Brief review: The potential impact of a new wave of public health events in Europe and the US

Affected by the continuing escalation of public health events in Europe, the major European stock markets fell sharply at the opening of today. Currently, the German and French stock markets have plummeted by 4.4% and 4%; the euro has plummeted against the US dollar, driving the dollar index to strengthen and gold to plummet, and the opening of the US stock market has also been dragged down. Currently, the decline of the three major indices is close to 3%. We suggest in this week's weekly report and last week's report “The Possible Impact of the Third Wave (Normalized) Public Health Incident in the US” that since this public health incident coincided with the simultaneous escalation of the US fiscal stimulus in Europe and the US, and the US fiscal stimulus is still at an impasse, this is still different from the environment where US fiscal stimulus was strong and Europe did not recur from June to July. Therefore, we need to pay attention to disturbances at the emotional level. Recent market changes also confirm our concerns.

Investors are generally concerned about the possible impact of repeated sharp fluctuations in overseas markets and assets, and the escalating public health events. In this regard, we have the following reviews for your reference.

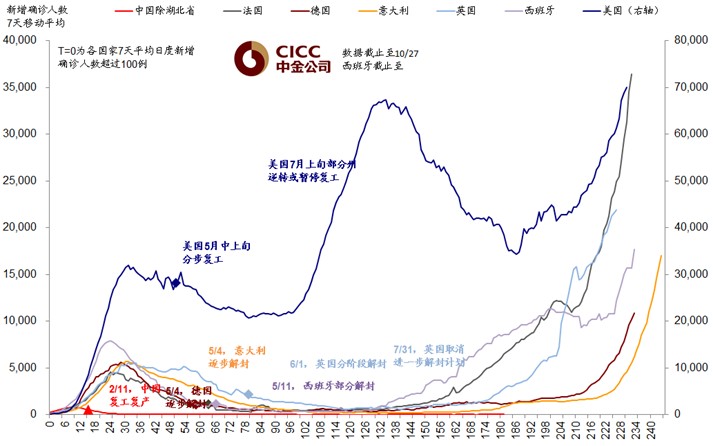

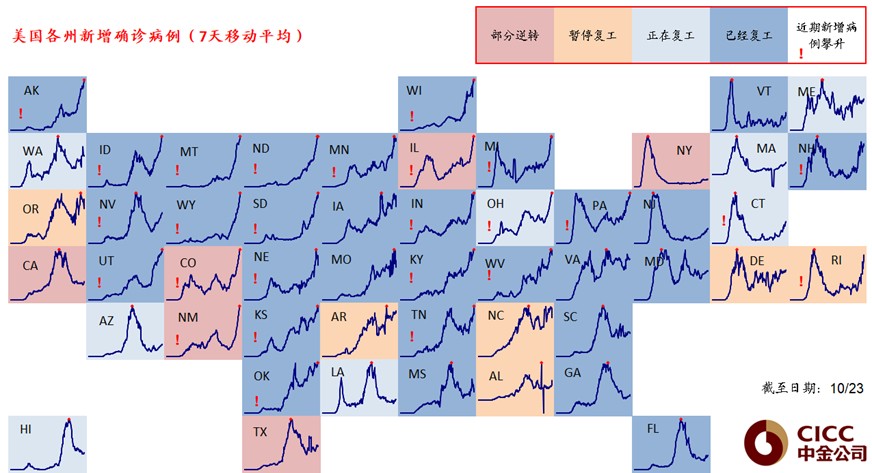

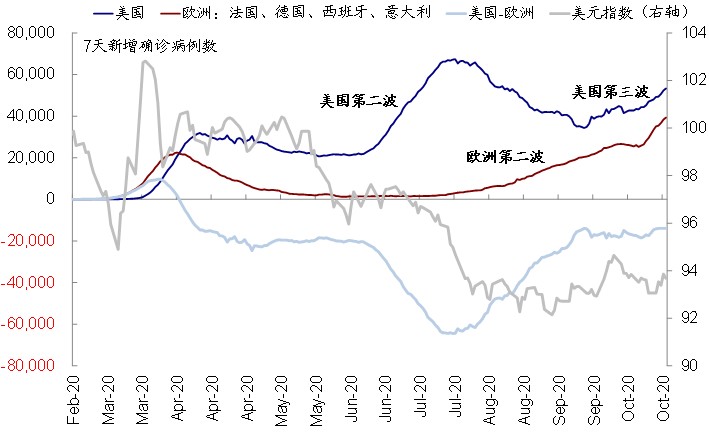

i. The recent sharp fluctuations in overseas markets (particularly in Europe) are mainly related to concerns about the continued escalation of public health events. Currently, the second wave of public health incidents in Europe and the third wave in the US continue to rise. The number of new daily confirmed cases of the third wave of public health events in the US has surpassed the high of the second wave, reaching 85,000 cases last Friday; Europe also continues to rise, especially in France.

i. The recent sharp fluctuations in overseas markets (particularly in Europe) are mainly related to concerns about the continued escalation of public health events. Currently, the second wave of public health incidents in Europe and the third wave in the US continue to rise. The number of new daily confirmed cases of the third wave of public health events in the US has surpassed the high of the second wave, reaching 85,000 cases last Friday; Europe also continues to rise, especially in France.

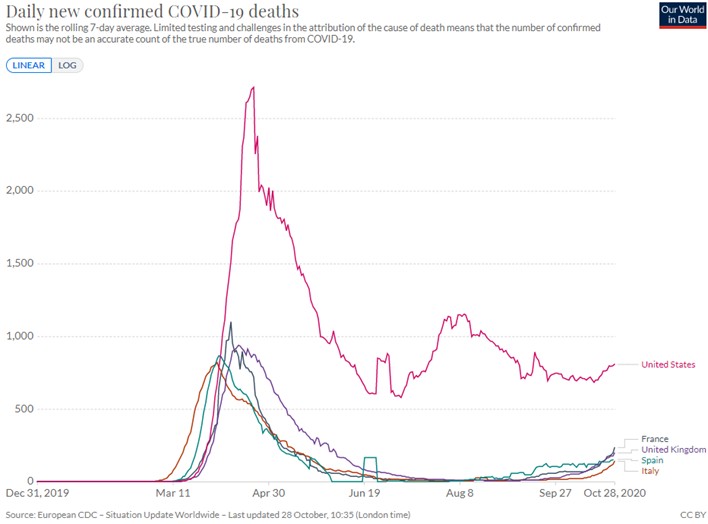

ii. However, the more important mortality indicators are still low, not even close to the peak of the second wave of public health events in the US in early August. Although the number of new diagnoses continues to increase, due to the possibility that the toxicity of the virus has declined marginally, the number of people infected in the new wave of public health incidents is mostly young people, and medical resources have not yet been as crowded as in March, although the overall death rate in Europe and the US has recently risen, it remains low. This is similar to the situation when the second round of public health events in the US escalated from June to July, and even the number of deaths fell short of the peak of the second wave of public health events in the US in early August.

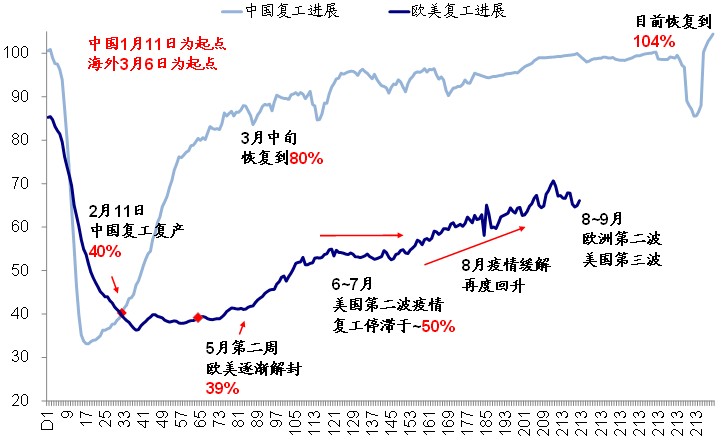

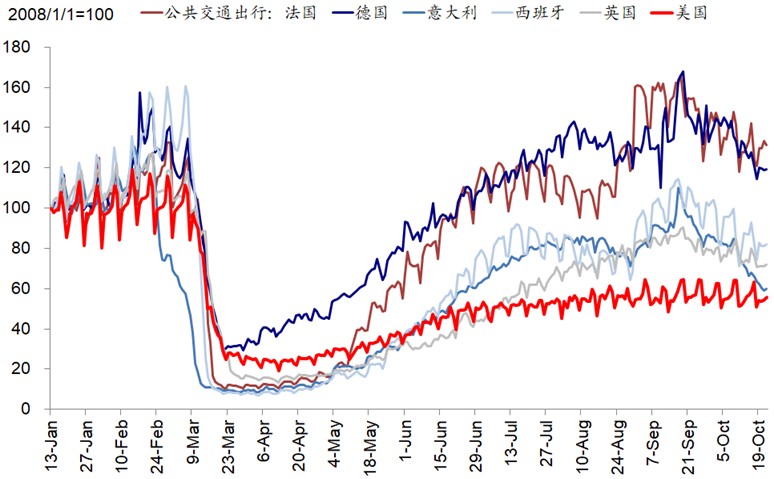

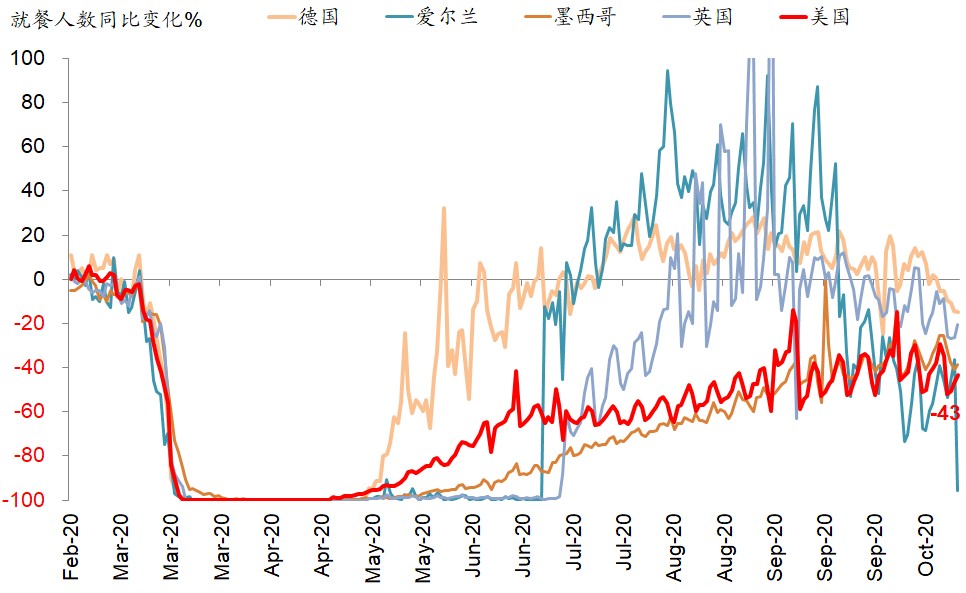

iii. As a direct result of the escalation of public health events, another phased slowdown in the pace of resumption of work is dragging down some demand. In order to cope with the continuous escalation and spread of public health events, major European countries have re-adopted certain lockdown measures. This can be reflected in recent high-frequency indicators such as travel and dining, so it will indeed slow down the resumption of work and demand.

But it's not a complete reversal. We compared the quarantine and lockdown measures currently implemented by major European countries, and after comparing them with March, we found that the current policy level is still less stringent than March. The experience of the second wave of public health events tells us that as long as the death rate is low, the impact of public health events may be more of a local rather than a global reversal.

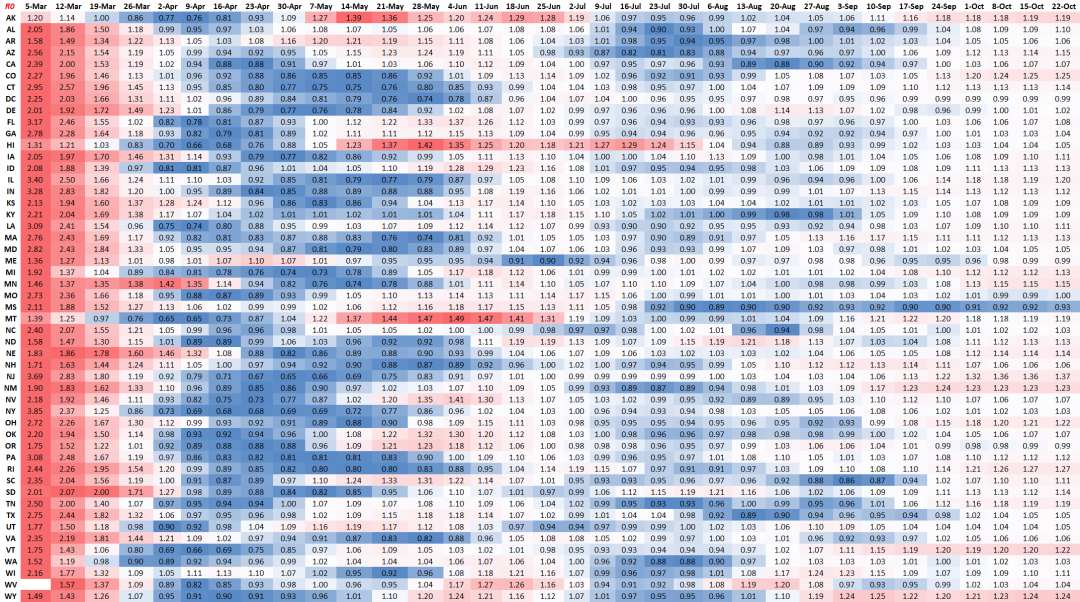

iv. In terms of time rhythm, according to historical experience, the interval between adopting certain quarantine and lockdown measures and peaking of new cases is about 3 to 4 weeks, so if the lockdown measures are implemented properly (after all, there are lessons learned from March), the next few weeks may gradually see a decline in the peak of new diagnoses in Europe.

In contrast, all Midwestern states, where the third wave of public health events in the US is relatively severe, are still in a state of complete resumption of work, have not taken many measures, and R0 is generally higher than 1, so it is expected that the current escalation of public health events will continue for some time.

v. In terms of impact, it is not ruled out that market sentiment will continue to be disturbed in the short term. The second wave of public health events in the US did not have an obvious impact on the market. When the second wave of public health events escalated from June to July, it was the stage where the first round of fiscal stimulus was effective and the economic recovery slope was the fastest. Combined, the European public health incident did not escalate, the death rate was not high, and the resumption of work was not reversed globally, so the market was not much affected.

However, the current environment is somewhat different. This round of the third wave of public health events in the US combined with the second wave of European public health events and the “wrong period” with policy stimulus, and the second round of fiscal impasse has been slow to break. Although we still don't think it will fundamentally reverse fundamentals, it is not ruled out that it will disrupt market sentiment.

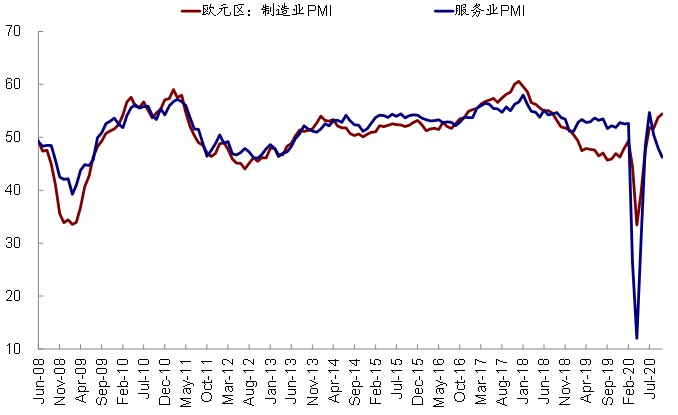

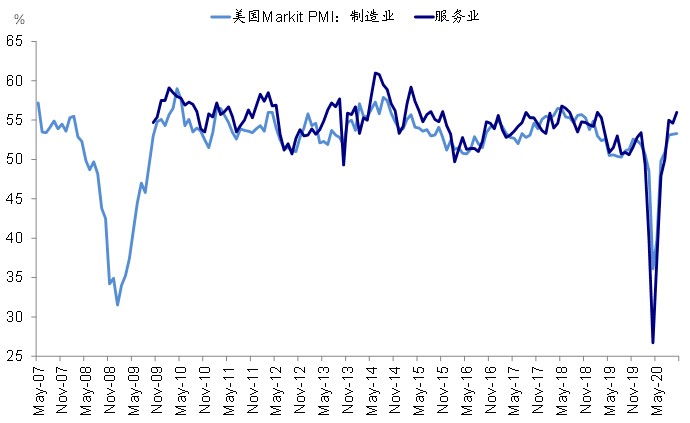

vi. from a fundamental perspective, the escalation of public health events may cause a relatively greater drag on European growth, which in turn will drag down the relative performance and exchange rate of asset prices. Since Europe's policy stimulus has not been as strong as the US, and the prevention and control measures taken are more severe than the US, its phased drag on some needs and growth will also be even more obvious. For example, the European service sector PMI has returned to the contraction range, while the US manufacturing and service PMI continues to improve and rise in the expansion range.

This differentiation may drag down European assets (such as the stock market and the euro exchange rate) in stages. Take the US dollar index as an example. Its trend since July basically closely coincides with previous public health events in Europe and the US. This is based on this consideration. We determined in the “Allocation Strategy for the General Election Sprint Period” of the October Report on Overseas Asset Allocation that the upgrading of European public health may put pressure on the resumption of work process and short-term market sentiment, and passively boost the US dollar index, so we maintain a cautious and optimistic view of Europe.

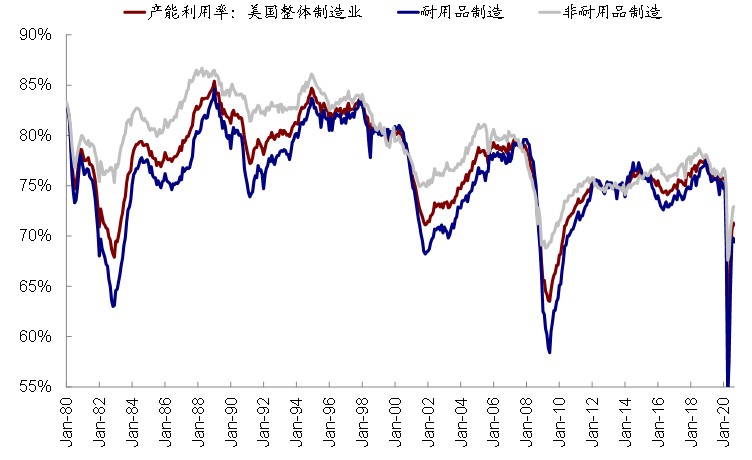

vii. In the medium term, normalized public health events dragged down production capacity and lagged behind demand, leading to significant inventory removal and increased imports to meet demand, particularly on the US consumer side. The third wave in the US and the second wave in Europe indicate that public health events are developing in the direction of normalization until the first or second quarter of next year, before public health events are successfully developed and can be applied on a large scale (if vaccines appear every year, but large-scale successful application may not be until the first or second quarter of next year). Although normalized public health events will not cause such drastic effects and fears as the first wave in March, they will still slow down the progress of the resumption of work and the rise in production capacity.

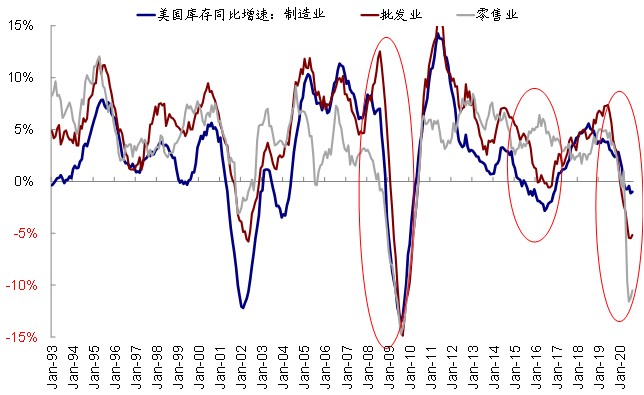

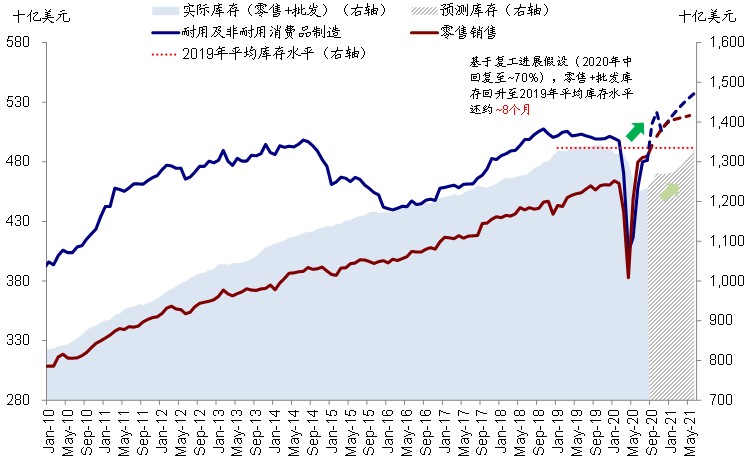

At present, the progress of the resumption of work in Europe and the US has been restored to only 66%, which clearly lags behind China's 104%. In the context of relatively steady consumer demand, delays in supply (US retail consumption was 1.9% month-on-month in September, much better than expected; industrial output fell unexpectedly in September) will cause rapid inventory removal (the growth rate of US consumer goods inventories all fell to historic lows), increase import demand, and even gradually begin a new inventory replenishment cycle.

For example, we calculated in the special report “Inventory Cycle for Overseas Asset Allocation: If a New Inventory Replenishment Cycle Begins”, if we assume that: 1) the current third wave of public health events caused a one-month reversal and recovery (currently ~ 66%); 2) consumption gradually decelerates and falls to a long-term month-on-month growth rate of ~ 0.2% after one quarter, then the current inventory recovery of retailers and wholesalers to the 2019 average will take about 8 months from now until mid-2021. The relatively optimistic and pessimistic public health events correspond to 4 months and 14 months, respectively, and do not take into account the impact of imports.

In summary, we maintain our recent view that as the general election and public health events escalate, the market may still be mainly wait-and-see, waiting for the election results to finally be implemented and the peak of public health events to subside (“Allocation Strategy for the General Election Sprint Period”). At the beginning of last week, we also indicated that we observed some signs of risk appetite weakening again.

However, we believe that short-term fluctuations will not change the medium-term trend of gradual deepening recovery. The marginal impact of public health events continues to decline, and progress in vaccine research and development is still worth looking forward to. From the perspective of the general election, whether the Democratic Party, which has a high probability of being swept by the polls, or the Republican Party, which has a low probability of winning, may not be bad for the market; while the Congress continues to be divided, it returns the market to its original logic of gradual restoration of fundamentals (“The Five Situations of the US Election”).

i. 近期海外市场(特别是欧洲)再度大幅波动,主要还是与担心公共卫生事件的持续升级有关。目前,欧洲第二波和美国第三波的公共卫生事件仍在持续攀升,美国第三波公共卫生事件的每日新增确诊病例已经超过第二波的高点,上周五一度高达8.5万例;欧洲也在继续攀升,特别是法国尤为显著。

i. 近期海外市场(特别是欧洲)再度大幅波动,主要还是与担心公共卫生事件的持续升级有关。目前,欧洲第二波和美国第三波的公共卫生事件仍在持续攀升,美国第三波公共卫生事件的每日新增确诊病例已经超过第二波的高点,上周五一度高达8.5万例;欧洲也在继续攀升,特别是法国尤为显著。