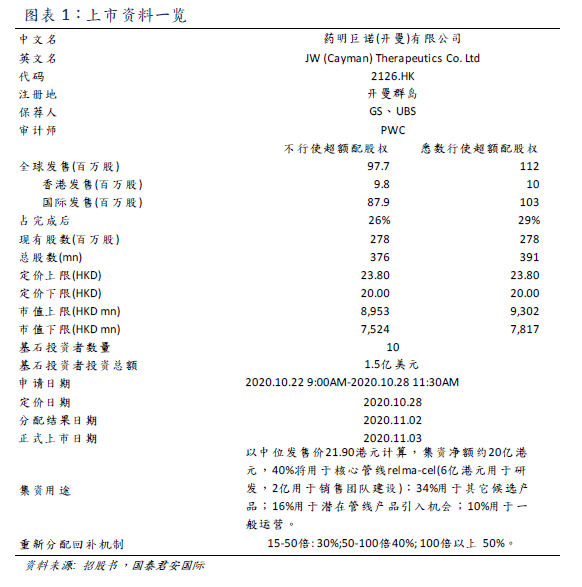

Yao Ming Junuo-B (02126) is a leading cell therapy company in China and is currently in the clinical stage. A joint venture between Juno and Wuxi Apptec in 2016 has established an integrated platform focusing on the development, manufacture and commercialization of breakthrough cellular immunotherapy for hematological cancer and solid tumors. Core pipeline CD19 target CAR-T therapy relma-cel 's new drug application for 3L

DLBCL has been accepted by NMPA and has been recognized as a breakthrough therapy for FL.

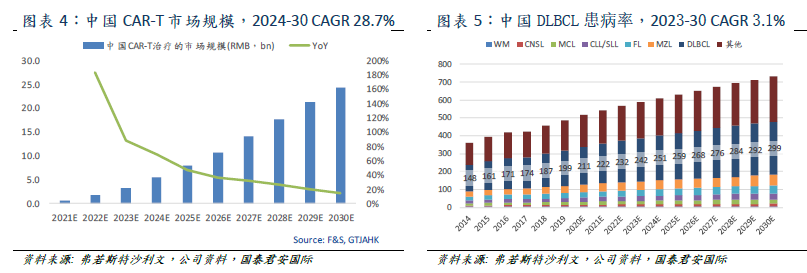

CAR-T therapy has a broad market prospect.Cellular immunotherapy is a breakthrough in cancer treatment, which can provide lasting relief of hematological tumors (B-cell lymphoma and leukemia) that are difficult to be treated by other treatments. Falls expects the size of China's CAR-T market to grow rapidly, from 600 million yuan in 2021 to 5.4 billion / 24.3 billion yuan in 2024 / 2030. It is estimated that the target number of patients for the target indication (3L

DLBCL/FL/MCL) of Relma-cel in 2019 is 28700 and 5200, respectively. According to the third-line diffuse large lymphocytic carcinoma (3L

DLBCL) submitted by relma-cel to NDA, the target sales of patients from 2021 to 2022 were 1000-2000.

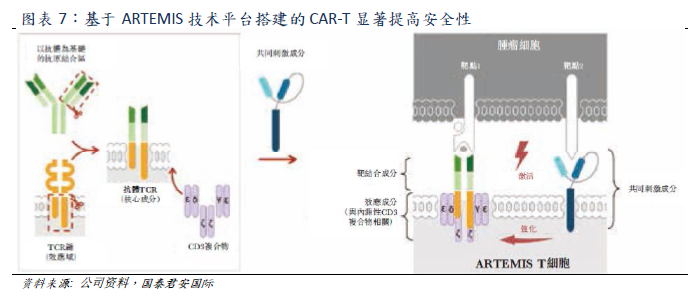

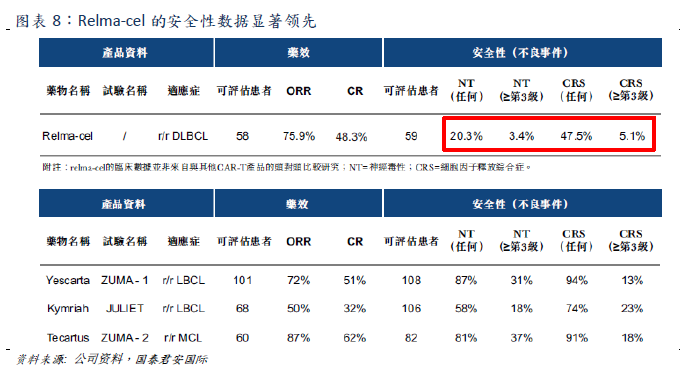

Relma-cel has great potential to become the CAR-T therapy of FIC/BIC in China.The better CAR of Juno was obtained by License-in, and the newer CAR-T structure was adopted. ITMA (CD3 polymer) was not directly linked to the costimulatory domain of T cells, which avoided the hyperactivation of T cells, which made relma-cel more safe. Relma-cel

the safety data are significantly better than the two existing international CAR-T therapies with similar efficacy. At present, there are no CAR-T products on the market in China, and Fosun Kate's products have also been submitted to NDA for acceptance. Novartis's products are in the third phase, but Fosun Kate's CAR-T

Yescarta products for License-in Kate are expected to be less safe than relma-cel.This makes it possible for relma-cel to become a domestic FIC and the best CAR-T therapy of its kind.Guotai Junan Securities expects relma-cel to be approved for listing in 2021, accounting for the leading share of the CAR-T market.

Sales enjoy first-mover advantage

In the clinical trial stage, the company has accumulated the doctor resources of some leading hospitals. It is helpful to the future business promotion. In addition, the company plans to initially build a sales team of 60-70 people, covering 50 top hospitals. In the next three years, it is expected to expand the sales team to 100-120 people, covering 100 cancer hospitals.

Sufficient production capacity, high production success rate and cost advantage

The company can currently support the production of therapeutic drugs for 5000 patients each year, which will be sufficient to meet the development needs of the company in recent years. At the same time, the manufacturing success rate of relma-cel is higher. The success rate of producing relma-cel during the whole DLBCL registration clinical trial was 100%, which was higher than the overall manufacturing success rate of 99%, 91% to 93% and 96% for Yescarta, Kymriah and Tecartus during the registration clinical trial, respectively. CAR-T therapy as a highly customized personalized treatment program, because it can not be large-scale production diluted cost, the success rate of production will directly affect the production cost. The higher success rate of Relma-cel will bring cost leadership and help to win the competition in the CAR-T market in the future.

The company can currently support the production of therapeutic drugs for 5000 patients each year, which will be sufficient to meet the development needs of the company in recent years. At the same time, the manufacturing success rate of relma-cel is higher. The success rate of producing relma-cel during the whole DLBCL registration clinical trial was 100%, which was higher than the overall manufacturing success rate of 99%, 91% to 93% and 96% for Yescarta, Kymriah and Tecartus during the registration clinical trial, respectively. CAR-T therapy as a highly customized personalized treatment program, because it can not be large-scale production diluted cost, the success rate of production will directly affect the production cost. The higher success rate of Relma-cel will bring cost leadership and help to win the competition in the CAR-T market in the future.

Catalyst:1)。

newly introduced project 2). Progress of Relma-cel 2L DLBCL 3). Application of CAR-T solid tumor. Risk: 1). Clinical progress is slower than expected (2).

market expansion is slower than expected.

Company profile

Yao Ming Junuo is a leading cell therapy company in China, which is currently in the clinical stage. A joint venture between Juno and Wuxi Apptec in 2016 has established an integrated platform focusing on the development, manufacture and commercialization of breakthrough cellular immunotherapy for hematological cancer and solid tumors. Core pipeline CD19 target CAR-T therapy relma-cel 's new drug application for 3L

DLBCL has been accepted by NMPA and has been recognized as a breakthrough therapy for FL.

The fast-growing CAR-T treatment market

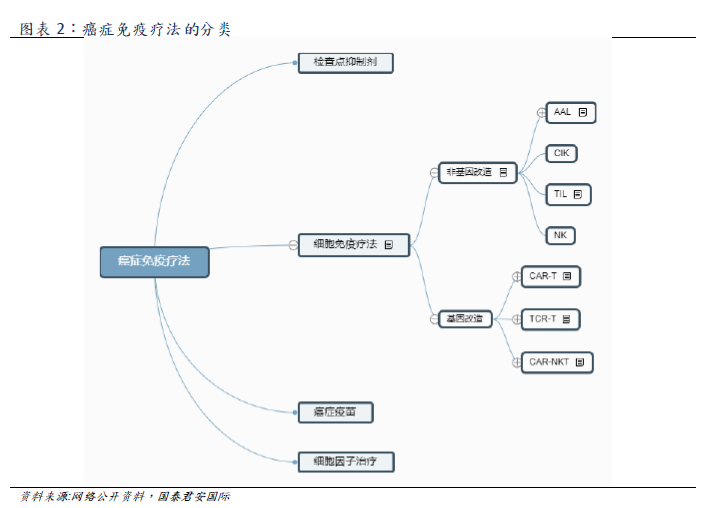

The main categories of tumor immunotherapy include cellular immunotherapy, checkpoint inhibitors, therapeutic cancer vaccines and cytokines. As tumor immunotherapy can provide lasting remission, and some advanced cancer patients usually have a good tolerance, the discovery and development of this treatment has become an important milestone in global cancer therapy.

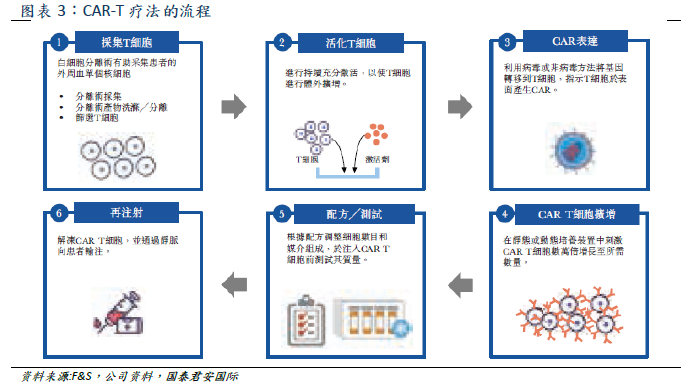

Cellular immunotherapy is a kind of tumor immunotherapy, which can be divided into seven categories (shown above). The main categories include genetically modified CAR-T, TCR-T and non-genetically modified NK, TIL. CAR-T obtains patient's T cells from peripheral blood. After genetic modification, T cells have the ability to target tumor associated antigen (TAA) and kill cancer cells (T cell surface insertion and antigen receptor CAR can bind to tumor cell surface antigen, thus activating T cells to eliminate tumor), and then through in vitro expansion, intravenous infusion back to the patient. CAR-T therapy has the advantages of specificity, adaptability, long-term persistence and so on, and it is effective for refractory patients with recurrence, short course of treatment, and suitable for the elderly.

At present, only two CAR-T products have been approved in the global market, the Yescarta jointly developed by Kate and Gilead and the Novartis Kymriah. Falls data CAR-T market size in 2019 is about US $734 million,

is expected to reach US $4.7 billion / 18.1 billion in 2030, and

2019-2024 CAR-T has a compound annual growth rate of 45.3% and 25.0%. At present, there are no approved CAR-T products in the Chinese market. With the launch of new products, the Chinese market is expected to reach 600 million yuan in 2021 and 5.4 billion / 24.3 billion yuan in 2024 / 2030, with a compound annual growth rate of 28.7 percent from 2024 to 2030.

Clinical studies have shown that CAR-T therapy can permanently relieve B-cell lymphoma and leukemia which are difficult to be treated by other treatments. Lymphoma is a hematological tumor cancer involving lymphoid cysts of the immune system, 90% of which is non-Hodgkin's lymphoma (NHL). The most common subtypes of NHL are DLBCL, FL, MZL, CLL/SLL and MCL. Only DLBCL accounts for about 40% of the incidence of NHL. Falls expects that the number of DLBCL patients in China will reach 242000 / 299000 in 2023 / 2030, with an average compound annual growth rate of 3.1% from 2023 to 2030. Taking into account the effectiveness of frontline treatment in China, the target number of 3LDLBCL/FL/MCL patients in China is 28700 Universe 5200 3,400.

Relma-cel has significant safety advantages and has great potential to become the best CAR-T therapy of its kind.

CD19 and BCMA are two hot targets in the field of CAR-T. At present, the two CAR-T products approved all over the world are CD19 targets. At present, there are 11 CD19 target CAR-T products in the clinical stage in China, among which the products of Mingjinuo and Fosun Kate (Yescarta introduced from Kate) have submitted new drug applications. Novartis is also in phase III clinical. In terms of BCMA targets, no products have been approved in the world, and four domestic products are in the clinical stage. Legend Biotech Corp has made the fastest progress and is in the clinical II phase. The main side effects of CAR-T therapy include cytokine release syndrome, CRs,B cell dysplasia and neurotoxicity. CRs is a common side effect of CAR-T. Macrophages release a large number of cytokines including IL-1 and IL-6, which cause inflammation, resulting in fever, hypotension, respiratory disorders, epilepsy, coma and even death. As a result, two CAR-T products that have been on the market have been warned by the black box of FDA. Some patients need to be treated with CRs in the ICU, which leads to an increase in the hidden cost of CAR-T therapy. Studies have shown that targeting IL-1 and IL-6 targets can treat CRs, and it has been incorporated into the CAR-T treatment guidelines by FDA.Guotai Junan Securities believes that reducing the incidence of adverse events is the key factor to win the market at present.

The CAR design of the main structure of CAR-T is divided into three parts: one is to recognize the single-strand variable region scFv of TAA, the second is the transmembrane TM, and the third is the intracellular domain. The change of CAR structure can be divided into five generations. The first generation CAR directly fuses the antigen binding domain with TCR constant chain CD3 ζ, and initiates the activation cascade reaction by CD3 ζ. The second generation CAR fuses CD28 or 4-1BB of T cell costimulatory domain into the intracellular fragment of CAR to improve the activation, proliferation and survival of T cells. The third generation CAR added a T cell costimulatory domain 4-1BB on the basis of the second generation to improve the long-term persistence of CAR-T cells and promote the memory of CD8+

T cells. On the basis of the second generation, the fourth generation CAR introduces a co-expressed cytokine, such as IL-12, which can trigger the signal originally induced by cytokines and further enhance the T cell response. The fifth generation of CAR is also based on the second generation, adding costimulatory domains that activate other signal pathways, such as the domain in which IL-2R β can bind to SAAT3/5.

Both Yescarta and Kymriah belong to the second generation CAR structure, which adopts CD28 and 4-1BB costimulatory domain respectively. However, the CAR structure of relma-cel, the core candidate product of Yao Ming Gu Nuo, based on ARTEMIS technology platform, is completely different from the former two. Relma-cel separates the co-stimulatory component from the polymer complex formed by the antibody TCR and CD3 complex, which can use the internal cellular response and regulatory mechanism naturally formed by immune cell signals to enhance T cell response through the activation of co-stimulating components. The company believes that the safety risk of listed products is mainly due to the T cell hyperactivation of the expressing CAR construct that directly fuses or couples the CD3 signal domain to the T cell costimulatory domain. The structure of relma-cel can significantly improve the safety of CAR-T therapy. Clinical trial data show that the incidence of severe adverse events of Relma-cel

is significantly lower than that of CAR-T products on the market when the efficacy is equivalent (ORR=75.9%,CR=48.3%).

Guotai Junan Securities expects relma-cel to be approved for listing in 2021. With reference to the price of American CAR-T products, domestic economic development level, domestic industrialization and market space, as well as the opinions of the industry, it is estimated that the price of CAR-T therapy will be about RMB500,000 yuan / dose / year, which will be much lower than the foreign RMB 20-3 million yuan level.

Guotai Junan Securities estimates that the diagnosis and treatment rate of CAR-T therapy accounts for about 10% of the target population. According to the third-line diffuse large lymphocytic carcinoma (3L

DLBCL) submitted by relma-cel to NDA, the target number of patients from 2021 to 2022 was 1000-2000. Relma-cel will gain a higher market share of CAR-T by virtue of its excellent security data and good hospital relationship.

Research and development focus process

Improved R & D is the core of the overall platform of Yao Ming Juno, and the company has comprehensive capabilities from discovery to clinical development of related products and processes. There are 63 R & D personnel, 9 of whom are clinical developers. Most of the company's R & D activities focus on improving the process and using the improved process to develop the next generation of candidate products. In the past, Yao Ming Gunuo mainly acquired the development capability through its relationship with Juno, Urico and Acepodia partners, but did not carry out internal product development. The medium-and long-term plan is to build internal product development capabilities, including through the use of the ARTEMIS platform, which was licensed and introduced by Urica in June 2020.

Sales

CAR-T needs a lot of publicity, and the company plans to set up a dedicated internal sales and marketing team to promote relma-cel across China. The current marketing plan focuses on r br

DLBCL, which will be gradually expanded with the progress of clinical trials in the future. The initial goal is to establish a sales team of about 60 to 70 people when relma-cel is initially commercialized, covering about 50 top hospitals in China with the best blood and transplant centers. Since most of these hospitals are clinical trial centers of relma-cel, many doctors are familiar with its application. In the next three years, it is expected to expand the sales team to 100-120 people, covering 100 cancer hospitals. At present, most of the hospitals in China that have been selected as clinical trial sites for CAR-T therapy are Grade 3A Hospital. Because Grade 3A Hospital has excellent medical research and development capabilities, qualified personnel and sufficient laboratories and equipment, it is more likely to be qualified to provide CAR-T therapy. China has a large number of Grade 3A hospitals (about 1442), and the Chinese CAR-T market is expected to grow further as more hospitals are qualified to provide CAR-T therapy.

Production

The company can currently support the production of therapeutic drugs for 5000 patients each year, which will be sufficient to meet the development needs of the company in recent years. At the same time, the manufacturing success rate of relma-cel is higher. The success rate of producing relma-cel during the whole DLBCL registration clinical trial was 100%, which was higher than the overall manufacturing success rate of 99%, 91% to 93% and 96% for Yescarta, Kymriah and Tecartus during the registration clinical trial, respectively.

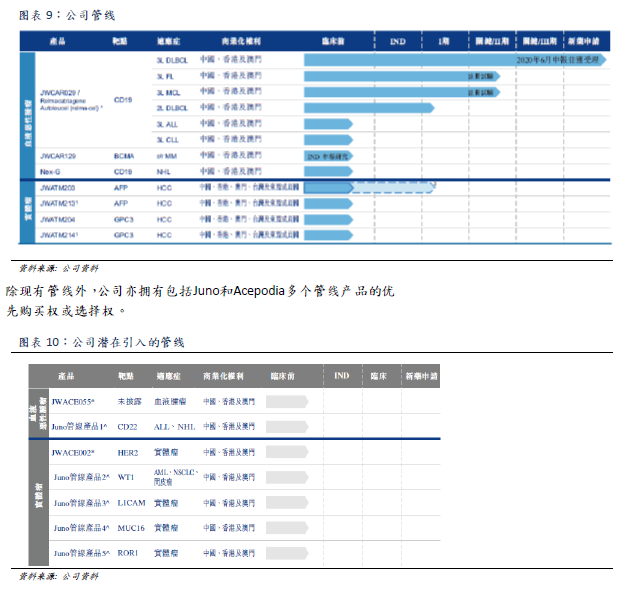

Company pipeline

Because relma-cel has significant efficacy and safety advantages in the treatment of third-line DLBCL by targeting CD19 antigen, the company believes that relma-cel can treat other blood cancers that also show CD19 antigen, benefiting more patients. The company currently plans to conduct further clinical studies with the goal of submitting other new drug applications to the SFDA to obtain approval for the use of relma-cel as a treatment for other blood cancers, including FL, MCL, CLL and ALL. In addition, the company's CAR-T therapy at the BCMA

target and the next generation of CAR-T therapy are also in preclinical research. Four other product lines for TCR-T treatment of hepatocellular carcinoma are also under development.

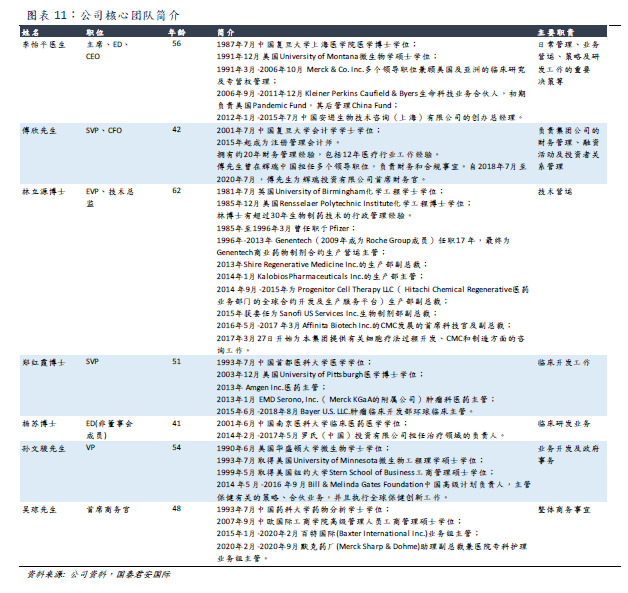

Core team, Architectur

The company's management team has many years of management experience in internationally renowned leading pharmaceutical companies, has a broad international vision, and has professional knowledge in technical operation, clinical development, clinical research and development, business operation and so on.

公司目前每年可以支撑5,000名患者的治疗药物生产,将足以满足公司近几年的发展需求。同时,relma-cel的制造成功率更高。整个DLBCL注册临床试验期间生产relma-cel的成功率为100%,高于Yescarta、Kymriah及Tecartus在注册临床试验期间的总体制造成功率分别为99%、91%至93%及96%。CAR-T疗法作为定制性很高的个性化治疗方案,由于无法大规模生产摊薄成本,生产成功率将直接影响生产成本。Relma-cel更高的成功率将带来成本领先优势,助力赢得未来的CAR-T市场竞争。

公司目前每年可以支撑5,000名患者的治疗药物生产,将足以满足公司近几年的发展需求。同时,relma-cel的制造成功率更高。整个DLBCL注册临床试验期间生产relma-cel的成功率为100%,高于Yescarta、Kymriah及Tecartus在注册临床试验期间的总体制造成功率分别为99%、91%至93%及96%。CAR-T疗法作为定制性很高的个性化治疗方案,由于无法大规模生产摊薄成本,生产成功率将直接影响生产成本。Relma-cel更高的成功率将带来成本领先优势,助力赢得未来的CAR-T市场竞争。