inflection point on the demand side probably also appeared in early '19. As a result, the design field has achieved significant growth. Relatively speaking, the domestic replacement logic for upstream equipment has not been fully interpreted. At present, the localization rate of major semiconductor equipment in China is below 20%, so there is plenty of room in the medium to long term.

Third, unlike Biden, Trump may continue to seek pressure from the trade side after being re-elected. In particular, negotiations on the second phase of the Sino-US trade agreement, which were previously shelved due to health issues, may continue after re-election. However, the second phase of negotiations involves issues such as intellectual property protection and cybersecurity. There are many differences, and progress may be slow, so the export-oriented industry may continue to be pressured by tariffs. It is not even ruled out that Trump will re-impose new tariffs in order to put pressure on the performance of industries with high overseas revenue, such as home appliances, electronics, chemicals, machinery and equipment, light industry, textiles and clothing, etc.

Risk warning: events exceeding expectations in the US election, downside risks of the economy, risk of market fluctuations, etc.

4.短期内,大选结果的最终落地都有利于全球风险偏好的回升,需要警惕类似2000年的悬而未决的风险。如果拜登获胜,民主党人主导的大规模财政刺激计划落地预期将会提振市场情绪;如果特朗普获胜,虽然财政刺激规模可能不及预期,但减税政策倾向下美联储维持低利率环境也将减轻对市场利率上行的担忧。但一旦出现类似2000年大选的悬而未决的情况,市场风险偏好将受到压制。

4.短期内,大选结果的最终落地都有利于全球风险偏好的回升,需要警惕类似2000年的悬而未决的风险。如果拜登获胜,民主党人主导的大规模财政刺激计划落地预期将会提振市场情绪;如果特朗普获胜,虽然财政刺激规模可能不及预期,但减税政策倾向下美联储维持低利率环境也将减轻对市场利率上行的担忧。但一旦出现类似2000年大选的悬而未决的情况,市场风险偏好将受到压制。